Forecasting Payments: How Treasurers Master Uncertainty and Thrive in 2025

J.P. Morgan Payments is helping treasurers navigate uncertainty, manage economic volatility and address sophisticated cybersecurity threats.

As 2025 unfolds, the evolving geopolitical landscape and changing fiscal and trade policies are reshaping treasury strategies. Treasurers need to manage much more than interest rate variability. They also have to reckon with multiple forms of uncertainty in the macroeconomic environment, cybersecurity threats and increasing demands for seamless, real-time payment processing across the globe.

"Addressing this complexity necessitates a return to the core principles of corporate treasury," says Madhav Kalyan, Head of APAC Payments for J.P. Morgan. "By maintaining a simplified and streamlined treasury function, treasurers gain the agility needed to adapt to evolving circumstances and excel in managing uncertainty."

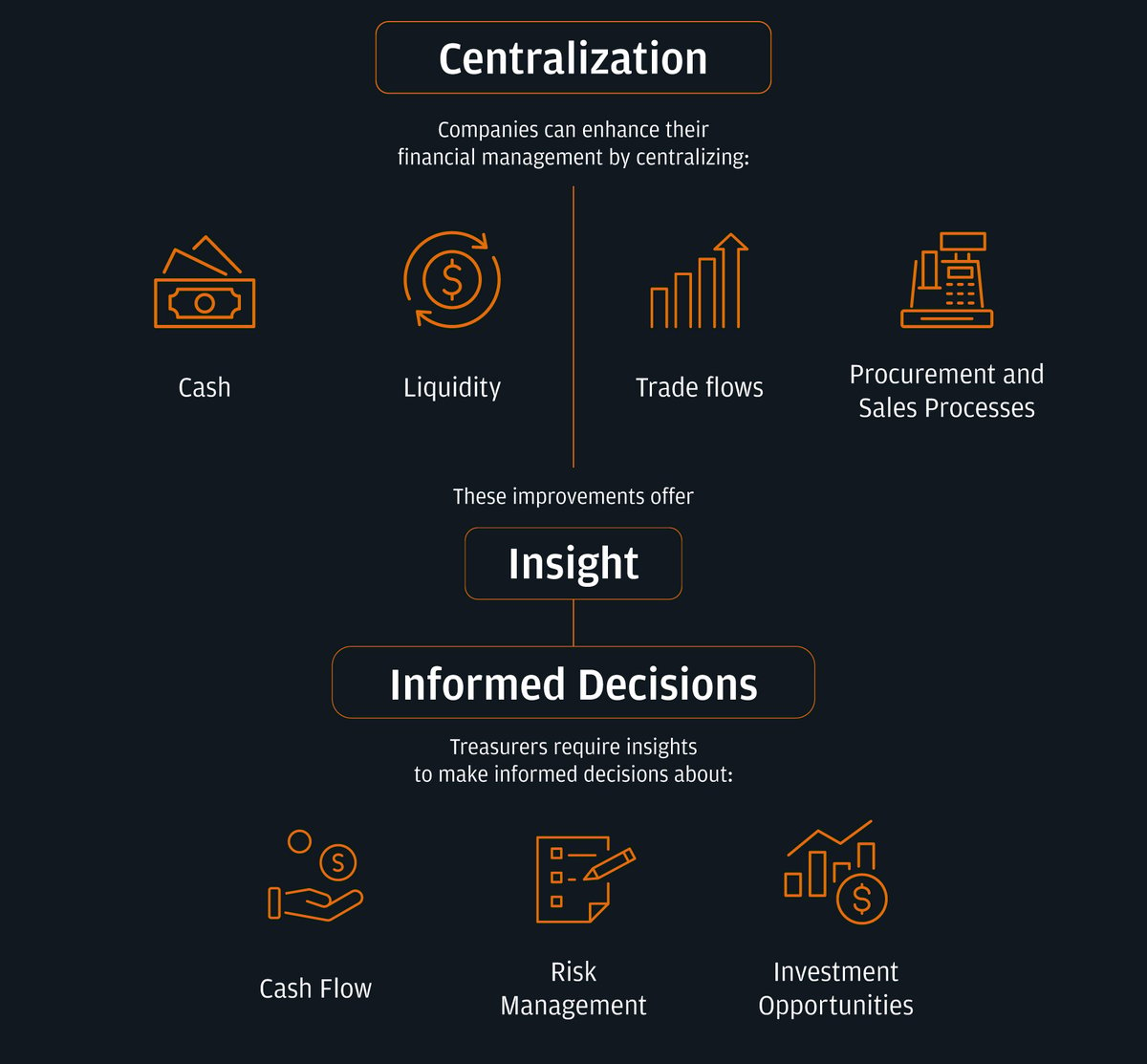

Gaining Insights through Centralization

Companies can enhance their financial management by centralizing cash, liquidity, trade flows, and procurement and sales processes. They can then streamline intercompany payments, standardize third-party payment collections, and establish a payment factory, in-house bank, and regional treasury center. Together, these improvements offer treasurers what they need most: insight.

Treasurers require insights to make informed decisions about cash flow, risk management, and investment opportunities. By gaining a comprehensive view of the company's financial activities, treasurers can optimize liquidity, reduce costs, and improve overall financial stability. These insights enable them to respond swiftly to market changes and align financial strategies with the company's broader objectives.

This is why more treasurers are turning to J.P. Morgan Payments for innovative solutions.

Navigating the Growing E-commerce Landscape

The growth of e-commerce is significantly reshaping treasury priorities and workflows, especially in APAC. The region has seen a plethora of new real-time payment rails and digital banks and accounts for about 50% of the global e-commerce retail volume,[1] which businesses can capitalize on — but only if they’re prepared.

To create a successful online storefront, either on their own or using one of the online marketplaces that already exist, businesses must adopt new technologies that allow for streamlined, automated, and same-day digital payments. “If they want to thrive, treasurers today have to be able to manage different kinds of payments and cash-flow needs,” says Kalyan.

Yet many face inefficiencies when facilitating cross-border payments to sellers in other countries, leading to complications such as foreign exchange (FX) risk and data security issues, among others. In countries with comprehensive regulations, innovative payment solutions from trusted banking partners can help ensure a streamlined and efficient payment process.

Pay-to-China, part of J.P. Morgan Payments’ Global Mass Pay solution, empowers e-marketplace clients to send cross-border RMB payments directly to their Chinese merchants from locations all over the world. This solution offers more transparency on FX management and data security with an efficient settlement cycle for the movement of funds. J.P. Morgan Payments is the pioneering foreign bank in China to process such direct payments for e-commerce clients, leveraging our innovative technology and global network.

From T+1 to T + Right Now

As the world shifts towards a more digital society, payment solutions are evolving from traditional batch processes to real-time offerings, providing enhanced speed and security. Real-time payments (RTP) also provides greater transparency, allowing treasurers to make more informed strategic decisions and optimize their financial operations, particularly in dynamic markets.

With a global footprint, J.P. Morgan Payments has RTP live in more than 46 countries in multiple currencies.[2] “In APAC, we continue to invest in RTP payment infrastructure, often known as ‘payment rails’, across markets, which allows us to support clients’ evolving business models with solutions like QR codes, request to pay, direct debit, and others,” Kalyan shares. “Leveraging our standardized global solution, our clients can use the same API to perform transactions in multiple countries for RTP transactions.”

Leveraging the latest blockchain technology, Kalyan points to Kinexys by J.P. Morgan, the firm’s blockchain business unit, and Kinexys Digital Payments, which uses distributed ledger technology to securely, transparently and efficiently facilitate cross-border transactions in a near real-time, 24/7 environment.[3]

The results are compelling. By optimizing working capital, speeding up settlement times, and reducing the need for manual interventions, Kinexys streamlines operations and minimizes human errors. Since 2021, the platform has facilitated more than $1.5 trillion worth of transactions and has an average daily transaction volume of over $2 billion.[4]

At the end of the day, no matter what challenges or uncertainties treasurers face, their mandate is clear: optimize capital and be able to move it instantly, efficiently, and transparently.

Combating New Threat Vectors

The treasury's role in ensuring security and providing a seamless payment experience means that any modernization efforts must heavily focus on advancing security features and adhering to processes. The systems need to be robust and capable of defending against sophisticated threats.

Treasurers are now de facto risk managers, says Kalyan, and it is specifically cybersecurity that is “the number one risk area treasurers tell us they're facing.”

For this reason, they need increasingly sophisticated tools to safeguard against potential threats, such as the tailored and efficient fraud controls provided through J.P. Morgan Access. The multi-platform service allows clients a wide range of self-service tools and resources for complete visibility. Having a best-in-class provider can help implement sophisticated fraud control techniques and provide valuable insights into emerging threats.

As we look to the future, treasurers stand at this forefront of transformation, empowered to shape the financial landscape with vision and purpose. Armed with cutting-edge tools and a mindset of continuous innovation, they can be uniquely positioned to turn challenges into opportunities, and uncertainty into growth. By embracing collaboration, championing sustainability, and fostering a culture of agility, treasurers are not just navigating the complexities of today—they are pioneering the pathways of tomorrow.

Sources:

[1] Euromonitor [2] J.P. Morgan Real Time Payments in APAC [3] Transfers on the network are completed on a 24/7/365 and same day basis. Moving funds to and from the network from traditional Demand Deposit Accounts on legacy systems to Blockchain Deposit Accounts has a three-hour downtime over the weekend (3-6 p.m. EST every Saturday). Enhancement is under development. [4] Kinexys by J.P. Morgan