Rethink your treasury platform

How J.P. Morgan Payments helps companies leverage technology to drive efficiency and optimize liquidity for sustained financial growth.

Today, global commerce presents unique challenges, from regulatory compliance across multiple jurisdictions to technological integration and cybersecurity. And as businesses expand into new markets, these issues can become more complex, explains Lillian Sim, Global Head of Multi-National Corporation (MNC) Sales at J.P. Morgan Payments.

Regardless of the region companies enter, they encounter similar complexities in navigating tax laws, compliance, cross-currency regulations, and local banking and clearing rules. Every region has its own distinct regulatory framework, and every market is at a different stage of development. This underscores the importance of having a partner who possesses in-depth knowledge of each country.

Sim emphasizes that uncertainty is an inherent aspect of business operations. “You never know when a country's cross-currency regulation might change,” she notes. “However, you can proactively ensure you have clear visibility into your cash positions.”

Optimizing Global Liquidity and Cash Management

HP Inc. is one of the world's leading technology companies, renowned for its printing, personal computing products, and IT services. Treasury at HP Inc. has been proactive in exploring ways to enhance automation and efficiency to future proof its organization in a fast-evolving landscape. Optimizing global liquidity was a key focus area and represented a critical step in the journey of establishing an in-house bank.

“Automating cash consolidation and flexibility of the solution with J.P. Morgan Multi Currency Notional Pool has significantly improved our productivity, payables efficiency and, importantly, added a key pillar to our working capital management strategy,” says Loh Kuai Yee, Director of HP Inc. Treasury Center, APJ and EMEA. “This has led to improved cash and liquidity management, increased automation, and greater flexibility to adapt to our changing needs. This project with J.P. Morgan Payments enabled us to integrate the region using a single global platform with connectivity to key global locations.”

Leveraging Technology for Efficiency

Technology and automation play a pivotal role in enhancing the efficiency of international treasury operations. Real-time data access enables faster decision-making, while automated processes streamline workflows and reduce errors.

Tracking the fast-moving global flow of cash requires advanced technology like Kinexys by J.P. Morgan, the first bank-led blockchain platform for exchanging money, information, and assets. Real-time visibility is crucial for ensuring safe cross-border transactions and managing currency changes, payment schedules, and global liquidity. “I can set parameters to automate this technology, operating around the clock,” says Sim. “Companies no longer need to worry about US holidays affecting the timing of US dollar transactions.”

Siemens collaborated closely with J.P. Morgan Payments to develop payment processes using blockchain and programmable money. This innovation empowers Siemens to execute real-time, 24x7 global liquidity transfers. Such capabilities are essential for corporate treasury in managing international operations, especially considering the complexities of cross-border transactions.

Building Cybersecurity

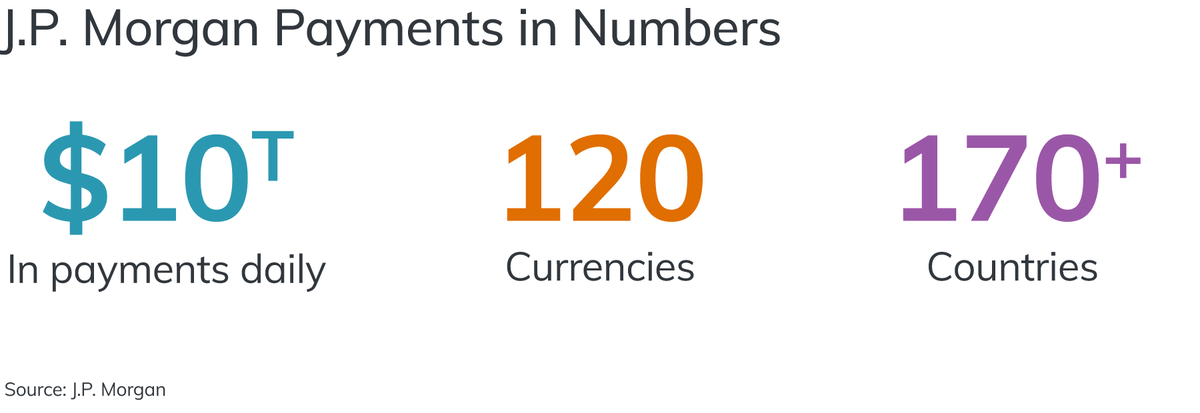

Technology is helping companies combat the growing threat of sophisticated cyberattacks. While clients can't foresee every threat, they can reduce risks by building robust digital defenses in advance, says Sim. “At J.P. Morgan, we process nearly $10 trillion in payments daily[1] across 120 currencies[2] in 170+ countries,[3] and we are dedicated to maintaining a strong infrastructure,” she adds. “We help clients use transaction data to identify potential vulnerabilities and enhance their cybersecurity strategies.”

The bank's commitment to innovation ensures that its cybersecurity measures evolve alongside emerging technologies and threats. This proactive approach not only safeguards financial operations but also bolsters client trust, emphasizing the vital role of a secure digital framework in today's interconnected landscape. As cyber threats advance, J.P. Morgan remains committed to enhance its cybersecurity capabilities.

"Amidst the ever-present cybersecurity threats, treasurers must adeptly navigate unforeseen risks while also capitalizing on the right opportunities for their companies," she explains. "A strong partner can guide them through these challenges, freeing up time and resources to explore new possibilities.”