The Path to Fast, Simple and Secure Cross-Border Payments

J.P. Morgan Payments is helping Non-Banking Financial Institutions across Asia Pacific

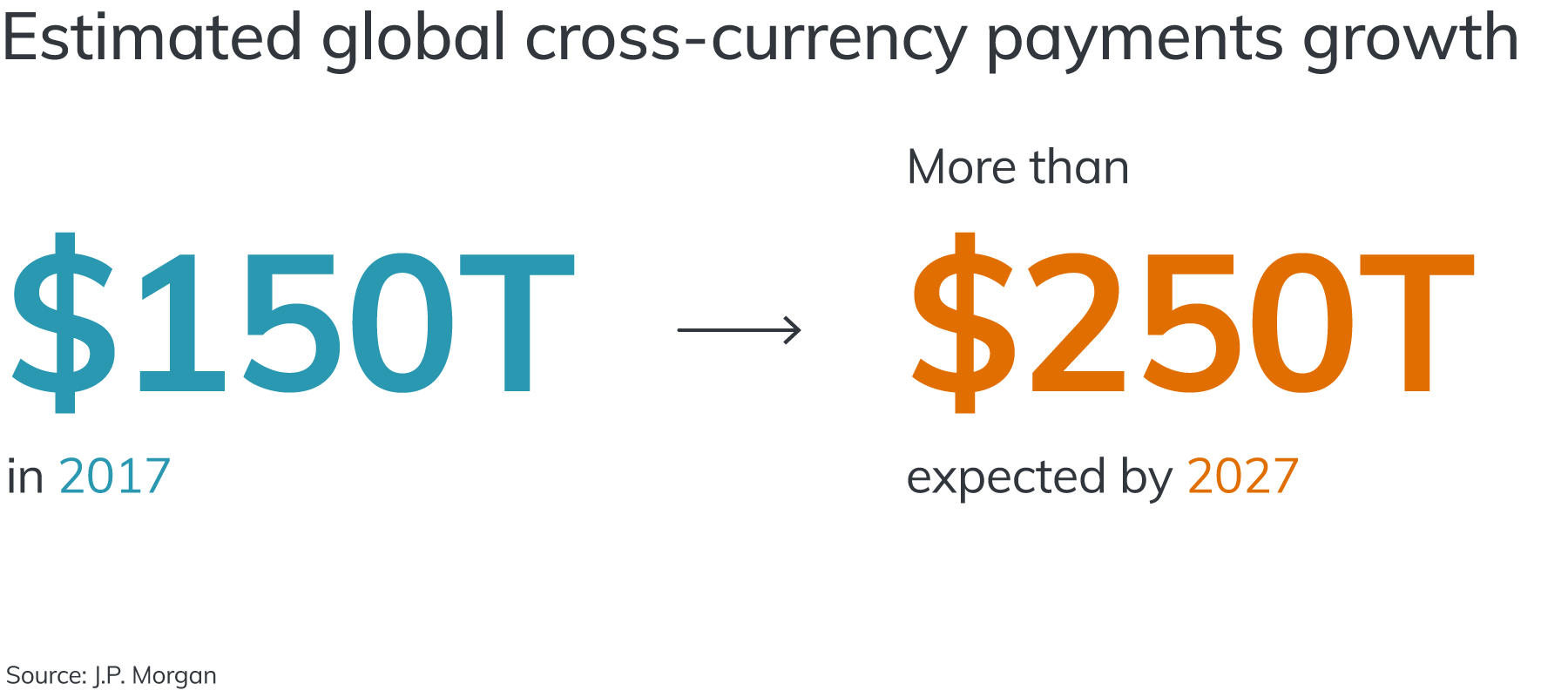

Global cross-currency payments are projected to rise from nearly $150 trillion in 2017 to over $250 trillion by 2027.[1] For Non-Banking Financial Institutions (NBFIs)—especially those within the Fintech segment—capitalizing on this growth is challenging, with many lacking the resources and experience of traditional financial institutions.

However, by leveraging tools from J.P. Morgan Payments and harnessing the power of artificial intelligence, NBFIs in APAC can navigate complex regulatory environments, optimize liquidity, accelerate payments, and enhance cybersecurity to mitigate fraud.

Sending money across borders is particularly challenging due to various factors such as unique regulatory frameworks, cybersecurity threats, and the potential for delays or failed transactions. However, in certain markets, there are additional, nuanced obstacles, according to Christine Tan, Head of Financial Institutions Group Sales, Asia Pacific, J.P. Morgan Payments.

“In Indonesia, the account number and name have to match exactly,” she says. “Even if it’s one letter off and everything else is right, it gets rejected.” This seemingly small technicality can result in significant frustrations, especially in a country with a high volume of remittances to foreign domestic workers.

In situations where communication is crucial, Kinexys by J.P. Morgan, the firm's blockchain business unit, has developed Kinexys Liink—the world’s first bank-led, peer-to-peer network for secure, privacy-preserving information exchange. According to Tan, this innovation allows validation of account information via a single API for a payment, ensuring that the transfer goes through smoothly.

Since the launch of Liink, over 220 million inquiries have been processed across more than 18 countries,[2] and this is just one of the innovative solutions and advisory services that J.P. Morgan is offering throughout APAC.

Navigating payments complexity across borders

Cross-border payments can be delayed for any number of reasons, from minor clerical errors, like the exact match system in Indonesia, to major compliance differences within the region. “We cover 16 markets in APAC,” Tan says, “and each and every one has different regulatory requirements, which leads to operational inefficiencies, higher costs, and slower transaction processing times.”

To operate in such a challenging and nuanced environment, NBFIs need clarity around anti-money laundering requirements, screening sanctions, and transaction reporting standards, as well as the source and purpose of the funds and any intermediary banks that may be involved. This complexity can be daunting—and it was holding back the growth of Nium, a Singapore-based fintech that specializes in cross-border payments.

However, Nium discovered Cross-Currency Solutions from J.P. Morgan Payments. This real-time automated foreign exchange solution enabled the company to overcome short-term fluctuations during the collection and reconciliation processes while helping Nium navigate the necessary regulations in the area. “Nium has grown rapidly in recent years,” says Anupam Pahuja, Nium’s EVP and General Manager of APAC & MEA, “and we’re excited to continue expanding globally with J.P. Morgan Payments as our trusted ally.” Nium now operates in 220+ countries and has issued cards in more than 30 countries.

Digitization tools from J.P. Morgan Payments offer cash flow intelligence forecasting, liquidity, and visibility that are tailored to the client’s unique needs, according to Tan. "We understand that businesses are always looking for the most efficient and economical solutions to succeed, thrive and expand into new markets. This is why we strive to provide customized solutions that businesses need."

A proactive approach to neutralize cybersecurity risks

Clients must also stay vigilant on cybersecurity, says Tan. It’s estimated that nearly 2,500 cybercrimes are committed every day, and between 2001 and 2021, cybercriminals netted nearly $26 billion in ill-gotten gains.[3]

To keep pace with the ever-evolving threat landscape, JPMorganChase invests $17 billion in tech a year firmwide to protect the firm and its clients—even in the high-volume universe of currency exchanges.

J.P. Morgan Payments processes nearly $10 trillion per day and is committed to helping mitigate risk for its clients. APAC is a large, complex region governed by many different jurisdictions, regulations, fluctuating currencies, and security threats. Companies can try and navigate these on their own—or they can leverage the expertise, experience, networks, and cybersecurity of a major player in the region. By collaborating with J.P. Morgan Payments, these institutions can make their payment experience faster, simpler, and safer than ever.