Growth and Growing Pains: Symptoms of an Ongoing Pandemic

For midsize companies that endured, robust optimism is meeting big challenges.

When supply chain disruptions during the global pandemic made it difficult to get enough chicken wings, FAT Brands Inc.’s restaurants began highlighting plant-based meat alternatives like “Chick’n Vings” on their menus. As the tightened labor market made hiring more difficult, some of the company’s chains offered employees more overtime to fill the gaps. And as costs skyrocketed, the owner of these 17 restaurant chains, including Fatburger, Johnny Rockets and Fazoli’s, raised prices for menu items that were most impacted.

Now, FAT Brands CEO Andy Wiederhorn is optimistic about 2022, noting that the company has continued to report positive sales at stores open at least a year—a common metric in the restaurant industry. “During the early days of the pandemic, the conventional wisdom was that many restaurants would go out of business,” he says. “But the majority of the industry has survived and thrived.”

The pandemic has dramatically changed the business landscape, forcing companies of all sizes to adapt quickly to shifting consumer habits, uncertain economic conditions and a work culture that has been flipped on its head.

Now, nearly two years later, many midsize companies that had to learn to operate more like big multinationals are experiencing historic demand and rapid growth, which has led to soaring confidence. J.P. Morgan Chase’s 2022 Business Leaders Outlook survey found that midsize U.S. business leaders are more optimistic about their companies now than they were before the pandemic. And for good reason: 70% say their businesses have returned to or exceeded pre-pandemic levels of profitability.

“With the onset of the pandemic, many businesses were forced to make changes in order to survive. Being more nimble, innovating, automating where possible, being flexible—with these lessons learned over the past two years, many companies are better positioned today than they were before,” says Ginger Chambless, J.P. Morgan’s Head of Research, Commercial Banking.

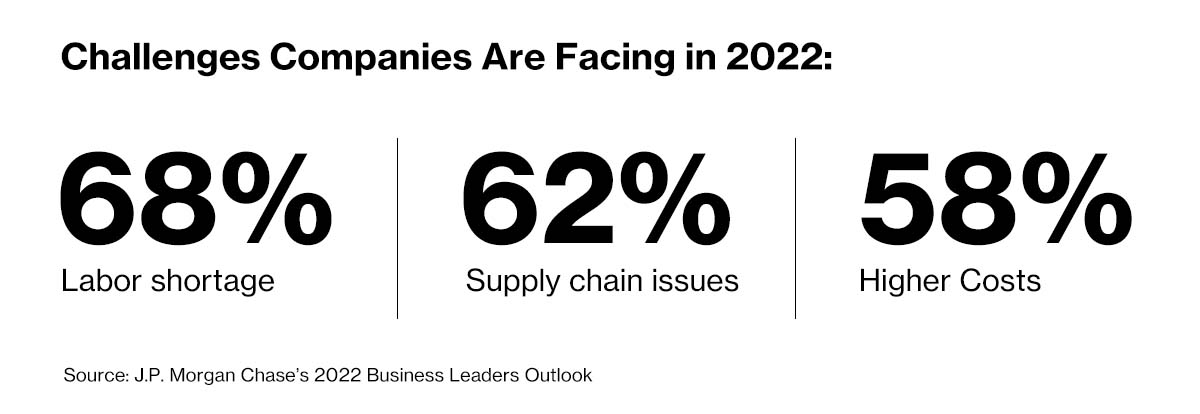

But behind the growth and optimism are big challenges that are being exacerbated by the extended pandemic and uncertain economy. According to the J.P. Morgan survey, three issues—once thought to be transitory—remain on the minds of midsize business leaders: a clogged global supply chain; a labor shortage that has made attracting and retaining talent difficult; and soaring costs. “These are growing pains,” Chambless says. “This is the world we live in today.”

Standing out in the competitive job market

Among the growing pains, labor is the most troublesome issue for midsize business executives, with more than two-thirds saying the worker shortage is the biggest challenge they face in 2022.

Labor troubles are largely linked to what has been dubbed the “Great Resignation.” The U.S. Bureau of Labor Statistics reported that a record 4.5 million workers quit their jobs in November, breaking the previous record set in September.

To fill positions and hang on to current employees, most business leaders expect to pay higher wages; the J.P. Morgan survey found that 81% of midsize companies are raising their wages. But while greater compensation is a way to lure talent, experts say that companies should be more creative when strategizing to attract and keep talent. Today, many employees and job candidates are placing a higher value on flexible work schedules, other benefits and getting the right mix of job experiences.

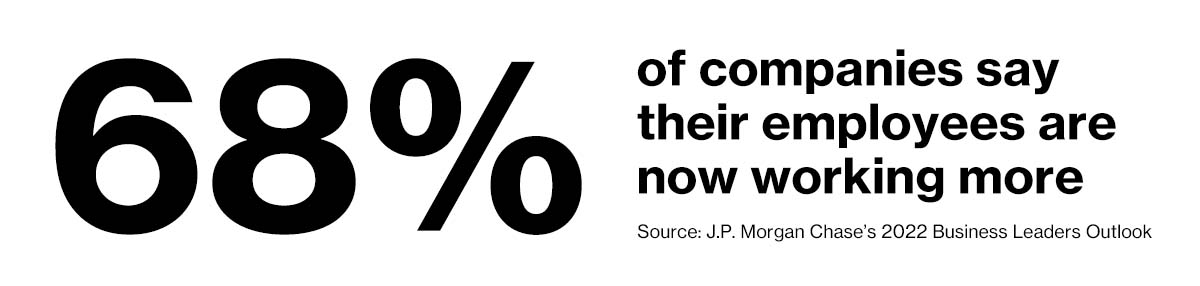

However, only 45% of midsize companies are offering flexible work locations, the J.P. Morgan survey shows, and just 37% have added flexible hours. More than two-thirds say they’re dealing with the labor shortage by having employees work more hours. “Many midsize companies are being affected by human resources tactics and policies that haven’t evolved for the post-Covid job environment,” says Baron Christopher Hanson, owner of RedBaronUSA, a turnaround consulting and coaching firm. “If your company wants to attract and retain talent, your workplace policies need to completely change.”

Diversifying the supply chain

The pandemic also forced many midsize businesses to focus on global issues that didn’t previously affect them. The highly intricate and interconnected global supply chain is a prime example.

Although bottlenecks have improved somewhat, supply chains are still struggling to meet demand. And while no one knows when the supply chain issues will be resolved, there are good reasons to believe that they will continue well into 2022, and maybe longer. But midsize companies have learned some important lessons about tackling this problem.

More than half of midsize businesses have added suppliers in different geographic locations to lower the risk of relying on a single supplier or region, while about two-thirds are taking a more strategic approach to how they source and stock goods.

Carlos Castelán, Managing Director of The Navio Group, a business management consulting firm that advises midsize companies on navigating supply chain challenges, says stockpiling will be key for these companies. “Having or not having inventory could be the difference between success and failure during early 2022,” he says.

Planning for higher costs of doing business

The third main challenge—increased costs—is a direct result of the tight labor market and supply chain issues. Companies are paying more to attract and retain employees, and sourcing goods has also become more expensive.

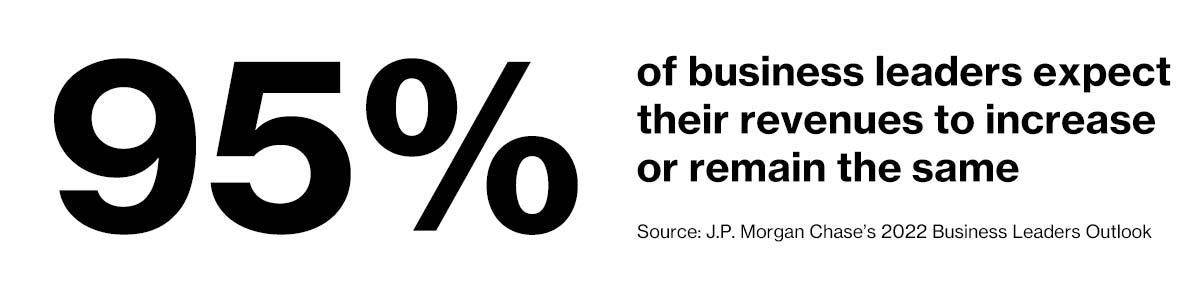

Many business leaders believe that higher expected revenues in the coming year will help their companies keep the inflation equation in check. Eighty-one percent of business leaders expect to see an increase in company revenue, which should help offset rising costs. But, in an acknowledgement that costs will be higher in 2022, just 67% expect profits to increase.

Experts say companies should continue to closely monitor costs to keep expenses in line with revenue. Nevertheless—in the latest sign of midsize optimism—a large majority of midsize business leaders expect their 2022 capital expenditures and credit needs to increase or remain the same. “When companies are willing to make investments to expand, and potentially use credit to do that, that’s a very positive sign of confidence,” says Chambless.

That’s certainly been true for California-based FAT Brands, which has acquired 12 restaurant chains in the last three years and is planning to add more than 100 new locations in 2022. “If your business endured the pandemic, and adapted to its challenges, it is probably now stronger than before,” Chambless says.