When It Comes to Board Diversity, Follow the Money

Pressure mounts for VC firms to use their influence to push for better representation on startup boards

A well-known pain point among big companies has also become a chronic problem for startups, one which their financial backers are increasingly being called on to help them solve.

Despite studies that have proven a positive link between diversity and performance, there continues to be a lack of diversity in the nation’s corporate boardrooms. But venture-backed businesses are struggling the most to fill these seats with a diverse slate of individuals. And because of the unique power dynamic that exists between venture capital firms and startups, VCs and accelerator programs are being pressured to do more to address the issue.

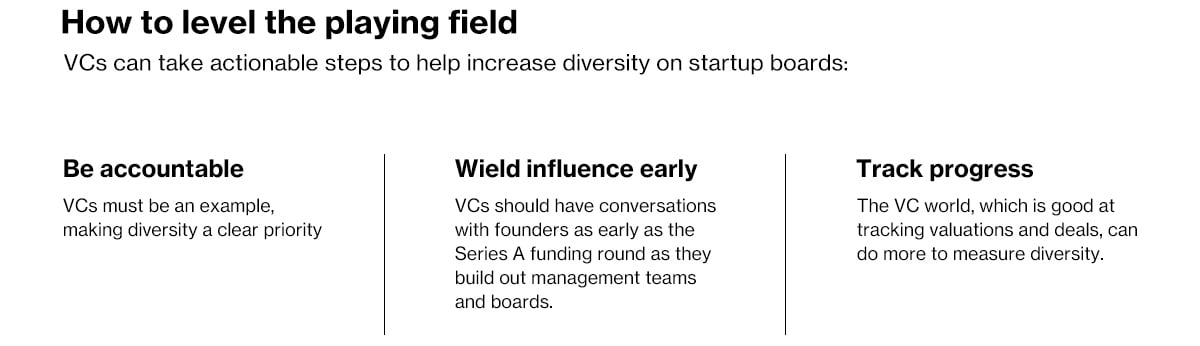

“At the end of the day, you answer to the person who’s giving you the money,” says Leyonna Barba, Managing Director, Technology and Disruptive Commerce, at JPMorgan Chase. “It could change, the accountability needs to be a lot louder. They should want metrics and ask questions, like, ‘What will the boards you’re building look like?’”

A missed business opportunity

Current metrics on startup board diversity are underwhelming. A first-of-its-kind report on gender diversity on startup boards by J.P. Morgan, supported by PitchBook data, found that the percentage of startup board appointments that are women grew 9% between 2018 and 2021, to 22%. But that’s only half the rate of public companies.

There’s also less racial and ethnic diversity on startup boards. Of the roughly 4,700 board seats at private companies funded by the top VC and private-equity firms that have gone public since 2000, only about 1% have been held by Black directors, according to the Board Diversity Action Alliance.

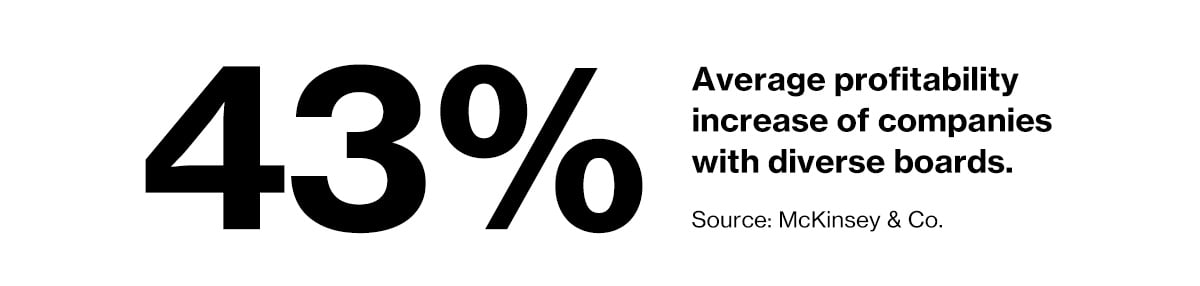

The business case for diverse boards is well established, and a growing body of research shows a range of business benefits associated with gender diversity on boards. But Quinetta M. Roberson, the John A. Hannah Distinguished Professor of Management and Psychology at Michigan State University, says some founders and other business leaders remain skeptical.

“They’re still questioning internally, ‘What’s in it for us, and how does it drive our outcomes?’ or, ‘How am I—or we—measuring impact?’” says Roberson, who has 20 years of experience teaching leadership, talent management and diversity.

Why the problem persists

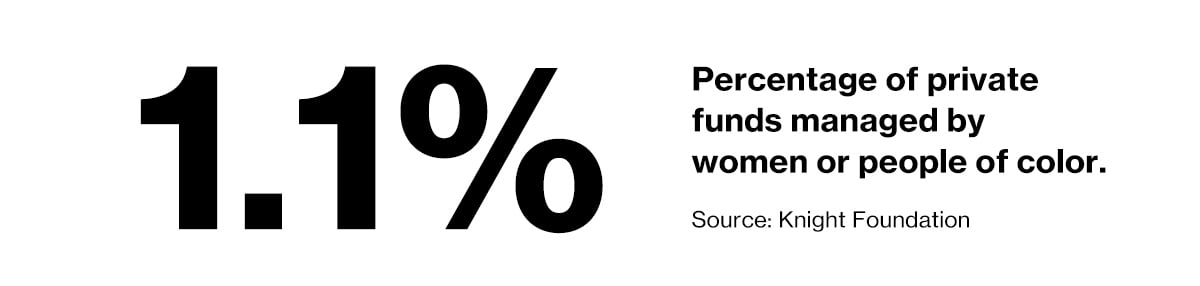

The makeup of the VC world is also to blame for the lack of board diversity. The VC ecosystem is inequitable on all sides; from founders to investors to the boards, it’s overwhelmingly white, Ivy League and male.

That’s a persistent problem, because board diversity improvements often hinge on whether VC firms mirror the faces at the companies where they invest. So, if there’s little diversity on the VC side, there tends to be less pressure on the firms they invest in to diversify their boards.

Another challenge is that founders sometimes don’t think about diversifying their board until they are about to launch an IPO. To help attract the capital and valuations investors want to achieve, many pre-IPO companies add women or other diverse appointments to the board to create the appearance of diverse governance.

But these last-minute appointments can simply mask the problem. According to the J.P. Morgan–PitchBook report, internal appointments—in which a current employee is installed on the board—have more than tripled since 2017. While this provides the appearance of a diverse board, it does not provide best-practice governance nor the fresh perspective that an independent director can bring.

“The role of the corporate director is to challenge the status quo, help shape strategy and push leadership to be its best,” says Pamela Aldsworth, Managing Director, Head of VC Coverage, JPMorgan Chase. “If your boss is in the room, it could change the dynamics for non-independent board members.”

Change is coming

The Equity Summit is one example of the small but growing effort in the VC community to increase diversity. The annual invitation-only gathering brings together thought-leading limited partners (LPs) and general partners (GPs) of private equity firms for intimate, off-the-record conversations to drive more investments in women and underrepresented minority partners and founders. The participants comprise a diverse set of LPs representing endowments, foundations, funds of funds and family offices, and GPs that represent the leading new firms as well as existing funds.

Big banks also are promoting board diversity. JPMorgan Chase, one of the largest underwriters for IPOs, has had a board advisory service since 2016 that makes diversity a priority. Of the 64 confirmed placements as January 2022, 55 are women or people of color. The company also has the Woman on the Move conference which has a primary goal of providing greater access to capital, networking, expertise and advice to women clients, serving women-owned or women-run businesses at all stages of development, from start-ups through large corporations.

JPMC also partnered with Techstars, the worldwide network that helps entrepreneurs, to launch the Techstars Founder Catalyst program. The experience provides startup education and mentorship to a diverse cohort of up to 20 women entrepreneurs. It will also give them access to Techstars’ network of entrepreneurs, investors and corporate partners.

Acrew Capital is among the VC firms that are doing their part to push for diversity on boards. It has a team of 500 diverse executives, emerging leaders and influencers who can serve in various operating roles—and three-fourths of them are prequalified to serve as independent directors on the boards of the startups Acrew funds.

At Acrew, which was founded in 2019, 88% of the investing team consists of women or people of color, while 58% of the companies it invests in have an underrepresented founder. And its Diversify Capital Fund targets underrepresented LPs to invest in growth-stage businesses on the path to an IPO—the kinds of investments likely to build wealth for investors.

“Our hope is that the strategy that we’ve employed is not something that differentiates us long-term,” says Lauren Kolodny, one of Acrew’s five founding partners. “We hope it becomes more commonplace.”