Investing in India’s Clean Energy Future

How J.P. Morgan supports the development of scalable renewable energy solutions for more than a billion people

As India feels the effects of climate change, from record-breaking heat waves to a rise in 100-year flood events, the imperative to embrace cleaner energy sources has never been more visceral. The investment race is on to help the country change course and meet both its economic and energy objectives.

The Avaada Group, an integrated renewable energy platform founded in 2017, is a global leader in the production of green hydrogen—which is created by splitting water molecules without emitting carbon dioxide into the atmosphere.

The group recently secured $1 billion in financing from Brookfield—one of the largest investments ever made in green hydrogen—and will use the funds to reshape India’s energy future by expanding into other sustainable energy sources like solar and wind.

“In this industry, it’s important to have deep pockets. It’s capital-intensive,” says Vineet Mittal, Chairman of Avaada Group.

Such sizable investments in innovation are as critical as they are timely, as India’s Prime Minister Modi outlined a commitment at COP26 to generate half of the country’s electricity via renewable energy sources by 2030.

In order to navigate the complexities of the financing deal, Mittal enlisted J.P. Morgan as Avaada’s sole investment advisor—a move they deemed critical to securing commitments from international investors.

“What we value most about J.P. Morgan is their ability to assess the investment objectively, leveraging their global expertise to understand the nuances of the deal and bring realism into the business model,” says Mittal. “They’re not just doing deals in Asia-Pacific; they are involved in similar transactions in Europe, similar transactions in the US, but also have a very large local presence in India. They can bridge the gap and make the deal happen.”

A greener future, led by India

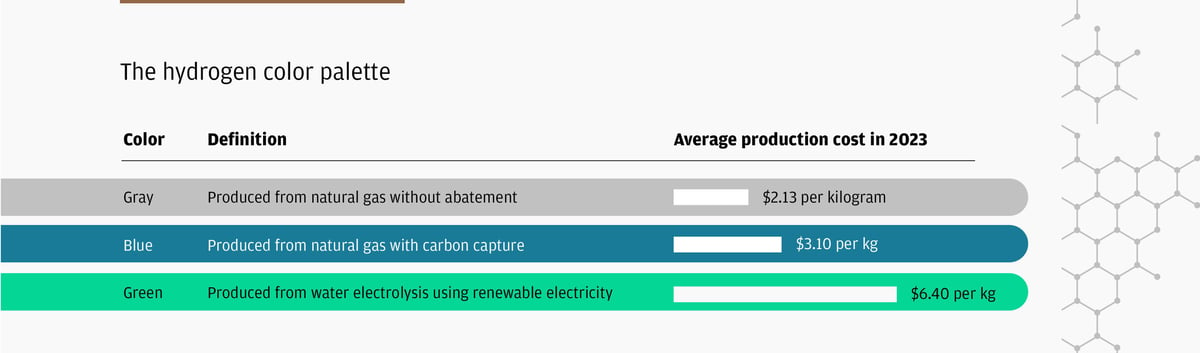

BloombergNEF forecasts that from 2030 on, producing green hydrogen in a new plant will be as much as 18% cheaper than continuing to run an existing legacy hydrogen plant. Traditionally produced hydrogen, made with natural gas, is known as gray hydrogen, while green hydrogen is made using renewable energy sources.

Green hydrogen also represents a major new field of opportunity for impact investors, who’ll need the expertise of financial institutions like J.P. Morgan that understand the renewables market from the big picture down to the smallest molecule.

To help Avaada navigate its deal with Brookfield, J.P. Morgan investigated progress of the global market for green hydrogen and other sustainable energy sources in development at Avaada. That wide-angle understanding of the marketplace proved a powerful complement to Avaada’s exhaustive research into its competitive landscape, which instilled confidence in investors.

“These businesses require substantial scale to be competitive,” says Kaustubh Kulkarni, Senior Country Officer, J.P. Morgan India and Vice Chairman, Asia Pacific. “The business plan and capital structure conversation we had with Avaada was to see how we could raise sufficient capital for them to pivot—scaling the existing green energy platform to raise intermittent capital to make green hydrogen effectively. You have to put your entire thought process at scale to get a business plan that works for the market.”

In Brazil, China, India, Spain and Sweden, green hydrogen from new plants will be cheaper than gray hydrogen from existing plants by 2030.

Source: BloombergNEF

The Avaada Group is part of a growing ecosystem of green energy platforms driving an effort toward energy transition in India and beyond. But generating investment in sustainable solutions requires firms to understand how an emerging class of energy entrepreneurs can drive return on investment, as well as how they will impact the wider energy economy.

Bhavin Shukla, Executive Director at J.P. Morgan, notes that investors are already scouring the world for opportunities in the sustainability space, but multiple risks—from market risks to business model success to execution risks—make the green hydrogen space new territory for financial investors who haven’t already dealt in gray hydrogen. The value J.P. Morgan brought to bear, he says, was in structuring to solve for those risks on behalf of Brookfield, while creating the opportunity for Avaada to unlock the potential of a sizable investment without taking on onerous terms.

Kulkarni stresses that these large-scale investments are significant not only because they provide an understanding of how India’s energy transition can actually happen, but also because they serve as a model for transitions across sectors around the globe.

“It’s our job to relate that knowledge to our other clients in harder-to-transition industries, like cement or steel or aluminum, and see how they’re thinking about their own transitions and how what we’ve learned can be relevant,” says Kulkarni.

These ambitious pursuits are exactly what J.P. Morgan wants to drive forward in every partnership.

“One of our principles is to help our clients, like Avaada, go big,” says Kulkarni. “These types of deals set the benchmark.”