Five Factors Fundamental to the Future of Thriving U.K. Cities

The UK’s urban environments are centres of excellence in innovation, research, sustainability and well-being. Five factors are vital to ensure their continued development—and each one presents significant opportunities for businesses to invest in the UK of the future.

As the UK government’s Levelling Up agenda looks to unlock prosperity outside London and South East England, business and investment will play crucial roles in nurturing the country’s other cities and regions, and in seizing opportunities to help reduce inequality and raise living standards for all.

Identified by expert analysis and data compiled by Bloomberg, the core elements of a thriving city are interlinked and mutually supportive, and their success depends on partnerships between the public and private sectors.

“If you look at any issue faced by any town or city today—inequality, public health, carbon footprint, economic development—no single organisation can solve it,” says Tom Riordan, Chief Executive of Leeds City Council. “On their own, neither the public nor the private sector can build the sort of places we are looking for. You need a team ethic and a collaborative approach.”

Lloyds Bank is partnering with local authorities, large corporations and small- and medium-sized enterprises (SMEs), and financing both public- and private-sector housing across the UK. Mark Burton, Head of UK Regions at Lloyds Bank, believes the bank has both the ability and a responsibility to play an important role in nurturing successful cities into the future.

“We are sitting down with city leaders, mayors, local enterprise partnerships and many other organisations to explore how we can help in everything from retrofit programmes to attracting investment and innovation,” he explains. “We want to help cities think about the big infrastructure projects and how they can be funded.”

So, what insights does this effort provide for businesses, and how can they contribute to the five key components of a thriving UK city?

Clusters—whereby an area becomes home to an industry and its related supply chains—creating virtuous circles of skilled employment, which attract further investment. As a consequence, innovation thrives and the wider economy benefits from the resulting prosperity.

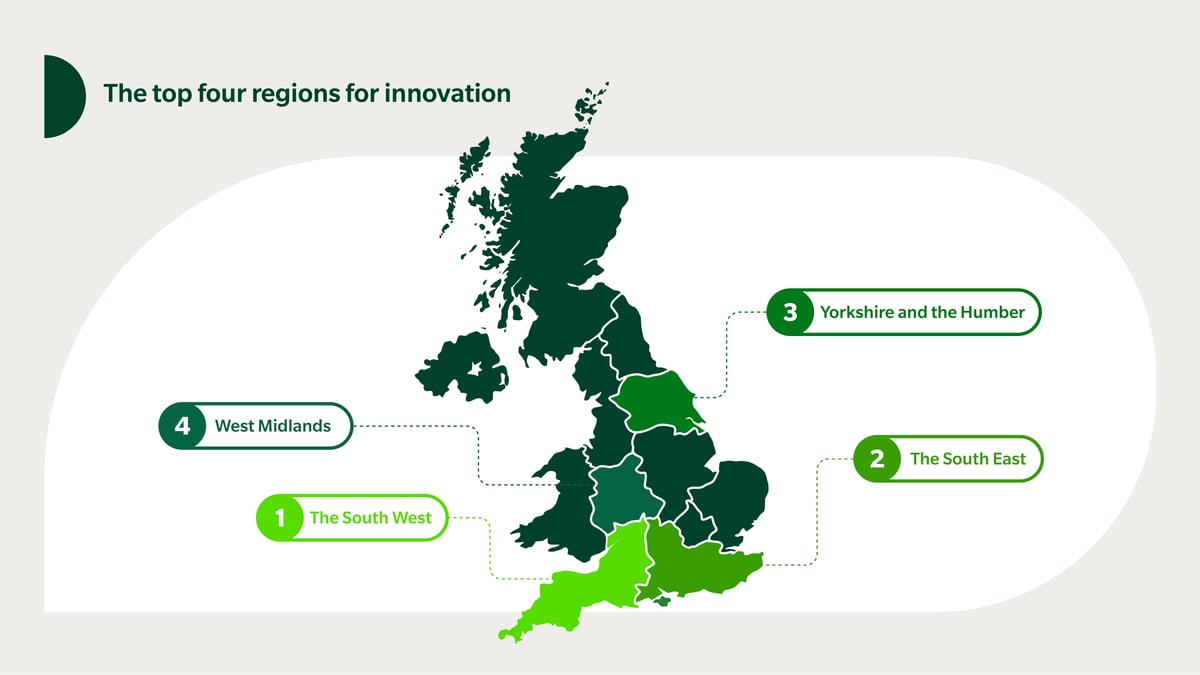

The CBI’s Reviving Regions report, sponsored by Lloyds Bank, tracks a range of economic measures and innovation across England to produce regional scorecards. As well as identifying well-known centres of innovation, such as the West Midlands automotive hub and the South East’s research golden triangle, the report also reveals newer and emerging centres of innovation.

The South West has a long history in the aerospace sector and is now developing a digital cluster, with the city of Bristol at its heart. Meanwhile, Yorkshire and the Humber are widely associated with the region’s traditional industries of coal, steel and shipping, but the Humber is now emerging as a centre for innovation in renewable energy and offshore wind technology.

“You have to ask, why is it that a business would invest somewhere? A lot of that comes down to whether they can easily access the right skills and the physical and digital infrastructure,” says Ahmed Goga, Director of Regional Policy at the CBI.

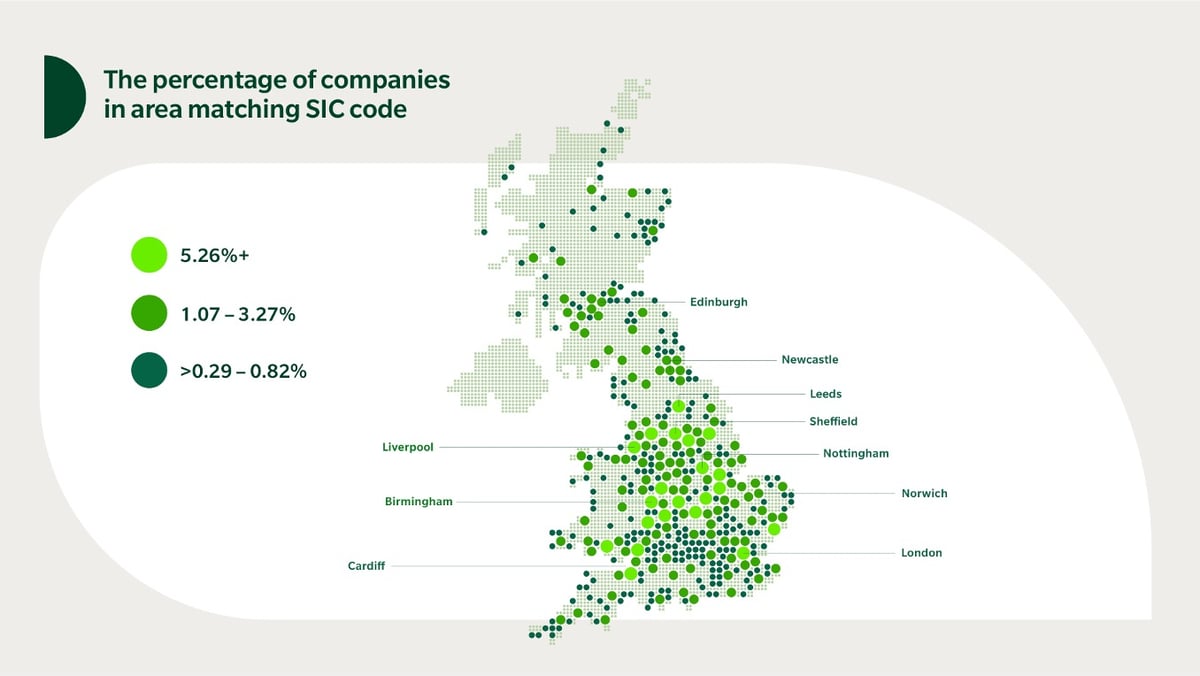

According to data from the Companies House registry compiled by Investment Monitor, many UK industries tend to congregate around centres of research, retail markets or sources of raw materials. By analysing the Standard Industrial Classification (SIC) codes of businesses listed on Companies House, it’s possible to identify several industry clusters across the UK.

When these clusters are plotted onto a map of the UK, showing the number of companies with a certain SIC code as a share of all businesses in each region, it becomes clear that industries congregate around major cities, with clustering particularly pronounced in the Midlands and northern regions of the UK.

Businesses investing in the UK’s future should look to capitalise on the power of clusters by understanding the unique strengths and characteristics of the regions they operate in.

A skilled workforce, an educated population and innovation in business and educational institutions are vital for a thriving city.

This is doubly so in a knowledge economy, says Andrew Carter, Chief Executive at the Centre for Cities think tank. “If you’re a service-based company or in a knowledge-intensive industry, the benefits you get from being in and around others like you are quite considerable,” he says. “As Britain’s economy continues to orient itself towards firms like these, they want access to skilled workers and people with degrees or even advanced degrees. The element of skill and access to skilled workers becomes incredibly important.”

Lloyds Bank’s Mark Burton says business can play a critical role by making clear investment commitments in city and regional economies, which in turn give local authorities and educational bodies the confidence to invest. It’s a positive feedback loop of investment, fostering trust between the public and private sectors and, ultimately, benefitting the local area.

“Leeds is a great example,” says Burton. “Educational institutions and other public-sector bodies have come together to form the Leeds Inclusive Anchors Network, which today comprises the city’s largest public-sector employers. It works to make supply chains more regionally focused, with anchor institutions now spending 52% of their discretionary spending in Leeds—that’s about £1 billion.”

In nearby Hull, the city’s main university acts as an “engaged civic institution” for the local area, according to Professor Susan Lea, Vice-Chancellor of the University of Hull. “The university has been thoroughly embedded in the city of Hull. It’s an institution that, through its academic mission, has set out to serve the region and all its people.”

Highlighting the opportunities for businesses to invest in local skills clusters, she adds: “As Hull is a major centre for renewables, the university has a partnership with Siemens Gamesa, which oversees big wind turbine factories in the region, and together we are offering the UK’s first offshore wind degree apprenticeships. So, students are learning in the university and working at the same time, which keeps talent working in the local region, where there are jobs to be had and a difference to be made.”

Transport is a key aspect of infrastructure for any city. Effective transport systems have a direct correlation with the economic productivity of a city, according to research by the Centre for Cities. Faster and more efficient transport allows a higher proportion of the population to access high-productivity, high-paying employment.

The Centre for Cities describes an “effective size” for urban areas—where a population can reach the centre of their city within 30 minutes. The Centre for Cities research indicates that increasing the proportion of the population with easy city-centre access could deliver productivity benefits of £23 billion to the UK.

However, the use of private motor vehicles, rather than public transport, is not conducive to reducing carbon emissions or improving local air quality.

According to the Confederation of Passenger Transport (CPT), buses are still the most used form of public transport in the UK. The government’s National Bus Strategy, launched in 2021, has announced 31 locations that will receive extra funding to improve bus services—which means there’s an opportunity for private operators to deliver those improvements with local governments.

Rethinking urban bus transport to make cities more productive is also a huge opportunity to reduce congestion and carbon emissions in urban areas. “Where there are short journeys currently made by car that could be made by bus, we need to make public transport more attractive,” says the CPT’s Tom Bartošák-Harlow. “This will help create those thriving, sustainable cities.”

By collaborating with government on public transport and urban planning projects, businesses have an opportunity to play a key role in developing the infrastructure that will deliver greener, more liveable environments for the UK’s city dwellers.

While physical connectivity remains vital, digital connectivity is increasingly seen as equally important.

The combination of robust physical and virtual connections is critical in attracting both a skilled workforce and business investment; delivering these connections is itself a business opportunity.

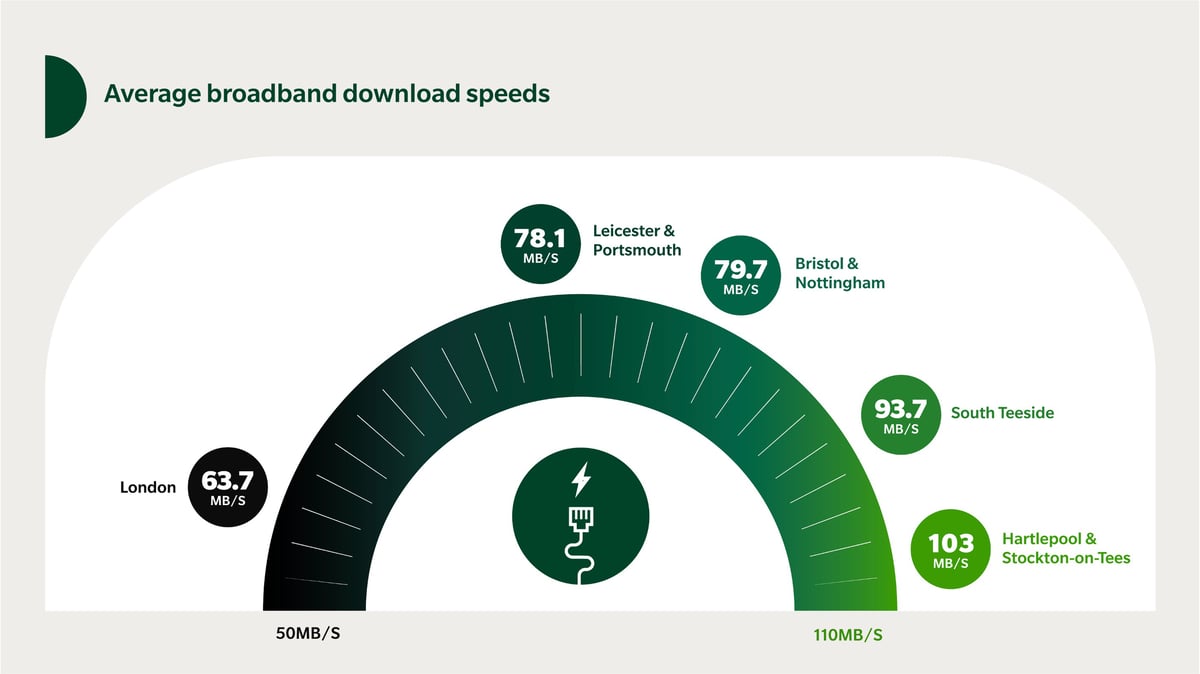

Digital connectivity varies widely, according to the CBI report. Many cities have made digitalisation an infrastructure priority, and the UK locations with the highest broadband speeds are overwhelmingly urban.

However, there are wide and surprising variations in broadband speed. Of the nine key regions identified by CBI, London has the fastest overall average broadband download speed, at 63.7 MB/s. However, many other thriving urban areas have markedly faster broadband speeds.

Digital infrastructure is as fundamental to a thriving city as transport, points out Ben Weland, Head of Telecoms, Media and Technology at Lloyds Bank, who says that the infrastructure now being put in place will last decades.

“Fibre cabling will future-proof the network for 30, 40, 50 years,” he predicts. “It can be upgraded so that you could get 100-gigabyte download speeds—far beyond any conceivable future usage needs that most of us could currently imagine.”

Partnerships between the public and private sectors are now driving the expansion of the most advanced fibre networks. Infrastructure group NGE and Cheshire-based ITS Technology have partnered with the Liverpool City Region Combined Authority (LCRCA) on a project to lay 212 km of fibre gigabit cable connecting six local authority areas in the Liverpool region. The project, half-owned by the LCRCA, is costing £30 million, and it is expected that the gigabit-capable network will attract investment and business to the region, potentially delivering a £1 billion boost to the economy.

“A fundamental part of Metro Mayor Steve Rotheram’s manifesto, this joint venture brings together the capabilities of the public and private sectors to stimulate the digital economy in the Liverpool City Region across six local authorities,” says Daren Baythorpe, CEO of ITS Technology Group. “Experts estimate that with 100% full fibre coverage, the economic boost to the Liverpool City Region could be worth up to £1 billion, creating thousands of local jobs and training opportunities.”

Mobile technology is also central to thriving cities, adds Weland, with 5G technology not just delivering better phone and internet connections, but also spawning new applications of mobile technology in business operations, including secure private 5G networks.

“5G is a key area because we’ve only just touched the surface of it. It can enable completely new ways of operating—for example, running a factory over a 5G network,” he says.

For a thriving city, investment in digital infrastructure is now as vital as investment in public transport. City authorities that work in partnership with private providers to build this digital infrastructure will create the thriving cities of the future.

The importance of partnership between the public and private sectors is particularly clear in housing. The CBI’s Goga says it is important to recognise that if areas become economic hotspots, demand for housing can overheat.

“You only have to look at what’s going on in Oxford and Cambridge to see how house prices are completely disproportionate to the sort of average wages in these places,” he says. “The private sector takes the lead on cluster development, and it is working hand-in-glove with the public sector to ensure that its investment is matched by public investment to make these cities more affordable places to live.”

It’s no surprise that home prices are high in the country’s best-known economic hubs. Yet it is noteworthy that some of the UK’s fastest-growing and most innovative locations have much more affordable housing. Of 65 towns and cities it studies, the Centre for Cities identifies Hull, a fast-growing hub for renewable energy and offshore wind, as having the best housing affordability ratio.

Balancing welcome economic growth with housing affordability is essential for a thriving city and may require innovative approaches to finance.

Burton, at Lloyds Bank, says addressing housing is essential for cities to capitalise on the other success factors. “You can have the right pull factor in terms of jobs and skills, but have you got the housing stock? Getting that right is the key to both economic growth and to tackling social exclusion,” he says.

Not only should housing be affordable, but a key consideration for today’s home builders is putting sustainability at the heart while ensuring that homes can stand the test of time. Investment in the built environment, including retrofitting of homes and buildings, is also a key action for a thriving, sustainable city. Funding this work requires a combination of public- and private-sector investment.

Urban Splash, a leading proponent of sustainable housing, is an award-winning regeneration company that uses pioneering building techniques to reduce waste and create environments that foster well-being.

“Our distinctive homes are as ambitious in terms of sustainability as they are in design, with off-site modular construction ensuring that we’re able to minimise their environmental impact and promote green, healthy living,” says Ben Thatcher, Urban Splash’s Head of Finance.

Thriving and sustainable cities are built through cooperation and coordination between multiple stakeholders from the public and private sectors, including educational institutions. The UK government has recognised the role it can play with the launch of the £4.8 billion Levelling Up Fund, aimed at regenerating public transport, rolling out gigabit broadband and relocating government departments out of London.

There is also a vital role and opportunity for private-sector investment, says Lloyds Bank’s Burton. “It’s clear that business and finance must be partners in this regeneration,” he says. “As the government decentralises power and works more directly with local partners and communities, businesses have the opportunity to drive investment to every corner of the country and contribute towards creating thriving cities across the UK.

“By working together across the five fundamental factors—clustering, skills, transport, digital connectivity and housing—the public and private sectors can realise opportunities in a sustainable way across all the cities and regions of the UK.”