How a 160-Year-Old Japanese Company Created the Investment Opportunity of a Lifetime

Sponsored Content From

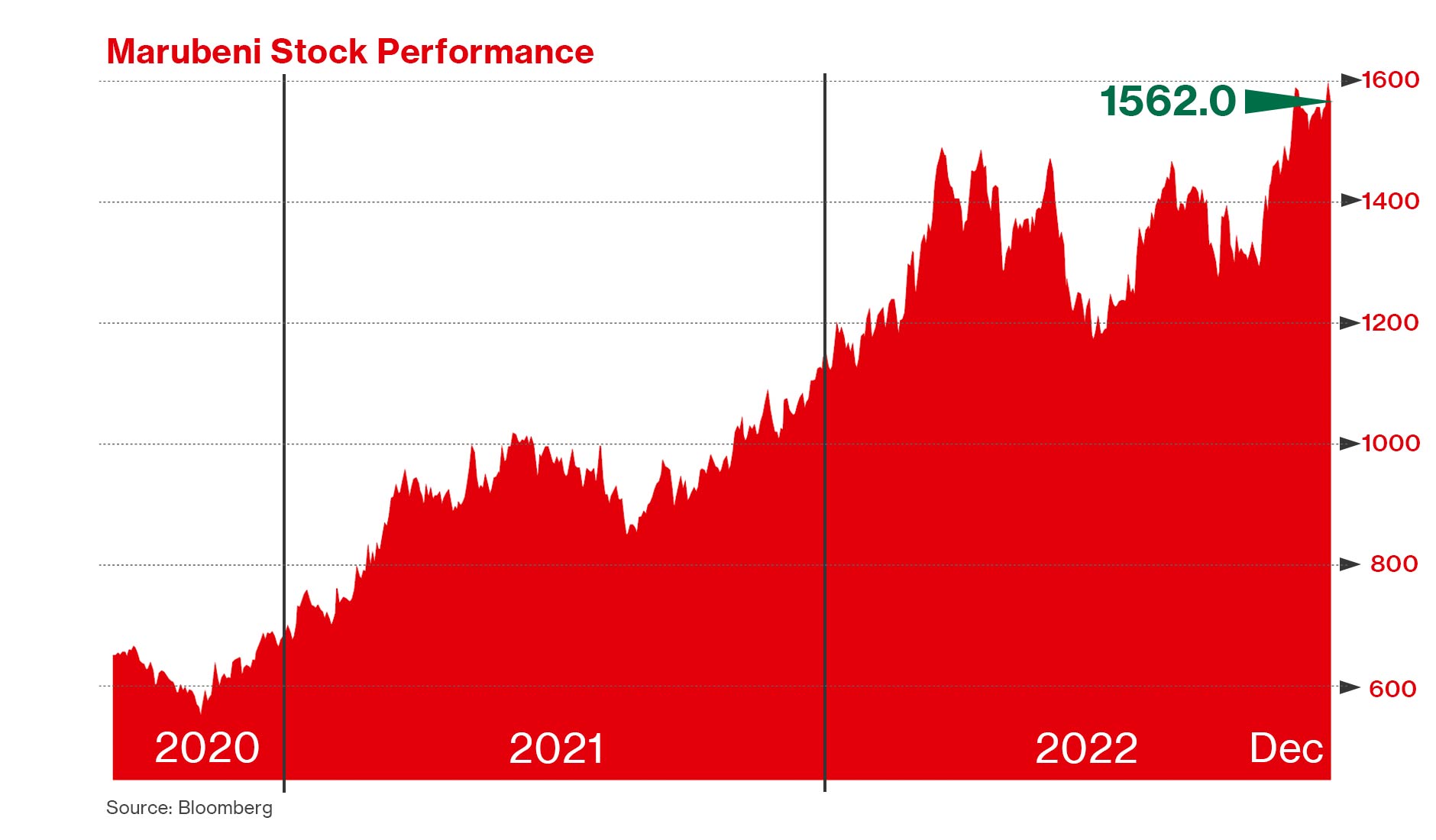

The emergence of Covid-19 rattled Japanese trading houses. Declining demand for fuel and raw materials derailed profits and eroded share prices at the onset of the pandemic. In hindsight, this created the buying opportunity of a lifetime.

Marubeni shares soared in the months that followed—driven by record profits in FY21 and drawing on a sound business model and successful investments in the US including Helena Agri-Enterprises and Creekstone Holding.

Investing in Growth Markets

The US accounts for around 42% of Marubeni’s consolidated revenue, followed by Japan with 37%. The US will remain a key market for Marubeni, thanks to ample growth opportunities and its low country-risk profile.

Vast swathes of land and an abundance of natural resources make the US an agricultural powerhouse—one of Marubeni’s key investment areas. Projections for a 10% increase in population by mid-century and rising food demand1 underscore Marubeni’s investments.

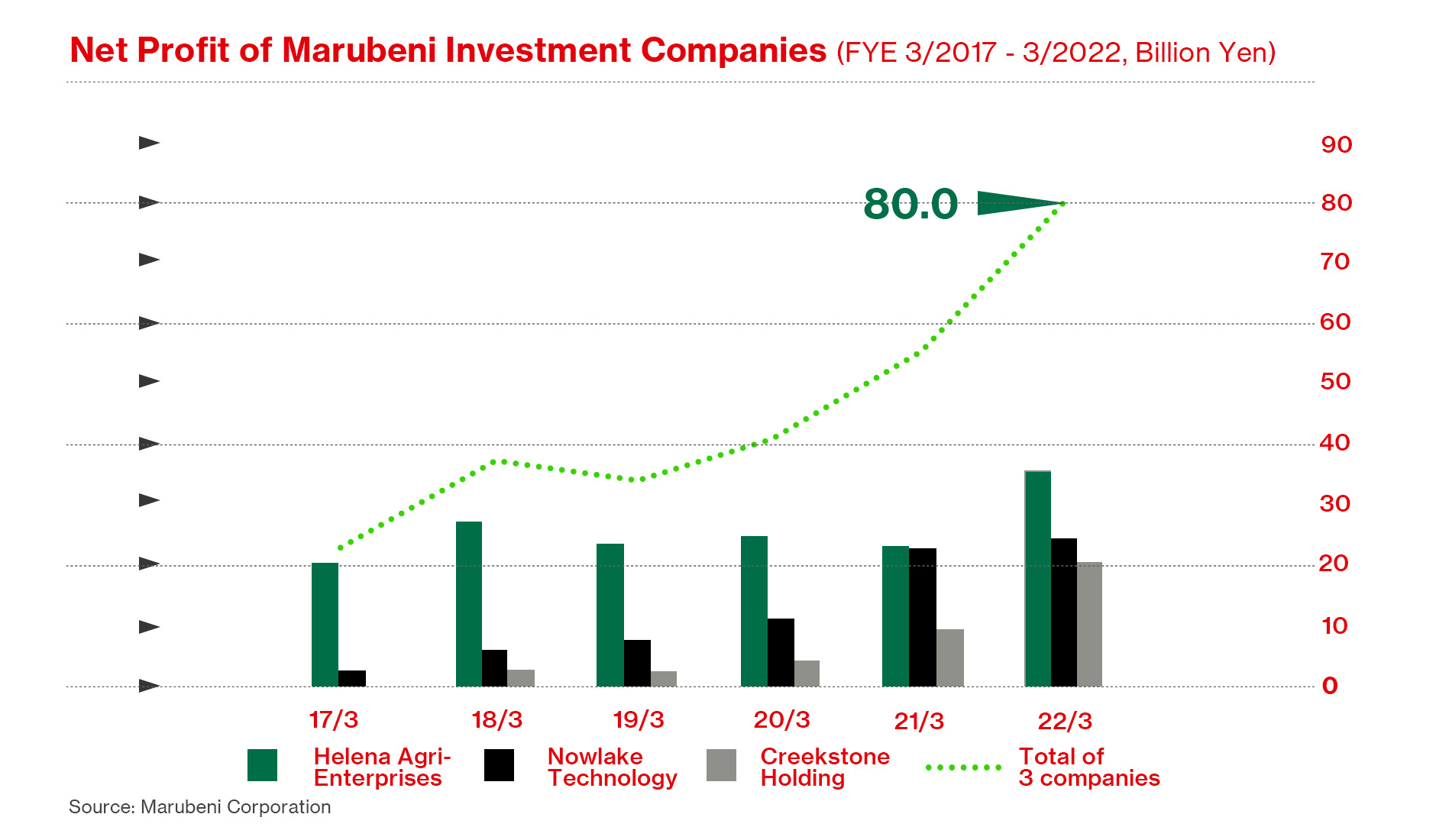

One example is Helena Agri-Enterprises—one of the US’s foremost agronomic solutions providers. Helena markets and sells inputs that improve productivity including fertilizer, seed treatments, seed and application services, crop protectants and precision agriculture services.

Creekstone Holding, which produces premium quality Black Angus beef, provides another example. Marubeni acquired Creekstone in anticipation of a steady increase in demand for beef, especially in emerging economies. Since then the company’s performance has improved rapidly, and thanks in part to being able to draw on Marubeni’s know-how from its livestock operations in other regions, it proved a resilient supplier throughout the Covid-19 pandemic.

Both companies are expanding their businesses and have enhanced their financial performance. Helena posted a record net profit in FY21, while Creekstone’s net profit more than doubled.

Marubeni recently restructured its grain and fertilizer company, Gavilon Agriculture Investment, to accelerate its expansion in the US agriculture marketplace. By selling the grain unit the company significantly strengthened its financial base and increased management flexibility. Marubeni will now focus on its grain export supply chain, enhancing earnings capacity.

Beyond agriculture, Marubeni’s US investments include Nowlake Technology—one of the country’s biggest used-car finance lenders. Used vehicles accounted for nearly 62% of auto loans in the second quarter of 2022, with the average loan size up 18.7% year-on-year.2 By harnessing big data, Nowlake continues to scale up, drive efficiency and spur revenue growth.

A Diversified Portfolio and Solid Financial Base

Wisdom holds that a diversified portfolio is most resilient to economic shocks. Here, too, Marubeni shines. From consumer products, transportation and industrial machinery to energy, infrastructure and agriculture, Marubeni has built a robust portfolio that has weathered the Covid-19 pandemic and ongoing geopolitical tensions.

Marubeni will continue to make growth investments in the years ahead, in line with its overall strategy. The company uses a multi-layered approach: strengthening the earnings base of existing highly profitable businesses through growth investment and capital expenditure, while employing a rigorous process to select and invest in new businesses with future growth potential.

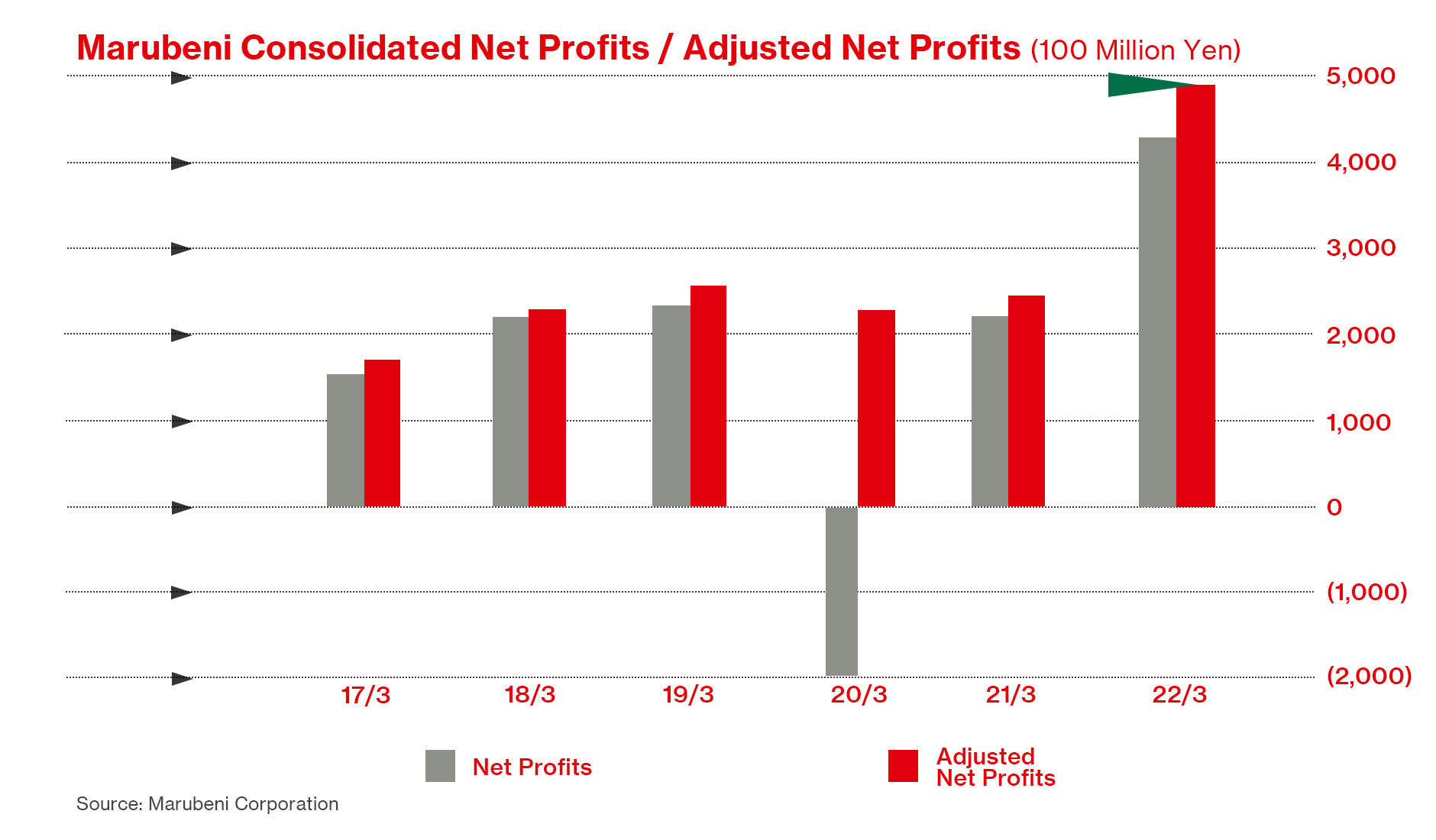

Naturally the trading house applies the same diligence to its own financial soundness and earnings performance. Sharp movements in global commodity prices have had an impact on net profits from resources over the past several years. Yet adjusted net profit from non-resources surged 66% year-on- year in FY21, reflecting the company’s financial prudence and growing earnings from its diverse portfolio.

Marubeni’s net debt-to-equity ratio also improved to 0.8x at the end of FY21 due to its improved core operating cash flow and increased shareholders' equity. Marubeni is committed to maintaining its financial discipline. While Marubeni’s performance has been strong, impairment losses and other one-time losses had a negative impact. Yet, by proactively strengthening its position in the non-resource sector, its performance will remain resilient to a wider downtrend even if the economy fluctuates.

The company’s efforts were recently rewarded. S&P upgraded Marubeni’s credit rating to BBB+ from BBB in April, while Moody’s raised the company’s outlook to “Baa2 (positive)” from “Baa2 (stable).” The company is also listed in the Global Fortune 500.

Sustainability-Minded Growth

As the world strives towards a greener future, Marubeni aims to be a forerunner in green businesses and is advancing initiatives in sustainability. It plans to grow its green businesses in areas where it boasts solid business foundations and create new ones in areas including new energy, recycling and decarbonization solutions.

Through these and other initiatives, Marubeni is taking steps to reduce its impact on the environment with the aim of achieving net zero emissions by 2050, transitioning to a circular economy and building a sustainable supply chain in all business domains.

While shares in Marubeni remain near recent highs, this 160-year-old company with a diverse portfolio, sound financials and a strategy rooted in insight and foresight has a lot to offer investors now and for years to come.

To find out more visit marubeni.com.