Bringing Clarity to the New Digital Payments Reality

The world has long moved on from the simple choice of payment by cash or cheque. The flow of money has never been more complex and varied. Our newly digitized economy facilitates infinite combinations of interactions between consumers, businesses, governments and financial institutions, both domestically and across borders. From bill payments and social benefits, to remittances and investments - for each of these interactions, there are a multitude of payment options.

Much of this boils down to the fact that people expect to be able to pay and get paid how, when and where they want, be that online or in person. According to Mastercard’s New Payments Index, 77% of consumers agree that their preferred payment method changes based on the situation and 93% of consumers are considering using at least one emerging payment method, such as cryptocurrency, biometrics or QR, in the next year.

Businesses, governments and financial institutions need to be alert to this demand for flexibility – and ensure they’re meeting the needs of those they transact with. Part of that offering is providing a secure and trustworthy service so consumers and businesses can explore their options safely, fitting the way they transact around their preferences, not the other way around.

The Future of Payments is Choice

At Mastercard, we have been broadening our network and capabilities to support all types of transactions and payment flows, beyond credit and debit, including real-time payments, account-to-account, push payments, open banking and digital assets. We refer to this as our ‘multi-rail’ strategy: it’s an expression we created to talk about payment by more than just cards and to reflect our focus on allowing people and organizations to use their money however they want, safely and conveniently, providing choice in a truly differentiated way.

With digital transactions predicted to total $3 trillion by 2030 and countless connections in the growing Internet of Things, we have an expanding and ever-evolving ecosystem that must be protected. Mastercard's Connected Intelligence approach helps to secure the entire payments ecosystem across all touch points, using thousands of data points per customer journey, replicated across hundreds of millions of transactions. Armed with data insights, ranging from biometrics to average spend information, issuers and merchants can confidently assess the risk of any kind of payment made via Mastercard’s network, resulting in both a reduction in the potential of economic crime such as fraud and money laundering, and a more seamless payment experience.

Choosing the Right Tools

We’re currently seeing tremendous interest in, and potential for, digital assets like cryptocurrencies and non-fungible tokens (NFTs). These new technologies are becoming increasingly intertwined with our everyday activities - from the way people pay and get paid to how they invest - making trust and security critical enablers to ensure broad adoption and scale. With this in mind, we recently acquired CipherTrace, a cryptocurrency intelligence company, which will allow us to help people, businesses and governments better understand and trust how these assets are used and support a safe and secure digital asset ecosystem.

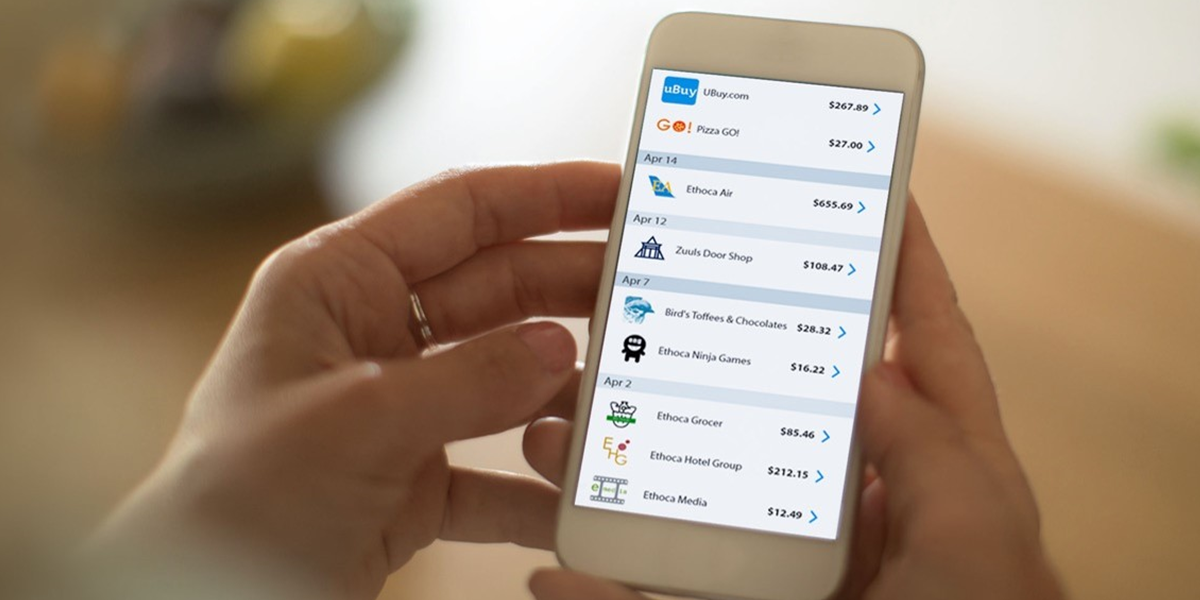

Another point of focus is post-purchase. Trying to decipher digital statements isn’t simply frustrating – that lack of clarity actively hampers the consumer from identifying when they have been a potential victim of fraud. It also results in cardholders being forced to raise unnecessary disputes with their banks as they query unrecognized transactions, adding needless extra steps and costs for merchants and banks.

To that end, Mastercard is providing consumers with more complete transaction information, through our collaborative solutions from Ethoca. This intuitive approach provides merchant names and logos with purchase location details and itemized digital receipts, all of which makes transactions easy to recognize. By limiting avoidable chargeback disputes, we help banks reduce their operating costs and provide consumers with a superior user experience.

Investing in Simplicity

The payments landscape today is complex. By focusing on the bigger picture, we are enabling our customers and consumers to transact and interact with confidence and peace of mind, whilst fostering innovation and growth. At Mastercard, we bring value by making the highly complex simple for our customers, so that whatever choice the consumer makes, the process just works.

— Ajay Bhalla, President, Cyber & Intelligence, Mastercard