Asia’s New Roles Amid the FDI Shake-Up

From energy to electronics, foreign direct investment (FDI) seeds new sectors and ecosystems, and has been pivotal in Asia’s economic development. While the region remains central for these capital flows—with about half of all FDI coming from or going to an Asian economy—the image many hold of Western FDI setting up factories on Asian soil needs to be updated to the new realities on the ground.

That message is clear in recent research from the McKinsey Global Institute (MGI), which describes the new FDI shake-up based on about 200,000 announced FDI projects over the past decade. Among the notable shifts we see pre- and post-pandemic: China switched from being a net recipient of announced FDI to a net investor for the world. The growing FDI outflows from Asian multinational companies are helping to build, for example, tomorrow’s leading-edge semiconductors, electric vehicles (EVs), and batteries in many regions, laying foundations for future corridors for trade.

Drilling down, MGI’s newly released report shows that in semiconductors, a resounding 70% of all greenfield FDI announced each year since 2022 (with data to May 2025) came from Asian multinationals, up from just about 45% between 2015 and 2019. In EVs and batteries, Asian firms were the source of about 60% of global announcement totals, up from 40% in the previous period.

To make more sense of the shifts underway, we spotlight FDI shake-ups in four parts—advanced Asia, China, Asean, and India—with headlines from each of these diverse Asias making up the world’s biggest regional economy.

Advanced Asia Quadruples Announced FDI Into the United States

Advanced Asia—including Australia, Japan, New Zealand, South Korea, and Taiwan—is a prominent FDI investor, especially in advanced manufacturing. Notably, since 2022, advanced Asia has announced an average of about $100 billion a year in outgoing FDI intended for the United States. The main drivers were Taiwanese and South Korean commitments to US manufacturing projects over the post-pandemic period analyzed. These FDI announcements have the potential to reconfigure advanced manufacturing industries globally, potentially drawing the United States into the circle of top leading-edge semiconductor-producing nations down the road.

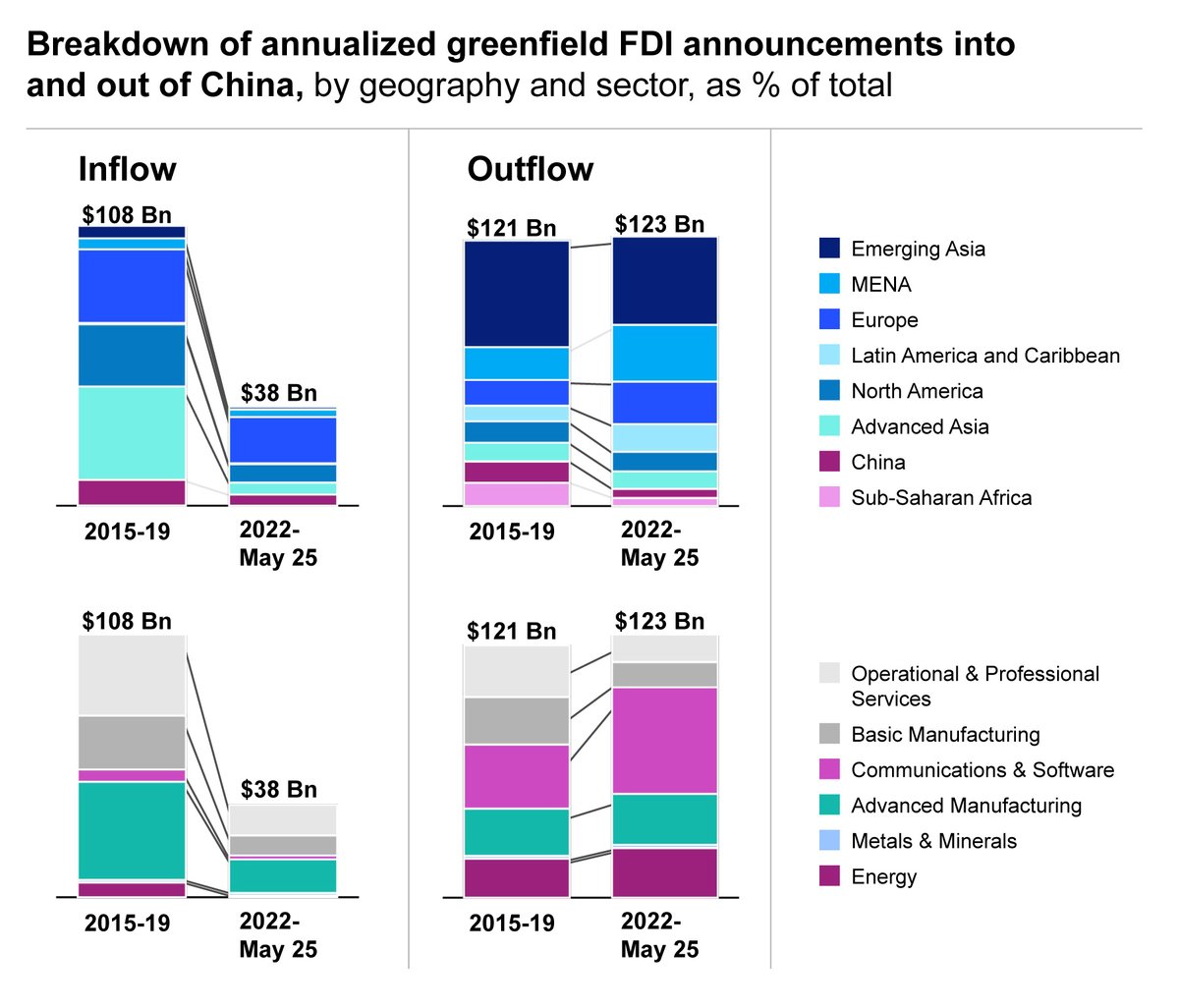

China Takes on a New Role as a Net Investor in Advanced Manufacturing

Geopolitical tensions and heightened domestic competition have dramatically reduced announcements of foreign investment in China. Since 2022, announced greenfield FDI inflows destined for China have declined by about two-thirds, a decline that has continued in 2025. Advanced Asian economies in particular have shifted investments elsewhere. At the same time, China ramped up its domestic investment so that total investment grew considerably. While the decline of capital inflows from greenfield FDI may be somewhat immaterial in this context, reduced access to know-how and human capital in future-shaping industries could become more pronounced over time.

Meanwhile, China still stands as the world’s leading investor in metals and minerals projects—a position it has held since before the pandemic. But since 2022, China has moved up the ranks to also become the world’s largest FDI source for announced projects in the automotive and electronics sectors, making up about 25% of total outbound announced investments for both.

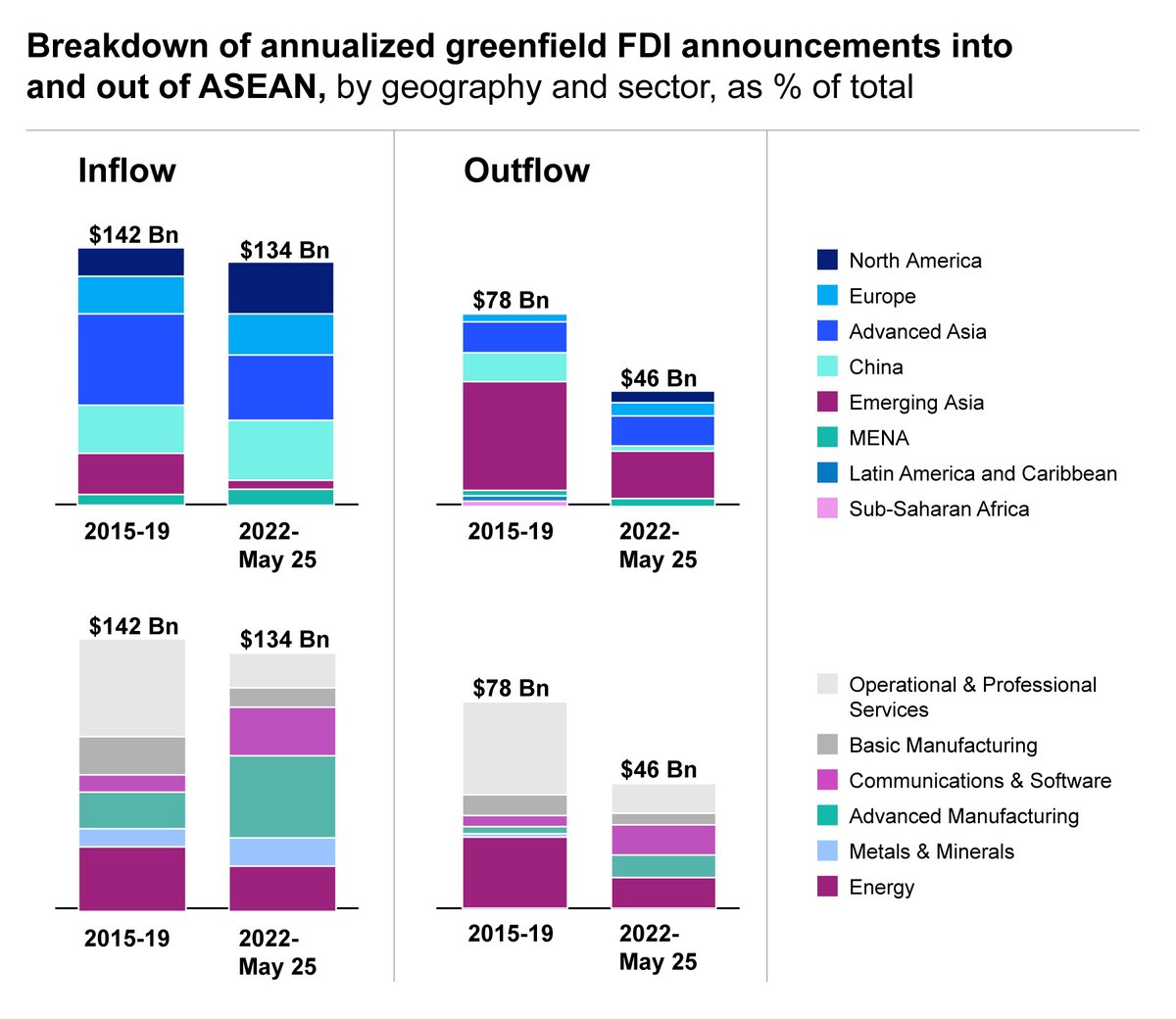

Asean Continues to Be a Major FDI Destination, But With Mixed Results

Asean remained a major destination for global investment announcements, especially from China, though FDI dynamics have evolved notably, as seen by comparing pre- and post-pandemic years. From 2022 to May 2025, announced FDI inflows dipped slightly compared to 2015 to 2019, from $142 billion to $134 billion a year, even as global FDI rose 24% over the same periods.

Performance varied widely across member states. Malaysia and Thailand led the region, with announced inflows growing 64% and 30%, respectively. They were buoyed by large-scale projects in advanced manufacturing and AI data centers. At the same time, Vietnam and Indonesia—historically two FDI mainstays—have seen announced FDI fall as a share of GDP since 2022. However, Vietnam is still drawing meaningful manufacturing inflows, including in electronics and semiconductors. And Indonesia is attracting new battery production projects.

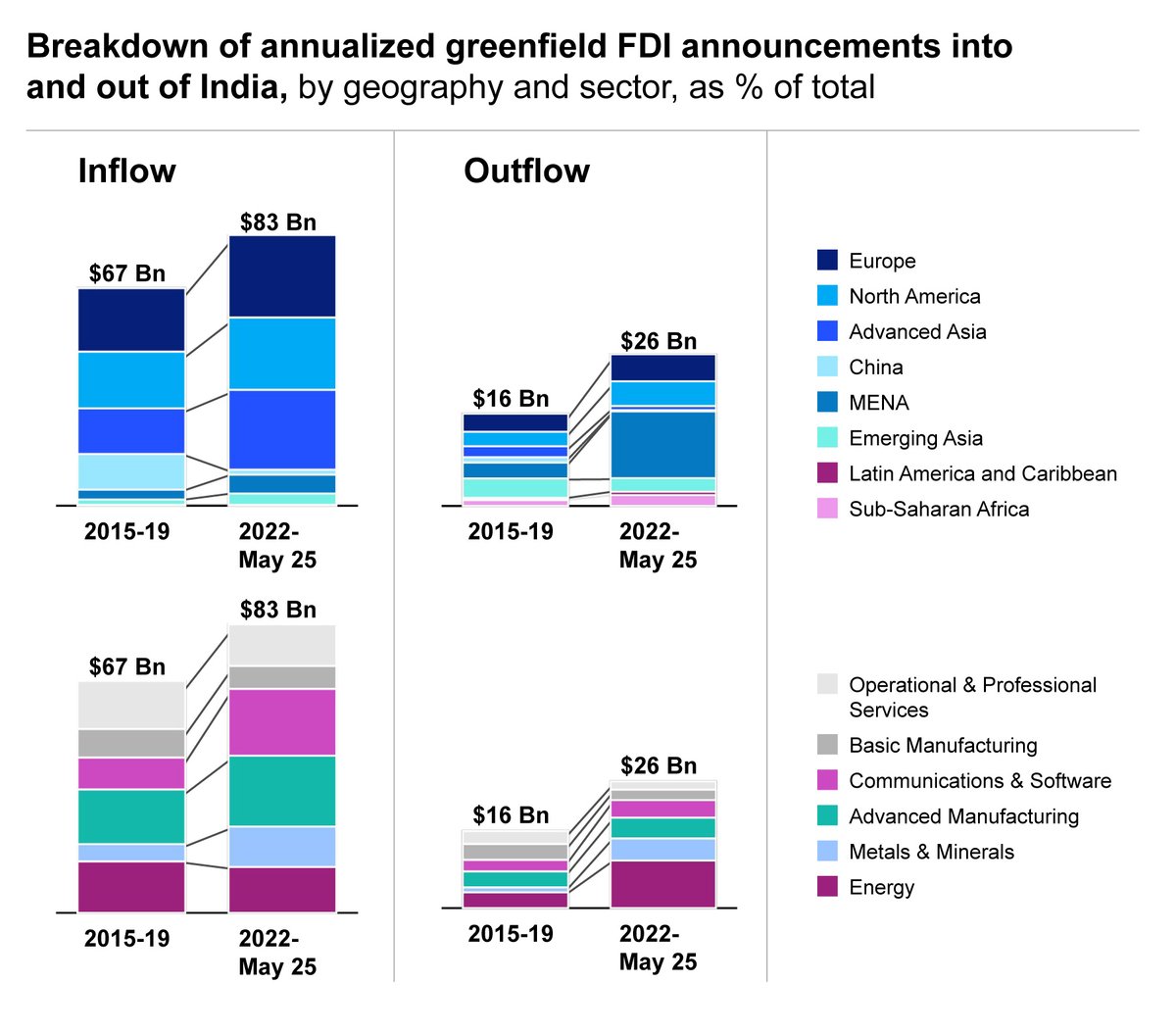

India’s FDI Magnetism Is Growing and Looking More Balanced

The picture is different for India, which has become the top emerging-market destination for announced FDI—not just for Asia’s FDI, but globally. Since 2022, India’s greenfield FDI inflow announcements have grown 24% to around $83 billion a year. India’s announced inflow composition is remarkably balanced geographically: roughly equal shares of announced investment are coming from North America, Europe, and advanced Asia, reducing India’s reliance on any single partner or region.

Of that $83 billion per year, almost half headed for just two of India’s high-potential sectors: AI infrastructure and advanced manufacturing. For example, US tech giants are announcing large data center projects on Indian soil. Sizable semiconductor investments are also in the works. Japanese and South Korean companies are announcing significant new EV assembly and battery manufacturing projects. These investments into India could bring more specialized expertise and empower home-grown tech talent.

Putting FDI to Work, for Recipients and Investors

In principle, for recipients, FDI can be an important engine of growth, both directly and via spillover effects. We find there are three conditions that point to FDI’s spillover success. First, an economy receiving FDI becomes integrated into global value chains by making upstream or downstream linkages with other countries. Second, an economy has adequate human capital, infrastructure, and regulatory frameworks to absorb incoming technology, skills, and knowledge crossing borders. Finally, FDI spurs domestic investment. When domestic investment follows after FDI plants initial seeds, growth is more sustainable over time.

Meanwhile, for investors, FDI helps reach new markets, secure resources for growth, and diversify amid geopolitically turbulent times. In the new FDI shake-up, we see Asia’s outgoing FDI expand its reach well beyond the region into strategic industries the world over. At the same time, we find China’s importance as a source of advanced manufacturing FDI is growing, redrawing the old image of China as the main benefactor of Western FDI. As Asia continues to account for $1 out of every $2 in global FDI, new roles are emerging.

Gautam Kumra is chairman of McKinsey’s offices in Asia, based in Singapore. Jeongmin Seong is partner at McKinsey Global Institute (MGI), based in Tokyo. Nick Leung is director of MGI and senior partner, based in Hong Kong.