Asia: The Epicentre of Global Trade Shifts

The world remains deeply connected by virtue of global trade, but the geometry of economies’ connections has been shifting. Some major economies are moving toward trading more with geopolitically closer partners while others continue to deepen their international trade networks both geographically and across the geopolitical spectrum.

Asia is at the forefront of this shifting geometry of global trade in all its shapes. How changing trade patterns will play out is far from certain, but four key trends in the region are already evident. Understanding these trends can help business leaders anticipate the shape of the region’s economic landscape, and its role in global markets.

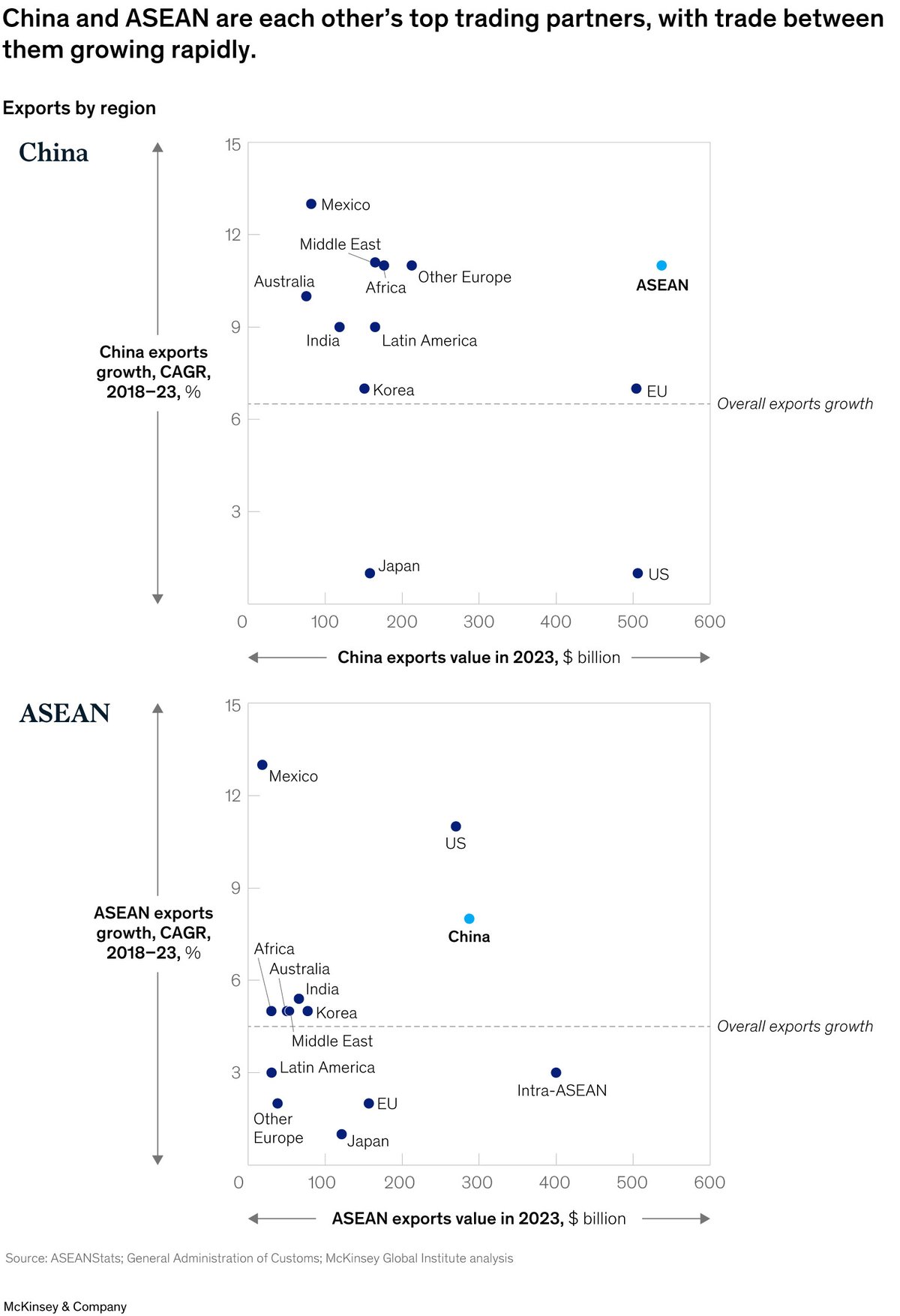

The deepening economic interdependence of China and the Association of Southeast Asian Nations (ASEAN)—each other’s largest trading partners—stands out. ASEAN accounted for 15% of China’s total trade in 2023, up from 10% in 2010, while China accounted for 20% of ASEAN’s total trade in 2023, up from 12% in 2010. Further integration could be propelled by the Regional Comprehensive Economic Partnership, the world’s largest free-trade agreement, which covers 15 economies in the Asia-Pacific region.

2. Asian economies are increasingly participating in trade, and geopolitics is influencing the shape of this growth. Globally, between 2017 and 2023, the value of goods traded grew by around 5% each year, on average. Many Asian economies’ annual trade grew faster: by 6% in ASEAN; by more than 7% in China and India; and by 8% in Vietnam.

Geopolitics may be exerting an increasing influence on the shape of this growth. The McKinsey Global Institute has developed a measure of the “geopolitical distance” of trade—an analog of geographic distance—that quantifies how geopolitically close an economy is to its trade partners. According to this metric, between 2017 and 2023, the average geopolitical distance of trade fell by 4% for China; for Japan and South Korea, geopolitical distance fell by 4% and 6%, respectively. This indicates that, for these economies, their trade has shifted to geopolitically closer partners. However, this is not a universal trend. Notably, geopolitical distance has remained stable for ASEAN and India, indicating that their trade continues to span a broad geopolitical spectrum, although geopolitics may reshape their trade ties in the coming years.4. Foreign direct investment trends suggest that further trade reconfiguration is underway. Foreign direct investment (FDI) can presage shifts in trade. Announced greenfield investments into India have surged, increasing by around 35% in 2022–2023 compared to pre-pandemic averages, according to fDi Markets data, with the manufacturing, electronics, IT, health care and renewable energy sectors largely driving this rise. Announced greenfield FDI into ASEAN increased by 10% in the same period. Conversely, announced investment into China fell by more than 60% in 2022–2023 compared to pre-pandemic averages. These changes suggest that the “connector” role of some Asian economies—indicated by the shift of investment away from China and toward other Asian economies—may strengthen further. The surge of investment into India indicates that it will continue to grow as a global supplier of goods and services.

3. Some Asian economies are emerging as global connectors. Between 2017 and 2023, trade between the United States and China fell, but ASEAN emerged as a “connector” between these two economies. In this period, ASEAN imports from China surged while ASEAN exports increasingly went to the United States. In the case of Vietnam, the value of imports from China doubled—an addition of $50 billion—and its exports to the United States increased by $60 billion. A similar, although less pronounced, trend can be seen in Malaysia, the Philippines and Thailand.

4. Foreign direct investment trends suggest that further trade reconfiguration is underway. Foreign direct investment (FDI) can presage shifts in trade. Announced greenfield investments into India have surged, increasing by around 35% in 2022–2023 compared to pre-pandemic averages, according to fDi Markets data, with the manufacturing, electronics, IT, health care and renewable energy sectors largely driving this rise. Announced greenfield FDI into ASEAN increased by 10% in the same period. Conversely, announced investment into China fell by more than 60% in 2022–2023 compared to pre-pandemic averages. These changes suggest that the “connector” role of some Asian economies—indicated by the shift of investment away from China and toward other Asian economies—may strengthen further. The surge of investment into India indicates that it will continue to grow as a global supplier of goods and services.How the patterns of global trade will evolve is uncertain. But one thing is for sure: Asia is the world’s new “majority.” The region accounts for more than half of global trade, middle-class households, manufacturing value added and GDP growth. This offers opportunities for those economies that can further integrate into Asian and global value chains.

Gautam Kumra is the Chairman of McKinsey’s Asia offices, while Jeongmin Seong is a partner at the McKinsey Global Institute based in Shanghai.