How Asian Companies Can Take Part In The Green Start-Up Boom

By Gautam Kumra and Vivek Lath

The opportunities for building green businesses are more attractive than ever and Asian energy players – both established firms and start-ups – should seize the moment and apply the lessons learned globally.

Asia could potentially see up to a ten-fold increase in overall start-up activity over the next three to four years, recent McKinsey research suggests. A large proportion of that could be in green and sustainability-related sectors.

Figures show that over the past three years, more than 25 green businesses around the world have joined the unicorn club, with a combined valuation exceeding $70 billion. There has also been a more than 67% increase in deals since 2018, with a total of $2 billion invested globally in sustainability-themed start-ups across 260-plus deals. Europe and North America currently lead in terms of investment size, with Asia rapidly catching up.

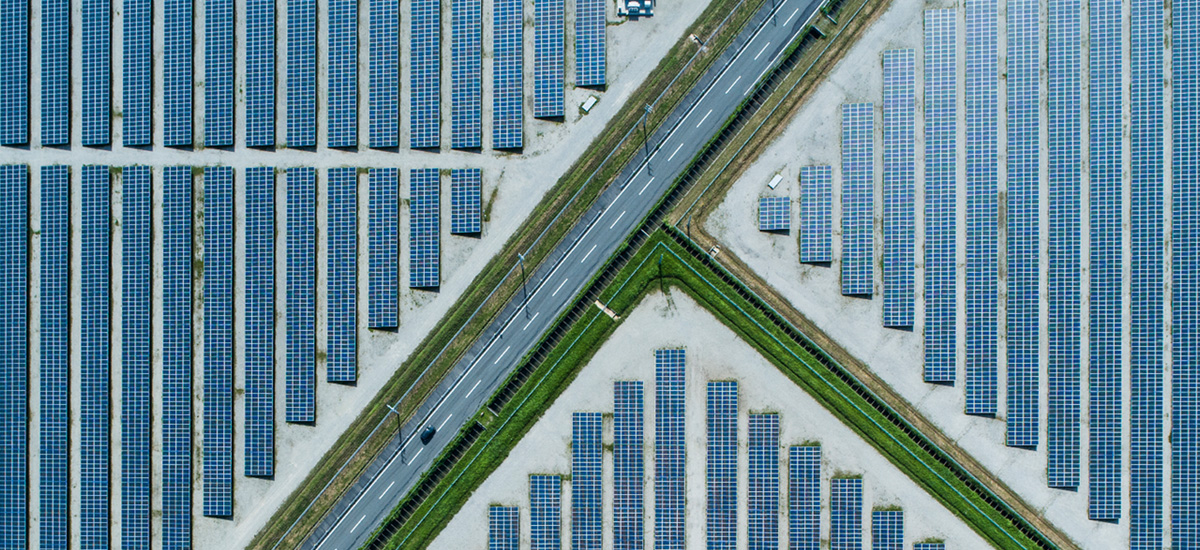

Much of this momentum is concentrated in the energy industry due to advances in technology, financing, and regulatory policies. In power generation renewable energy (RE), sources will only grow, and are expected to account for half of all power generation by 2035. In shipping, the pressure to decarbonize has also encouraged the development of alternative fuels such as liquefied natural gas (LNG), hydrogen and ammonia. In road transport, there is an ongoing major shift from internal combustion engines (ICEs) to hybrid and electric vehicles (EVs).

Committed To Action

Companies should recognize the urgency of the moment and act decisively. Value pools are shifting and all stakeholders – consumers, investors, and regulators – are now committed to sustainability. Firms and investors need to rapidly pivot to greener avenues and be committed to following this path.

The lessons learned from other regions show the strategic way forward on this green path:

- Identify replicable opportunities. Different regions and different countries are further along their green journey than others. Rates of adoption of the latest technology also differ. As a result, companies can look at various green sectors (such as hydrogen or batteries) in Europe and the United States, or even across neighbors in Asia, and see what they can apply in their respective countries

- Build with agility and strength. Top business leaders need to achieve a balance between having the agility of a start-up and the strength of an incumbent. Having a focus on leadership, customers, and talent, allows firms to launch new ventures that are both a pathway to organic growth—safeguarding at-risk revenue streams – and new growth areas

- Corporate Venturing. Leaders need to set up a screening system and then invest meaningfully in innovative startups.

Taking such a portfolio approach diversifies risk and builds the capability for launching new businesses. BP, for example, created its in-house, business-building engine called Launchpad to set up five digitally led, low-carbon businesses

- Find partners. By seeking out partnerships, companies can expand and replicate what other companies have learned. For example, Japanese onshore wind players Japan Wind Development (JWD) and Eurus Energy partnered with Orsted. The Danish firm is the world's largest developer of offshore wind power. Together the partners are jointly bidding to win one of Japan’s first offshore wind projects in 2022

- Work with the public sector. Regulatory incentives such as feed-in tariffs and other subsidies are behind many of the notable success stories in green business building. These have also created value beyond the local markets in which they originated. For example, Chinese electric vehicle companies have grown out of domestic subsidies and are now supplying vehicles and components to global markets

Green-Business Value Proposition

Developments in both technology and government policy have decisively shifted momentum towards sustainability in the energy sector. Governments are working towards carbon neutrality with more than 130 nations committed to or considering a net-zero target. One in five global Fortune 2000 companies have pledged the same. At the same time, consumers are paying more attention to the environmental credentials of the brands they consume.

As consumers, investors and regulators demand more sustainability from companies, the green-business value proposition should accelerate. In this dynamic landscape, incumbents will find themselves defending their positions and competing against start-ups hungry for a slice of the pie. The winners will be those that can identify emerging trends, create clear value propositions, work hand in hand with policymakers and execute at speed.

Gautam Kumra is the Chairman of McKinsey’s Asia offices, while Vivek Lath is a partner based in McKinsey’s Singapore office.