Overfunded Pension Plans: The $120 Billion Opportunity

Corporate pension plans now provide for the company and the workers.

After being injected for years with returns from the raging bull market, corporate pension plans are showing signs of life. In fact, they haven’t been this popular since the 1980s – the era of big hair, acid-washed jeans and MTV.

Back then, pensions were the primary source of retirement income in the US, with 88% of Americans receiving retirement coverage from defined benefit plans, according to the Center for Retirement Research at Boston College. But corporations began to move to defined contribution plans — such as 401(k) plans — that shifted the primary responsibility for saving and investing from the company to workers.

While defined benefit plans remain common for government employees, a dwindling percentage of workers in private industry participate in them — down to just 11% as of 2022, according to the US Bureau of Labor Statistics.

But earlier this year, IBM made a surprise announcement that it was thawing its long-frozen defined benefit plan and opening it up to new participants.

What was behind the change? IBM’s pension plan, on ice since 2008, had become a cash cow: Its $24 billion pension plan had $3.6 billion more in assets than liabilities at the end of 2022, with a funding ratio north of 115%. IBM decided to use that pension surplus to provide participants with a benefit equal to 5% of their annual salary, but it also eliminated its company match for contributions to an employee’s 401(k) plan.

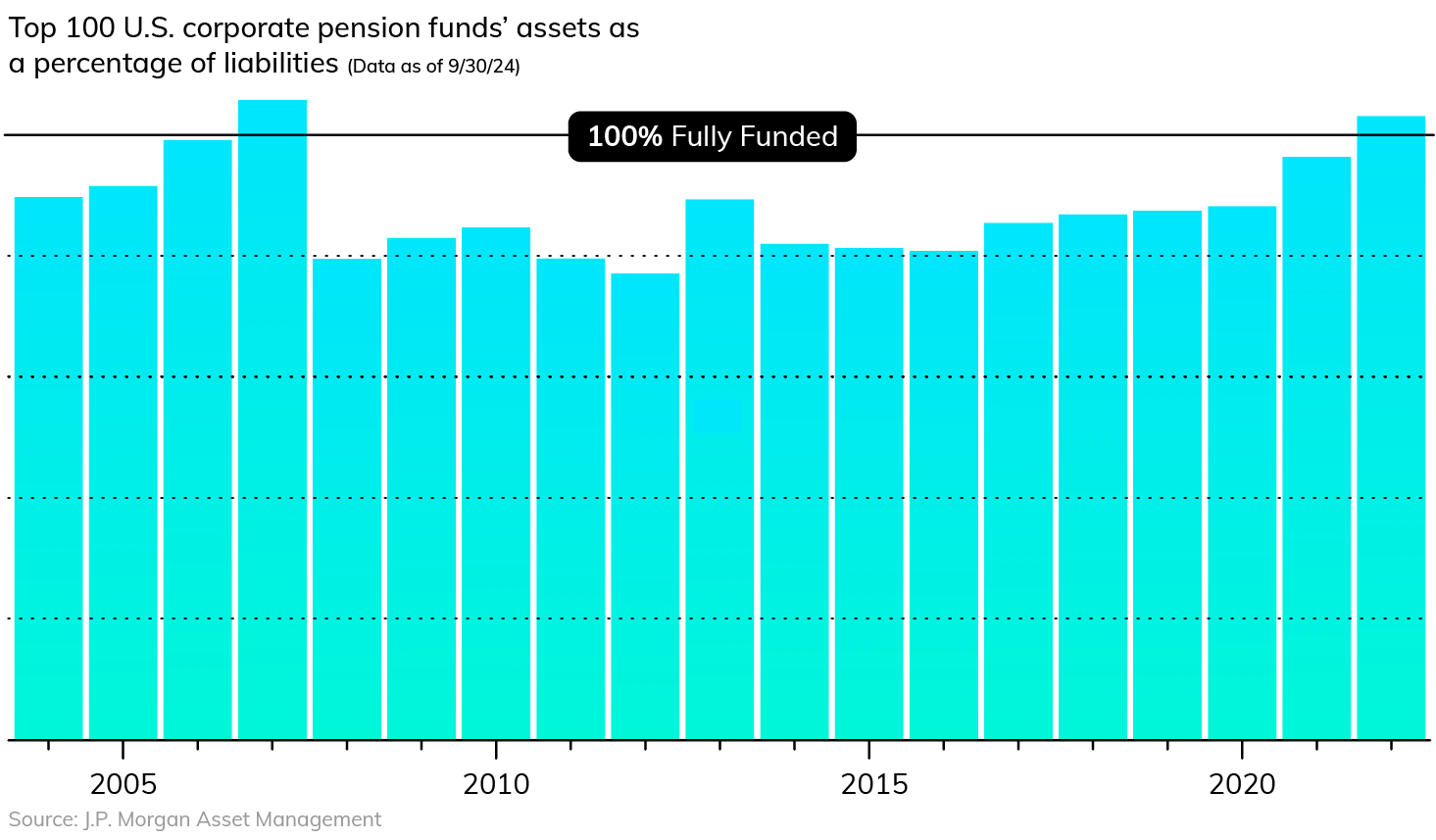

IBM isn’t alone. After years of strong market gains, companies around the country are suddenly sitting on overfunded pension plans. For the first time in more than a decade, the average corporate pension is fully funded.

Corporate pension plans are fully funded for the first time since 2008

“A lot of people think pensions are dinosaurs and that they’ve completely disappeared,” says Jeff Passmore, Lead Liability-Driven Investment Strategist at MetLife Investment Management. “But they’re still a big deal. Strong funding levels have allowed pension managers to de-risk, and for the first time, their fixed income allocations have surpassed stock holdings. The landscape has changed.”

The flush status of legacy plans is opening up new opportunities. In the US, corporate pension plans represent a $3 trillion pool of assets. MetLife Investment Management estimates that Russell 3000 companies with defined benefit pensions were sitting on a surplus worth a combined $62 billion as of October 2024.

Now, companies are looking for ways to tap into the windfall. “The question they’re asking is: How can the surplus be used efficiently and effectively?” says Passmore.

The conundrum is shaping corporate strategy — and even merger talks.

How Did Pensions Become Overfunded?

The last time corporate pension plans in the US were fully funded was in 2007, just before the global financial crisis. After the market crash, many plan sponsors implemented liability-driven investment (LDI) strategies, leading to decreased allocations to stocks and higher allocations in bonds.

Passmore says that since then, many sponsors began launching programs to reduce the size of their pensions, and closed plans to new entrants. Many companies “froze future benefit accruals, offering lump sums to separated participants and transferring liabilities to insurers through the purchase of annuities in a pension risk transfer,” he says.

Beginning in 2019, three years of double-digit stock market returns meant that the average pension was fully funded in 2022. The Federal Reserve’s rate-hiking cycle that started in 2022 further improved pension funding, as increased interest rates drove down pension liabilities.

The mindset changed “from wanting to get out of the pension business to seeing it as something that could be managed very effectively from a risk standpoint. They saw that there were tax-efficient uses for surplus assets.”

How Can Companies Use the Surplus?

For corporations, taking the cash earmarked for retirees to use on other expenses is costly; they’re slapped with a 50% excise tax. Once corporate income taxes are included, companies get only a small fraction of the surplus.

IBM’s restart of benefits is one example of a tax-efficient option. In a situation like IBM’s, the new pension benefit can be structured differently than the legacy benefit. IBM adopted a new cash balance plan where, unlike a traditional defined benefit plan, the benefit accruals grow more predictably.

But plan sponsors with a surplus have options beyond restarting benefits. Under current Internal Revenue Service rules, defined benefit plans can transfer retirement assets to medical benefit accounts through a qualified transfer.

“Most of the big industrial plan sponsors who have these large pension plans have old legacy retiree medical accounts, and they’ve been paying those benefits out of corporate cash,” Passmore says. “One way to efficiently use pension surplus is to pay these retiree medical benefits and save corporate cash.”

Sponsors can also use pension surplus assets to fund a pension risk transfer (PRT), which moves the pension liability to an insurer through an annuity purchase. PRT transactions have become a popular way for plan sponsors to reduce or eliminate financial risk.

The PRT market comprises two types of strategies: plan terminations and lift-outs, and partial buyouts, most often for retirees. “Market demand, high interest rates and improved funded status are really driving PRT transactions,” says Passmore.

Pension assets can pay plan expenses like actuarial fees and investment management fees. A plan surplus can be used to pay a greater proportion of a plan’s administrative expenses from plan assets, like the expenses of staff who support the plan, including associated employee pay and benefit costs.

But sponsors have other options beyond plan-related activities. Surplus assets can be leveraged as an M&A tool, with companies using surpluses to mitigate costs in a potential acquisition for a target company with an underfunded plan; the surplus can help pay for the acquired plan.

If, for example, Company X with a pension plan surplus of $100 million acquires Company Y with a plan that’s underfunded by $50 million, the acquisition purchase price could be adjusted down $25 million to reflect the underfunded pension plan. Company X will have a pension surplus of $75 million when the acquisition closes. The plans of the two companies could then be merged or left as standalone plans.

What Are the Benefits of a Surplus?

Companies have another option: They can simply hold on to the surplus, which can provide protection from future market volatility. Once a plan is overfunded, Passmore says that companies are not required to make further contributions until their pension obligations rise above the overfunded amount. Nor do companies have to pay further premiums to the Pension Benefit Guaranty Corporation, the federal agency that insures pensions. “Another benefit is that accounting treatment for overfunded plans results in income on the sponsor’s P&L,” says Passmore.

Passmore says that the reinstatement of IBM’s pension plan hasn’t started a trend of companies doing the same. But, he says, with the pension environment changing so dramatically over the last few years, “We’re at a watershed moment” — a moment that companies can leverage by reimagining what their legacy pension can be in a new era.