Justice in Climate Finance: Bridging the Global Gap

As the world addresses a myriad of challenges, climate change, with far-reaching implications, has been rightfully pushed to the forefront of the global agenda. However, the pursuit of a comprehensive climate agenda comes with a hefty price tag estimated in the trillions, which calls for collective action and innovative financing solutions to accelerate the transition to low-carbon and climate-resilient development.

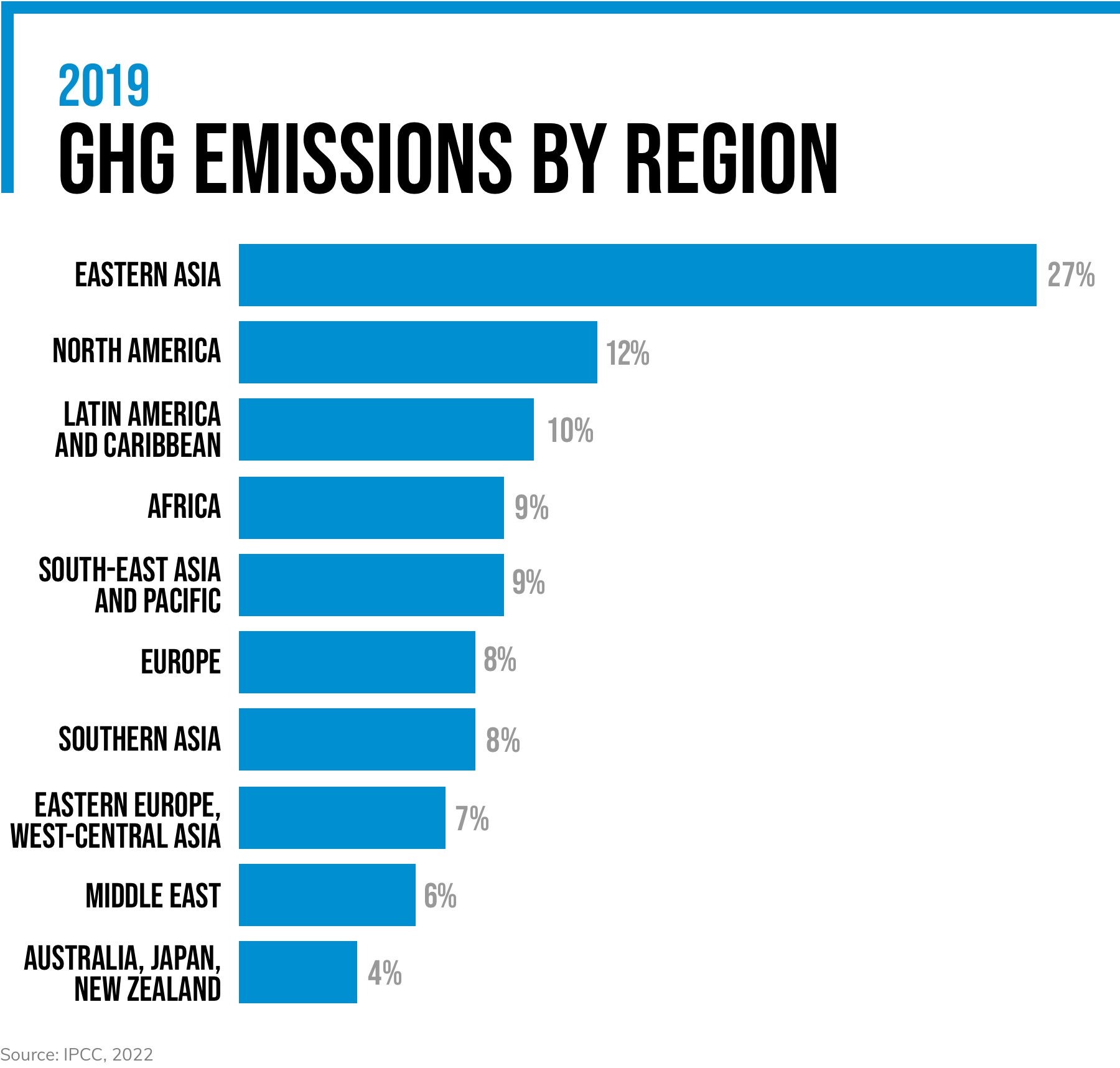

Despite a commendable surge in climate pledges in recent years, they remain short of investment in this era of competing priorities. Even when financing is available, it doesn’t often flow to the countries that are disproportionately affected by climate change. This is particularly evident in Africa, which contributes around 9% of global GHG and is perhaps the continent most vulnerable to climate change, yet receives less than 5.5% of global climate finance flows. Over 50% of these flows are concentrated in 10 high- to low-middle-income countries.1

From an investor’s perspective, developing countries are associated with high real and perceived risk, large information gaps and the absence of investable projects. Advancing the climate agenda in these countries will require a multi-pronged approach to reduce the risk and uncertainty associated with climate investments and to clarify objectives, while promoting just financing.

1Egypt, Morocco, Nigeria, Kenya, Ethiopia, South Africa, Mozambique, Cote d’Ivoire, Tunisia and Ghana

2022 represented an important milestone for climate action, with Egypt hosting COP27—the “Implementation COP.” The event laid the foundation for a more robust climate finance system, and called upon the international community to push forward a transformative agenda that takes into account the development priorities of developing countries, while ensuring equitable access to financial and technical resources.

In efforts to move from pledges to implementation, Egypt made significant strides with the launch of two presidency initiatives during COP27: the Sharm El Sheikh Guidebook for Just Financing, and Egypt’s Country Platform for the Nexus of Water, Food and Energy (NWFE نُوَفِّـــي). Rooted in the principles of equity and justice, the Guidebook emerged as a collaborative effort to synchronize and leverage the ambitions of diverse stakeholders, offering a comprehensive roadmap to navigate the intricate landscape of climate finance. It provides guidance on how to enhance the investability of climate projects, and identifies the main components and key stakeholders in the climate governance plan, as well as current gaps.

The Guidebook marks an important milestone by introducing the concept of just financing for the first time on the global stage. This novel approach “accounts for historical responsibility for climate change while ensuring equitable access to quality and quantity climate financing that supports resilient development pathways, leaving no one behind.” The Guidebook also lays out a set of 12 core principles that underpin just financing, structured around country ownership, equitable pathways to climate finance and good governance.

NWFE نُوَفِّـــي is a pragmatic manifestation of the guidebook’s principles. It lays out a replicable demonstration of the concept of “country platforms,” anchored by the G20 Eminent Persons Group on Global Financial Governance, which proclaimed in 2018 that country ownership of development objectives should guide the coordinated efforts of all stakeholders to achieve more value-centric, sustainable results.

Guided by the Guidebook’s principles of country ownership—including recognizing the right of countries to develop and industrialize while maintaining ownership over their development trajectories—the NWFE نُوَفِّـــي platform underscores Egypt’s commitment to transition toward a low-carbon development pathway. Promoting transparency and mutual accountability, this dynamic platform serves as a conduit to align policy frameworks, mobilize financial and technical resources and foster collaboration among stakeholders to catalyze investments in projects that promote climate resilience and balance mitigation and adaptation. It provides visibility into a pipeline of nine priority projects and highlights key objectives, intended impact and needed resources, in line with Egypt’s National Climate Change Strategy 2050 and nationally determined contributions (NDCs), as well as the international climate agenda.

NWFE نُوَفِّـــي champions equitable pathways to climate finance and a blended finance approach, mobilizing resources to proactively and justly address climate-related socioeconomic challenges. Reflecting the Guidebook’s principle of mainstreaming just finance across all stakeholders to improve access to climate finance from all sources, Egypt’s country platform has strategically leveraged technical cooperation and financing from over 30 stakeholders, harnessing a diverse array of capital sources including debt swaps, guarantees, concessional loans, grants and private investments.

According to the Sharm El Sheikh Guidebook, just financing can only be achieved when systems that promote transparency and accountability are in place. The NWFE نُوَفِّـــي platform reinforces good governance through its steering committee and a robust M&E system that facilitates coordination among all stakeholders, tracks progress toward the mobilization of needed investments and enhances the efficient utilization of climate finance and resources. Through these governance structures, the platform has successfully facilitated harmonious collaboration, exemplified in the recent update of Egypt’s NDCs, which was announced in June 2023. This update aligns seamlessly with the political declaration jointly issued during COP27 by the governments of Egypt, Germany and the US. The revised NDCs are poised to secure grants, debt swaps and concessional finance, as well as catalyze private investments to support the energy pillar of Egypt’s NWFE نُوَفِّـــي Country Platform.

Looking to COP28 and beyond, the aforementioned initiatives offer a solid foundation for continued discussions on financing climate adaptation and mitigation efforts, and forging a path where financial inclusivity and viability coexist. As countries gear up for the next conference, it is important to focus on translating the principles outlined in the Sharm El Sheikh Guidebook for Just Financing into concrete actions through country platforms. Multi-stakeholder engagement will be crucial in refining the framework to account for global changes, and in laying the groundwork to attract investments that drive climate action and sustainable development.