Morocco’s Manufacturing Mission

Guided by a long term vision of sustainable and inclusive development, Morocco is on the verge of unveiling its true potential as a prominent global manufacturing powerhouse, with various sectors proudly representing its capabilities and achievements. The investment of 20 years in high-speed railways, highways, education for the young population, and green energy has moulded a production and export framework capable of supporting industries as they undergo transformation for the digital era and embrace a low-carbon future.

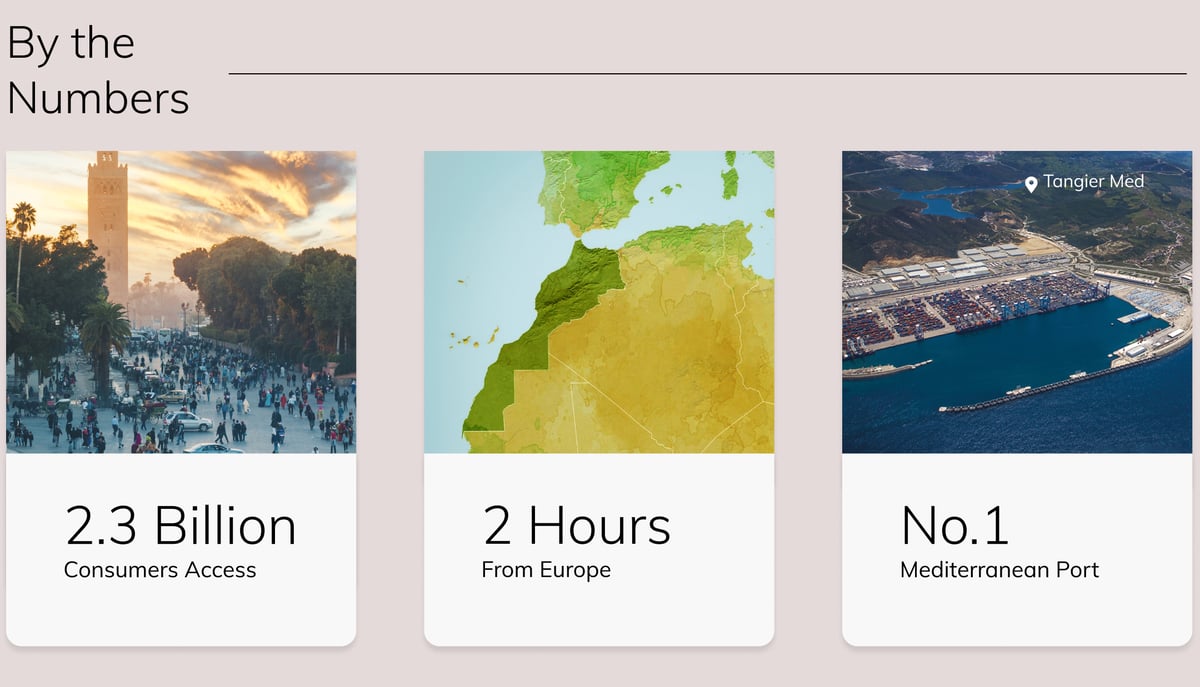

Morocco, the only African country with coastal exposure to both the Atlantic Ocean and the Mediterranean Sea, has built its economic success on manufacturing and export. Its historically strong agriculture and textile industries are now being complemented by the higher value automotive and aerospace sectors, as well as pharmaceuticals and outsourcing. For companies reeling from shocks to global supply chains from the Covid pandemic and the war in Ukraine, the Kingdom offers a stable base in which the private sector is being galvanized to drive socioeconomic development.

A new Investment Charter serves as a compass for the country’s mission. Adopted in December 2022, the Charter guides investment towards priority sectors, promotes balanced growth among regions, sustainable and inclusive development and supports exports and the internationalization of Moroccan enterprises.

The International Monetary Fund lauded the Charter as a stimulant for private investment during a visit to the country late last year. Investors and companies can avail direct incentives, such as access to land and energy, and simplified administration processes. Inbound funds are also being enticed by efforts to reform state-owned enterprises, and the operationalization of the Mohammed VI Fund for Investment, a $4.1 billion state fund created to bolster Morocco's post-pandemic recovery.

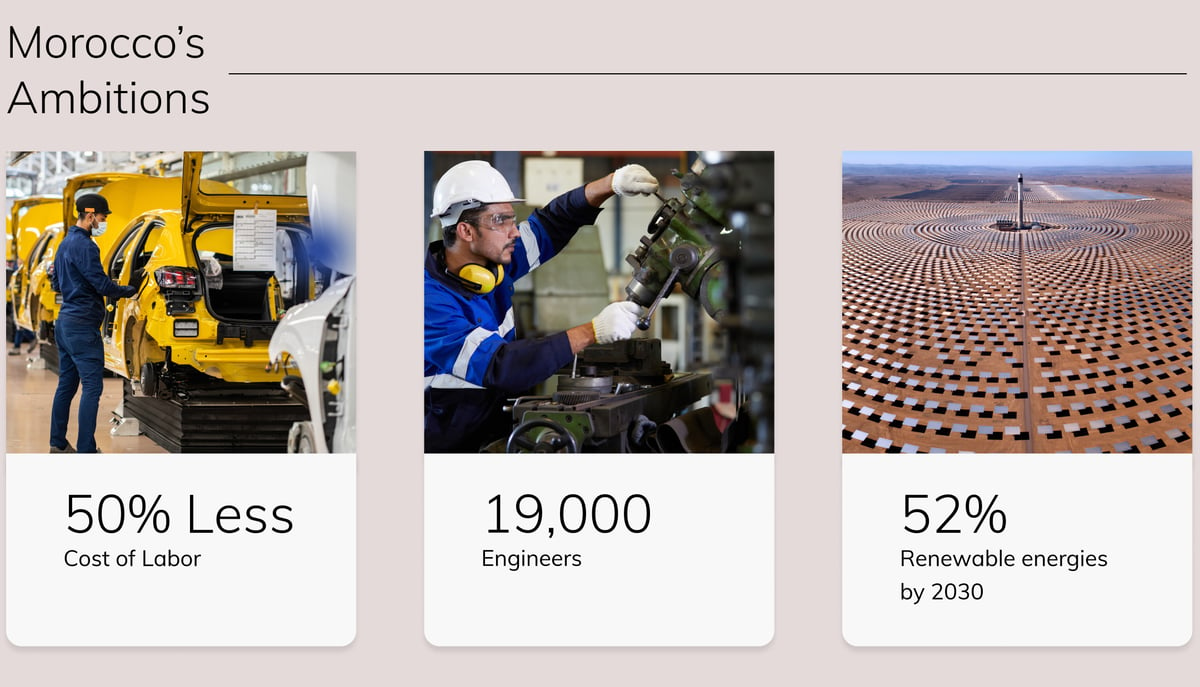

The automotive industry and aerospace are at the forefront of Morocco’s global manufacturing ambitions. Morocco is already the leading passenger-car manufacturer in Africa: output reached a record 470,000 passenger and commercial in 2022, 15 percent higher than the previous year, according to the International Organization of Motor Vehicle Manufacturers. Local content, a prerequisite for ‘global hub’ status, stands at 69 percent, while decarbonizing both vehicle production and the industry itself – crucial for its sustainability – is well underway.

Renault Group’s Tangier facility, which opened in 2012, was the world's first zero-carbon and zero-industrial-liquid-emission automotive plant. And the Kingdom is becoming a conveyor belt for electric vehicles. Stellantis Group already makes two electric cars, the Citroën AMI and Opel E Rock, at its factory in northwest Morocco, and has pledged 300 million euros to double capacity to 400,000 cars and launch its smart-car platform on-site. Further proof that Morocco is powering the future of transportation: Renault will manufacture its Mobilize Duo electric microcar in Tangier, and Dacia too has announced an electric vehicle to be made in Morocco.

Meanwhile, the Kingdom’s aeronautic industry is growing apace. It hosts more than 140 aircraft companies: in fact, every commercial plane in Airbus and Boeing’s fleet contains at least one Moroccan part, according to the Morocco Aerospace Industrial Group. The Kingdom is now targeting complementary sectors such as defense and space, in a bid to multiply aerospace export revenues two-and-a-half times by 2025, from $2 billion in 2021.

“Boeing, Airbus and other major players are investing more and more into Morocco, because it’s giving them what they want,” says Stephen Orr, Vice President and General Manager, Spirit Aerosystems Morocco. “In all my previous global experience, I’ve never seen anything as well coordinated and as effective as what’s happening in Morocco.”

The hardware to support Morocco’s manufacturing ambitions is already in place. The country has 15 ports, including Tangier Med, the largest port in Africa and the Mediterranean, while more than 150 sector-specific industrial zones offer conditions for investors to quickly establish and grow their businesses. While all zones provide incentives, companies setting up in export-oriented ‘industrial acceleration zones’ are exempt from value-added tax, business tax for 15 years and corporate tax for five years.

And companies can plan to stay for the long-term, thanks to Morocco’s pioneering investments in clean energy coupled with a young and skilled workforce. More than 50 large-scale renewable projects have been implemented to date, including one of the world’s largest concentrated solar plants, and some of the largest wind farms in Africa. Meanwhile, the median age of its population is 29 – compared to 38.5 in the US and 44 in the European Union – with a cost of labor as low as half of China’s, according to a report from FDI Intelligence.

This commitment to renewables is set to continue as the Kingdom capitalizes on abundant wind, solar and hydro resources. More than half its electricity needs will come from renewables by 2030, from just under 40 percent now. And it is also looking to become a regional player in clean energy. EDF Renewables, for example, has chosen the Kingdom as the hub for its wider North and West African ambitions as the French utility giant deploys cutting-edge technologies such as green hydrogen and energy storage. Indeed, EY’s Renewable Energy Country Attractiveness Index ranks Morocco first in Africa for green-energy investment opportunities.

Just a two-hour flight away to Europe, and seven hours to either North America or the Persian Gulf, Morocco distinguishes itself as a regional and international hub. For those investors targeting African markets: Morocco, as the largest investor in sub-Saharan Africa after South Africa, is an expedient gateway.

The kingdom is already on the right path. Net FDI inflows reached 20.97 billion dirhams ($2 billion) in 2022, an increase of 8.3 percent compared to the previous year. And in March the Kingdom returned to international financial markets to successfully borrow $2.5 billion – its first bond issuance in US dollars since 2020 – reflecting investor confidence in the resilience of the Moroccan economy amid a volatile global backdrop as well as the soundness of its macroeconomic fundamentals.

“One thing that any business wants is continuity. In the 20 years that we’ve been working with Morocco, we’ve seen great continuity in terms of the country’s industrial mission and business environment,” says Gideon Jewel, President, Global Just-in-Time Operations, at global auto parts maker Lear Corporation. In terms of agility, “we’ve experienced many times in our history here where we’ve been able to do things faster than in other countries. Even at the moment, with the tragic war in Ukraine, we’ve used the agility of our Morocco business to be able to support our customers.”