How Global Investors are Rewriting the Playbook-on Resilience

Resilience is not simply an attitude. It is a primary driver of value.

Just as the resilience of steel or concrete is inherent to their value, so too is the durability of systems that are built to perform even in the most adverse circumstances. Such resilient systems are integral to the health of businesses, nations and entire regional economies.

Today, the global economy is enduring a period of fragmentation across multiple vectors: geoeconomic regionalization; divergent monetary trajectories; the disparate impact of climate change; and rapid technological disruption. This fragmentation is testing the durability of investments.

In response, investors worldwide are working to build greater resilience and agility into their portfolios, while recognizing that no framework can anticipate every future shock.

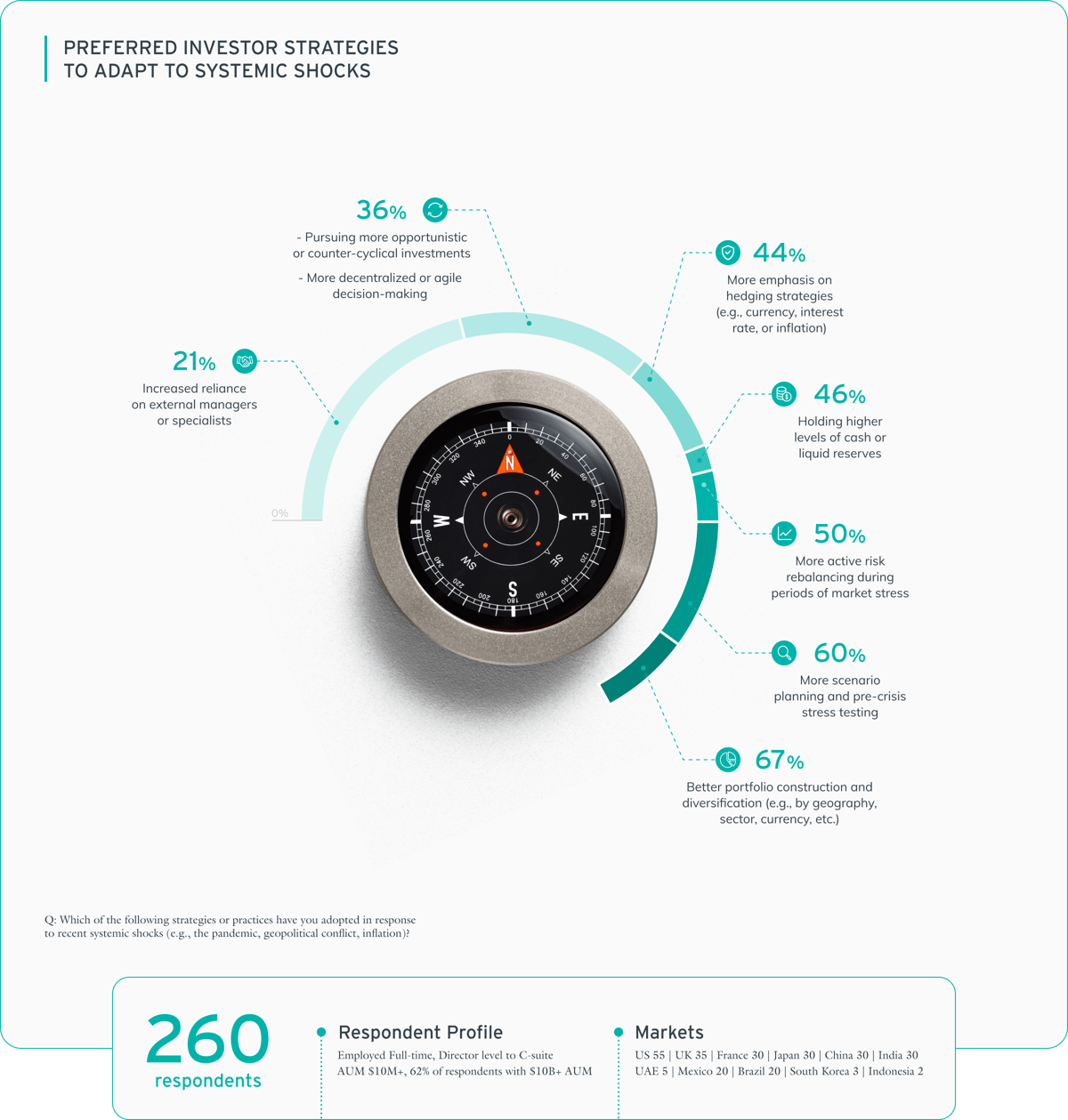

This turn to resilience is one of the key findings of Bloomberg Media’s latest Strategies Under Stress study, sponsored by Mubadala of Abu Dhabi, one of the largest sovereign wealth funds in the world. Based on a survey of 260 global investors, the study explores perspectives on how resilience is being reexamined amid rising uncertainty.

The study shows that most investors are diversifying their capital across asset classes and geographies, doubling down on scenario planning and the use of risk tools to stress-test portfolios, strengthening their cash reserves and enhancing their hedging strategies.

True resilience doesn’t just mean fortifying against short-term risks. It’s also about crafting portfolios and operating strategies that can absorb shocks while remaining adaptable to long-term structural change.

Recognizing that attempting to manage and mitigate specific risks on a case-by-case basis can be a losing battle—given the interlocking nature of secular forces such as the globalized macro-economy, advancing digitalization and climate change—investment teams at Mubadala take a comprehensive approach to building portfolio resilience through a combination of qualitative and quantitative methods.

This includes systematically simulating crises, including those of the past 25 years and hypothetical future crises, to assess their impact on macro trends and internal variables like liquidity. This helps gauge how specific asset classes react to such crises before making investment decisions, explains Pierre-Yves Mathonet, Head of Enterprise Risk Management at Mubadala.

“We look at resilience from three dimensions: a resilient strategy, a resilient portfolio and a resilient institution,” he says. “This allows you to take on the unknown, so that even under stress, you can absorb information, analyze it effectively, and respond with confidence.”

The success of this approach is highlighted by the UAE’s ability to emerge stronger from the multifaceted Covid-19 global crisis, thanks to the government’s management of the pandemic’s impact.1 The UAE is also known for proactively reducing its reliance on oil and investing in the development of alternative sectors2 to retain its economic leadership position in the region, and in the process fending off a so-called “gray rhino” event3— a highly probable, high-impact threat that is sometimes ignored until it’s too late.

Khaled Al Shamlan Al Marri, CEO of Real Assets at Mubadala, explains that the fund’s approach prioritizes examining the downsides, so that every investment is built around its ability to handle stress. This approach includes scenario-based stress testing and disciplined underwriting that incorporates appropriate buffers, helping to create a robust, diversified portfolio.

Just as well-diversified portfolios help investors hedge against risks and generate returns through crises, national economies can ensure dependable returns and long-term value creation—the primary focus of investors worldwide—by diversifying their investments into areas like renewable energy, adaptive logistics and connected infrastructure. By reinforcing their power, water and transportation systems, they in turn enhance the resilience of all national industries.

This approach is driving a broad reallocation of capital toward “resilience-first” sectors, particularly infrastructure, the study suggests, mirroring Mubadala’s own focus on strengthening critical networks, systems and businesses.

Institutional investors such as sovereign wealth funds, with their deep pools of capital, are particularly well placed to fuel growth and innovation, and to build systemic resilience to the challenges faced by our world.4 Mubadala has played a key role in this resilience-building trend, channeling billions of dollars in investments into new economic sectors5 including renewables, life sciences, advanced manufacturing and artificial intelligence (AI).

“The more we do that, the more we benefit the local economy, by creating these solid champions that fuel real economic growth with services, with products, with spending and with an ecosystem,” says Marc Antaki, Deputy Chief Strategy and Risk Officer at Mubadala.

From diversifying the UAE’s economy and transforming it into a global hub for talent and innovation, to future-proofing society by aiding energy transition efforts and improving health care and education in Asia, to enhancing digital connectivity across Europe, Mubadala’s efforts highlight the real-world impact of its active, resilience-focused investment strategy on economies, communities and the environment.

“When done well, real asset investment becomes a powerful tool to support economic development, improve quality of life and build resilience to future shocks,” Al Marri says.

Mubadala’s example demonstrates how institutional investors around the world can contribute to building systemic resilience into their domestic economies—bolstering their reputation as responsible societal partners while fulfilling their mandates by creating stress-tested portfolios capable of generating returns in the face of various disruptions.

Across the investment leaders sampled in the Strategies Under Stress study—spanning different mandates and time horizons—many agreed that resilience is synonymous with long-term value creation.

Resilience strategy includes developing the skills and processes to maintain consistency—from product standardization to balance-sheet strength—underpinned by sufficient liquidity to absorb stress and remain active through periods of turbulence. This is why resilience is such a vital component of long-term value creation, and is axiomatic to the value of brands, companies and even entire economies.

Both Antaki and Mathonet emphasize that investors cannot seize opportunities without adequate liquidity—as illiquidity, particularly during stress, can quickly undermine even the strongest long-term strategies. This component of resilience provides freedom to act when others may be indisposed.

“The name of the game here is that we need to be able to survive, and survive in a positive way. And to do so by not just weathering the shock, but coming out stronger,” says Antaki.

“Think about it like a boxer,” he says. “You can punch very hard, but if you don’t know how to take punches, you’re going to fall very quickly. So resilience is about being able to adapt to the shocks, stay up and punch back. Unless you can be defensive, you cannot be offensive.”

As with life in the boxing ring, being prepared is essential to building resilience. That preparedness can be achieved by simulating crises before they happen, so business leaders can make calm, informed decisions during real-time turmoil. It also means being agile when pivoting and adapting to change, without giving up the core convictions that guide your overall investment strategy, notes Mathonet.

Resilience is now the central organizing principle for many of the world’s investors. By investing in the creation of robust, durable assets, investors aim to generate both healthy long-term returns and the resilient ecosystems that underpin those returns.

This overarching trend towards resilience represents only one layer of the study’s analysis. The complete findings and data-driven insights will be explored in the full Strategies Under Stress study, set for release in Q2 2026.