Moving Climate Tech from Lab to Reality

Investments in physical and digital solutions that mitigate CO2 emissions have reached record levels, and NEOM is set to further advance climate tech for both innovators and investors.

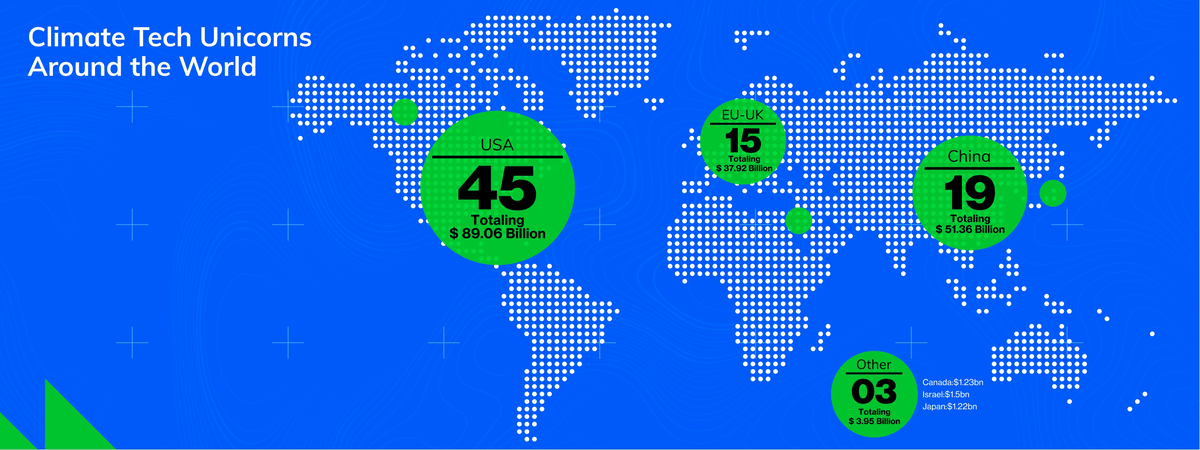

A climate technology unicorn was born every two weeks in 2022. Now, there are over 80 startups valued at more than $1 billion that are focused on reducing greenhouse gas emissions. Not every startup will reach that valuation, but the rise in climate tech unicorns highlights the overall investment appetite and market potential for emission-cutting solutions.

New policies pave the way for game-changing tech that can mitigate the impact of climate change, which is a sweet spot for investors as they look for the next disruptor to generate significant financial returns and create positive social and environmental impact.

Bloomberg New Energy Finance (BNEF) highlights that companies that want to take their innovations from lab to market must cross at least one “valley of death” where capital shortfalls may appear. This is prevalent in the earliest stage when a technology is ready to exit the lab or during the scaling-up phase.

Dr. Manar Al Moneef, Chief Investment Officer at NEOM, the gigaproject in northwest Saudi Arabia, says that this is where investors stand to gain. “Being a first mover in a market has significant advantages,” she says. “However, investors and startups alike need the right ecosystem to move concepts into companies.”

A launchpad for innovation

Creating investments of the future is a central focus for NEOM. Spanning an area of more than 26,500 kilometers across a diverse landscape, this greenfield development is free from legacy infrastructure and outdated regulations which provides an easier road for new technologies to be trialed and implemented. NEOM’s regulatory framework will facilitate doing business, which will allow for faster company growth—a win for investors.

“This unique environment lays the foundation, but to really bring about sustainable innovation that is commercially viable, there must be a thorough understanding of market dynamics to push the right ideas at the right time, and this is what sets NEOM apart,” says Al Moneef.

This understanding comes from the specific economic engines that are driving sustainable innovations to transform the multiple regions of NEOM, such as The Line.

The Line, a vertical city where renewable energy will power everything, presents an opportunity to unlock new dimensions of transport, which led to NEOM creating a partnership with Volocopter, a climate tech company, and pioneer of advanced electric air mobility.

The partnership will deliver the world’s first fully integrated electric air taxi network, providing transportation of people and goods without extensive surface infrastructure. These vertical mobility services will connect The Line to the clean and advanced manufacturing hub Oxagon, as well as to other NEOM regions as part of a multimodal sustainable mobility system.

“We know that to do things differently, we must think differently. It’s about creating a realistic balance between the technology of today and the technology of tomorrow,” says Majid Mufti, Managing Director of NEOM Investment Fund. “Every innovation that we are driving at NEOM is sustainable, tangible and market-oriented.”

According to BNEF’s 2022 data, renewable energy remained the largest sustainability sector, at $495 billion (up 17% year-over-year), while electrified transport is growing much faster to $466 billion (up 54%). These investments have driven growth in areas such as the electric vehicle (EV) market, and now, more than 450 different EV models are available with EV sales representing one in every seven cars sold globally, according to the International Energy Agency (IEA).

EV advancements have spurred innovations in related industries like battery storage, which offers a solution to the intermittency of renewable energy sources. Battery storage, particularly lithium-ion technology solutions, has become more competitive, with costs dropping by 60% over the past five years.

“We are working toward bringing innovative technologies to the market that will play a role in launching sustainable transformations across other industries,” Mufti says.

Market readiness

Despite a bear market in venture capital funding in 2022, one of the most resilient sectors was climate technology. According to HolonIQ, global climate tech venture capital delivered $70.1 billion of investment.

The long-term outlook for climate tech remains strong. Despite a turbulent macroeconomic landscape, venture capital and private equity directed a record $59 billion towards climate solutions in 2022, a 3% increase from 2021, according to BNEF.

So far this year, VC firms have been keeping that power dry. In Q1, climate tech companies raised $12.6 billion – down 6.7% from the same quarter in 2022, according to BNEF. However, that was a smaller decline than the overall VC investment market.

“Companies operating in the low-carbon buildings and industry sectors had the biggest fundraising jump, in terms of percentage increase,” up 48% compared to its rolling-four-quarter average, BNEF reported. “For industry, this was thanks to large investments in bioplastics and clean mining companies. For buildings, investment was spread across everything from energy efficiency, to heat pumps, to district cooling.”

BNEF data shows that global investment from all sources in the low-carbon energy transition set a record in 2022, reaching $1.1 trillion, spurred by policy action that drove faster deployment of climate technologies. And for the first time, companies and governments are raising more money in the debt markets for environmentally friendly projects than those associated with fossil fuels. Almost $350 billion was raised from green bond sales and loan arrangements in the first half of this year, compared with less than $235 billion of oil, gas and coal-related financing, according to data compiled by Bloomberg.

Against this backdrop, climate tech in the Middle East presents an opportunity that has not been fully explored. Governments across the region have implemented net-zero targets to diversify their economies and mitigate climate change. Saudi Arabia, the fastest-growing economy in the G20, has committed to have 50% of its power generated from renewable sources by 2030 as part of its larger goal of net-zero emissions by 2060.

In addition, the amount of solar and wind available across the Middle East furthers the cost competitiveness and adoption of climate tech. The cost of producing solar, wind and green hydrogen in the Arabian Gulf is approximately one-third cheaper than the global average, according to PwC. These advantages have recently led to a significant increase in climate tech investment in the region. Of the $6 billion invested in climate tech in the Middle East over the past decade, nearly a third of that came in the first six months of 2022.

That is a trajectory that shows no signs of slowing, according to Al Moneef. And NEOM aims to play a leading role in markets designed around sustainability.

As Saudi Arabia’s sustainable gigaproject NEOM continues to pilot cutting-edge technologies for multiple use cases, its deal structuring opens opportunities to scale solutions for global partners, from suppliers to direct investors, through revenue-sharing models and joint ventures.

“Ultimately, we hope that the innovations made possible at NEOM will be adopted by the wider world through a model of true partnership, because only by working together can we address the current and future global challenges,” Al Moneef says.