The Policy Pendulum Swings

What Trump’s victory means for the next four years

It’s a red sweep, folks. In his third presidential election, Trump has secured a second term. Republicans have regained control of the Senate and appear to be on the verge of keeping control of the House. The critical question for investors is: What comes next? Impacts to the U.S. debt and deficit, trade policy and equity sectors are clear culprits for change—but perhaps not in the way investors may think.

A sweep risks deficit expansion: beware interest rate risk

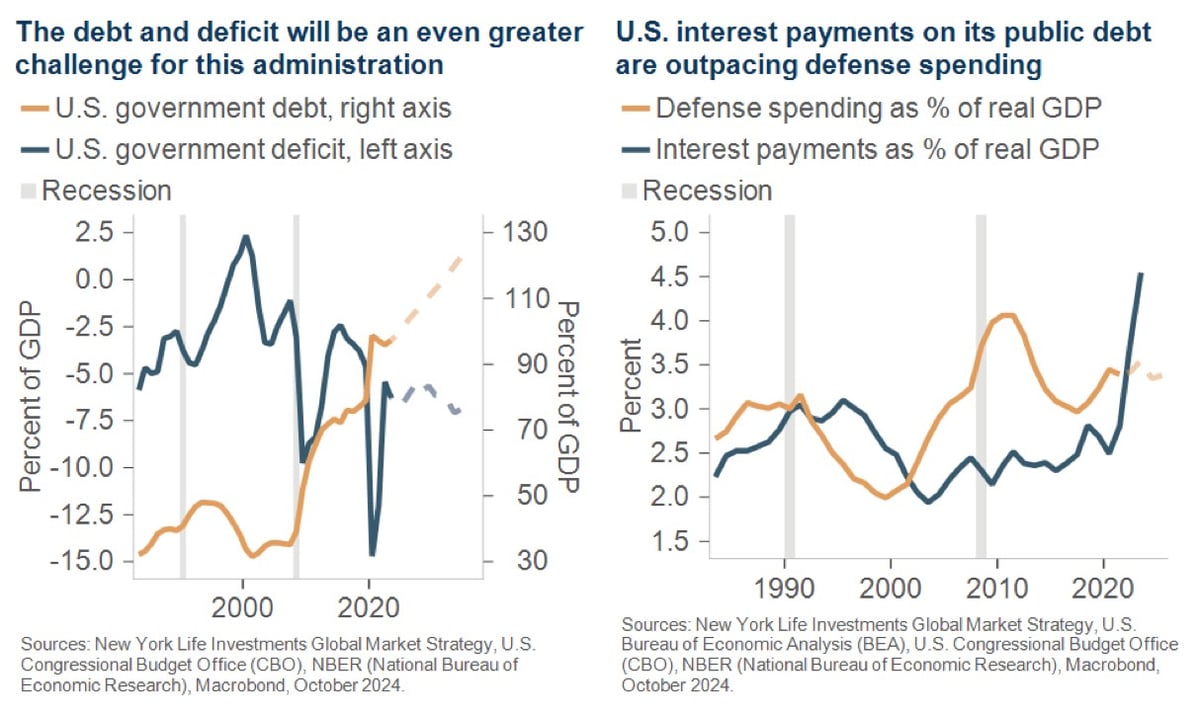

Both Republicans and Democrats have recognized the political benefits of deficit spending, but neither party has offered strong plans to offset it with higher taxes or significant spending cuts. Now, a full Congressional sweep will likely accelerate U.S. deficit spending, already rising since the implementation of the 2017 Tax Cuts and Jobs Act (TCJA), and through pandemic-era programs, and extended with recent infrastructure spend.

How much spending are we talking about? The Congressional Budget Office estimates that holistically extending the TCJA would add approximately $3.5 trillion to the federal deficit through 2034, potentially doubling the current shortfall. Such a boost to household balance sheets should, all else being equal, stimulate growth.

The challenge for investors is that this incremental spending may not stimulate markets. Expectations for higher government spending come with higher expectations for economic growth and for policy risk, especially as debt levels rise. Market interest rates are likely to move higher and could spur volatility.

When will deficit expansion—a long-term trend—matter more for U.S. debt sustainability? For U.S. voters, concern is only beginning to rise. The U.S. is now paying more in interest on its federal debt than on defense—a reminder of the mounting fiscal strain, and a data point that has historically caught voter attention. Globally, the size and depth of U.S. capital markets create some stability and potentially lower the likelihood of a prolonged rout in U.S. Treasuries. However, a structural change, such as a reduction in use of the U.S. dollar, or a Congressional mistake, could increase this chance.

Trade change risks higher costs but points to sustained capital investment

Long gone are the days of free trade. Both Trump and Biden oversaw a shift in U.S. trade policy away from the free trade and low government interference that marked the post-WWII period. Trump 2.0 is likely to ratchet up trade protections and has the latitude to do so even without Congressional approval. Whether it’s a negotiating tactic or a desired endgame, trade risk is moving higher.

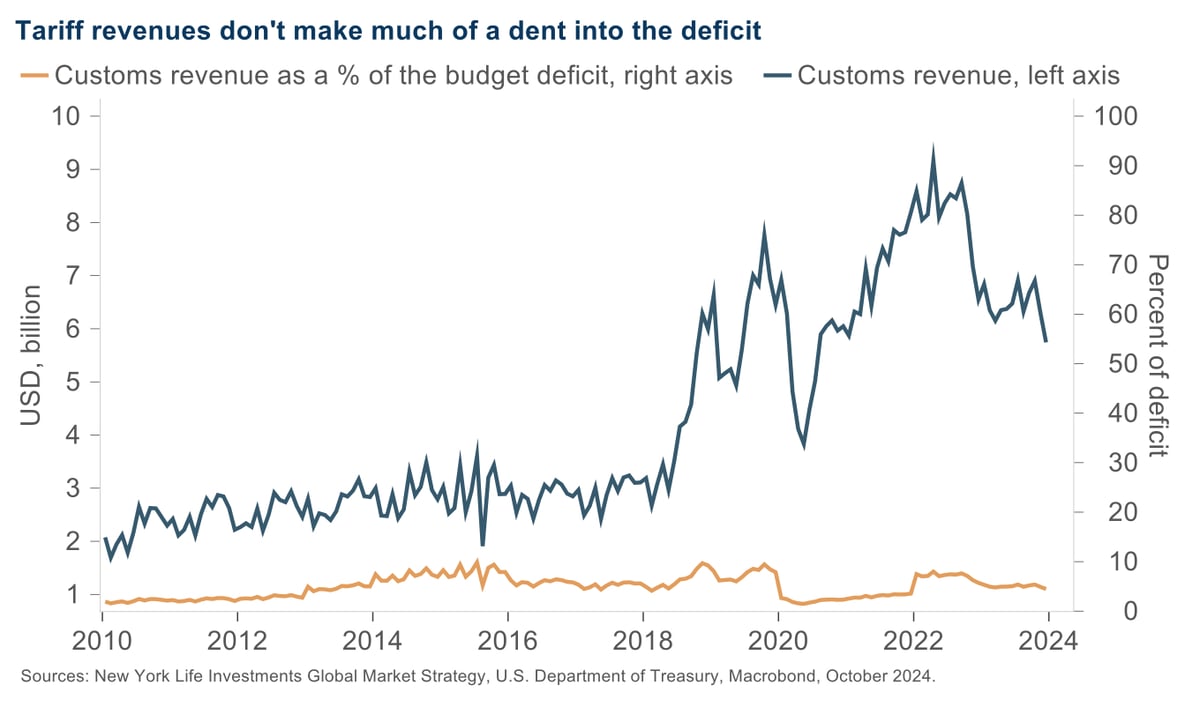

Global markets have been bracing for the possibility of a more challenging trade environment—diversifying trade relationships and strengthening regional agreements to mitigate the risks of U.S. protectionism. Notably, the U.S.-China trade war, marked by steep tariffs on Chinese goods, is likely to reignite. While President Biden left many of these tariffs intact, Trump’s return could see an escalation, with proposals to raise tariffs on all U.S. imports to 20%, and on Chinese goods to 60%.

In economic terms, such tariffs are feared to have highly inflationary potential—adding $2,600 in annual costs for middle-class households, according to the Peterson Institute for International Economics. And the budget benefit that Trump points to is likely to be very modest; the current $100 billion in annual tariff revenue pales in comparison to the over $2 trillion generated from individual income taxes.

For investors, though, we believe the through line of these measures is clear: Supply chains are re-globalizing, and costs are moving higher. In the medium term, it is difficult for us to see a world without higher-than-target inflation, moderate interest rates and higher interest rate volatility. We would only expect sustained-duration bets to win in the event of rising recession risk.

This outcome is highly investable in our view. Government and private-sector capital is flowing to develop supply chain, digital and energy infrastructure, creating opportunities for broadening equity and credit exposure.

Equity sectors: the typical ‘red sweep’ portfolio may not work in Trump 2.0

Investors should be wary of traditional sector bets along party lines. Under typical Republican leadership, sectors like technology, energy and financials benefit from reduced regulation. However, structural changes in the global economy and politics introduce unique risks that may alter this pattern.

Take the technology sector, for example. Normally a beneficiary of lighter regulation, it now faces potential headwinds from Trump’s tariffs on key supply chains, particularly those involving China. On the flip side, clean energy—historically under-supported by Republican administrations—might not be as vulnerable as expected. The Inflation Reduction Act (IRA) has funneled significant clean energy investments into Republican-controlled states, creating jobs and economic growth. Rolling back these policies could prove politically difficult, making clean energy a less risky bet than in the past.

For sector-focused investors, the areas of bipartisan agreement present opportunities, in our view. Infrastructure, energy—including quality brown and low-cost green energy—and defense are likely to see continued support in the medium term regardless of political climate.

The through line: re-globalization, inflation and rates risk are all investable

The red sweep election outcome sets the stage for major policy shifts. And as is always the case, change brings investment opportunity:

- Rising deficit spending and trade-driven inflationary pressures may mean firmer interest rates and higher rate volatility. Within the context of a still-strong economy, we favor balancing interest rate risk by taking short-duration credit exposure alongside longer-duration risk in infrastructure bonds where structural investment themes and yield curve slopes are attractive.

- Re-globalization of supply chains likely means sustained capital investment in the semiconductor supply chain and the energy required to fuel it. Public and private exposure to sectors such as infrastructure, energy and defense will likely see bipartisan growth.

For related insight from New York Life Investments into the impact of macroeconomics on portfolios and high-conviction asset allocation ideas, visit newyorklifeinvestments.com/global-markets.

Michael LoGalbo is a Global Market Strategist at New York Life Investments. The firm’s Global Market Strategy team is responsible for economic and market commentary, asset allocation and thought leadership.

As a diversified, global asset management firm with $725 billion in assets under management,* New York Life Investments is invested in our clients’ success with guidance, resources and investment solutions that reflect the diverse perspectives of our boutiques.

“New York Life Investments” is both a service mark, and the common trade name, of certain investment advisors affiliated with New York Life Insurance Company. *Assets under management (AUM) includes assets of the investment advisers that make up “New York Life Investments” as of 6/30/2024. AUM includes certain assets, such as non-discretionary AUM, external fund selection, and overlay services, including ESG screening services, advisory consulting services, white labeling services, and model portfolio delivery services, that are not necessarily considered Regulatory Assets Under Management according to the SEC’s Form ADV. AUM is reported in USD. AUM not denominated in USD is converted at the spot rate as of 6/30/2024. The total AUM figure of “New York Life Investments” is less than the sum of the AUM of each affiliated investment adviser in the group because it does not count AUM where the same assets can be counted by more than one affiliated investment adviser.

7193185