.jpg?width=1200)

The New Money Mover: OwlTing’s Bid for the Trillion-Dollar Stablecoin Opportunity

Each day, trillions of dollars flow across borders through outdated rails: correspondent banks, SWIFT messages, multiple intermediaries, and settlement cycles that can take days. This legacy infrastructure imposes friction at every step, slowing remittances and trade and placing costs on individuals and businesses worldwide.

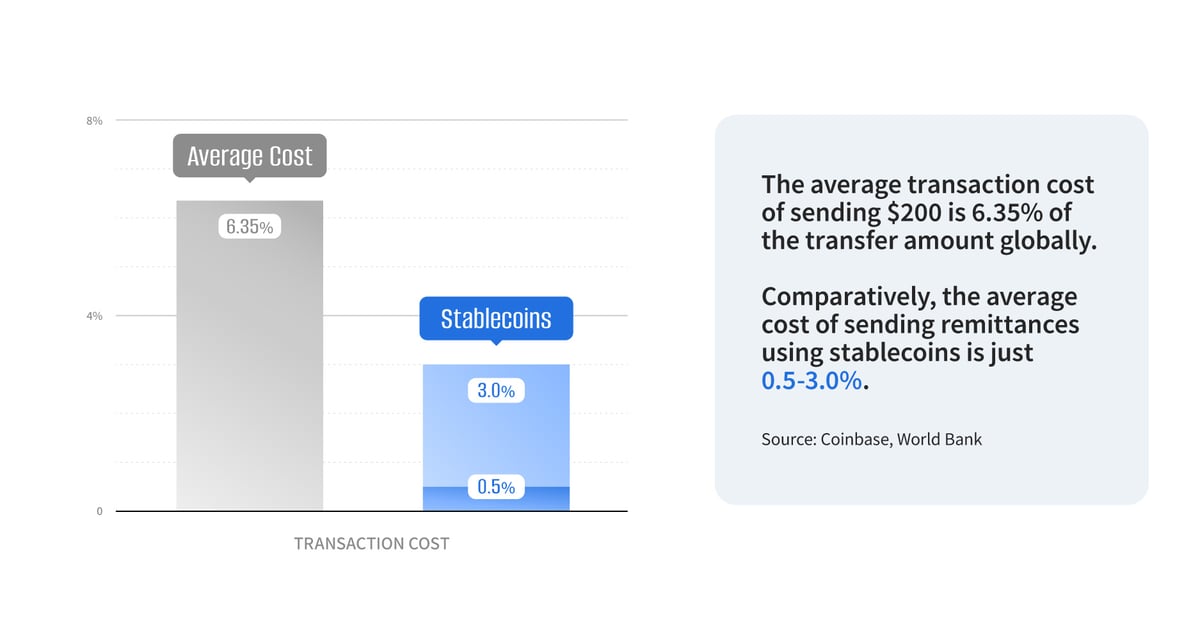

A new frontier is emerging. Stablecoins, digital tokens pegged to fiat currencies, already move billions of dollars across borders daily at a fraction of the cost.[1] They hold the potential to make money movement as seamless as sending a text. But realizing this promise requires trusted rails that can scale with the demands of global commerce.

That’s the mission of OwlTing, a blockchain technology company from Taiwan.

Founded in 2010, OwlTing first built blockchain solutions for hotels[2], farms, and even timber supply chains[3]—always with the same focus on trust and transparency. For founder and CEO Darren Wang, these projects laid the groundwork for a bigger ambition: to reimagine the infrastructure of global payments.

“As TSMC [the Taiwanese semiconductor manufacturer] powers the world’s computing, we want to power the world’s money flows,” Wang says from OwlTing’s Taipei headquarters. “The real bottleneck isn’t the tokens themselves—it’s the lack of infrastructure. We want to build the rails that connect the existing financial system to a regulated stablecoin payment infrastructure.”

Stablecoins enable near-instant cross-border transactions, with network fees often less than one dollar[4]—compared to the $20–30 fees typical of banks. Yet in 2024, stablecoin transactions accounted for just over $1.5 trillion in cross-border payments—only a sliver of the nearly $1 quadrillion global total estimated by the IMF.[5]

The gap highlights the opportunity, but also the challenge: without infrastructure to connect stablecoins seamlessly to the existing financial system, adoption remains limited.

“Most banks still don’t have the technology to accept stablecoins,” Wang says. “The industry won’t grow until someone builds the rails.”

OwlPay, OwlTing’s payments platform, is designed to build rails for both sides of the market. On the institutional end, OwlPay Harbor provides the APIs that let banks, payment firms, and merchants plug directly into stablecoin rails. It handles USDC cross-border on/off ramps, multi-chain conversions, and global AML/KYC screening — the kind of invisible infrastructure that makes new money flows possible without forcing incumbents to rip out their existing systems.

For businesses, the Stablecoin Payment Gateway translates those rails into a practical advantage. Merchants can accept stablecoin payments at checkout and settle in fiat, bypassing the delays and high fees of traditional credit card acquiring. For a supplier, that means faster access to working capital; for a platform, it means global reach at lower cost.

Consumers, meanwhile, enter the ecosystem through OwlPay Wallet Pro, a non-custodial digital wallet that lets users buy stablecoins with bank transfer, card, or cash through MoneyGram, and spend them directly. From everyday payments to redeeming gift cards from major brands, the wallet shows how digital assets can start to bridge into daily life. In the near future, OwlTing plans to expand access with OwlPay Cash, a mobile-first remittance app built on Visa Direct to support affordable transfers across Asia, Latin America, and Europe.

In practice, that means a small business can plug in directly and settle in dollars, while a large enterprise can embed the rails via API, keeping brand control and outsourcing the hard parts: compliance, security, and cross-border settlement.

OwlTing’s ecosystem is reinforced by deep collaborations that embed its rails into the broader financial system. Visa supports card payments, Circle provides stablecoin liquidity, and Stellar offers blockchain infrastructure along with the existing support on Ethereum, Solana and other major blockchains — together, they ensure that OwlPay’s rails are not only functional but interoperable with the institutions and networks businesses already rely on.

Other alliances extend that reach to the edges of the economy. Through MoneyGram, OwlPay users can deposit or withdraw cash at hundreds of thousands of locations worldwide, while Nium powers fiat-to-fiat flows for B2B clients. The effect is to give enterprises, merchants, and individuals multiple ways to connect to stablecoin rails without leaving behind the financial system they already know.

“We are the Web3 infrastructure for stablecoins,” Wang explains. “As indispensable, yet invisible, as the chips inside smartphones and AI servers.”

The merits of stablecoins have attracted global regulators. The IMF acknowledges their potential to reduce costs and broaden financial inclusion but warns that without safeguards, they could drive dollarization in smaller economies, increase volatility, and create new channels for financial crime.[6]

Policymakers are clear: adoption will only scale if the rails are as safe as they are fast.

Wang views this not as a constraint, but as a catalyst. The turning point, he says, came in 2021 when the U.S. Office of the Comptroller of the Currency (OCC) permitted banks to use stablecoins for payments.[7] “When the OCC gave its green light, we knew it was time to secure licenses and scale.”

Since then, OwlTing has secured licenses in 37 U.S. states, the EU, and Japan—a rare breadth of coverage that allows it to serve multinational enterprises.

“Having licenses across different regions is our biggest strength,” Wang notes. “It gives us the first-mover advantage to educate enterprises and bring them onto the solution.”

By embedding compliance at its core, OwlPay positions itself not as the fastest rails, but as the safest rails institutions can trust.

Wang stresses that the full promise of stablecoins will not materialize overnight. But once rails are built that satisfy both users and regulators, the impact will be transformative.

He envisions a future where sending money is as effortless as sending a WhatsApp message. Businesses and consumers will no longer need to think about fiat-to-stablecoin conversions, AML checks, or multi-jurisdiction licensing. The rails will simply be there—embedded and invisible.

“People don’t see the chips that power their iPhones or AI servers, but without them the digital world wouldn’t function,” Wang says. “OwlPay aims to play the same role in global commerce—the unseen infrastructure that makes new forms of money movement possible.

“What Visa and Mastercard are to credit cards, OwlPay can be for stablecoins. Our goal is to unlock the power of digital assets and make them usable in the real-world economy.”