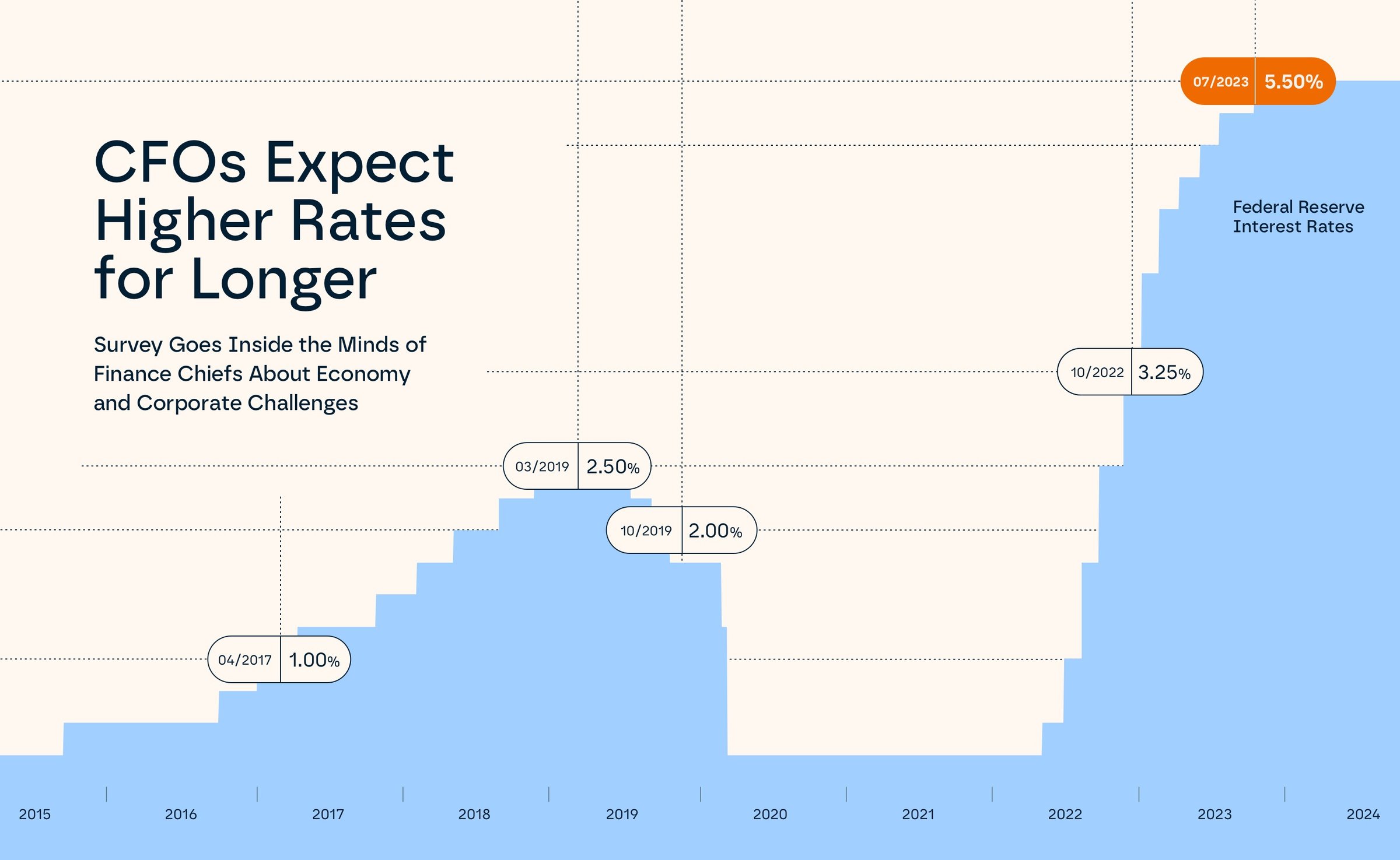

CFOs Expect Higher Rates for Longer

Survey Goes Inside the Minds of Finance Chiefs About Economy and Corporate Challenges

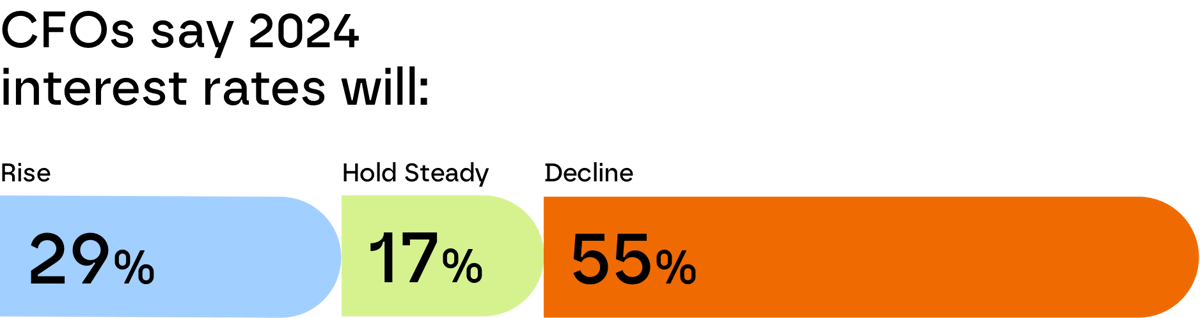

Almost half of US CFOs surveyed don’t expect the Federal Reserve to cut interest rates this year, counter to predictions by Federal Reserve officials, according to PNC Bank’s Inside the Minds of CFOs survey.

Almost a third of CFOs surveyed go a step further, predicting that interest rates will actually rise this year, despite a slowdown in inflation, weakness in the job market and a slide in homebuying in recent months.

Gus Faucher, Chief Economist at PNC Financial Services Group, believes this surprising result might indicate that CFOs are seeing strong demand in their own businesses. “They’re not seeing the slower economic growth that the Fed wants to justify rate cuts,” he says.

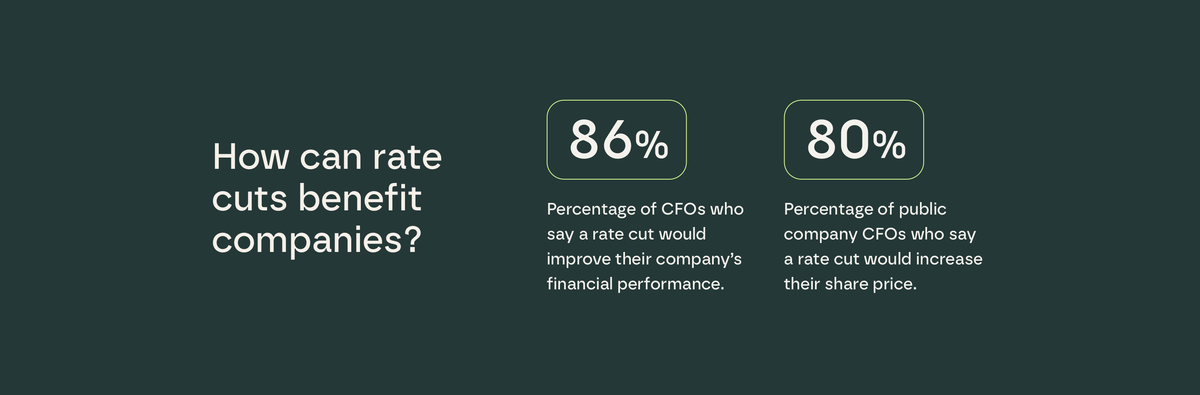

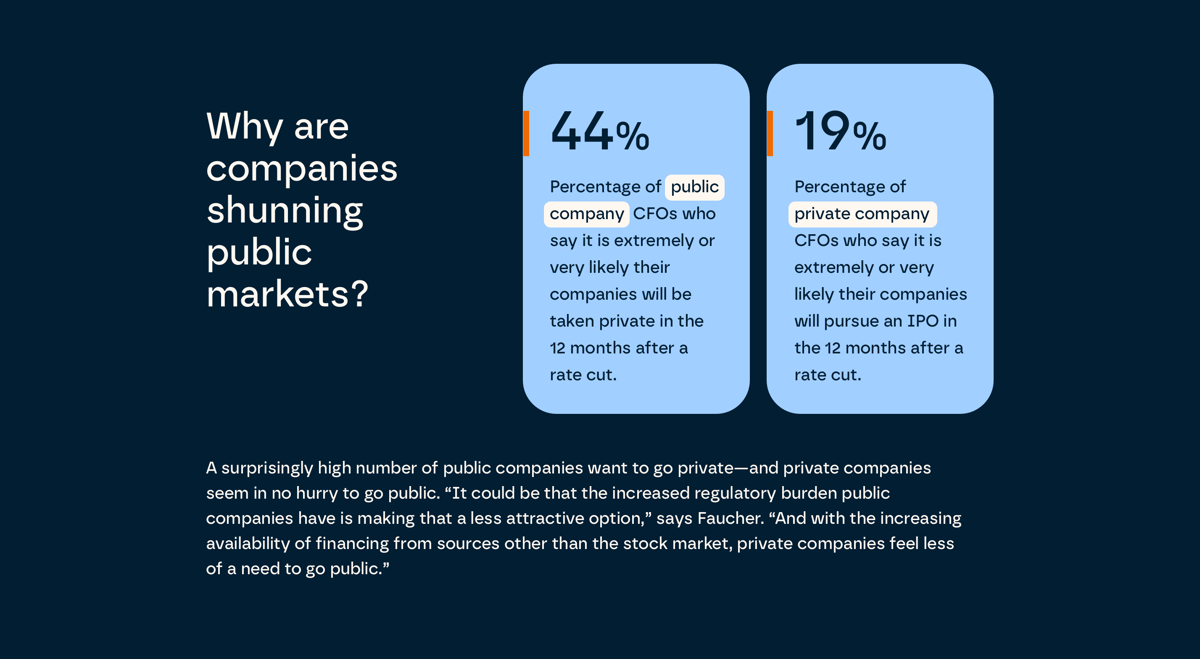

While only about half of survey respondents expect one or more rate cuts this year, PNC is predicting two rate cuts of 25 basis points each by the end of 2024.

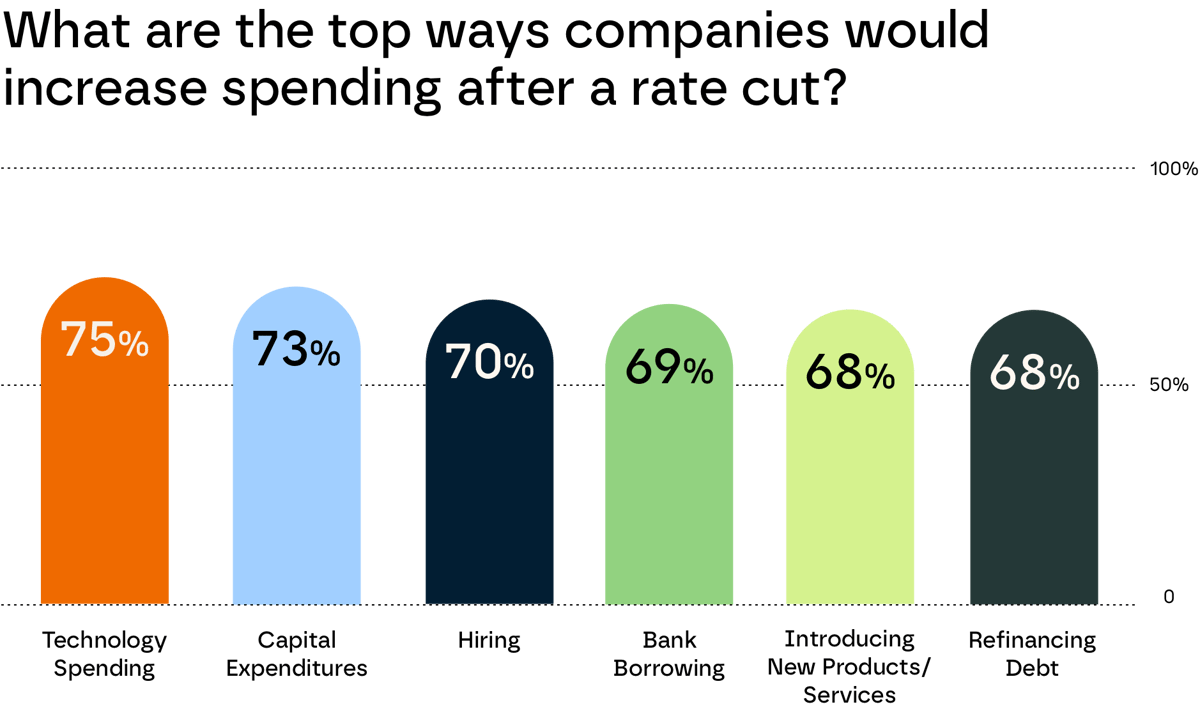

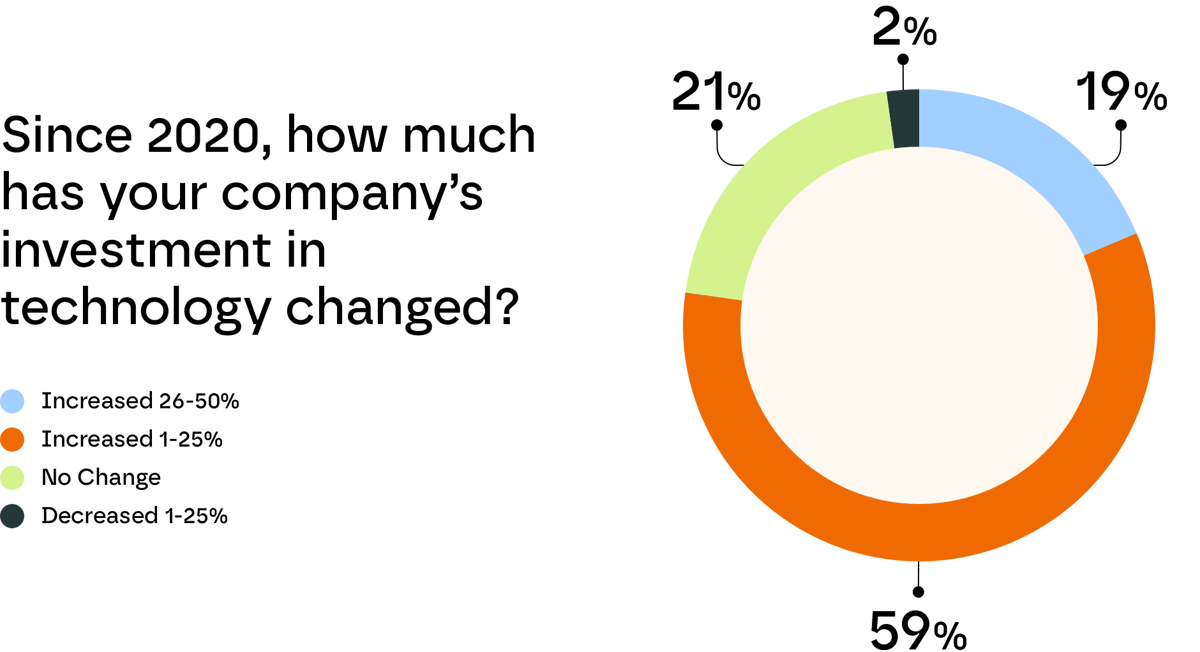

Technology spending has increased substantially since 2020 at most companies and is poised to rise even further once the Fed loosens monetary policy, notes Mike Thomas, EVP and Head of Corporate and Institutional Banking at PNC Bank.

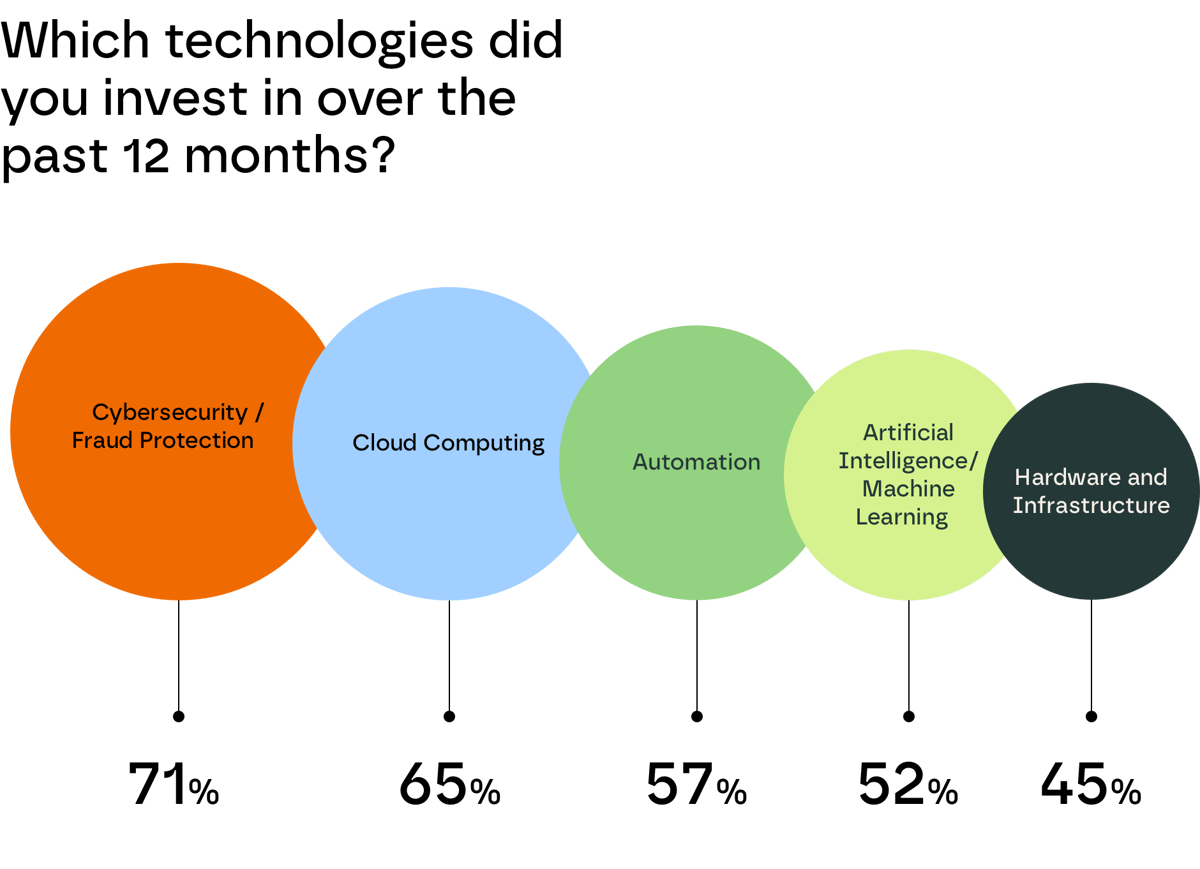

Cybersecurity and cloud computing have claimed the most tech dollars in the last year, while, surprisingly, only about half of companies have spent on AI projects.

“There is a lot of discussion around AI, so it may be somewhat surprising that it doesn’t rank higher on the list. But the reality is that there is still some level of caution about AI opportunities. Businesses are evaluating its potential uses, but in these early stages it can be costly to implement and hard to estimate the return on investment,” Thomas says.

“It seems clear that there is a belief in the transformative potential of AI, but in a higher-for-longer rate environment, CFOs have a crisp cost management strategy and are prioritizing their most urgent needs when it comes to spending,” he says. “So, it makes sense that cybersecurity and fraud prevention would rank higher as areas of focus.”

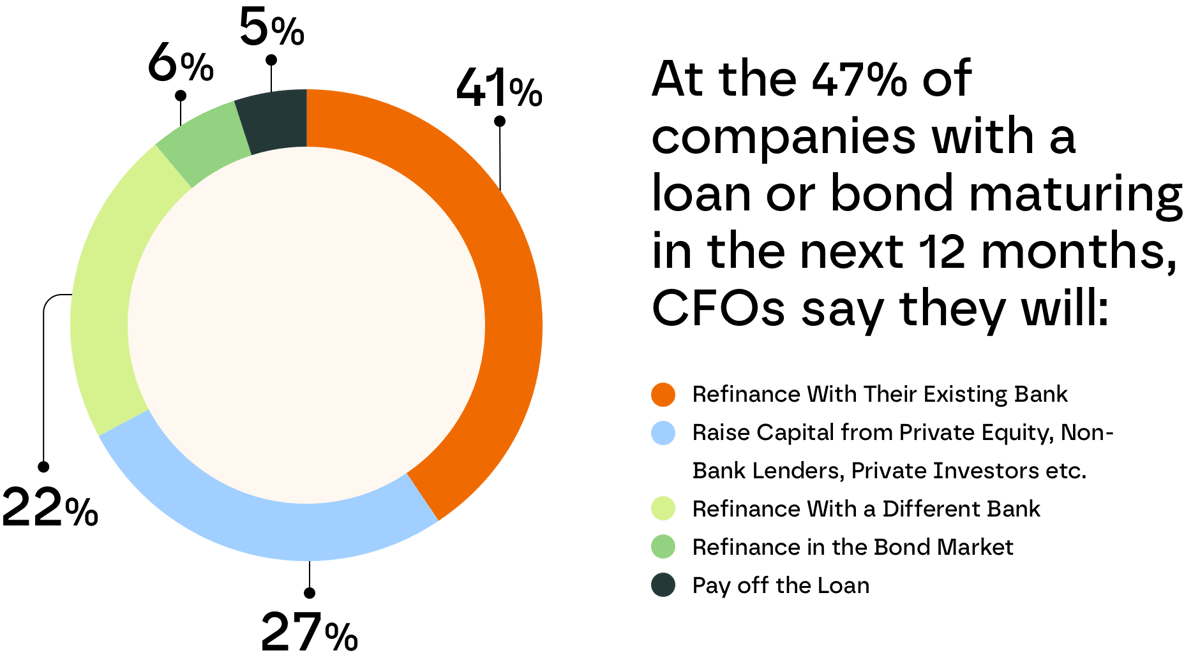

“We’ve seen private debt become a bigger and bigger part of the marketplace, and I think it’s because companies have found the terms more flexible than those of a traditional loan,” says Thomas. “Every company’s situation is unique, and private credit can provide options for certain borrowers.”

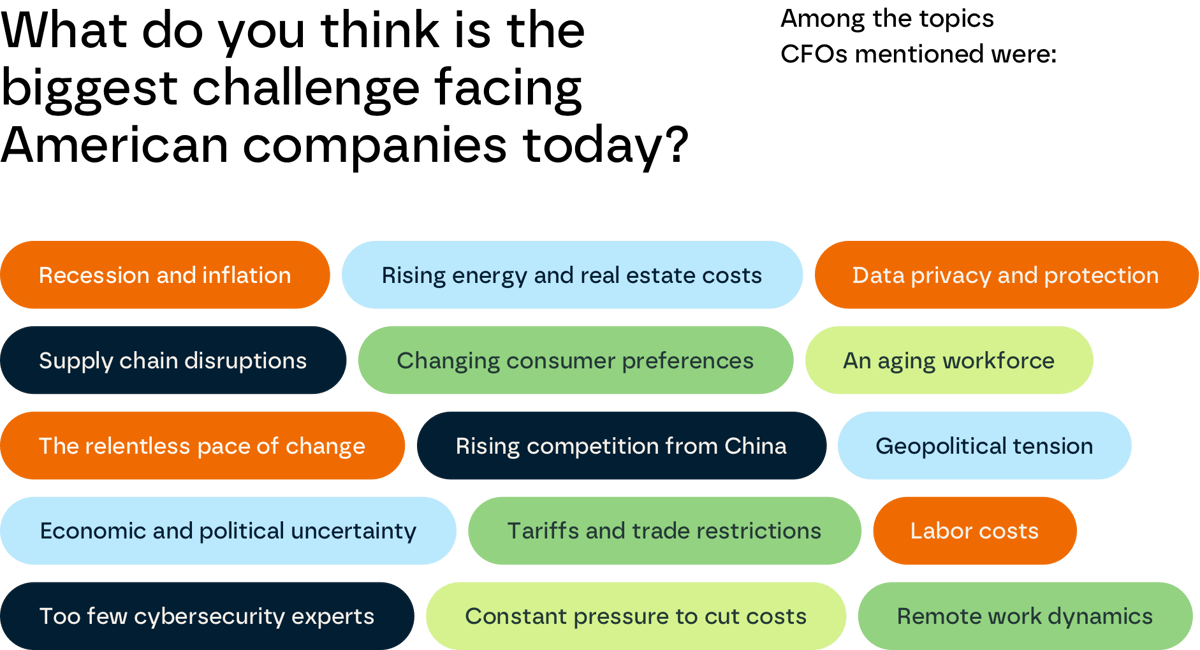

“CFOs know the Fed will eventually cut rates. This seems to be a given they can plan for, even as persisting uncertainty about the possibility of a recession may have influenced some of the survey results," says Faucher. "In the meantime, they’re more concerned about other big uncertainties, including the political environment and resulting regulatory impacts from the upcoming election, as well as geopolitical tensions abroad and concerns such as cybersecurity that are hitting them closer to home.”