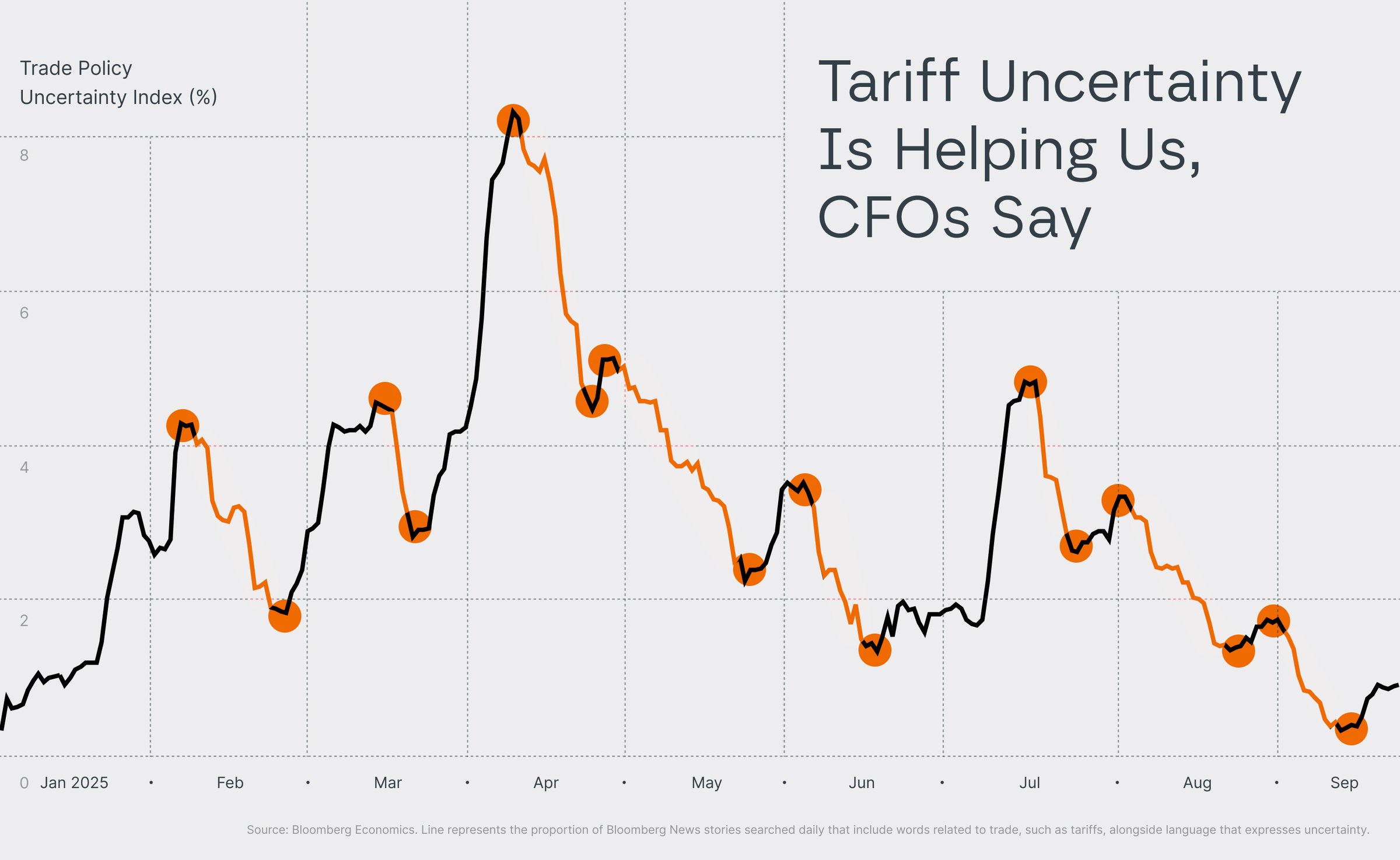

Tariff Uncertainty Is Helping Us, CFOs Say

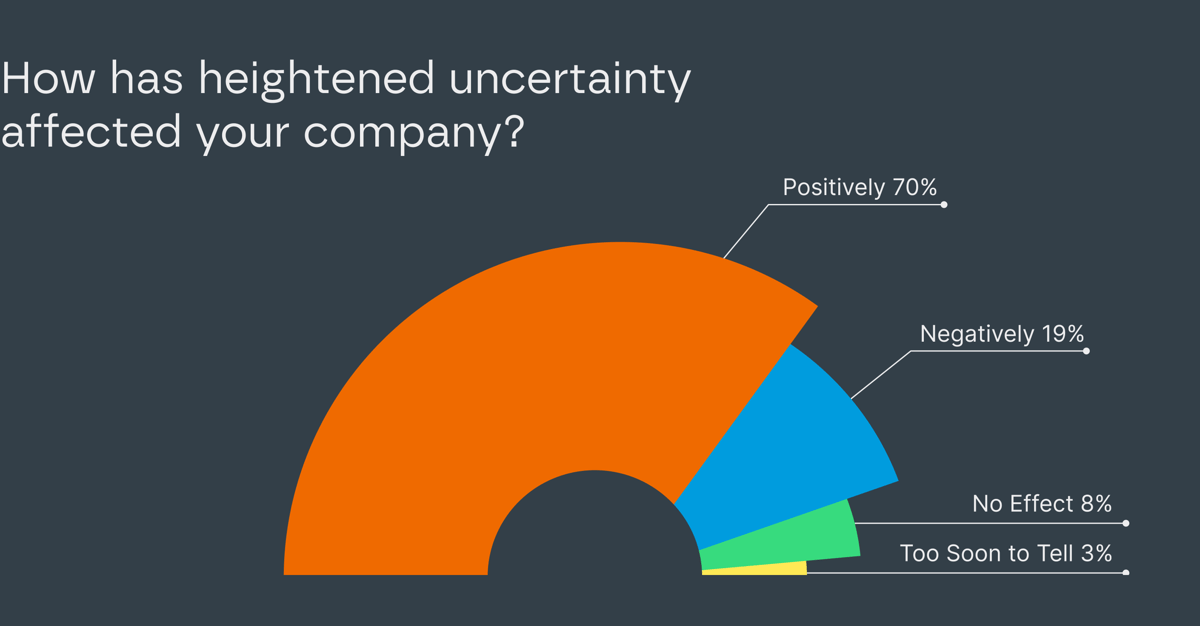

Approximately 70% of US CFOs say this year’s uncertainty about tariffs and the economic outlook has positively affected their companies, according to PNC Bank’s annual Inside the Minds of CFOs survey of more than 300 CFOs nationwide. Only 19% say the lack of clarity was a negative.

The results run counter to the generally accepted wisdom that predictability is the foundation of successful business operations. But this year, the uncertainty caused by rapidly changing tariff rates forced many companies to increase the pace of their business operations, turning the uncertainty into an advantage:

“You grow up in the business believing that consistency and certainty is really the fertile ground for business growth,” says Mike Thomas, EVP and Head of Corporate and Institutional Banking at PNC Bank. “But if you live with it long enough, at a certain point uncertainty almost feels like certainty. It's the idea that the only constant is change.”

But what about those news reports during the first half of 2025 that said companies were fearful about what the new tariffs would mean for their operations? Those reports may have been skewed by their focus on the very largest companies, the PNC Bank survey suggests.

Only 46% of companies with $1 billion or more in annual revenues said the uncertainty was a net positive. Yet 78% of the broad middle of the market—companies with $50 million to $1 billion in revenue—said the ambiguity was a plus. About 57% of companies with $5 million to $50 million in revenue said it was positive.

“Their smaller size may make these smaller companies more nimble, so it’s easier for them to respond quickly,” says Gus Faucher, Chief Economist at PNC Financial Services Group. “If you think about big companies, they have more complicated supply chains that take a bigger hit from tariffs."

Compared to how they felt in January, most CFOs are now more optimistic about the expected performance of their companies, their local economies and the national economy over the next 12 months.

The CFOs surveyed expressed more optimism in the economic outlook than some financial industry experts. “I have downgraded my forecast from the start of the year,” says Faucher. “The probability of a recession in the next 12 months has gone from 15% at the beginning of the year to around 40% currently.”

“We're probably a little bit more cautious generally than what shows up in these survey results,” says Thomas. “But I certainly understand where those results would come from, given the conditions that we're operating in right now. It’s a very favorable lending environment for being able to finance, the stock market continues to hold up, the consumer has hung in there and the labor market has largely held together.”

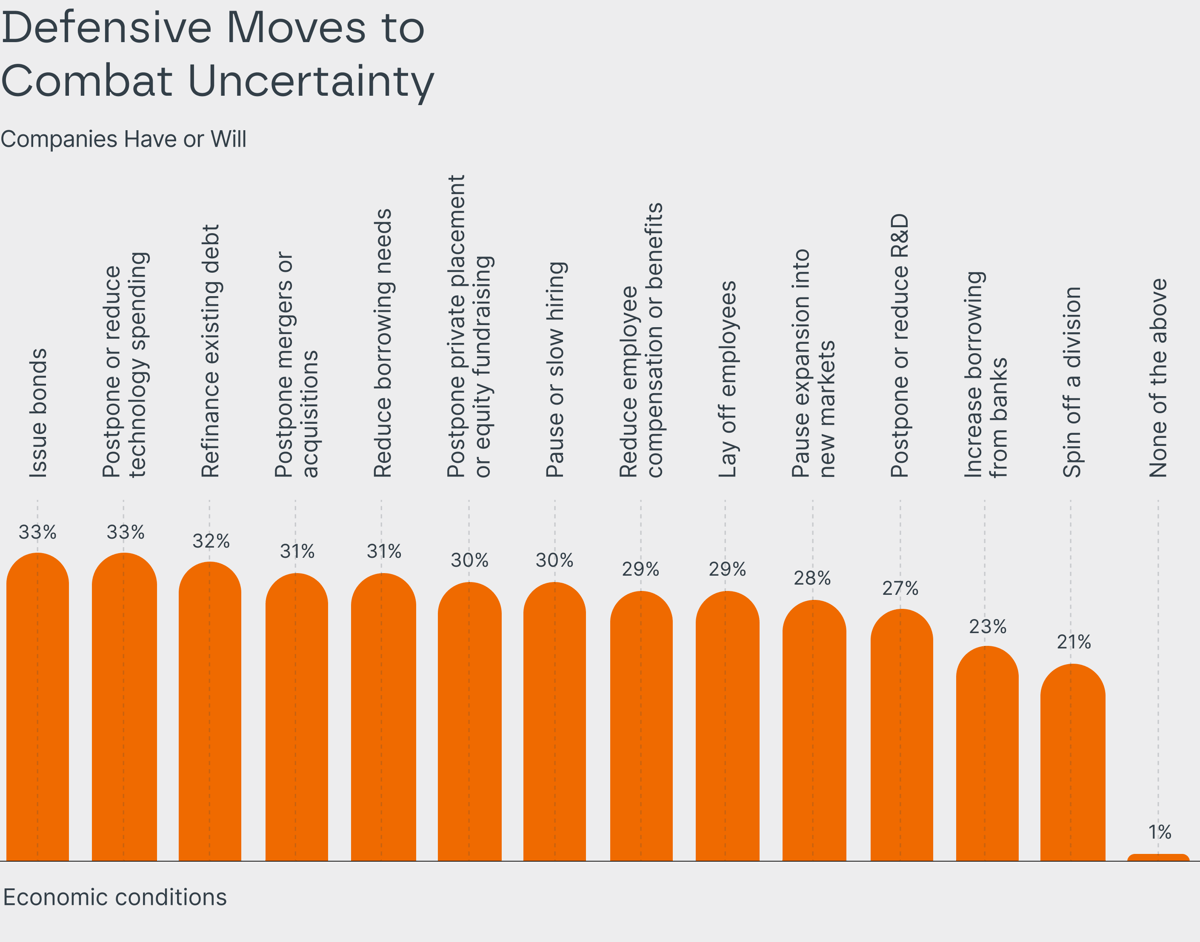

The CFOs surveyed confirmed that their companies have taken actions as defensive moves—ranging from issuing bonds to postponing mergers to laying off employees—to combat the uncertainty.

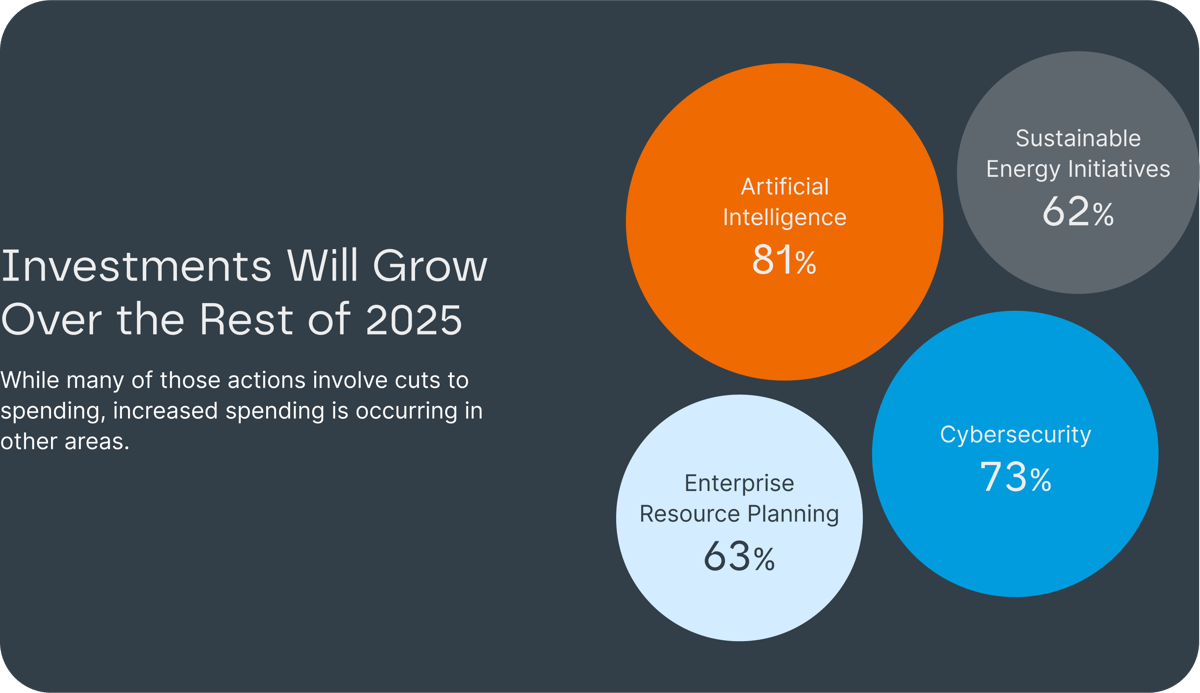

Despite the shift in the US zeitgeist away from climate change and renewable energy, a majority of companies are increasing spending on sustainable energy initiatives, and only 2% of CFOs report that they expect to cut funding from these ventures during the rest of this year.

With the rise of energy-hungry AI data centers, the need for more power means companies are loath to turn away from anything that promises to provide them with more energy, says Thomas. “It's really difficult to go and get more traditional sources of power,” he says. “And so, in some cases, the sustainable part of that ecosystem is easier to build. I think these companies are just saying, ‘Hey, I've got to continue this because I need the power.’”

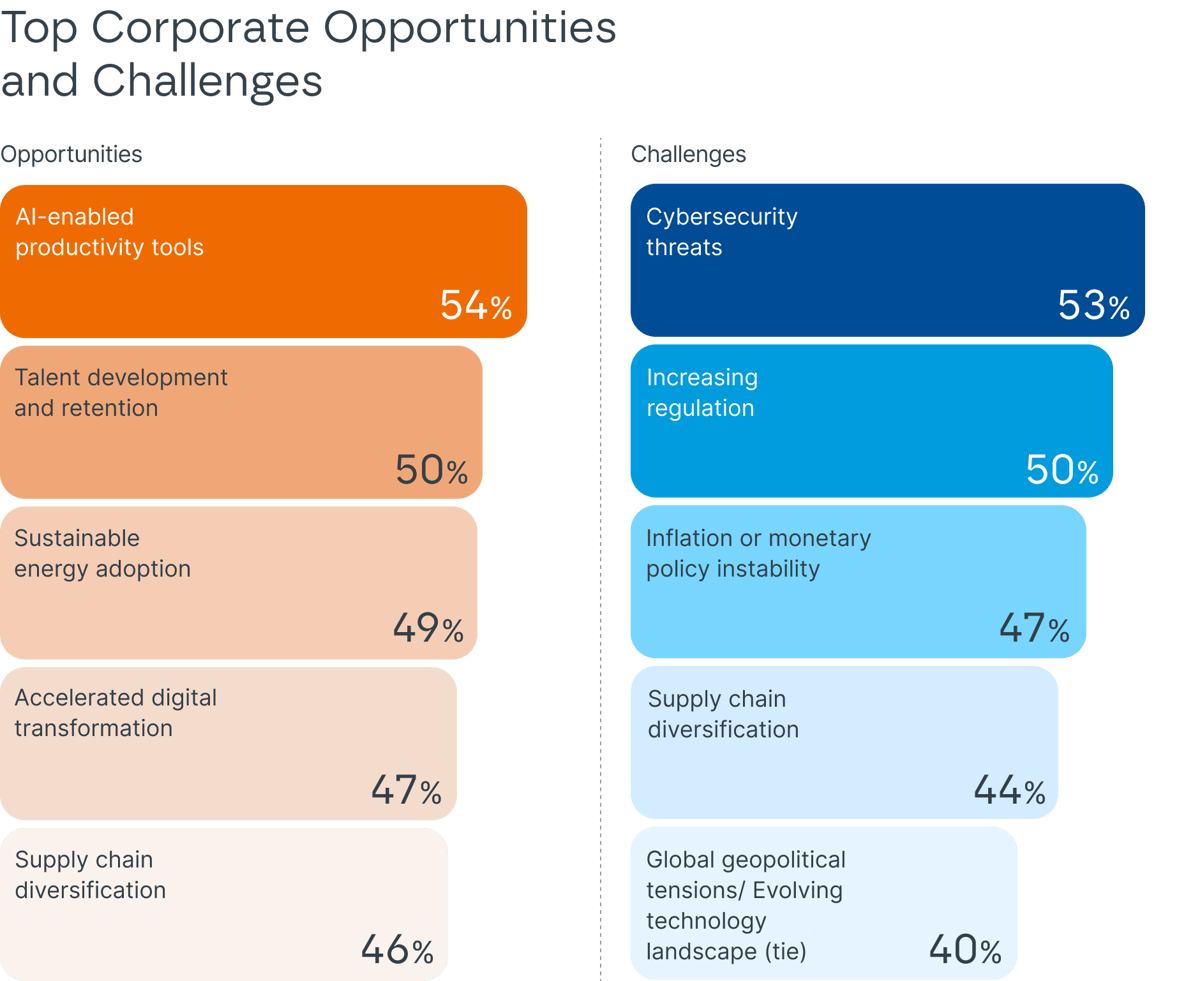

Looking forward to the next 1 to 3 years, CFOs identified the opportunities and challenges they expect to face. Most of the top challenges stem from government action or inaction, while opportunities tend to be more in the control of the companies themselves.