The Thai Chemicals Giant at the Forefront of Change

The chemicals industry is in a state of change. Shifting supply chains, digitalization and a drive to sustainability are creating new challenges and opportunities. Against that backdrop, the landmark acquisition of European specialty chemicals maker Allnex Holdings firmly positions PTT Global Chemical (GC) as a market leader for an exciting new era.

Rooted in GC’s ambitious “Three Steps” strategy for growth, competitiveness and sustainability, the acquisition paves the way for the company to scale its presence in high-value chemicals products—clearing strong barriers to entry and diversifying its revenue streams into a less cyclical market with fewer competitors.

“allnex is a great company that will empower us with a broad portfolio of specialty chemicals and further integrate sustainability into our business,” says Kongkrapan Intarajang, Chief Executive Officer of GC. “We conducted our due diligence over the course of several months and we are confident that one plus one will become more than two as GC and allnex realize the synergies of working together.”

Valued at 4 billion euros ($4.75 billion), this is the largest overseas acquisition by a Thai company since 2012 and the biggest in GC’s history.[1]

The company agreed to acquire 100% common stocks of allnex from the current owner and assume 426 million euros ($503 million) of loans. To finance the deal, GC will tap into its ample cash pool with extra support from parent company PTT.

“Cash is king, so we entered this deal from a strong position,”

Kongkrapan says. “The timing was perfect. This is the right window of

opportunity for M&A because you can make an acquisition at a good

value. We are confident that it will pay dividends for our business.”

Stepping Out to Realize New Opportunities

Chemicals make the world go round. Manufacturers use them in thousands of products including plastics, cosmetics, medicine, appliances, electronics, furniture and wind turbines. Refining specialty chemicals for use in manufacturing is a complex process. And trying to build a presence in the market from the ground up could take decades. The acquisition of allnex parachutes GC into a prime position.

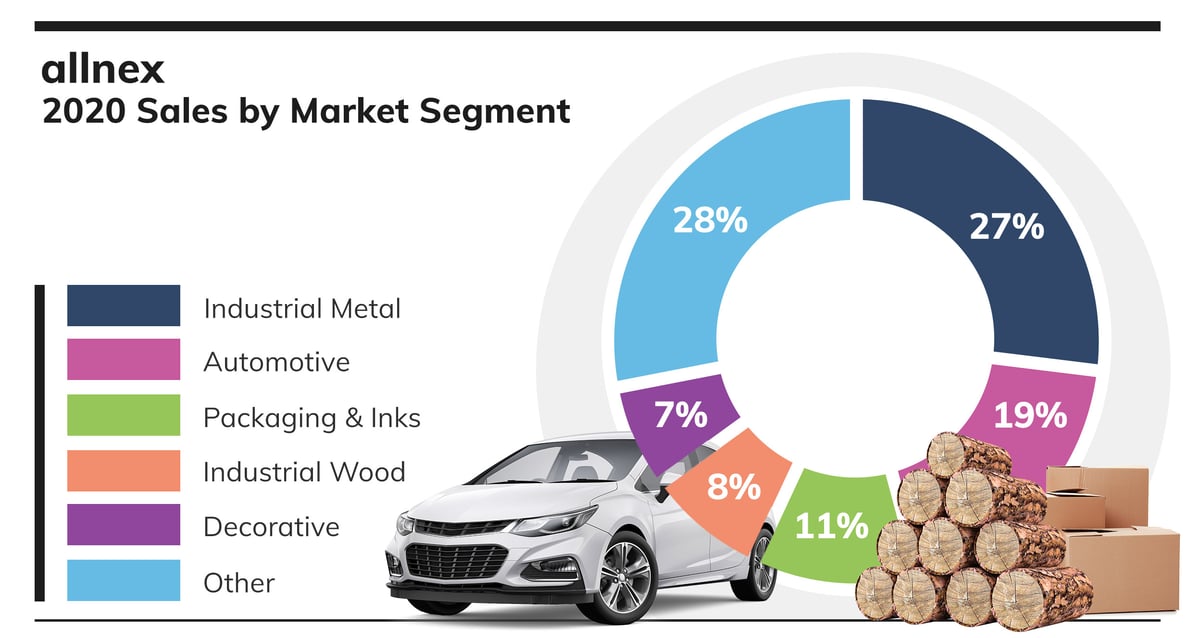

“Looking at global mega trends including urbanization, the electrification of vehicles and digitalization, we determined that there are two high-growth areas that would serve a range of growing needs,” Kongkrapan says. “One is high-performance polymers, the other is coatings and adhesives. With allnex, we can take advantage of those opportunities in the years ahead.”

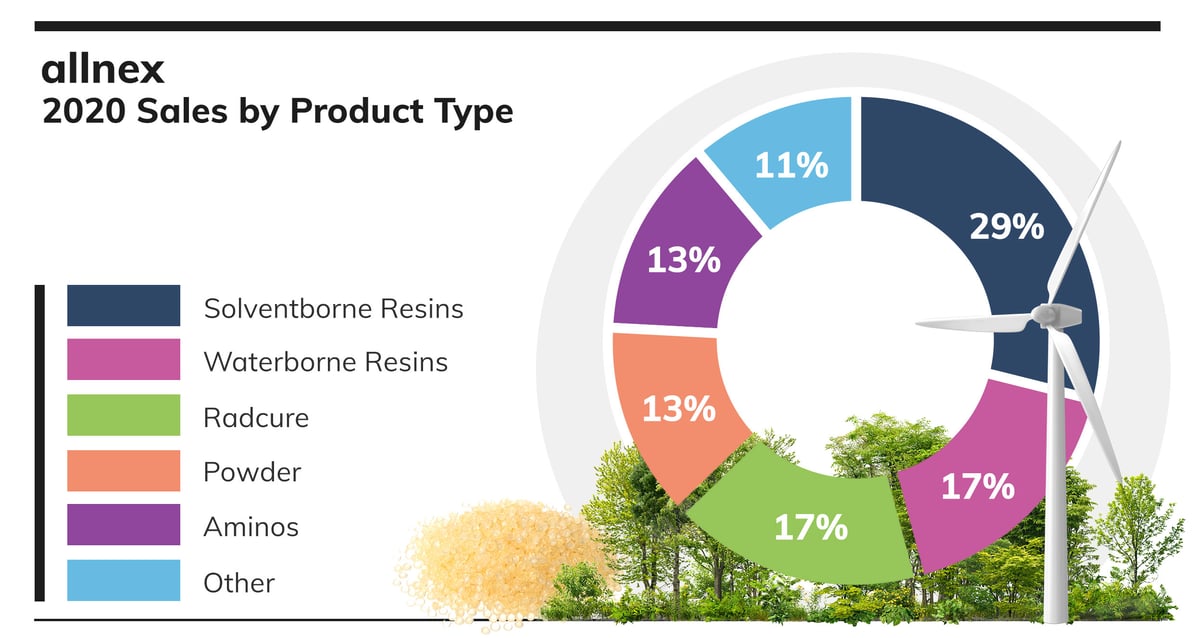

allnex boasts 4,000 employees, a global production network of 33 state-of-the-art manufacturing sites, 23 research and technology facilities, and over 70 years of experience. And it brings a strong legacy of pioneering sustainable innovations for the coating industry. With the global chemicals market forecast to reach $4.3 trillion in 2025, up from $3.34 trillion in 2020,[2] together, GC and allnex can take a bigger share of the pie.

With revenue of 2 billion euros and around 4,000 employees worldwide,

allnex is a major producer of key industrial coating segments, including industrial metal, automotive, and packaging.

“The management at allnex is excellent,” Kongkrapan says. “They are agile and have great customer relationships, so they will maintain their autonomy. What GC will do is support them in terms of business optimization, supply chain digitalization, operation maintenance, and financing and resources. This will accelerate their growth and make the company even more competitive than it is now.”

Stepping Up to Embrace Sustainability

Decarbonizing hard-to-abate sectors is vital to achieve the goals outlined in the Paris Agreement. The chemicals industry is among them. It accounts for 6% of global emissions and faces increasing pressure to decarbonize.[3] Yet, many companies trail when it comes to carbon-transition goals. GC is among the companies driving change.

Already, GC has weaved ESG principles and the United Nations’ Sustainable Development Goals (SDGs) into the core of its operating model. To do its part in the battle against climate change, for instance, GC aims to reduce scope 1 and 2 emissions by 52% per ton of production by 2050 from 2012 levels. It will also reduce emissions from internal business operations 20% by the end of this decade.

In 2020, The Dow Jones Sustainability Index ranked GC first in the world for sustainability in the chemicals sector for the second consecutive year.[4]

GC is also the only Thai-owned conglomerate to achieve the highest score in the 2020 annual environmental disclosure of the Carbon Disclosure Project, earning top marks for its climate change and water security initiatives.[5]

“Later this year we will announce our plan to achieve net zero,” Kongkrapan says. “Our goal is to define a clear pathway to decarbonize our operations and our portfolio so that we do not burden the next generation with today’s challenges.”

allnex compliments GC’s commitment to sustainability. In 2020, around 53% of the electricity that allnex consumed came from renewable sources.[6] And the company reduced the amount of greenhouse gases per ton of product by 16%. Looking ahead, it will further reduce non-renewable energy purchases 15% by the end of 2023.

Around 70% to 80% of allnex’s end products are sustainable. The company has a long history of producing specialty ingredients that are low in volatile organic compounds (VOC) and enable greener coatings. Among them are low-VOC high-solid, water borne and powder coatings, and solutions for formaldehyde-free crosslinking. Its Sustainable Portfolio Management system promises to make its current project and product portfolio even more sustainable in the years ahead.[7]

“Not only does allnex increase our exposure to new markets, it adds environmentally friendly assets to our product portfolio,” Kongkrapan adds. “Between new business and greater sustainability, this acquisition will create a good platform for GC to grow.”