Investing in Disrupters:

How sovereign wealth funds are providing much-needed patient capital

Advanced technologies such as AI, renewable energy and biotech will define the next decade of the global economy.

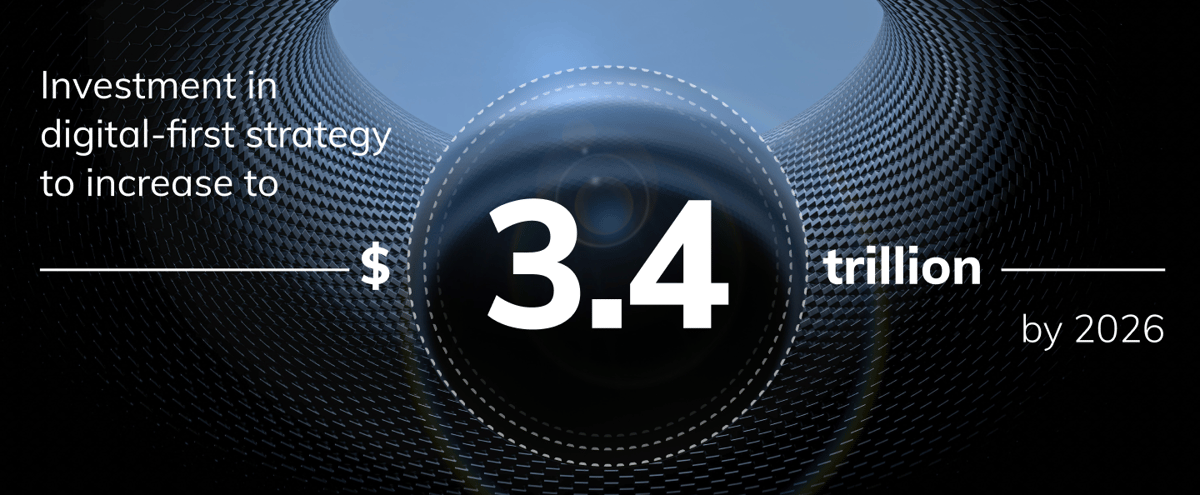

For many of these emerging technologies and companies, digital transformation is the key enabler. Companies spent $1.8 trillion in 2022 on embedding digital technologies across their businesses, an increase of 17% over 2021, according to International Data Corporation. As organizations accelerate their pursuit of a digital-first strategy, this level of investment will be sustained, reaching $3.4 trillion by 2026, forecasts IDC.

Innovators, however, often take time to realize their full potential, which means that long-term capital—known as “patient capital”—is needed to develop ideas through to the scale-up phase. While VC funds are crucial for seed funding, forward-thinking investors that see the potential, but don’t necessarily need to see immediate strong financial returns, are critical to ensuring success.

Beyond the establishment phase, companies need long-term, reliable partners to support them to scale and reach their full potential.

The recent macroeconomic environment has demonstrated just how vital such patient funds are. After a period of outperforming tech stocks linked to the global pandemic of 2020-2021, technology valuations have dropped sharply in many markets since early 2022.

The US health tech sector, for example, saw venture capital funding drop to $27.5 billion in 2022, from $39.3 billion a year earlier, according to Deloitte. Meanwhile, VC investment in climate tech has fallen to its lowest level in nearly three years: In the first quarter of 2023, some 4,600 companies raised just $5.7 billion—the lowest amount since Q2 2020, according to financial data firm PitchBook.

QIA was established in 2005 to invest Qatar’s surplus revenue from liquefied natural gas (in 2022, Qatar tied with the US as the biggest exporter globally), and it now ranks as the world’s 10th-largest wealth fund, according to the Sovereign Wealth Fund Institute. As policy makers worldwide increasingly prioritize energy security, the institution is deploying more capital to promising new enterprises.

In recent years, Qatar’s wealth fund has pursued a diversified investment approach boasting some large-scale investments in rapidly advancing technologies, pushing boundaries in a range of sectors.

“QIA sees itself as a catalyst for innovation, investing in businesses that are transforming their industries, whether that industry is finance, healthcare, agriculture or business solutions,” says Al-Mahmoud. “We are focused on the sectors shaping the future global economy. We help build businesses and support them to thrive across their life cycle.”

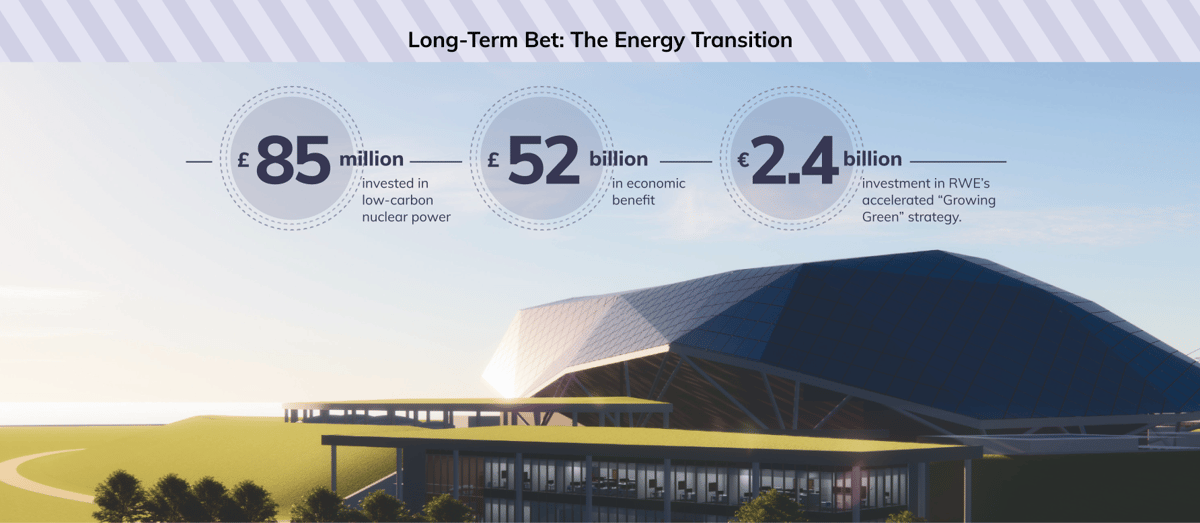

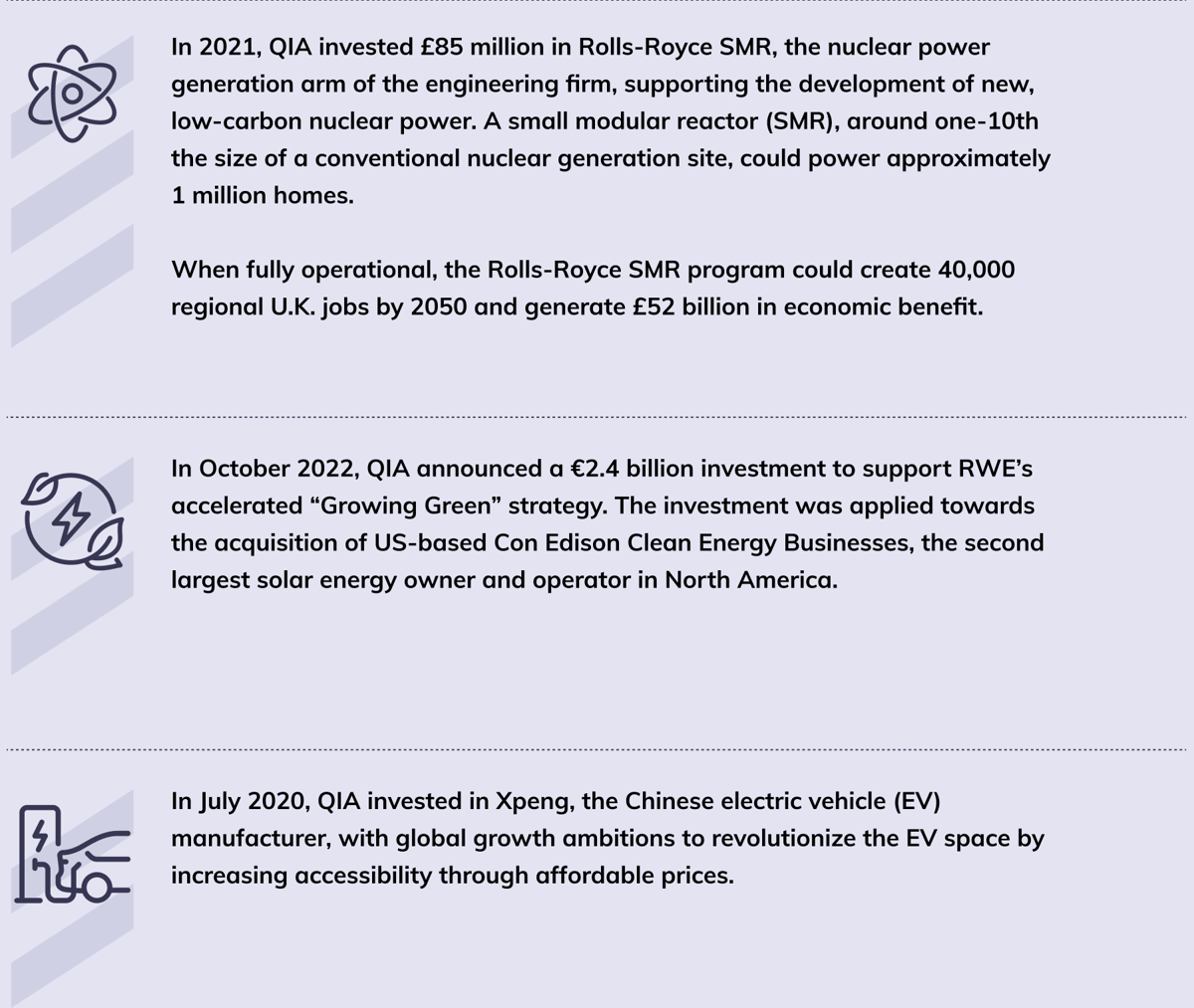

QIA is putting significant capital towards technology that is furthering the global energy transition.

“Structural, regulatory and legacy issues mean that healthcare is still one of the least digitalized of the major global industries, and there are huge opportunities here that will benefit both patients and healthcare providers, ” said Dr Mohamed Ghanem, Head of Healthcare at QIA. “Investing in tech can make healthcare systems more efficient, cheaper and more accessible”.

In health tech, QIA has invested in Ensoma, a genomic medicines company; BioXcel, which uses AI to develop medicines and treatments in neuroscience and immuno-oncology; and JenaValve, developer of a heart valve system that reduces surgery time.

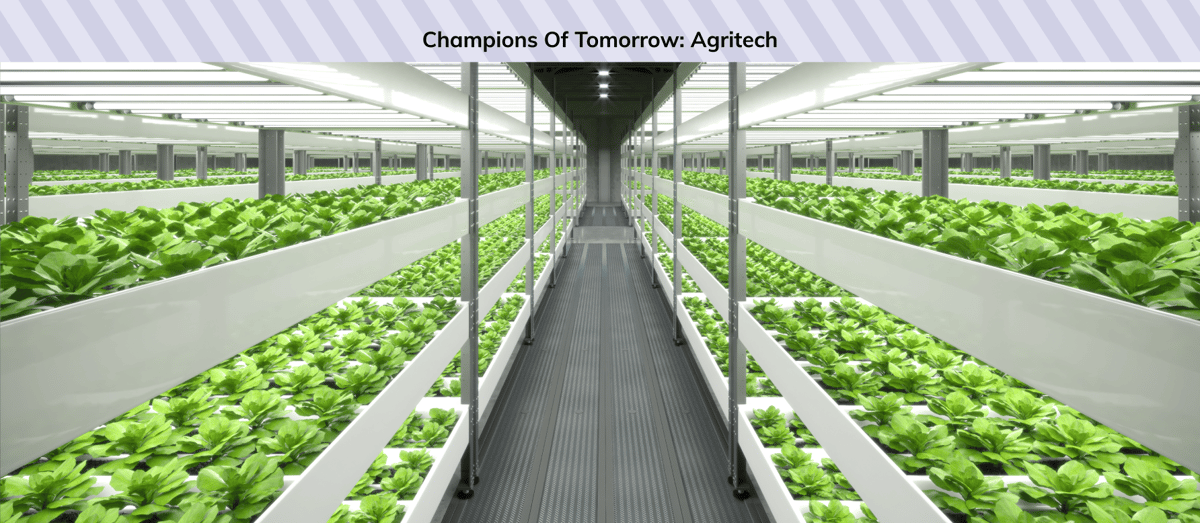

The global need for food security, supply chain challenges and an international food crisis have seen a redirection of investment out of traditional food production and into agritech technologies and startups, such as:

“These innovations are determining the pace at which we are able to address global challenges, from food security and financial inclusion to climate change, health care and energy availability,” says Al-Mahmoud, QIA’s CEO. “That is why we look to identify future trends and focus on the champions of tomorrow, rather than short-term returns.”

Ongoing geographical diversification means that QIA is looking to deploy a larger share of investments into the US and across Asia. In 2021, QIA led a $175 million funding round for unicorn Rebel Foods, an India-based cloud-kitchen meal startup that is now the world’s largest chain of online restaurants. The same year, QIA opened an advisory office in Singapore, increasing its access to some of Asia’s largest companies and investors.

“We continue to monitor and analyze global trends for opportunities to expedite transformative changes across all industries and geographies,” says Al-Mahmoud. “QIA has a unique advantage when investing in startups and innovative companies: We are a sovereign wealth fund with no short-term liabilities. And we’re willing to take risks.”

Despite this, the fund’s commitment to Europe remains strong and it continues to support companies such as Checkout.com, an online payment platform that is one of Europe’s leading tech unicorns. In 2022, QIA was part of a $1 billion series D funding round for the tech giant, which processes hundreds of billions of dollars in payments for some of the world’s largest merchants, such as Netflix, Sony and Siemens.