Banking On ASEAN’s Digital Economy

According to Bloomberg research, foreign direct investors this year are betting on technology and innovation as a key driver for investment – closely followed by new consumer markets and lower production costs.[1] The Association of Southeast Asian Nations (ASEAN), whose 660 million-strong population is forecast to add USD1 trillion to the region’s digital economy by 2030,[2] ticks all three boxes.

More than ever, today’s foreign direct investment (FDI) surge is powered by the promise of online commerce. As the region’s business landscape changes, an estimated 70% of new economic value created over the next decade in ASEAN will be found on digitally enabled platforms.[3]

Building a Bigger Boat

Even on the back of a global pandemic, FDI into ASEAN surged to USD224.2 billion in 2022.[4] Helping to boost these inflows was an easing of regulations in nations like the Philippines and Indonesia,[5] which allowed a surge of much-needed investment into data towers and other key digital infrastructure.[6]

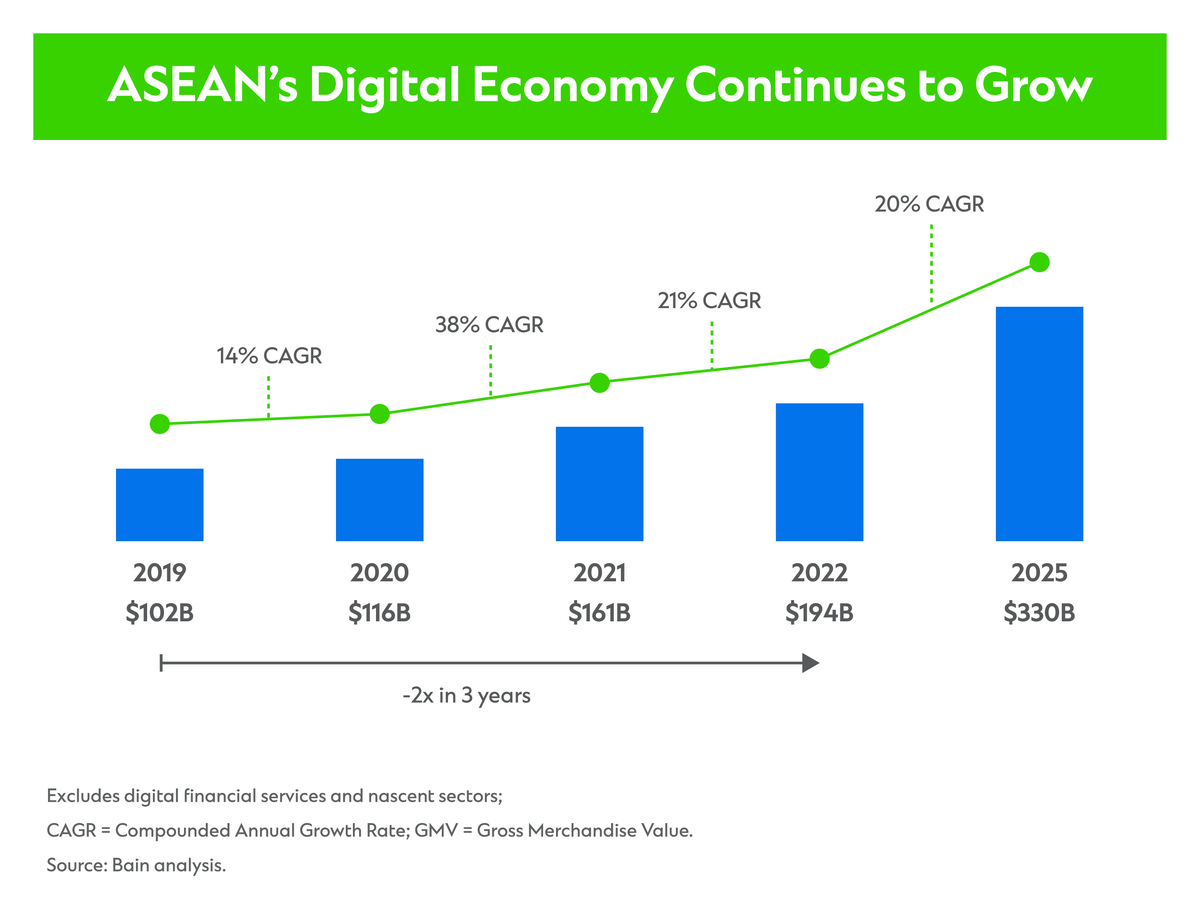

Emboldened by the promise of faster bandwidth and smoother transactions, Southeast Asia has ushered in a new digital decade, fueled by an ever-expanding base of digital consumers and merchants, and an acceleration in e-commerce and food delivery.[7] According to the e-Conomy SEA report by Google, Temasek, and Bain & Company, Southeast Asia's digital economy surpassed USD200 billion in gross merchandise value in 2022.[8]

The ASEAN Digital Master Plan (ADM) 2025 is designed to lock in and accelerate these benefits – envisioning a leading digital community and economic bloc, powered by secure and transformative digital services, technologies and ecosystem.[9] Among its eight desired outcomes, ADM 2025 aims to see digital services connect business and facilitate cross-border trade – promoting e-commerce in the trading bloc, enhancing last-mile fulfilment cooperation, and improving competition in the digital economy.[10]

Eyeing the Opportunities

As movement towards the ASEAN Economic Community (AEC) 2025 gather pace,[11] the promise of true economic integration is exciting for those seeking a stake in ASEAN’s burgeoning digital economy.

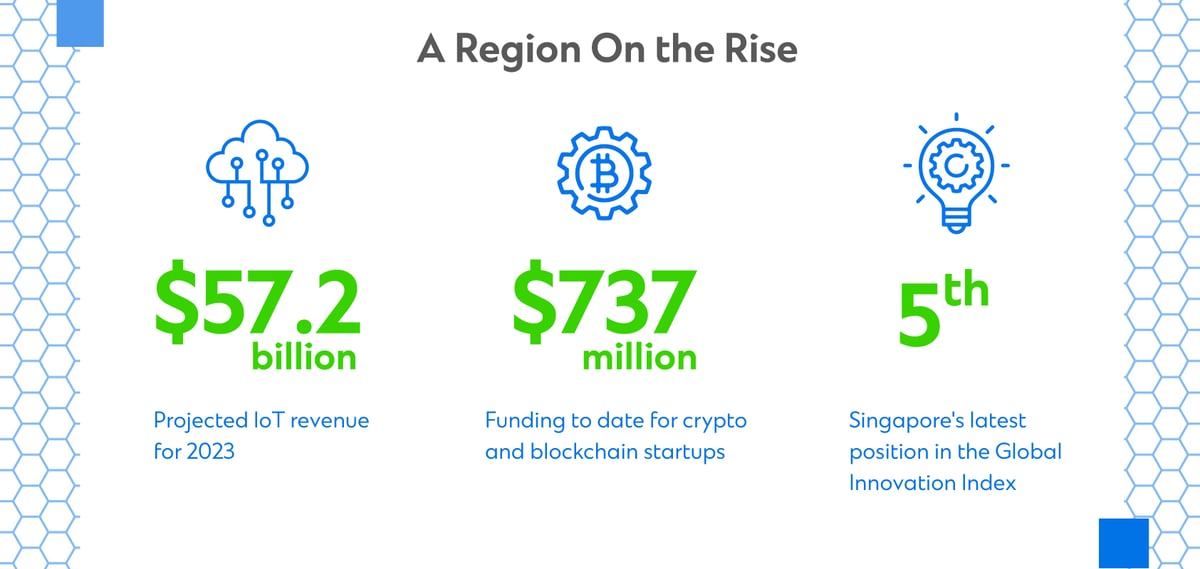

Revenues from IoT across ASEAN are projected to reach USD57.2 billion in 2023,[12] while more than 600 crypto and blockchain startups have headquartered in Southeast Asian countries, attracting more than USD737 million in funding to date.[13] And as the region’s most digitally advanced economy, Singapore, soars to fifth place in the Global Innovation Index (GII),[14] savvy investors are beginning to consider capitalising further on ASEAN’s digital landscape.

Already, digital payments in the region move fast – exceeding USD800 billion in 2022.[15] And likewise, for today’s e-businesses, keeping up with cash and digital payments in real time is crucial to streamlining their business operations. As online merchants seek to focus on the rapid rollout of first-to-market products, they are increasingly looking to ingenious plug-and-play financial solutions to ease their daily challenges, such as reconciliation of cash flows or close control of payment cycles.

Paving a smoother path for these processes are a host of novel solutions in financial services. Amid a growing number of digital ecosystems and evolving regulatory frameworks, a new wave of bank-fintech partnerships is helping to foster the use of application programming interfaces (APIs) to allow real-time interactions.[16]

E-commerce is also a powerful tool for economic mobility. ASEAN’s unbanked and underbanked populous sits at an estimated 70% of its adult population.[17] As such, today’s advancements in open digital banking can act a key step towards greater financial inclusion for many Southeast Asian families.[18]

Next-Generation Solutions

As the only international bank with a presence in all 10 markets and a track record of supporting clients in ASEAN for over 160 years,[19] Standard Chartered’s partnerships and investments in fintech are helping clients unlock numerous innovative solutions.

Eyes on the Prize

Those running a business at the cutting edge of the digital economy increasingly look to financial partners with their finger on the pulse of today’s business megatrends. These include artificial intelligence (AI) powered operations (AIOps) in finance,[25] which bring benefits such as the ability to analyze vast amounts of data to improve decision-making, as well as the integration of blockchain technology in banking to increase the speed and transparency of transactions.[26]

Evolve and Adapt

While constantly delving into new areas of expansion and technology that will power our region tomorrow, leading financial services partners are mindful that as today’s digital landscape changes, so too will the role of banks. It’s imperative that they continue to evolve and adapt accordingly.

And Standard Chartered recognises the responsibility it has to help facilitate and maintain a vibrant, inclusive, and sustainable digital economy in ASEAN.[29]

Sources:

[1] Bloomberg [2] Bain [3] Bloomberg [4] Statista [5] Fitch Solutions [6] Macquarie [7] Bain [8] ERIA [9] ASEAN [10] ASEAN [11] ASEAN [12] Statista [13] Korea Blockchain Week [14] The Straits Times [15] ERIA [16] Standard Chartered [17] Bain [18] Standard Chartered [19] Standard Chartered [20] Standard Chartered [21] Standard Chartered [22] Olea [23] Standard Chartered [24] ASEAN Sector Insights Report, page 68 [25] Standard Chartered [26] Standard Chartered [27] Monetary Authority of Singapore [28] SGTraDex [29] Standard Chartered