Financing ASEAN’s Energy Future: Unlocking Green Growth

Why bold financial solutions are needed to accelerate ASEAN’s energy transition, address climate vulnerability and sustain economic growth.

Record temperatures across Southeast Asia in 2024, including a high of 53oC (127oF) in the Philippines,[1] triggered a surge in electricity demand for cooling. The hot weather underscored the region’s continued reliance on fossil fuels to power itself, and reinforced the urgency of the shift to renewable energy.

As the world’s fourth-largest energy consumer, the 10-nation Association of Southeast Asian Nations (ASEAN) is projected to account for 25% of global energy demand growth by 2035,[2] fuelled by a growing population, rapid economic expansion, and its strategic role as a global manufacturing hub.

Recognising the region’s climate vulnerability, ASEAN countries are prioritising clean and renewable energy solutions. This shift requires significant investment: US$1.5 trillion through 2030 for ASEAN to be on a Paris Agreement-aligned trajectory.[3] However, only US$45 billion in cumulative investments from public and private sources were made from 2021 through 2023.[4]

The region’s ambitious renewable energy goals[5] depend on unlocking affordable alternatives to fossil fuels such as wind and solar. This will require investment in the necessary clean energy infrastructure, the creation of innovative financing solutions, and closer collaboration between the public and private sectors.

Southeast Asia’s Green Economy 2024 Report, produced by Bain & Company, GenZero, Standard Chartered and Temasek, highlights the key initiatives, investable opportunities, and innovative financial mechanisms that can unlock the potential of ASEAN’s energy transition and put it on track to meet its climate goals.[6]

Overcoming regional challenges through collaboration

ASEAN’s energy transition is complicated by disparities in resources and infrastructure across its member nations. Wealthier nations attract infrastructure investments more readily, leaving less-developed economies struggling with limited funding for clean energy initiatives.[7]

With this in mind, Standard Chartered works with governments, central banks, and other private-sector financial institutions to provide these requisites through various partnerships. One partnership model, the Just Energy Transition Partnership (JETP), allocates capital to help phase out the use of fossil fuels in emerging markets. Standard Chartered and its JETP partners have committed US$15.5 billion to support Vietnam’s energy transition and US$20 billion to phase out coal and invest in renewable energy in Indonesia.[8]

Another example of collaboration driving impact is the partnership between Puro.earth, Standard Chartered and Swedish bank SEB that aims to boost the carbon dioxide removal (CDR) market. By facilitating offtake agreements for high-quality, Puro Standard-certified carbon removal credits, the two banks will drive liquidity in the market and increase production of CO2 removal certificates (CORCs).[9]

How financial institutions help accelerate the energy transition

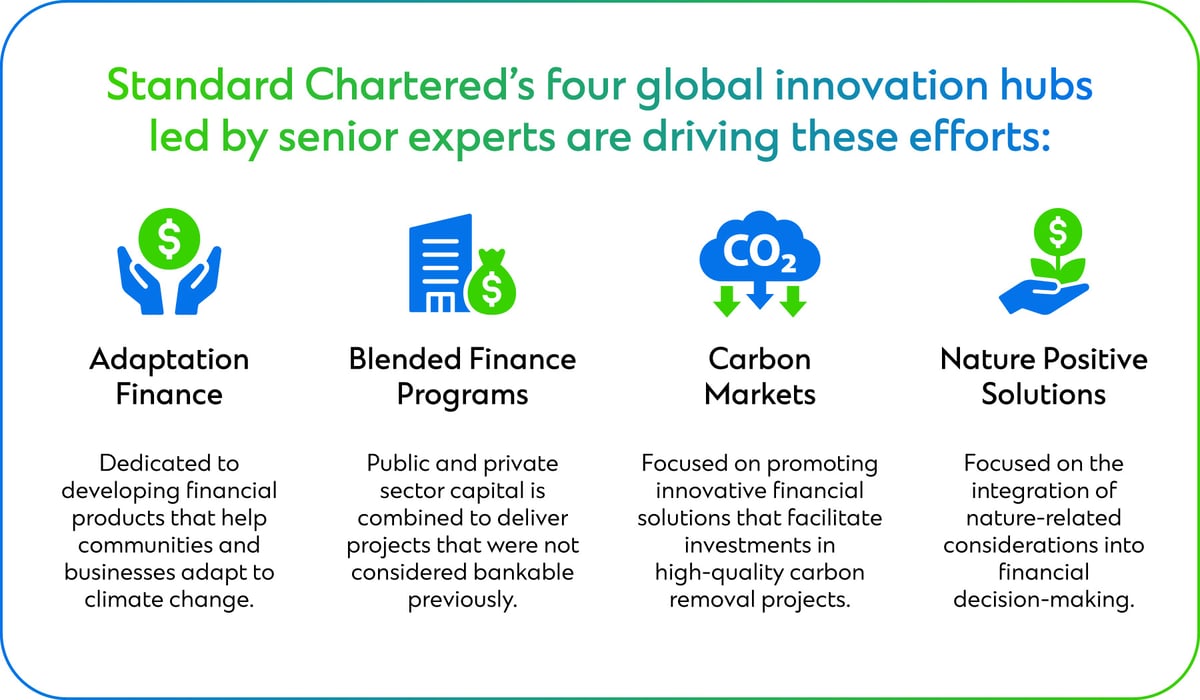

Financial institutions play a pivotal role in ASEAN’s energy transition by channeling investments into renewable energy and deploying innovative financial solutions that enable long-term sustainable growth. With a presence in all 10 ASEAN markets, Standard Chartered is uniquely positioned to connect capital to critical growth opportunities.

The bank has pledged to mobilise $300 billion in sustainable finance by 2030, with $23.3 billion already deployed and sustainable assets growing at 32% year on year.[10] This includes funding for projects such as the Cirata Floating Photovoltaic Power Plant in Indonesia, the largest of its kind in Southeast Asia. The investment aligns with Standard Chartered’s broader strategy of supporting low-carbon growth in hard-to-abate sectors.[11]

To meet the timeline for a low-carbon economy, Standard Chartered has developed innovative products tailored for these challenging sectors, which include heavy transport, steel and cement manufacturing and chemical production. The bank’s multidisciplinary teams in ASEAN offer expertise in areas including transition finance, ESG and carbon accounting, while its sustainable finance offerings—spanning loans, bonds, trade finance, and carbon trading—are rapidly evolving to address diverse client needs.

Leading the way through innovative financing

Accelerating ASEAN’s green transition demands significant investment in critical infrastructure. Innovative financing solutions have recently driven several successful projects across the region, highlighting their potential scalability.

In Vietnam, Standard Chartered partnered with the Asian Development Bank in 2020 to finance the 257MW Phu Yen Solar Power Plant, the country’s largest operating solar project and one of the biggest in Southeast Asia.[12] Through its onshore operations in Vietnam, Standard Chartered provided critical debt structuring expertise and long-term interest rate hedging to bring this landmark project to life.

To finance this project, Standard Chartered participated in the first green B-loan facility in Asia certified by the Climate Bonds Initiative.[13] With the potential to reduce 123,000 tonnes of CO2 emissions annually, the Phu Yen plant has set a benchmark for renewable energy financing in the region, and was named Green Project of the Year in Vietnam.

In Singapore, in 2023, Seatrium, a prominent player in the offshore and marine industry, secured significant financial support from Standard Chartered in the form of a US$500 million credit facility,[14] which included an embedded sustainability-linked conversion option aligned to sustainability-linked loan principles. This has strengthened Seatrium’s efforts to integrate sustainable practices into its operations while contributing to the industry’s energy transition.

Towards a greener and more resilient ASEAN

Globally, innovative financial mechanisms are reshaping sustainability efforts and providing valuable templates for ASEAN. One notable example is Standard Chartered’s pioneering debt conversion initiative In The Bahamas, which unlocked US$124 million for marine conservation[15] by repurchasing US$300 million of external debt. This approach provides a compelling blueprint for ASEAN countries to mobilise capital for renewable energy projects, ecosystem restoration and climate resilience.

Bridging investment gaps is essential to realising ASEAN’s net-zero ambitions. Success will depend on strong partnerships backed by bold and innovative financing solutions. With its strategic location and dynamic economic growth, the region is well-positioned to lead the charge towards a greener and more resilient future.

--- Chow Wan Thonh, Head, Banking and Coverage, Singapore and ASEAN, Standard Chartered