Investing for Today, Tomorrow, and Forever

Financial planning can be a bewildering process.

While most of us agree that putting money aside for future needs is a good idea, deciding what to do with that money is considerably more complex. Having the means and desire to save is an important first step, but building and managing a portfolio to meet your financial goals can be more challenging.

The result is that many investors end up with a portfolio that is ad hoc and scattered, without any clear plan or goals.

Standard Chartered Wealth Management makes that challenge less daunting by breaking it down into a series of steps.

Three Stages of SC Wealth Select

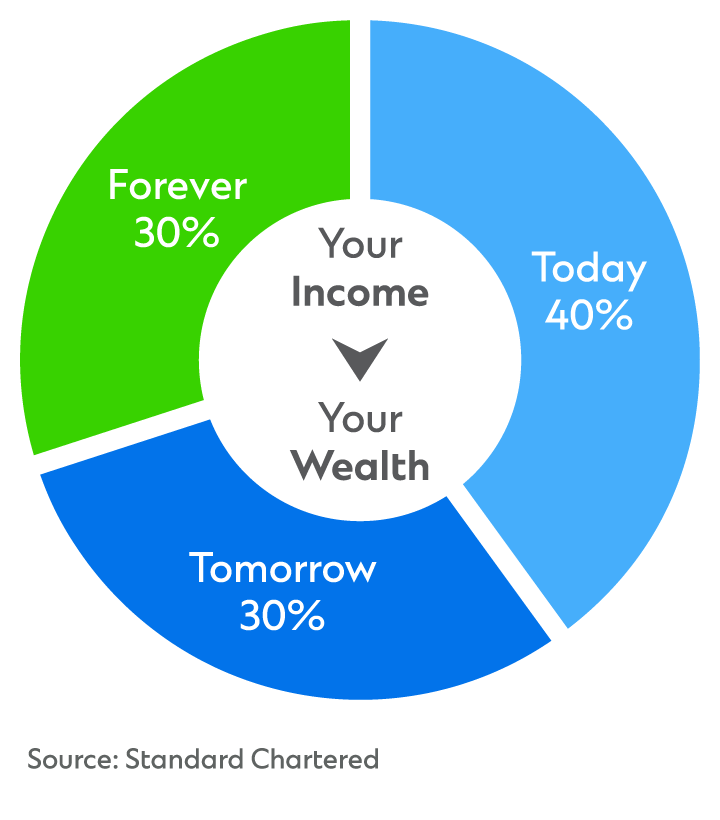

As you go through life, you have different wealth needs for life's milestones. How can you build a portfolio foundation that meets your needs today, tomorrow, and forever?

- Today covers short-term expenses such as school fees or mortgage payments that require a stable cash flow and low volatility.

- Tomorrow is about ensuring you can meet your longer-term needs and aspirations through to retirement.

- Forever focuses on what you want to leave behind for children and future generations.

Laying a Foundation

Once the needs for each stage are understood, we move on to the building phase. A portfolio approach to investment is the best route to long-term financial security. That means taking our initial “Today, Tomorrow, Forever” view and allocating assets to suit the individual’s goals to build a strong foundation.

Setting and maintaining this foundation is critical, particularly during periods of market uncertainty and volatility, when the temptation to react to short-term swings in asset prices is especially acute. Ultimately, a strong foundation portfolio should be diversified and robust enough to perform through business cycles.

Given asset-class performances tend to be more predictable over the long term, our methodical portfolio construction process begins with Capital Market Assumptions (CMAs) – an annually updated seven-year view of expected risks and returns across all asset classes.

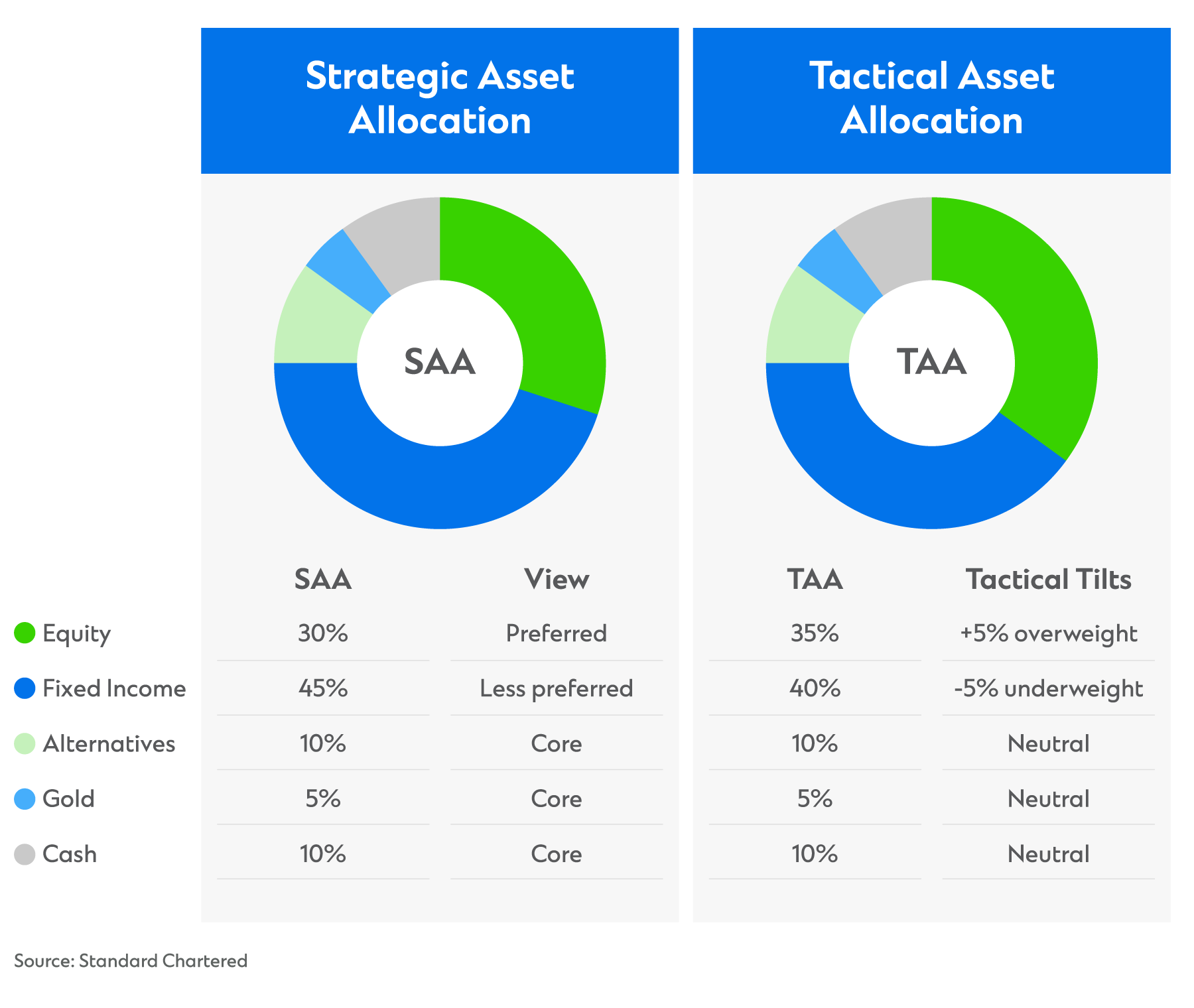

The next step is Strategic Asset Allocation (SAA), which uses the expected returns derived from the CMAs and assigns portfolio allocations to five broad asset classes and 15 sub-classes with the same seven-year horizon, based on your individual investor profile.

For example, older investors might prioritize income and wealth preservation over capital growth. They might build a more conservative portfolio, with a balance of priorities and investment profiles tailored to their specific needs:

- Today (40%) – cash equivalents, fixed income, high-dividend stocks, real estate or mutual funds.

- Tomorrow (30%) – Multi-asset growth portfolio, life and property insurance cover.

- Forever (30%) – High-growth portfolio, trusts.

A young professional with school-age children who wants to prioritise growth might tilt their portfolio differently, such as 10% Today, 80% Tomorrow, and 10% Forever.

Tactical Flexibility

Now we have a solid foundation portfolio as the basis for long-term wealth appreciation. As the investing journey unfolds, it’s important to maintain this fundamental structure because it limits the danger of succumbing to short-term euphoria, pessimism, or a pre-occupation with trying to “time” the market, which undermines many investors.

But markets, like people, do not stand still. Short-term opportunities continuously arise, and successful investors are flexible enough to capitalise on them without destabilising their fundamental strategy.

The importance of this was particularly evident in 2022, when almost every major asset class declined and commodities, which had underperformed for much of the previous decade, boomed. Investors who were able to rebalance a portion of their portfolio to take advantage of the commodity opportunity were able to offset losses elsewhere.

For this reason, Standard Chartered’s approach includes a tactical element – Tactical Asset Allocation - in addition to the SAA.

Every month, our Global Investment Committee meets to assess the outlook for different asset classes over the coming 6-12 months and identify emerging opportunities. Based on their view, investors can refine their portfolio with a Tactical Allocation for a period of time, then revert to the underlying Strategic Allocation once the opportunity has played out.

So, if the committee believes the business cycle will improve substantially over the next year, for example, an investor might increase their allocation to stocks and higher-yielding bonds to boost returns.

The scope for opportunity doesn’t end there.

Investors might have specific areas of expertise, watch certain markets, or follow individual companies. The SC Wealth Select approach enables these investors to overlay their foundation portfolio with Opportunistic investments to take advantage of market moves over 12 months or less. These might be single stocks, structured products, bonds, or sectors - investment ideas which an investor has a strong short-term conviction on.

Strength in Diversity

By allocating investments in this structured and methodical fashion, the SC Wealth Select approach helps avoid many of the pitfalls that can damage your long-term financial future.

To stay focused on this approach, we adhere to five key wealth principles that guide and guardrail the decisions you make on your investing journey:

- Discipline – Setting a fundamental strategy and maintaining it, with enough built-in flexibility to capture shorter-term opportunity.

- Diversification – Spreading investments across a broad range of asset classes is the best way to manage long-term risk.

- Time in the market – Staying invested is more effective than trying to “time” your investments.

- Risk and return – Matching the potential returns of an investment to the risk profile of the investor.

- Protection – Ensuring financial peace of mind in times of uncertainty.

Growing Your Future

Many investors begin their journey focused solely on expanding their wealth. Of course, every investor wants to see their money grow, but thinking solely about returns carries a risk, too.

Over time, all portfolios experience peaks and troughs, but the profit-focused investor is more prone to panic and short-term thinking when asset prices fall.

Instead, the SC Wealth Select approach encourages investors to think about growing their wealth holistically. By working together to build structured, disciplined portfolios, we can embark on an investing journey that takes care of Today, Tomorrow, and Forever.

--- Pia Cooke, Head of Advisory Solutions, Wealth Management, Standard Chartered