Is Cash King Once Again?

Cash can mean different things to different people. Most of us would associate its yield with the interest earned on a deposit. However, this only partly captures the asset class. Many investors consider fixed income investments of up to 12 months in maturity as a proxy for cash given their yield tends to be closely associated with policy rates. What’s common across various approaches to ‘cash’ are: perceived safety of the nominal value of principal and easy access to liquidity. In return for these attributes, a lower yield than on most riskier asset classes.

At Standard Chartered, we actively address market conditions by providing clients with the latest markets views and insights to help them navigate their investments.

The Case for Cash Today

We believe that in today’s investment environment, a case can be made for a greater-than-usual allocation to cash.

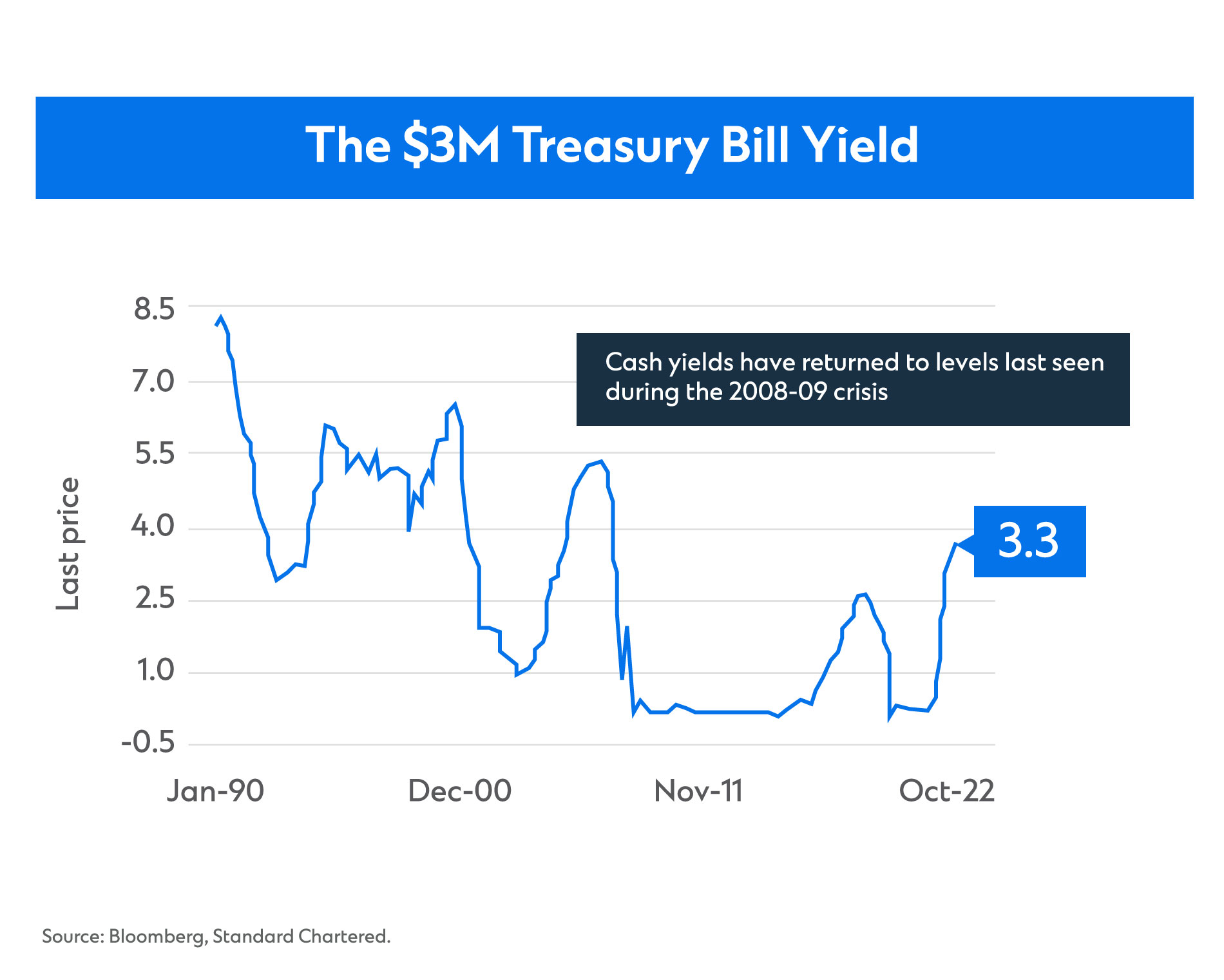

Yields Are No Longer Zero: The yield on cash is often viewed as the threshold that other asset classes ‘have to beat’. If this yield is available with (perceived) certainty, the expected return on any other asset class has to be higher so it becomes more attractive for an investor to take on the additional risks associated with that asset class.

Since 2008-09, this cash yield threshold was largely zero, which meant there was little reason to consider a significant allocation to cash for purely investment reasons (the TINA or ‘There Is No Alternative’ argument for riskier assets like equities). Today, however, the 3-month USD yield is just above 3.5% and could rise further until the Fed hiking cycle peaks. This significantly raises the threshold for other asset classes making cash more attractive relative to other major asset classes.

Safe-Haven Appeal: In current markets, cash can offer a safe-haven amid concerns that the drawdowns in equities and bonds are not yet complete – especially if the S&P500 takes another leg lower. This argument, of course, would hold regardless of the yield on cash.

The Challenges of Cash

Given the advantages of holding cash, why not hold much more? We see at least two reasons:

Riskier asset classes usually pay a premium over cash over the long term: While it may not feel like it this year, riskier asset classes do indeed pay a premium over cash in the long run. This premium can be negative during periods when the market is adjusting to a higher yield on cash, but such periods are usually transitory and short-lived.

Cash can be detrimental to maintaining real purchasing power: While the yield on cash may be positive in nominal terms, it remains very negative on real, or inflation-adjusted, terms. Riskier asset classes, on the other hand can offer a good chance of beating inflation over longer time horizons.

We see a case for holding more cash than usual because of heightened risk of equity and bond market drawdowns and because cash now pays a positive nominal yield. However, we remain mindful of the longer-term drawbacks of holding cash (even today, global Investment Grade corporate bonds yield around 5% vs c.3.5% on cash). This is why our preference for cash is accompanied by an active willingness to redeploy into riskier asset classes at the soonest available opportunity.