Unleashing ASEAN’s Economic Potential

Much has been said about the current global economic turbulence. Geopolitical tensions, rising trade protectionism and more have resulted in disruptions to supply chains that have contributed to surging inflation and business interruption.

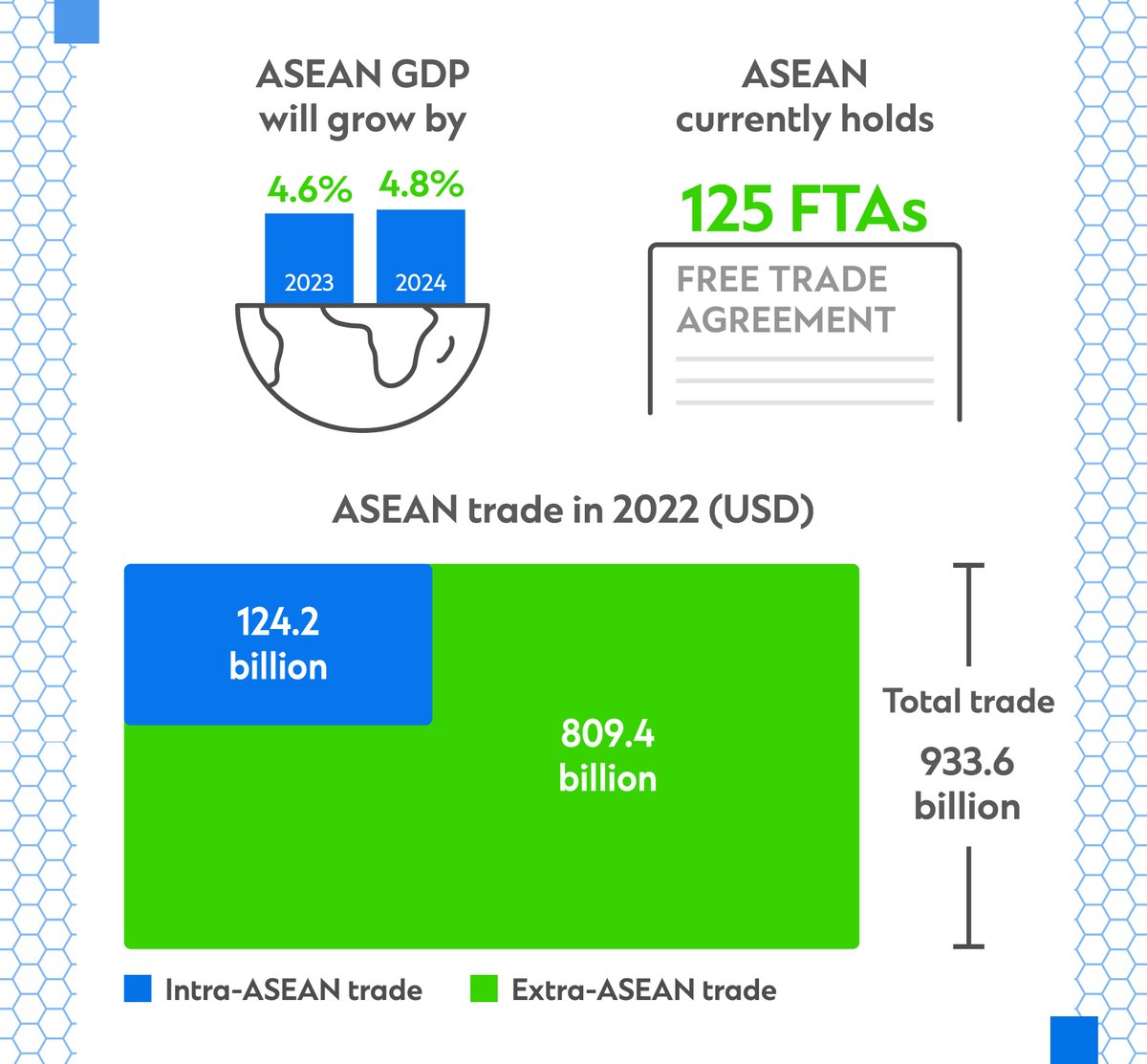

While not immune to these challenges, the 10-member Association of Southeast Asian Nations (ASEAN) is benefitting from the redrawing of global supply chains and trade partnerships. Between 2017 and 2022, trade between ASEAN and US surged by 98%, while ASEAN’s trade with China grew by 95%.

Why? For one, member nations have remained neutral regarding US-China trade disputes, especially in areas like semiconductor and technology manufacturing. For example, ASEAN as a result now exports 17% of the world’s consumer electronics, generating USD230 billion annually.

Moreover, many multinational corporations (MNCs) are adopting a China Plus One strategy and choosing a Southeast Asian market as an alternative manufacturing base. Such MNCs are not only benefitting from more diverse supply chains, but they are also capitalising on favourable production costs as well.

Foreign Direct Investment

ASEAN is undeniably attractive to international trading partners. Foreign direct investment (FDI) into ASEAN for 2022 reached USD224.2 billion, up from USD174 billion in 2021. Prior to this, FDI flows averaged at about USD120 billion per year. MNCs involved in manufacturing, financials, some services industries, and the digital economy are spearheading overseas interest in ASEAN.

While competitive and diversified supply chains underpin this resurgence, other matters are playing their part. The region’s rapidly growing consumer base is one: by 2030, ASEAN will house an additional 140 million new consumers, representing 16% of the world's consumer class. The region’s workforce, which stands at more than 450 million, is another, especially with the proportion of tertiary-educated employees on the rise.

Further, ASEAN has implemented numerous free trade agreements (FTAs) with countries around the world. FTAs typically reduce import and export barriers and help facilitate FDI. ASEAN currently boasts 125 FTAs, with the majority signed at the country level and six at the bloc level. All 10 ASEAN states are also members of the Regional Comprehensive Economic Partnership (RCEP). The partnership, which accounts for 30% of global GDP, extends favourable trade and investment terms to China, Japan, South Korea, Australia and New Zealand, further boosting the appeal of ASEAN to businesses from these countries.

Public-Private Partnerships

China’s investment interests in ASEAN are noteworthy. The country is ASEAN’s second-largest external investor behind the US and continues to develop a multitude of projects in tandem with its Belt and Road Initiative (BRI). The breadth and scale of the projects typify the vast investment opportunities ASEAN presents, whether these involve conventional hard infrastructure like energy, telecoms, and transportation; or soft and emerging infrastructure, including education, healthcare, and the digital economy.

While BRI projects in respective ASEAN markets rely heavily on investment from Chinese companies and governmental institutions, private sector projects typically require capital pooled from a wide range of organisations and agreements, including public-private partnerships (PPPs).

Within PPPs, governments work with private-sector players and multilateral development banks to raise the capital required to build infrastructure and other assets. Known as “blended finance,” this has been particularly appropriate for projects that are capital-intensive and carry high risk. Pooling capital from a wide range of diversified investors mitigates the risk for each financier, while still amassing the necessary capital.

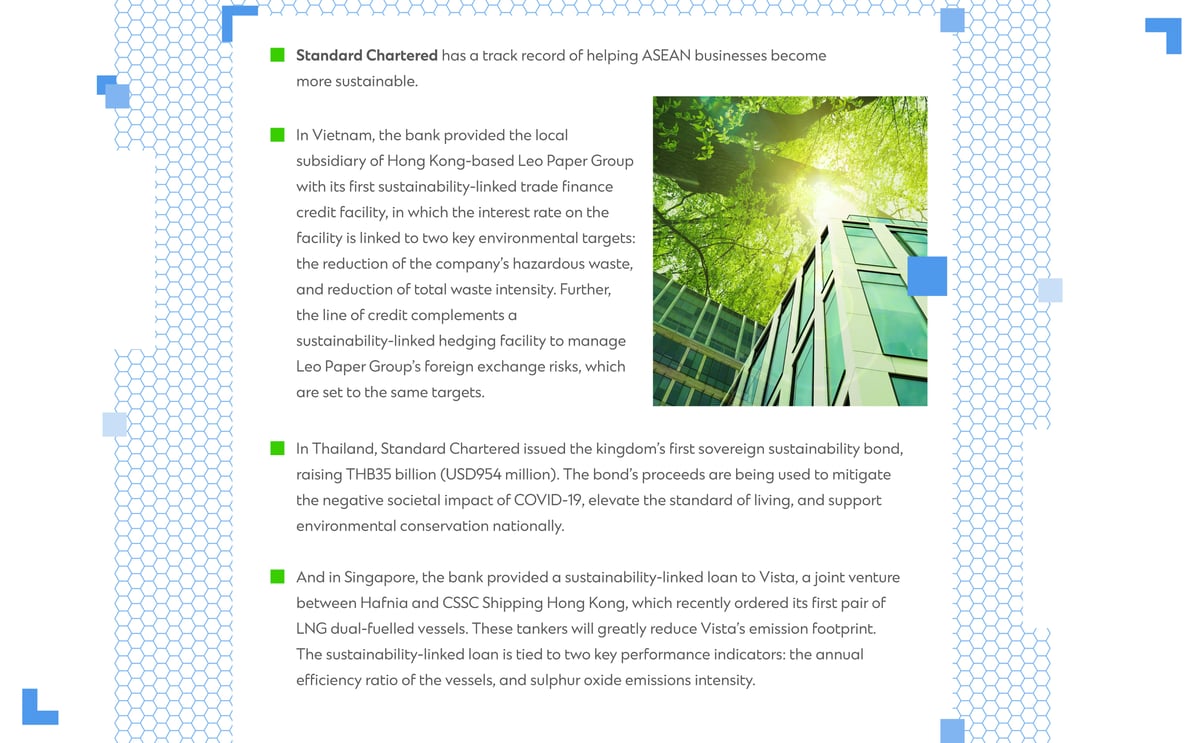

The financing efforts of Just Energy Transition Partnerships (JETPs) exemplify the potential of PPPs. Coordinated by the Glasgow Financial Alliance for Net Zero (GFANZ), a global coalition of leading financial institutions of which Standard Chartered is a founding member, JETP will allocate USD30 billion to help phase out coal use in Indonesia by investing in renewable energy and will raise USD15.5 billion to help cap Vietnam’s CO2 emissions by 170 million tonnes by 2030.

Digital Economy

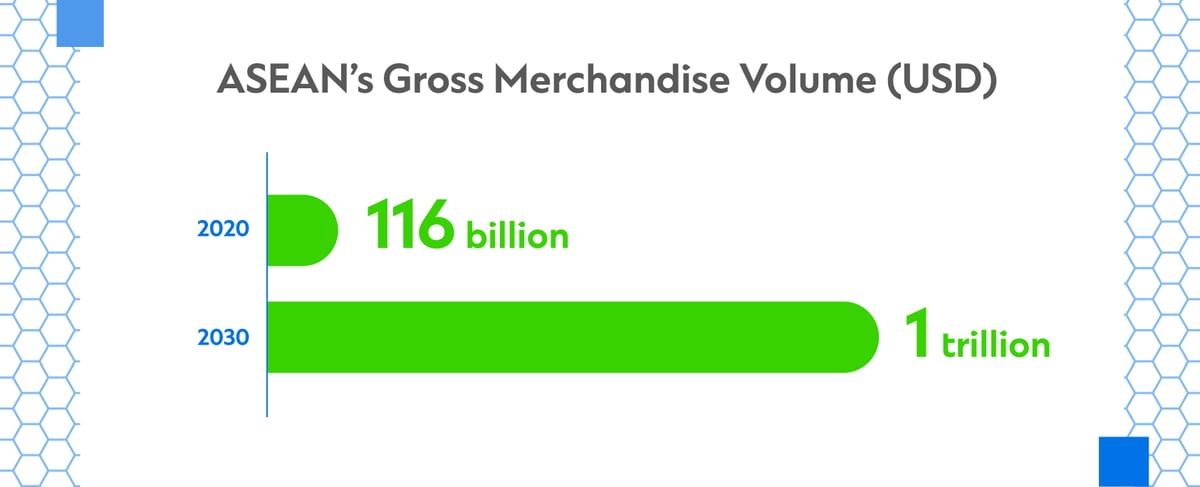

Businesses should also take note of the rapid rise of ASEAN’s digital economy. A joint study by Google, Temasek and Bain & Company estimates ASEAN’s gross merchandise volume could reach up to USD1 trillion by 2030 from USD116 billion in 2020. Spearheading this growth is the proliferation of digital services and greater automation.

Financial institutions like Standard Chartered are critical partners helping businesses forge ahead with digitalisation. For example, the bank has partnered with DHL to co-create an online collections solution that allows DHL customers in select Asian markets to make online payments for shipping charges, duties and taxes via the DHL portal using local payment methods. The solution replaces cash transactions and accepts local payments in local currencies across multiple geographies. Standard Chartered also launched a QR code generation app, which enables DHL to generate dynamic QR codes when accepting payments for shipments at their service points in Singapore.

Similarly, Standard Chartered has partnered with Barry Callebaut to streamline supplier payments through a new SWIFTNet proposition. The solution, which facilitates the efficient exchange of payment files and bank statements between Barry Callebaut and its suppliers via straight-through processing for multiple payment types and currencies, allows clients to track the status of their payments in real time in a single dashboard. This provides greater transparency to the bank’s clients while enabling quicker payments.

Powering a Sustainable Future

To stay relevant in the modern business landscape, companies in ASEAN are having to chart a more sustainable course. Among other things, some organisations are working to reduce emissions to fight climate change, embrace recycling to curb mounting solid waste volumes, and/or leverage diverse and inclusive workforces to help alleviate poverty while boosting company performance.

An Inclusive Opportunity for All

Despite an upbeat outlook, risks remain. As with other parts of the world, inflation is a challenge for ASEAN businesses, as high input costs through rising labour and material expenses continue to erode profitability. Regulatory fragmentation among member states exists across a wide range of industries, and economic uncertainty lingers, especially in Europe and North America, both of whom are key ASEAN trading partners. Further, the risk of climate action slowing could hamper the growth prospects of businesses involved in ASEAN’s energy transition, and other industries crucial to Southeast Asia’s decarbonisation agenda.

Nonetheless, ASEAN’s economic trajectory is extremely positive, with the group on track to becoming the world’s fourth-largest economy by 2030. Underpinning both this growth, and how the trading bloc tackles the above risks and more, are partnerships that involve fellow businesses, government organisations, industry groups and many others. By working in close collaboration, organisations can create solutions to the region’s foremost challenges.

As the only international bank with a presence across all 10 member ASEAN states, Standard Chartered is well-placed to assist local and international businesses seeking to capitalise on the many opportunities ASEAN presents.