What Five Personas Reveal About Barriers in ESG Investing

Profit alone no longer drives investment decisions. Increasingly, investors aim to address environmental and societal concerns, yet even as ESG investing matures, making a positive impact remains challenging.

Institutional flows fueled global growth in ESG assets over the past few years and underscore growing interest in social and eco-conscious investments. Nearly one-third of institutional investors say climate change will have the biggest impact on how they invest over the next 3-5 years.[1]

In turn, ESG assets could surpass $50 trillion by 2025.[2]

Retail investors are keen, too. One in five globally has invested in ESG and more than twice as many are interested.[3] For many, climate issues are front of mind.

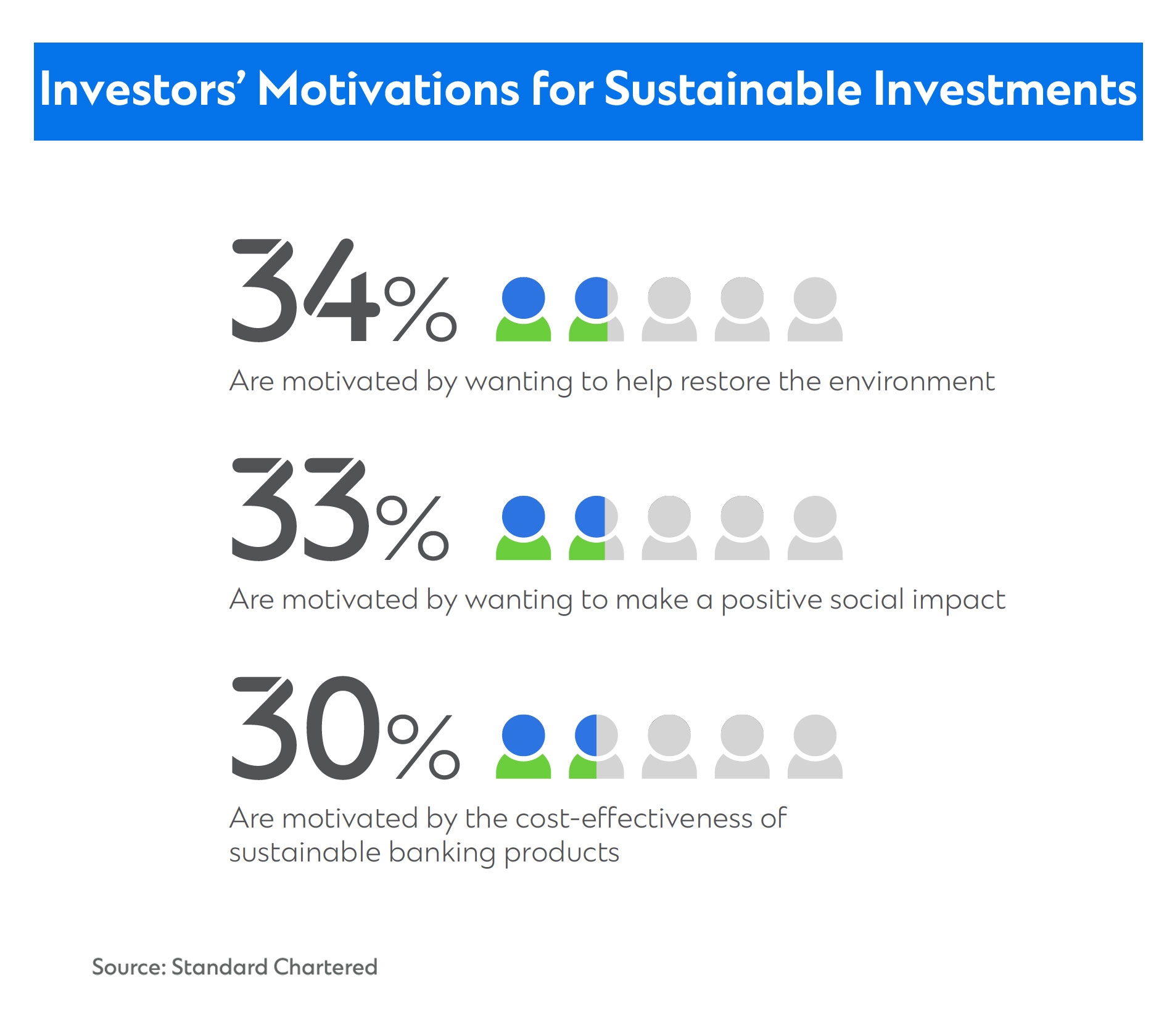

“Today, retail investors list restoring the environment as one of the top factors motivating them to consider ESG investments, which marks a change from even three years ago,” says Eugenia Koh, Global Head, Sustainable Finance, Consumer, Private and Business Banking, Standard Chartered. “Stories in the press, changes in the weather and other factors have investors thinking hard about how they can make an impact with their money.”

While investors’ intentions bode well for the global push toward a greener, more equitable future, a raft of barriers including a lack of global standards, data inconsistency and conflicting ratings systems block the way. Standard Chartered’s Sustainable Banking Report 2022 identifies five retail investor personas and the ESG barriers they face.

Barrier 1: Accessibility

While gaining access to sustainable investments is the most common barrier across all five personas, it’s the biggest barrier for Young Professionals. This group is interested in sustainability and related investments—especially those focused on climate change and carbon emissions—yet many believe investment options are not available for them.

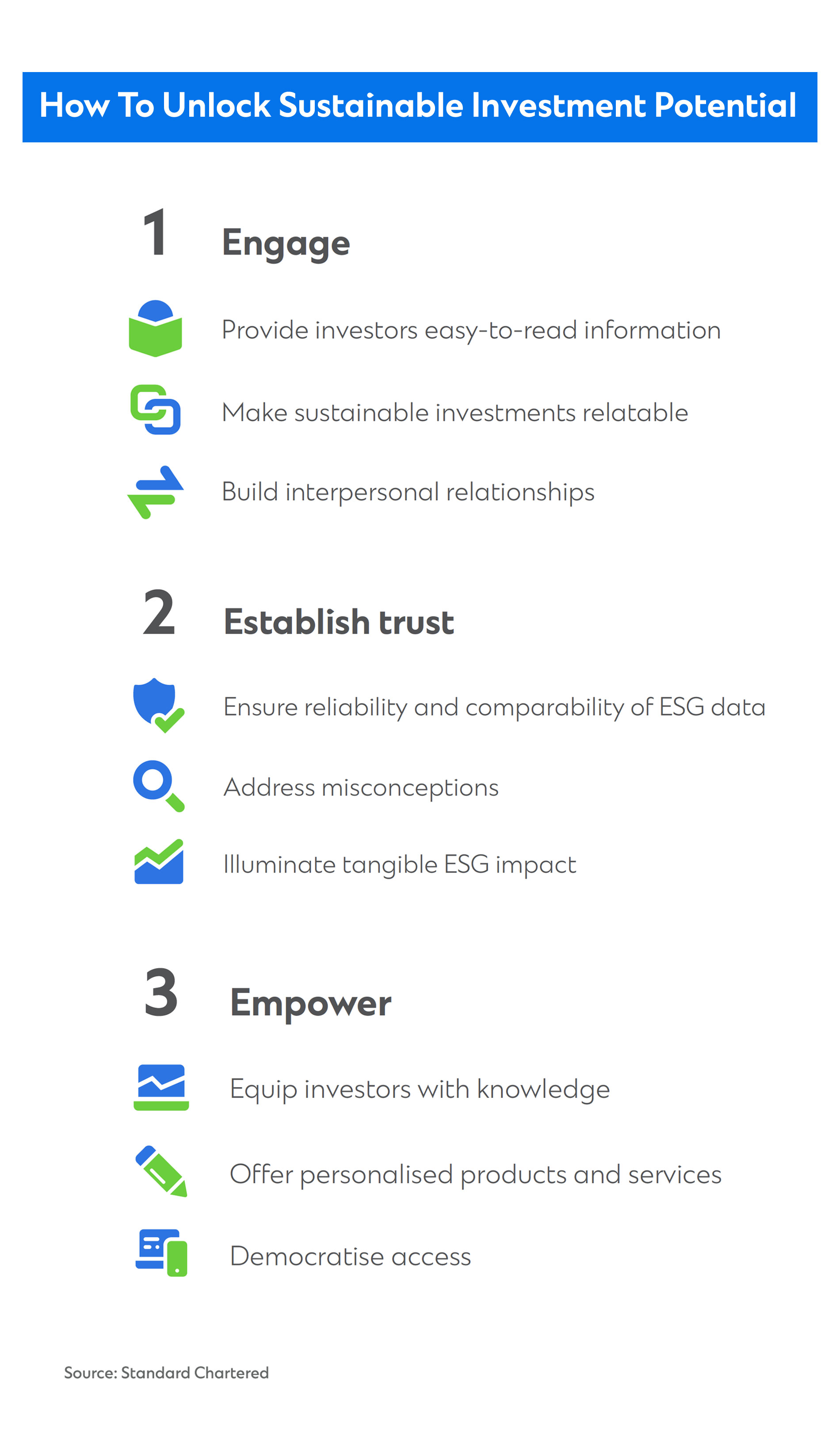

“Young professionals are not very familiar with this space,” Koh says. “They hold this misperception that sustainable investments are only for wealthy investors. You can see why. Private investments that channel large amounts of capital into sustainable projects tend to get the most attention, overshadowing what’s accessible to everyone. The reality is that Young Professionals can access a wide range of sustainable investments from bonds and mutual funds to ETFs and structured products.”

This group also finds most investment platforms difficult to navigate. More than one-third would be more likely to invest in sustainable investments if they could access them via user-friendly, digital platforms.

“Standard Chartered is doing quite a bit of work in terms of integrating sustainable investing within our digital channels,” Koh adds. “I think that will help move the needle on these barriers to entry for Young Professionals.”

Barrier 2: Comparability

Comparing sustainable investments across asset classes is the biggest barrier for both The Entrepreneur and The Legacy Builder. Entrepreneurs are business owners who want their investments to reflect their personal beliefs. By contrast, Legacy Builders are individuals at the tail-end of their careers who view sustainable investing as a way to hedge against ESG risks.

“This is consistent with what we hear on ground,” Koh says. “These personas have been reading about the lack of data comparability and standardization, which concerns them because they put money into sustainable investments with the dual objective of driving financial returns and contributing to social and environmental outcomes.”

Around one-third of Entrepreneurs find it difficult to compare sustainable investments assets because of the different ESG rating methodologies involved. And just as many Legacy Builders want to be able to compare sustainable investments opportunities within the same asset classes.”

“Transparency is important in the absence of global standards,” Koh adds. “We take that seriously so that, even if our clients are not always able to compare apples to apples, at the very minimum, they understand the universe of sustainable investments and the criteria that Standard Chartered offers. This enables them to make informed decisions on whether an investment aligns with their outlook on the world.”

Barrier 3: Comprehensibility

Understanding sustainable investments presents the biggest barrier for both The Family Person and The Retirement Ready. The Family Person is keen on sustainable investments but finds that the lack of standardised and well-documented information makes it difficult to compare opportunities. The Retirement Ready has heard about sustainable investments from friends and family but is not sure how to pursue them.

“There’s so much jargon around sustainable investing,” Koh says. “It can be confusing. What's interesting is that both personas want more information so that they can assess the impact of sustainable investing. This brings us back to the point on transparency, but also on educating them about the different approaches to sustainable investing.”

When it comes to The Family Person, more than half of them would prefer more extensive and granular information to understand the impact of sustainable investments on ESG issues. And two-thirds of The Retirement Ready would prefer to have more information to assess the impact of sustainable investments on ESG issues.

“Standard Chartered is piloting a portfolio report that provides a multi-dimensional view of the different ESG metrics and lenses,” Koh adds. “It provides a view on the ESG risks of your portfolio, a view on how carbon intensive your portfolio is and how it contributes towards the different Sustainable Development Goals. This will help investors make informed decisions.”

Barrier 4: Misunderstanding

In Asia, investors across all five personas fear that embracing sustainable investments means compromising returns despite ESG outperformance amid the pandemic. In turn, many still prefer traditional assets with similar risk profiles.

“The misconception around higher risk should be debunked,” Koh says. “In public markets, many sustainable funds and thematic opportunities don’t carry higher risks. The starting point for investors is deciding which investment approach they want to get into and to better understand what that could deliver for their portfolios.

“The challenge for the industry is to make sure that the products being offered really meet investors’ needs and achieve the kind of impact they want to make. That’s why Standard Chartered puts due diligence at the core of sustainable investing.”

As interest in sustainable investing grows, Standard Chartered’s team of experts continues to delve deeper to understand your needs and remove potential ESG barriers so you can make an impact.