Leading Banks Will Rebuild With GenAI – Others Will Be Built Over

Takeaways

Banks are at a crossroads in adopting Generative AI (GenAI). Institutions that align GenAI with strategic goals, modernize legacy systems, and invest in data-driven innovation stand to gain efficiency and competitive advantage. Others risk being outpaced by inefficiencies and outdated processes.

Legacy systems consume 80% of tech budgets, blocking innovation and inflating costs. GenAI tools like Morgan Stanley’s DevGen.AI and Thoughtworks' CodeConcise and Haiven improve code comprehension and software delivery. These tools reduce effort, speed up transformation, and enhance software quality.

Successful modernization requires incremental delivery tied to business value, strong cross-functional collaboration, and clear success metrics. Banks must pair GenAI with sound engineering practices and work with capable partners to overcome legacy barriers, unlock business value, and modernize sustainably.

Summary by Bloomberg AI

GenAI is here and has successfully navigated the treacherous waters known as the “hype phase.” But now, the banking sector finds itself in a critical juncture: will institutions harness GenAI to innovate and thrive, or will they falter and be rendered obsolete by this powerful technological wave? Let’s examine the high stakes involved as banks determine their position on the winning list of the GenAI revolution.

In most banks, 80% of technology budgets are tied down to keeping legacy systems running. Their inflexibility introduces process and business inefficiencies, leading to high operating costs of over $78 million for an average business of 10,000 employees, according to Gartner.

At a leading Australian bank, Thoughtworks uncovered over $12 million annual efficiencies in the technology delivery processes if they modernized just one of their platforms.

With limited remaining budgets, banks often struggle to innovate and drive their top line. Smaller banks are much harder hit with a challenged cost-to-income ratio, sometimes taking them to the edge of insolvency.

While legacy modernization is on every bank’s key strategic agenda, 70% or more of these programs fail or deliver late and way over budget, according to BCG. One key reason introducing substantial risk to these programs is the lack of sufficient subject matter expertise to guide the development of a modern replacement.

So it comes as no surprise that Morgan Stanley has built its own code comprehension tool called DevGen.AI. It comprehends convoluted legacy codebases written in antiquated languages like COBOL, and creates plain English language specs for developers to rewrite those systems. Morgan Stanley claims that it has saved 280,000 hours when reviewing 9 million lines of code.

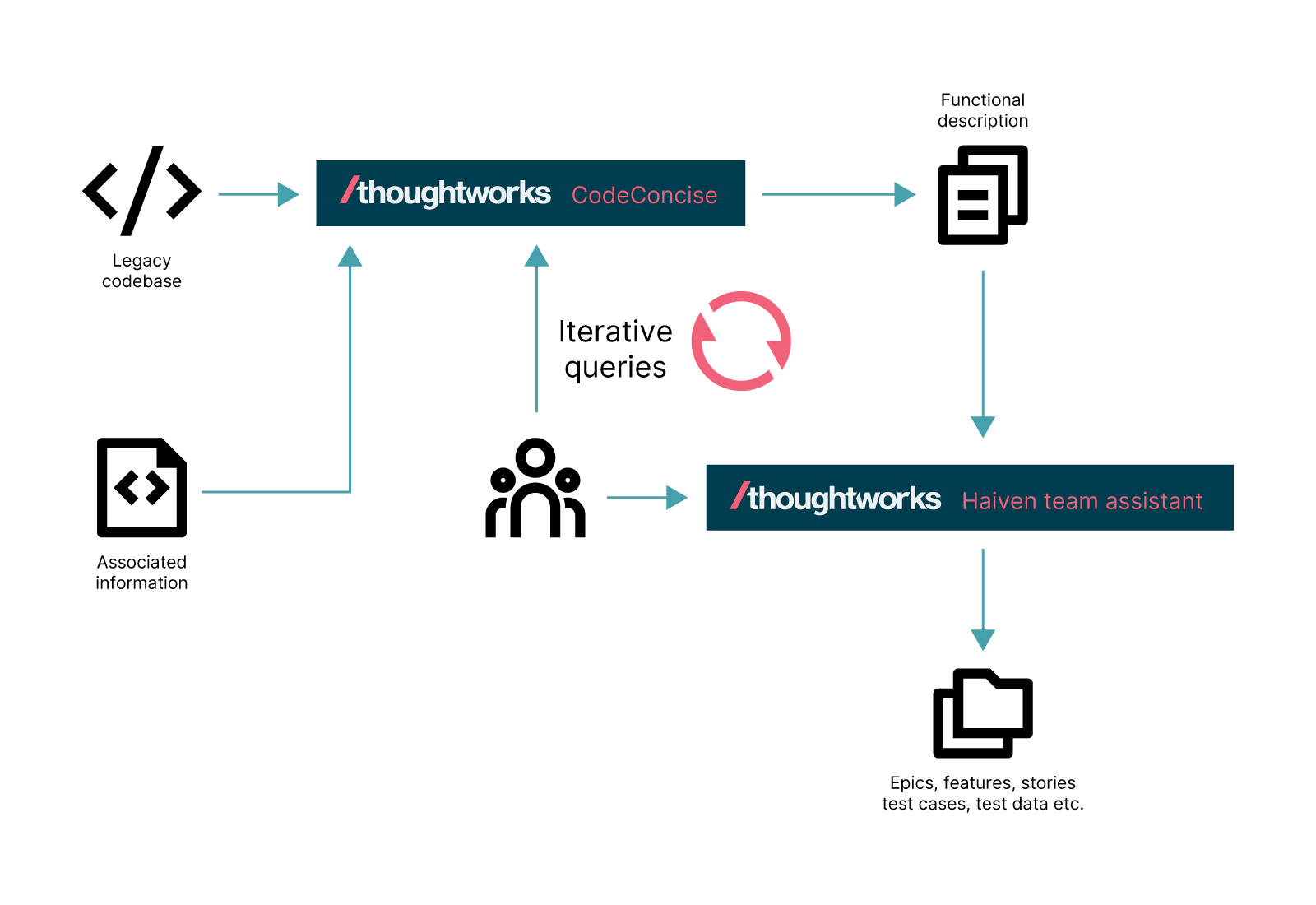

To help businesses better tackle capability gaps and reduce the time needed to reap the rewards of enterprise modernization, Thoughtworks produced a code comprehension accelerator called CodeConcise.

A major North American financial services firm faced a huge challenge of modernizing 4.5 million lines of legacy IBM mainframe assembler code. A lack of specialized expertise obstructed their effort to reverse engineer this code. CodeConcise helped parse and reverse engineer 160,000 lines of the IBM assembler code (HLASM) to generate a business requirements document (BRD) and the domain model. With an integrated chatbot for functional queries, they achieved 80% accuracy in code comprehension. This, combined with AI-driven forward engineering, enabled the firm to complete a successful proof of concept (POC) for modernization in just 14 weeks. This success gave them the confidence to move forward with modernizing their entire policy administration system.

Comprehending legacy codebases using GenAI is just one part of the legacy modernization puzzle. GenAI also has a significant role to play in the entire modernization value stream.

Thoughtworks complements CodeConcise with Haiven, a GenAI-based team assistant which helps automate a significant portion of the modernization value stream, with strategy formulation, requirements elicitation, test generation, architecture synthesis and threat modeling as some of its core capabilities.

Team assistants like Haiven have helped Thoughtworks’ enterprise clients achieve an overall 30% reduction in time and effort in creating epics and stories. Further, Haiven uncovered edge cases and exploratory scenarios, improving software quality and resulting in 10% reduction in defect rates. Using Haiven, Thoughtworks produced a comprehensive technology strategy for a top 10 US bank in one month. This included a detailed roadmap of actionable opportunities tailored to the bank, which the bank is in the process of executing to materialize the associated benefits.

Using GenAI to improve developer productivity is all the rage. Various studies have shown that coding autopilots can improve individual developer productivity but may lower delivery performance if teams ignore sound engineering practices. Technology organizations within businesses should focus on using the potential of AI across their delivery value stream alongside industry standard engineering practices to deliver value to business with both speed and stability.

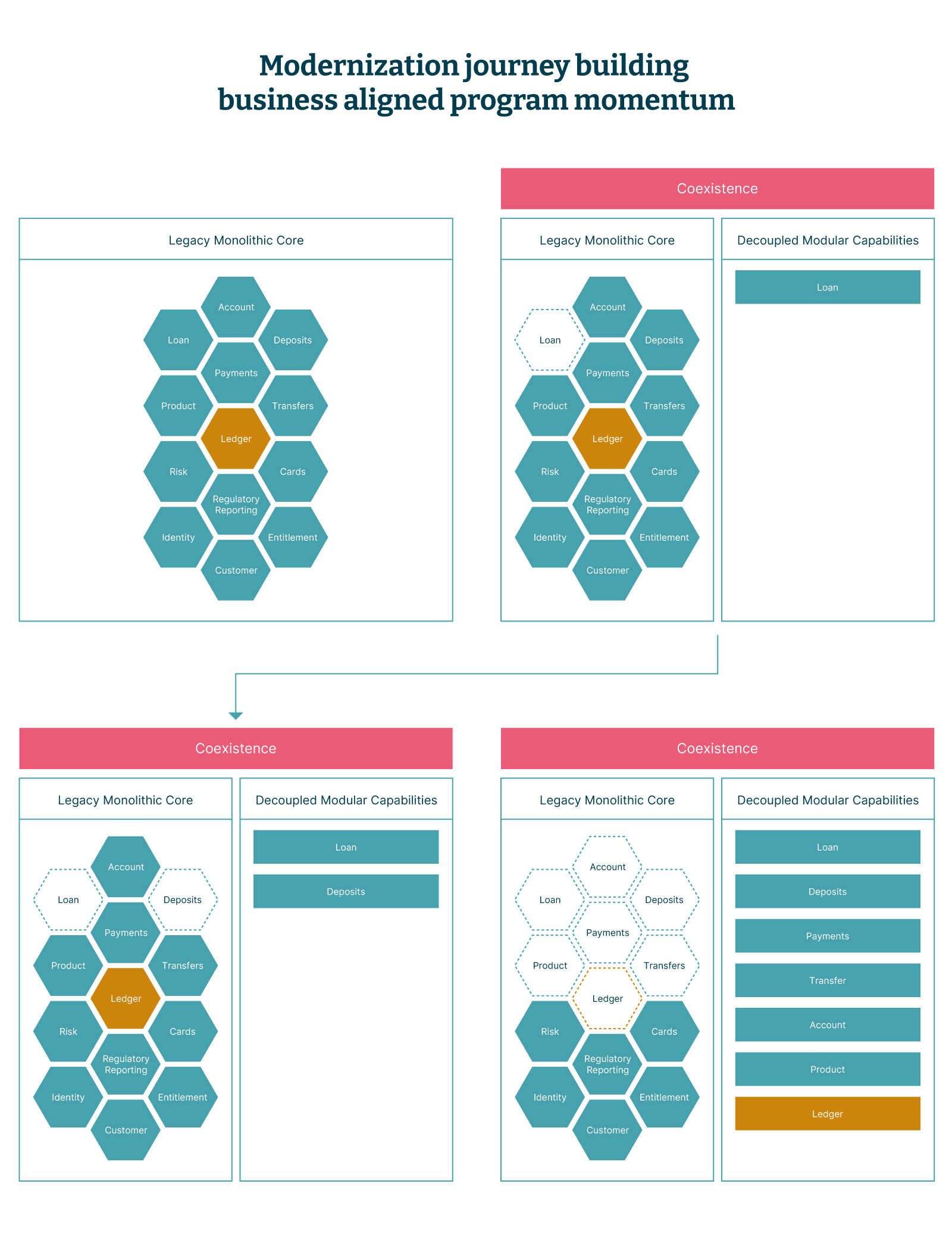

Modernization programs die when they lose their oxygen – the funding to continue. This usually happens when technology is not able to build business aligned program momentum. The business not seeing any tangible commercial value for their substantial initial investment either reduce or withdraw their funding. This stalls modernization programs which results in fragmented technology and operating models leading to a situation worse than before.

Most successful modernizations involve delivering incremental modernization in slices of business value all along the delivery roadmap. This enables technology to captivate business’ motivation to continue to fund the program to its successful completion. There are three key aspects to this approach, namely right sizing scope to reduce risk, incrementally delivering to demonstrate value and adopting a platform mindset to accelerate.

An incremental delivery model also helps spread costs along the delivery roadmap giving the business greater flexibility in managing their cash flows, making the entire venture more financially sustainable.

Thoughtworks helped a global bank successfully modernize their banking stack to achieve their strategic goal of doubling their revenues through new products and growing their business lines, and by enhancing their customer experience. This program was delivered incrementally using the Thoughtworks' Enterprise Platform Modernization strategies. The resulting technology helped the bank earn $800 million in additional revenues in two years, with zero downtime and 30% cost reduction, amongst other benefits.

“Thoughtworks was instrumental in creating our new platform. Their best-in-class thinking and logic, along with their step-by-step execution approach, ensured we were hitting the right goals with the right methodology,” notes the director of consumer lending and deposits at one of the United Kingdom's largest credit card providers.

Many businesses pursue a highly risky Big Bang approach to modernization, as the UK’s Trustee Savings Bank (TSB) attempted in 2018. The disastrous release of their new banking system left nearly two million customers locked out of their accounts for weeks and months. The failure cost TSB £330 million across customer payouts, fraud and operational losses, tech fixes and lost income, with 80,000 customers moving to their competitors, and the CIO in charge fined a further £81,000 by the UK regulators.

With three-quarters of bank executives polled by KPMG predicting that GenAI will shoulder up to 40% of their teams’ daily tasks by the end of the year, the business benefits of AI are undeniable. But they are often elusive to banks trapped in legacy systems. Without open and secure access to high-quality data, even the most advanced AI models will struggle to provide the desired value.

For banks struggling with their legacy, realizing the potential of GenAI requires more than experimentation. Success results from pairing GenAI adoption with sound engineering foundations and business priorities, enabling faster, safer and more confident modernization. Only when that approach is backed by partnerships with technology firms that have a strong track record of delivering transformation at scale and at pace, can banks unlock real business value and leave their legacy behind.

Choosing the right partner can transform stalled ambition into sustainable transformation.

“We had a modernization challenge, where building a next-generation technology stack required highly specialized skills. Thoughtworks was the ideal partner in this journey,” notes the CIO of one of the UK’s largest credit card providers.

With 1 in 3 CIOs and CTOs expecting to grow their GenAI budgets by more than 10% between 2025 and 2026, according to Bloomberg Media’s Techfluence study, the right expertise will make the difference between leading with GenAI – or being built over.