Why Diversity in Financial Advising Matters in Creating Wealth Equality

When Sabrina Bowens-Richard was a child, financial topics weren’t discussed at home.

“Money just was not talked about in many African-American households when I was growing up,” she says. “It was almost a taboo topic.”

In fact, she didn’t learn about things like investing until college, when she studied business and finance. Her first career job was on Wall Street and she later went on to earn her MBA from Emory University in 2001. Now, as Senior Investment Solutions Specialist at Truist Wealth, Bowens-Richard knows just how important it is to raise awareness about money matters—especially for women and people of color.

Several wealth gaps divide the United States today. First, there’s a racial wealth gap: The average white household holds nearly seven times more wealth than the average Black household, according to the U.S. Federal Reserve, a chasm that has grown despite the Civil Rights Movement of the 1960s that spawned laws to protect people from racial discrimination.

Then there’s the gender gap: According to the 2021 Bloomberg Wealth Study, only half of affluent female investors feel they are meeting financial goals, and they are less confident in their investments than men. And while 54% of affluent men surveyed use a financial advisor, only 41% of women reported using one.

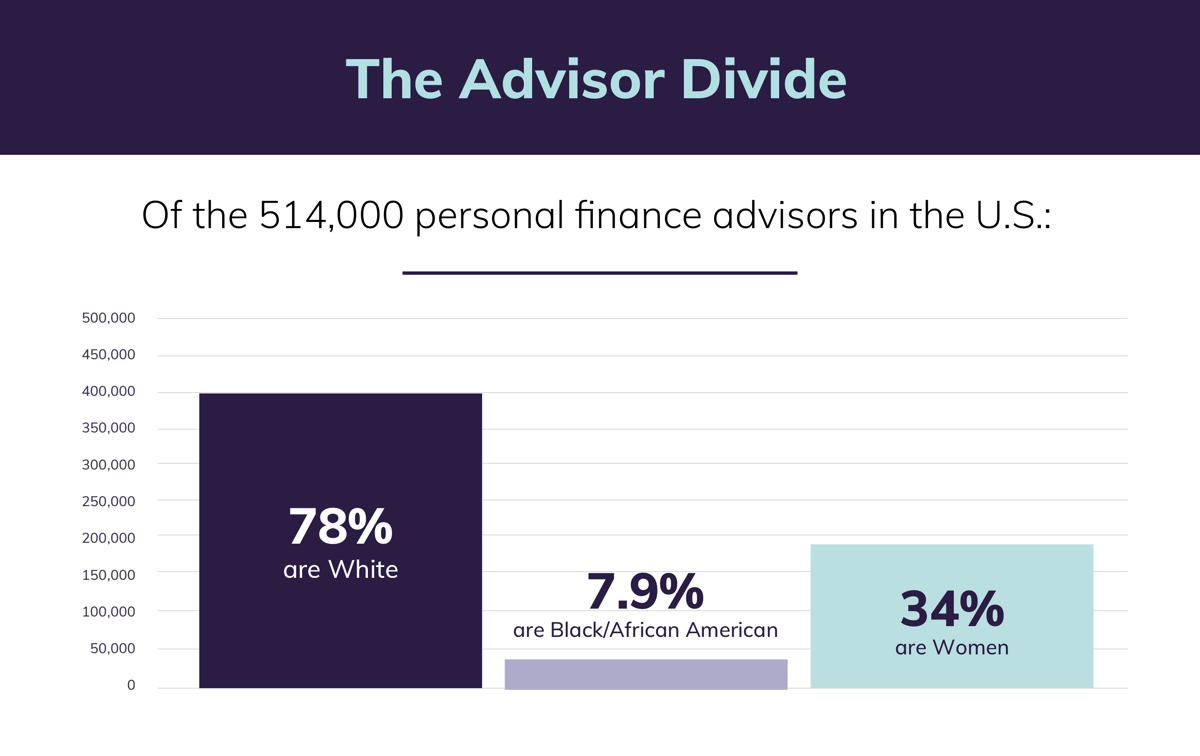

Bowens-Richard believes that financial advisors can help women and people of color make strides in investing and accelerate wealth equality. But too often, financial advisors don’t reflect the gender and racial composition of society.

“It’s been a decades-long issue that people just don’t see folks that look like them making these decisions,” says Bowens-Richard.

Still, she’s starting to see changes that make her hopeful. Following the racial reckoning of 2020, many businesses, including Truist Wealth, are more intentional about making diversity, equity and inclusion a priority—in the workforce and through the products and services they offer to their wealth clients—in order to reflect and represent all communities.

Truist Wealth is committed to fostering wealth creation that delivers equitable results, says Charlene McNeil, Senior Vice President, DEI Segment Leader and Head of BRG Strategy Enablement at the Charlotte, N.C.-based company.

“There is a lot of untapped wealth existing within racially and ethnically diverse communities. The same can be said for other underrepresented populations such as women and those identifying as LGBTQ+,” McNeil says. “At Truist Wealth, it is a business imperative to not only help the historically overlooked and underserved, but also to establish and help meet their financial goals to close the wealth gap for all.”

The journey toward economic equality can’t succeed unless the tools to build prosperity are accessible to everyone, and financial education and planning is critical. Jose Mendez, Senior Vice President and Wealth Advisor at Truist, and Bowens-Richard shared these insights on how financial planners can help accelerate wealth equality.

1. Financial advisors can connect clients to diverse funds.

Diversity of thought brings new perspectives and ideas to the table, and in investing, that can translate to greater value, says Bowens-Richard, whose work supports strategies led by diverse individuals as well as firms with diverse ownership, including women, racially/ethnically diverse individuals, those identifying as LGBTQ, veterans and persons with disabilities. It has become increasingly critical that the firm makes these diverse funds available to clients of Truist Wealth.

“We’re focused on finding these underrepresented, untapped managers,” she says. “A number of studies out there show that these diverse firms tend to do just as well as any other firm, and in many cases, better. However, there’s just been a lack of demand for them.”

By making them easier to find, she and Truist’s manager research teams are working to change that.

2. Advisors can help clients create a portfolio that matches their values.

Does an investor want to invest in a fund that focuses on the gender pay gap, or on equality issues around the world? What other issues do they hold dear? A financial advisor can help with that.

“A lot of investors may not realize that they can actually invest in something that they believe in,” says Bowens-Richard.

Even as more young investors turn to robo-advisors, she likes to remind clients and would-be clients that financial advisors offer a human touch that technology simply can’t mimic.

“If you want your investments to reflect your values and your beliefs, there’s still a need for financial advisors,” she says.

Mendez says that when financial advisors bring diverse perspectives to the table, they can relate to the experiences of their diverse clients. Coming from a Cuban heritage and living in Miami, Mendez often hears experiences that sound familiar to his own, and that gives him a deeper understanding of his clients.

“With closer ties to a community, you can give more concrete and insightful advice that is specific to their needs," he says.

3. Advisors can design a personalized plan to help clients reach their financial goals over time.

Financial advisors can devise the right mixture of stocks, bonds and other asset classes—the asset allocation—for each client, based on factors such as how much a person has to invest, how old they are, what their risk tolerance is and more.

“That’s often going to explain the majority of your performance,” says Bowens-Richard.

Getting that asset allocation right will help the client achieve their long-term goals over time and also help them gain a better understanding of financial management.

4. In case of death, a financial advisor can offer trusted guidance to the survivor.

In many families, one person handles the financial planning. If that person dies, their partner might be lost when it comes to their finances.

“When someone's left behind and they are totally in the dark, that's when we've seen the greatest challenges, because that's where mistakes can happen, or people are misled, or they just don't know what to do and they run to a friend or a family member who may give bad advice,” says Mendez.

A financial advisor can help avoid such distress by meeting with a couple, hearing both voices and keeping them both involved and informed. Then, if tragedy strikes, there’s an established relationship with a trusted expert who can discuss the financial decisions at hand.

5. Through education, advisors can help people of all backgrounds build up confidence and skills around finances.

Mendez regularly travels to different neighborhoods in Miami and meets with people who may not have had opportunities to talk with advisors, whether it’s because they live in communities historically underserved by the financial industry, they’re college students, or they’ve simply had no exposure to the profession.

In one-on-one talks, he educates them on a number of basic concepts, such as simple savings, cash flow, how to open a checking account, how to avoid unnecessary fees, online banking security tips and more, using easy-to-understand language. By helping more people realize how finances work, he knows he may help them think smarter about their money and their future.

“We're out there trying to educate every day,” says Mendez.

Wealth equality depends on increased education and awareness, and it’s never too early—or too late—to start. Bowens-Richard says that even her 10-year-old daughter has an investment portfolio that she’s held since she was a year old.

“I try to help her understand the basic concepts of investing. She actually goes in and picks the stocks. We base it on companies that she knows about, places that we shop,” she says.

It’s the opposite of the way that Bowens-Richard grew up, and that makes her optimistic. Because not only does her daughter know basic concepts around investing, she also has finance industry role models that look just like her.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.