How to Navigate the Enticing and Risky World of Alternative Investments

With market volatility high and stocks getting more expensive, alternative investments like hedge funds and private equity funds are getting a lot more attention.

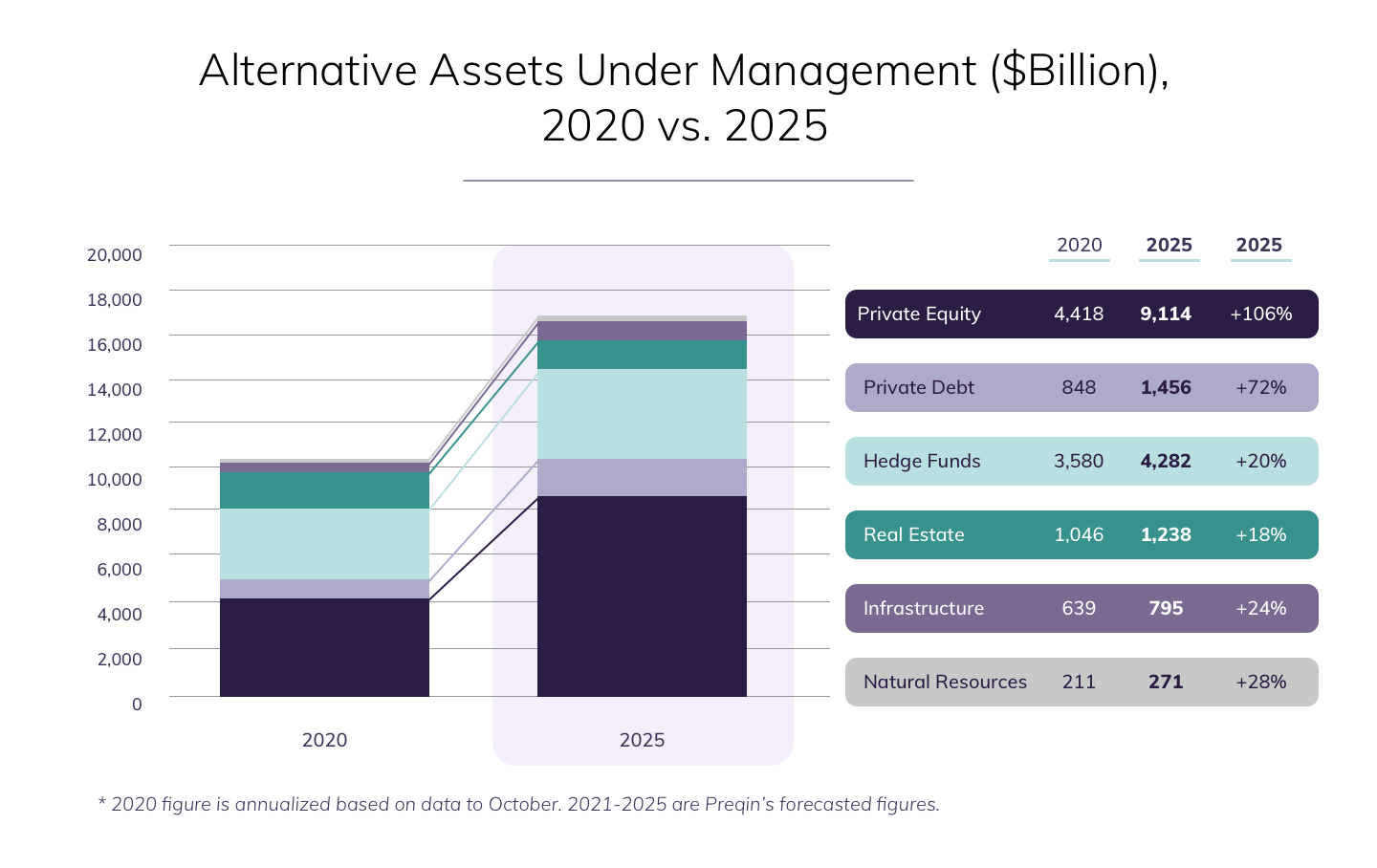

Alternative assets under management are expected to surge to more than $17 trillion by 2025, growing an average of 9.8% per year, according to data analytics firm Preqin. Private equity and venture capital, in particular, are expected to comprise 53% of alternatives by 2025, up from 42% in 2019.

The availability of more alternative investments brings more choice. New online platforms make it fast and easy for people to put money into all kinds of speculative products, without thinking about how these investments might affect their finances.

“It is easy for investors going it alone to be overwhelmed by information, which is coming at us all in warp speed,” says Oscarlyn Elder, Co-Chief Investment Officer at Truist Wealth. “And one significant issue that we've often seen with our prospective clients is that they may not fully understand what they're invested in.”

Fear of missing out, lack of objectivity about investment strategies and the desire to get wealthier faster can cloud judgment and conceal risks when it comes to weighing alternative investments.

“It’s fundamental to want more return, but if you want more, you’re going to take more risk and you just need to know that the level and type of risk are appropriate for your situation,” Elder says.

More access to alternatives brings more risk

In the past, anyone interested in alternative investments would have to transact through an intermediary or advisor, who could potentially steer them away from investments that are too risky or ill-suited to an investor’s timeline. Now, it’s easy for anyone to invest directly online. While investors have more access, they have less—or no—capacity to evaluate or perform due diligence on different investments. That’s worrisome because in alternatives such as private equity, the difference between the best and worst performers is enormous—far more than in other asset classes.

That dispersion makes research even more critical. Spencer Boggess, Managing Director of Alternative Investments Research at Truist, analyzes hundreds of hedge fund and private equity managers each year.

“We probably look at 300 to 400 managers a year and invest in maybe three to six managers a year. We spend a lot of time, resources, and research effort to try to find managers that are going to consistently be in the top quartile,” he says.

Getting unbiased advice

Choosing alternative managers is not just a matter of cherry-picking those with the highest returns. The best or most appropriate alternative investment manager for an individual investor also depends on the investor’s risk appetite, and if they have a particular target for returns or a specific goal or purpose for those funds.

Investors interested in alternatives have plenty to go over with an advisor. Truist Wealth’s investment platform has a team that dissects alternative investment strategies, performs thorough due diligence and supplements it with third-party research from other providers and research houses. Advisors then work with clients to determine which strategies and funds are most appropriate for clients and how much to invest. Some questions to consider are the liquidity profile, any and all downsides, capital calls and cash flow profiles.

“The advisor has a critical role in framing how that mix is established,” says Boggess.

Other essential elements to consider include how a product is structured and its fees. Many firms create their own fund structures or platforms for alternative investing. While this may be convenient, it also results in more fees that ultimately cut into returns.

“Your net return gets affected when you start paying all those different fees,” says Ravi Ugale, Managing Director for Private Equity and Credit Strategies at Truist.

By contrast, Truist Wealth prides itself on working directly with advisors and clients. The firm does not receive any additional fees if investors invest in one fund over another, and there’s no “pay to play” for particular alternative funds recommended by Truist advisors.

- Think about why you’re interested in alternative investments. Is it to hedge against market volatility? To generate larger returns over time? Advisors can help steer you toward appropriate investments depending on your goals, and check your expectations. It’s particularly important to seek out an advisor for investments in private equity, which require giving up liquidity. “It becomes very important to understand the choices that you make, because it's going to be a long marriage, so you want to make a good decision as to who to partner with,” Elder says.

- Alternative investments like private equity funds are subject to lockup periods, when investors can’t withdraw their money. That’s fine if you don’t need the money anytime soon, but be sure to go over investment goals and timelines so there are no surprises.

- Think about how much money you’re ready to put into alternative investments. There’s no one correct answer; it depends on needs, goals, risk appetite, time horizon and other factors.

- What are the fees and structure of the fund, and why does the advisor advise one particular fund over another?

Amid all of the risks and other considerations, there’s plenty of opportunity in alternative investments, particularly when an advisor can guide you. A recent Bloomberg Wealth study found that investors with advisors tend to be the most affluent and the most confident. The study also found that:

Affluent investors with advisors tend to be the most affluent, and the most confident, the study found.

To reach a high level of confidence and growth, especially where alternative investments are concerned, clients should make sure their advisors can create a customized plan that is central to their goals. A firm working with one or two pre-set strategies may not be able grasp an alternative investor’s needs or help them fully understand risks and commitment levels these investments entail.

“Our approach is client-centered and consultative, and we’re able to customize a client’s portfolio for their unique situation,” Elder says. “That’s a secret sauce — and it's necessary. You want to make sure that your portfolio works for your unique situation and you want to avoid negative surprises.”

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

Alternative strategies are not suitable for all investors. Many alternative strategies use sophisticated and aggressive techniques. Certain alternative strategies may be tied to hard assets such as commodities, currencies, and real estate and may be subject to greater volatility as they may be affected by overall market movements; changes in interest rates of factors affecting a particular or currency; and international economic, political, and regulatory developments.