Why a Financial Plan Is Sometimes a License to Splurge

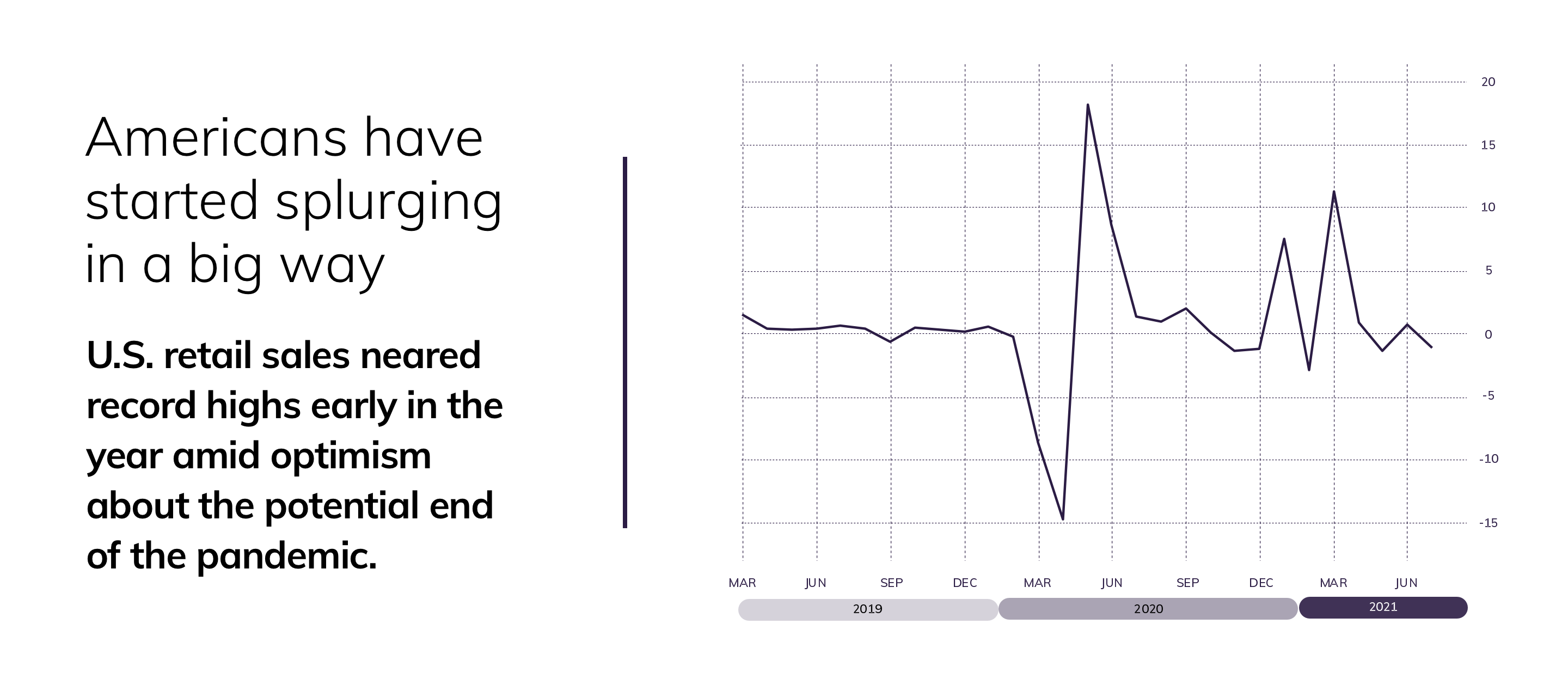

After being stuck at home for a year and a half, many affluent Americans have started splurging in a big way. Those with extra funds are choosing to enjoy their money whether it’s spent on luxury goods, dining out or an overdue family reunion. Overall, U.S. retail sales neared record highs early in the year amid optimism about the potential end of the pandemic.

Truist Wealth’s Trey Smith, Senior Managing Director at the Charlotte, N.C.-based financial services firm, has seen many wealthy clients increase spending, especially on travel. Some clients are choosing private jets over commercial air travel, he says. Some are renting houses in the Caribbean instead of staying at resorts, while others are opting to buy vacation homes.

“What we’ve been seeing is a lot of catch-up spending. A lot of folks are booking more trips and higher-dollar trips than they historically would have. They’re trying to make up for some of the missed time,” Smith says.

While Covid’s resurgence is currently slowing down retail sales and travel, there could be more ups and downs ahead, as data shows that spending habits can change quickly depending on outlook and personal circumstances.

For wealthy Americans, the roller-coaster year created a conundrum: Is it OK to splurge or is it time to save? Determining the answer to that question is very individual, says Smith, and it starts with a comprehensive financial plan. For some, the pandemic led to life changes like early retirement and a desire to curb spending due to uncertainty. For others, it meant extra cash and a desire to go out and see the world and loved ones again.

Of course, individual plans are not set in stone. Financial plans, which map out milestones in life such as retirement, paying for education for kids or grandkids, or starting a business, can change when there’s an event as disruptive as a pandemic. Smith says he’s seeing many clients rethinking their lifestyles. For instance, some who are never going back into the office are planning to move to a different state.

“The plan is a living document that we deal with on a day-to-day basis and update continually depending on how their situation changes,” Smith says.

When it’s time to save

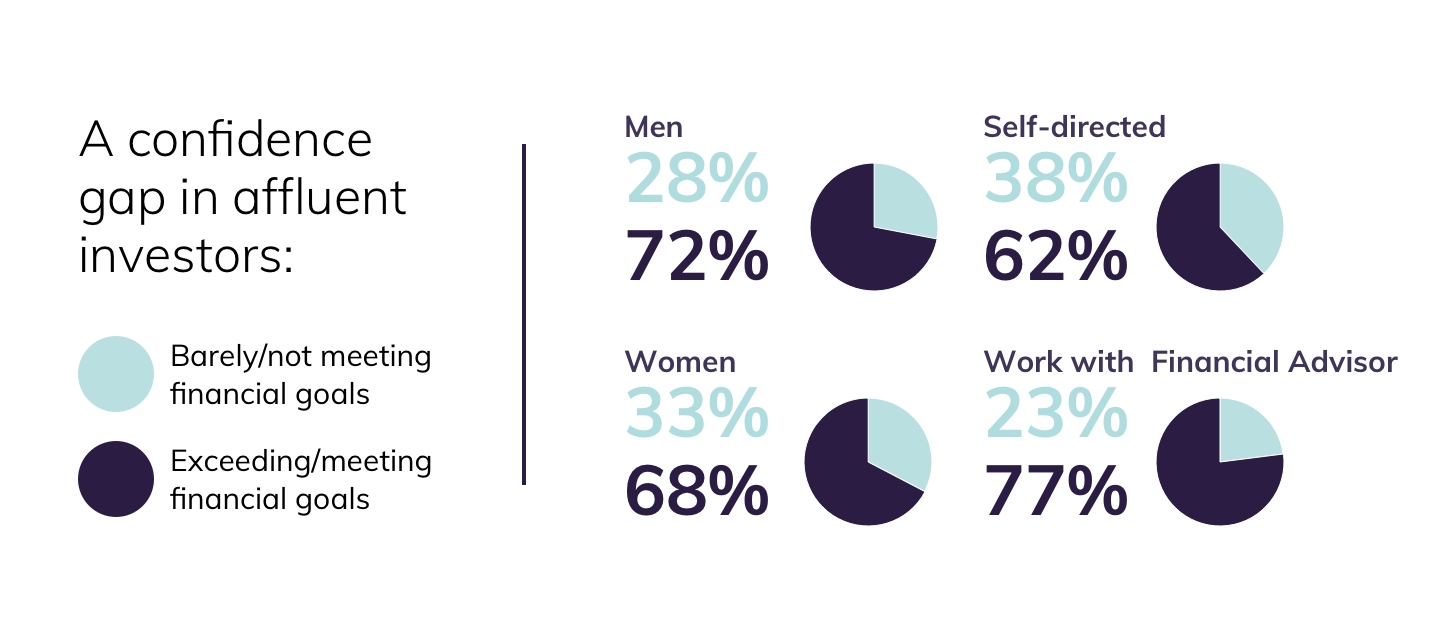

The pandemic has affected people very differently. A recent Bloomberg Wealth Study of affluent investors ages 25–54 found that most say they are meeting financial wealth goals and intend to splurge on luxury items in 2021. But not everyone feels so confident: About a third of affluent women and beginning or self-directed investors said they are barely meeting or struggling to meet their financial goals.

Smith says he’s also seeing this bifurcation in confidence from clients. The older generation that’s close to retirement is more likely to spend; they’ve already built up their savings over decades, and markets have surged over the past year. Other investors who already have substantial savings are also likely to splurge or consider retiring early. On the other side of the spectrum are those who are newer to investing or don’t have a robust financial plan.

“They’ve seen a lot more disruption and are more concerned. They will be increasing their savings rates, which are at historical highs at this stage,” Smith says.

While there is some optimism that the pandemic may be winding down, there are plenty of other uncertainties. Paying for health care can concern even the wealthy, because future expenses can be difficult to estimate. And if someone retires a few years before they’re eligible for Medicare, that often creates a significant expense that may mean reducing spending elsewhere.

The bite from higher tax rates and the limits of generating income in a low-interest-rate environment also may be concerns for affluent investors who are more risk-averse.

When it’s time to splurge

If bustling airports and full flights are any indication, there is currently plenty of spending on travel. As long as it’s within a financial plan’s guidelines, and people have the money to do it, it’s an affordable splurge, Smith says.

The challenge is to not splurge in a way that sets a precedent. Someone who flies all their friends or relatives by private jet to a luxurious week away might be able to afford it, but that doesn’t necessarily mean it’s affordable every year.

Although there is a natural inclination to want to repeat such an extravagance, Smith says he goes by a rule of three.

“The first time you do anything, it is a surprise, and whoever you do it for is thankful and will appreciate it,” he says. “The second time, it’s not such a surprise, but the recipient is still pretty thankful. The third time, it’s not a surprise, and they’ll thank you but maybe not appreciate it as much. Then, if you stop doing it, the recipient will have already expected it and will be angry at you for not doing it.”

To avoid any disappointment, make expectations clear, and always stick to your financial plan. An extravagance is affordable if it doesn’t set a precedent for risky splurges in the future.

Don’t forget your map

As the last 18 months have shown, life holds plenty of uncertainties. Going through a planning process with a financial advisor helps to clarify goals and priorities. There are outcomes that people can’t control, but they can learn to make sound financial decisions amid changing circumstances, so that it’s easier to know when it’s time to safely splurge or when it’s time to save.

Smith likens a financial plan to a travel itinerary: Individuals have different milestones in mind, and it’s essential to plan for them. Having no plan is like heading across the country without a map.

People spend weeks planning a vacation that’s going to last a weekend, Smith notes.

“You need to have at least a little focus on that longer and bigger goal of retirement, because otherwise you may not make it, or it may take you twice as long to make it as you thought it was going to,” Smith says.

- First, find out if your financial plan is flexible enough to handle changes in spending habits and goals. An advisor should help you develop a resilient plan that can adapt to disruptions. “There is no static plan that works because everybody’s life adapts and changes. So we have to have that adaptability,” Smith says.

- Make sure your advisor is asking you about what’s happening in your life, educating you about plan options and creating a forward-looking plan centered on your unique goals—not just based on the current state of the market.

- Once you have a flexible, tailored plan, and a comfortable cushion of savings, you can usually splurge moderately without worry. But when you’re thinking of a major expenditure that will dip into your long-term savings, it’s time to connect with your advisor to see how you can recalibrate your plan to keep your goals on track.

- Your advisor also needs to know when your spending could lead to lasting lifestyle changes. “The old adage I always think of is, are you taking a trip or buying a boat?” Smith says. “A trip is a one-time event. You buy a boat, you change your lifestyle forever.”

- Die-hard savers may see disruptive times as a good reason not to splurge, but that hesitancy may merit a second opinion. It's worth checking with your advisor to see whether a splurge will really affect your long-term finances.