How Fintech Can Make Soaring Travel Costs More Manageable for Emerging Enterprises

Corporate travel is back—and testing companies’ resources.

The cost of business travel continues to rise and shows no signs of stabilizing in 2024. A shortage of pilots, cabin crew and planes, paired with the burgeoning post-pandemic appetite for travel, has pushed airfares to new heights, while hotel chains are grappling with spiking labor and supply costs. As enterprises try to find efficiencies to mitigate these rising costs, their finance teams are running into a hidden source of friction from within their organizations: outdated finance tools.

Emerging enterprises—those pulling in between $10 million and $150 million in annual revenue—are more likely to have separate corporate card providers, expense providers and travel providers—if they have travel providers at all. Having separate providers can increase a company’s overhead, as each provider’s system requires additional resources to maintain. The fragmented and duplicated data that results from having too many systems also makes it difficult for finance teams to analyze information, which is spread out across platforms, and limits finance’s ability to generate insights and reports.

Getting the leverage to negotiate better rates

Large enterprises have several advantages not often enjoyed by emerging enterprises, like greater travel needs that can help them secure favorable rates from hospitality partners.

“Smaller companies often don’t have the access, or quite frankly the leverage, to negotiate better rates,” says Dan Skaggs, head of product for the U.S. Bank Commercial Rewards Card, which helps to alleviate this disparity by providing clients with access to negotiated rates with airlines, hotels and car rental agencies.

Smart travel management software can also reduce or eliminate this disadvantage by consolidating transactions and identifying spending trends in the travel space. Skaggs explains that finance teams are better equipped to negotiate discounts with vendors when armed with clear data that reveals how much employees and contractors are spending on travel and expenses (T&E).

To meet this need, the U.S. Bank Commercial Rewards Card, with its comprehensive platform powered by TravelBank, simplifies travel management for clients. By allowing businesses to sync employees’ corporate cards to their T&E software, the Commercial Rewards Card also makes it easy for finance teams to gain real-time visibility into spend, says Skaggs.

A better way to enforce corporate travel policies

Employees are the first line of defense to keep travel costs in check, which is why it’s crucial for organizations to ensure that everyone within their organization has a firm grasp of the corporate T&E policies. Nevertheless, even the most stringent accounting teams are often forced to examine line items after a trip has already concluded—an inefficient process that slows down reimbursements and creates tension with employees when an expenditure unexpectedly falls outside of a company’s corporate policy.

Enforcing travel policies can be more challenging for emerging enterprises, which lack the resources to chase expenses. Skaggs says these issues can be avoided when a company’s travel policies are integrated into its travel management platform. With the Commercial Rewards Card, finance teams can customize policy controls and set spending limits for T&E, helping organizations proactively enforce travel policies and ensure that employees adhere to company guidelines as they book flights and accommodations.

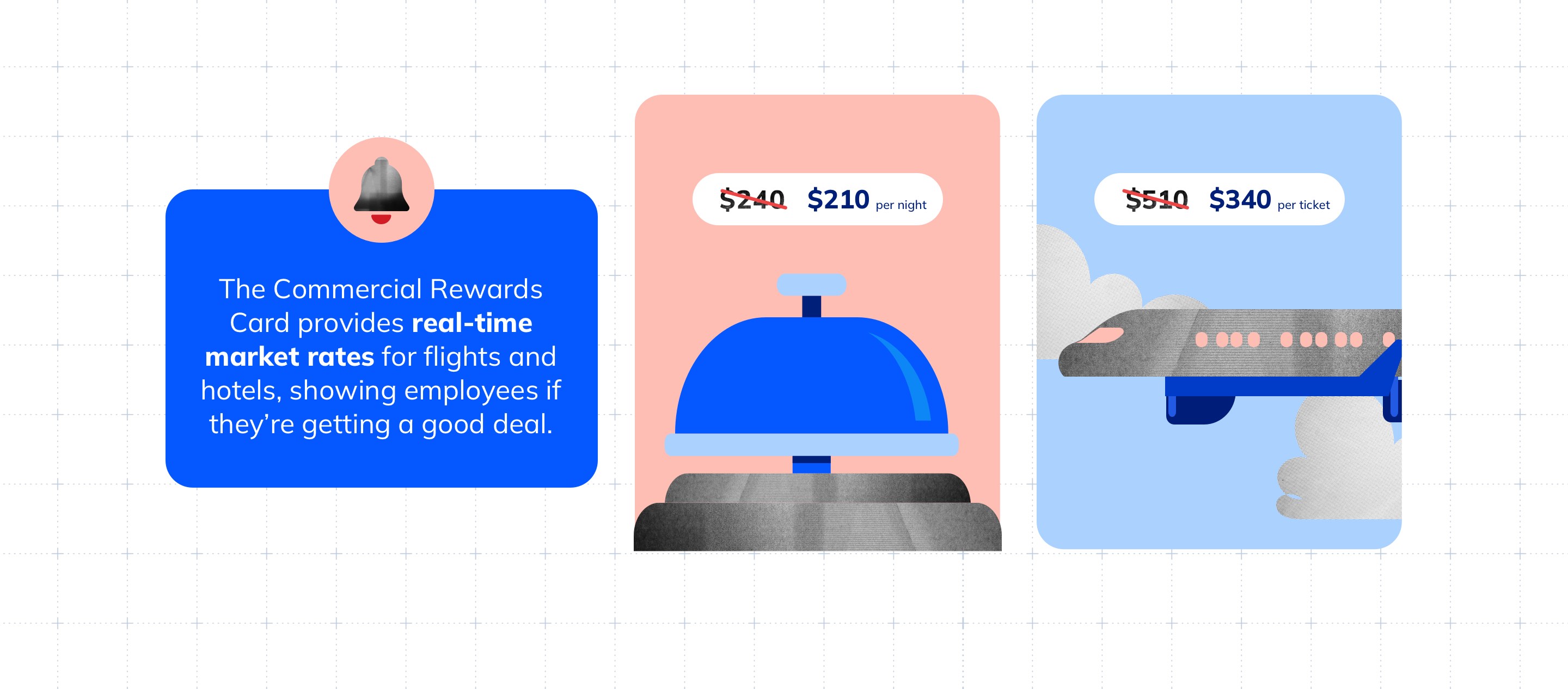

The Commercial Rewards Card also incentivizes smarter spending through employee rewards and helps employees make more cost-effective travel bookings. With real-time market rates for flights and hotels, employees booking a trip know instantly if they’re getting a good deal.

“You can have proactive visibility and control, instead of scrutiny after the fact,” Skaggs says.

Skaggs notes that travel costs will likely continue to rise, as will demand for organizations to orchestrate face-to-face meetings. But by making strategic and efficient travel plans, emerging enterprises can build the resilience necessary to weather future price surges, while generating savings they can invest in future growth.

“Prices skyrocket up, but they fall very slowly, if they fall at all,” says Skaggs. “As a result, we’re seeing more CFOs put a premium around efficiency, and leverage fintech solutions that can deliver those efficiencies.”

Discover a more efficient way to manage travel and expenses with the U.S. Bank Commercial Rewards Card.