Closing the $2.4 Trillion Funding Gap: How Visa Charts a Path for Asia Pacific SMBs

Hong Kong regularly ranks among Asia Pacific’s most financially literate economies.

Few people in Hong Kong, for instance, would have problems applying for a commercial loan, understanding basic financial products, or keeping a savings buffer.

Even so, there can be surprising gaps in their financial knowledge.

Hong Kong’s Investor and Financial Education Council 2023 study reveals just half of respondents know that digital financial contracts are valid without signed paper contracts. The study also reports that debt is expanding rapidly among younger people.

If these gaps in financial literacy exist in a population regularly exposed to sophisticated financial products, the situation for the rest of the region – where cash still reigns supreme, and access to formal financial services remains limited – is even more challenging.

Imagine, for example, a family-run garment factory outside Jakarta where production lines have slowed to a crawl due to cash flow issues, and where delayed payments are straining relationships with suppliers.

Or an online food delivery startup in Ho Chi Minh City struggling to expand, turning to high-interest informal loans instead of completing a complex bank loan application, and risking the business’s long-term viability.

A Seriously Underfunded Challenge

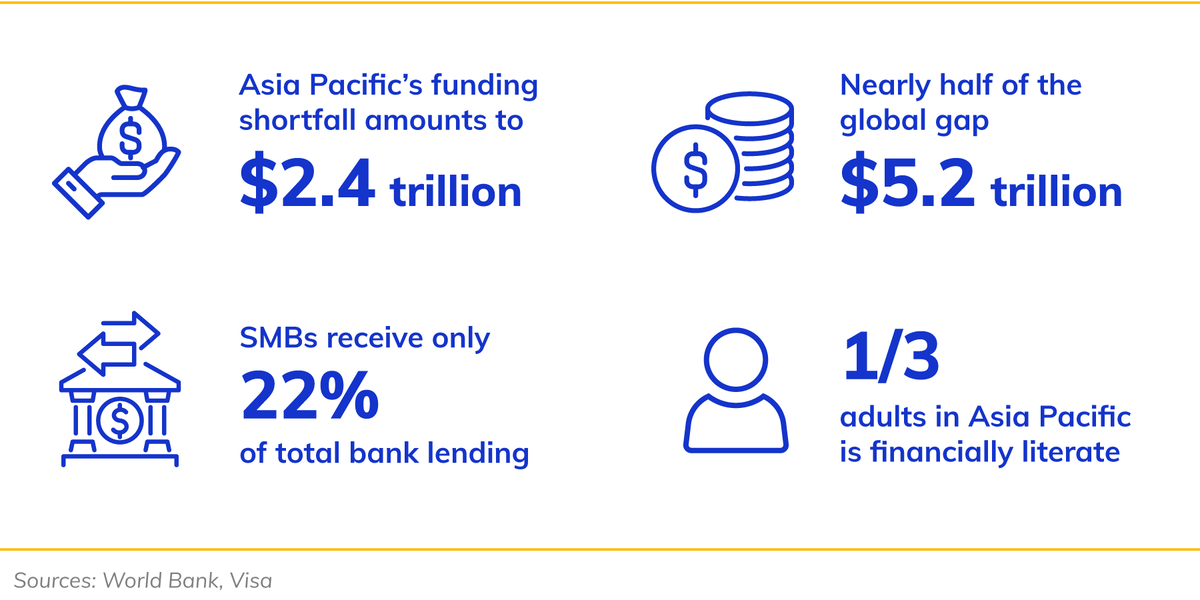

Scenarios like these reflect the very real and measurable cost of financial illiteracy. Small and medium-sized businesses (SMBs) in Asia Pacific face an acute funding crisis. The region’s funding shortfall amounts to a staggering $2.4 trillion, or nearly half of the global $5.2 trillion gap, according to the World Bank.

Despite their vital role in regional economies, these businesses receive only 22% of total bank lending, leaving many struggling to access the resources needed to grow and thrive.

"While banks usually specialize in large, long-term collaterized funding, short-term working capital loans for SMBs are limited. And while Southeast Asia is poised to become one of the highest-growth regions in the world, it's not necessarily getting its fair share of support," Teo adds.

Financial literacy compounds the issue. Recent research by Visa found that only one in three adults in Asia Pacific is financially literate, limiting the ability of SMBs to make informed financial decisions and ultimately access readily available financial solutions.

This lack of knowledge shows up in cash flow challenges, faced by nearly half of SMBs in Southeast Asia. Of these, more than half have reserves lasting less than six months, putting them at constant risk of closure.

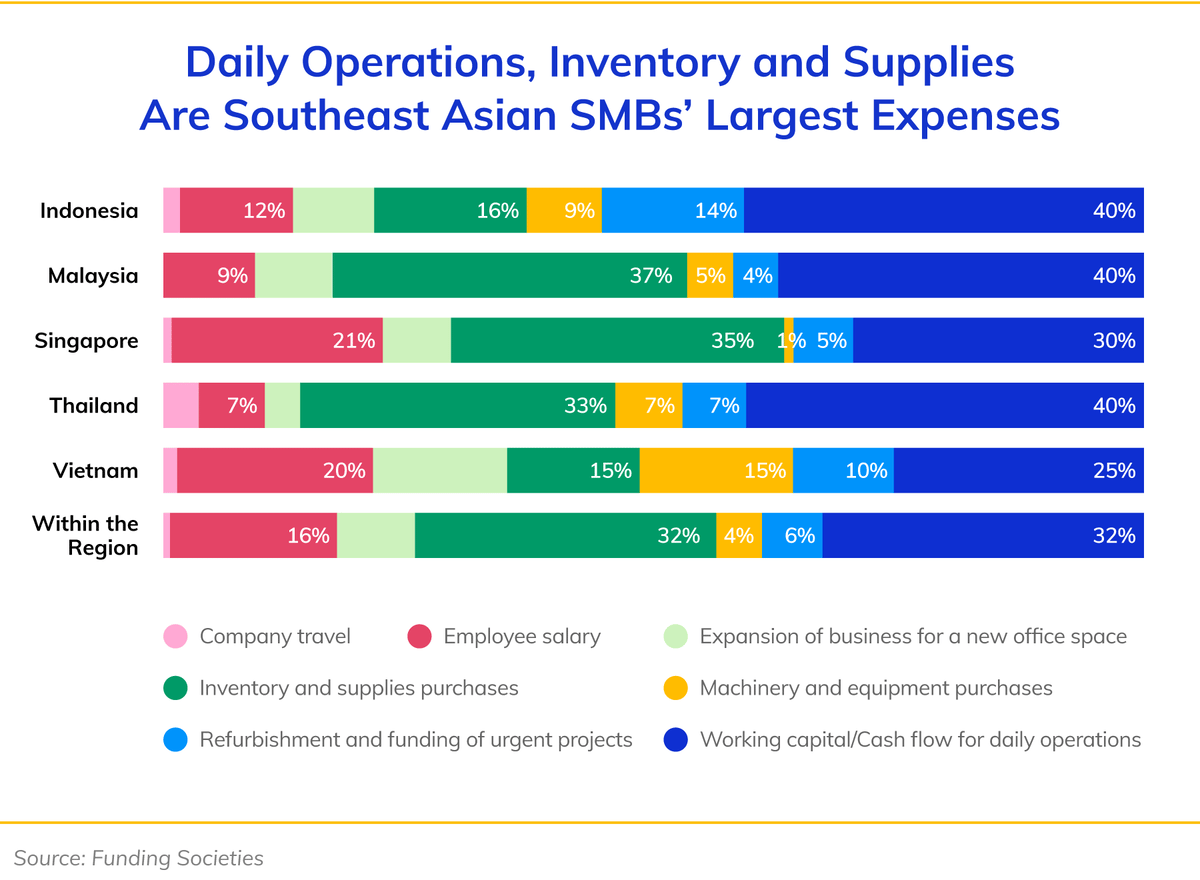

"Across Southeast Asia, we found that around one-third of SMBs' expenses goes into daily operations, and another one-third goes into inventory and supplies," says Teo. “A common view is that SMBs borrow money when they’re in trouble, but really, working capital is needed for day-to-day growth.”

Making Working Capital Work

The region, however, is not sitting still. The rise of fintech and digital lending is helping businesses bypass the rigid, time-consuming processes traditionally associated with securing working capital.

Commercial cards have also proven to be a versatile tool for SMBs, providing immediate access to flexible capital while simultaneously building a credit history.

In Malaysia, the Alliance Bank Visa Platinum Business credit card is a game-changer for entrepreneurs. This collaboration between Visa and Alliance Bank enables SMEs to obtain financing backed by the Credit Guarantee Corporation (CGC) in Malaysia, helping SMBs improve working capital management with credit guarantee coverage on Visa’s commercial cards and financial flexibility through tailored credit limits, simplified expense tracking and rewards programs.

The card provides up to 56 days of interest-free repayment and 0% flexible payment plans for up to six months, providing SMBs with enhanced cash flow control and transparency over their business expenses.

“This initiative also assists SMBs in building a robust credit history, facilitating access to larger funding opportunities in the future,” says Gareth Parrington, Head of Commercial Money Movement, South East Asia, Visa. “We’re not only focusing on helping businesses manage their current cash flows, but also positioning them to scale efficiently.”

The Next Frontier

Beyond access to capital, financial education is crucial to SMB success: in particular, those SMBs run by traditionally marginalized groups that have fallen through the gaps, and whose lack of collateral, limited credit histories and high transaction costs make it difficult to secure funding from traditional lenders.

Visa found that women entrepreneurs face unique hurdles, from cultural biases to restricted access to credit, exacerbating a significant gender gap in SMB financing.

To tackle this, Visa's She's Next initiative aims to empower and support women-owned small businesses globally. Launched in 2019, it addresses the disproportionate barriers faced by women entrepreneurs through a combination of funding, education, and mentorship.

Through She's Next, Visa has invested more $2.8 million in grants and coaching services, benefiting thousands of women entrepreneurs through virtual and in-person workshops. Meanwhile, Visa’s collaboration with ITC SheTrades supports women-led enterprises by providing access to essential digital tools, financial resources and educational content.

In many cases, geography also plays a role in financial inclusion. Rural workers with farms located in remote areas and reliant on cash-based supplier relationships often have limited formal financial education, making it more challenging for them to optimize cash flow.

In 2023, Visa joined Grow Asia as a business council co-chair, with the aim of promoting financial inclusion and digitalization for small farmers and rural businesses through the adoption of climate-resilient practices.

The three-year collaboration, which runs to June 2025 and targets geographies as diverse as Cambodia, Indonesia, Myanmar, Papua New Guinea, the Philippines, and Vietnam, has already seen Visa participate in more than 30 multi-stakeholder events and contribute to SMB-targeted projects and training. Currently, an estimated 45% of agri-finance needs are unmet in the region.

“Financial inclusion for smallholder farmers is at the heart of sustainable development, and by collaborating closely with Grow Asia and other members of Grow Asia’s Advisory Councils, we aim to unlock new opportunities for digital finance to drive climate resilience through sustainable farming practices within the agri-food sector,” adds Parrington.