Fighting Payment Fraud in Asia Pacific: Visa’s Multiplier Effect

If cybercrime were a country, it would be the world's third-largest economy – and payment fraud would be a major contributor to its GDP. As fraudulent actors become more sophisticated and refine their tactics, global losses in online payments are due to snowball to $343 billion between 2023 and 2027 (MRC).

Nowhere is this more pronounced than Asia Pacific, the region with the largest losses from online payment fraud. To protect their bottom line as well as business reputation, omnichannel businesses like Singapore-headquartered fashion retailer Love, Bonito are investing in fraud prevention and detection strategies, and monitoring threats around the clock.

“This includes advanced fraud detection tools, secure payment gateways, fraud filters, regular software updates, strong customer authentication processes, and constant monitoring of transactions and chargebacks,” says a spokesperson from Love, Bonito.

With Popularity Comes Vulnerability

The rise of payment fraud is not isolated to E-commerce.

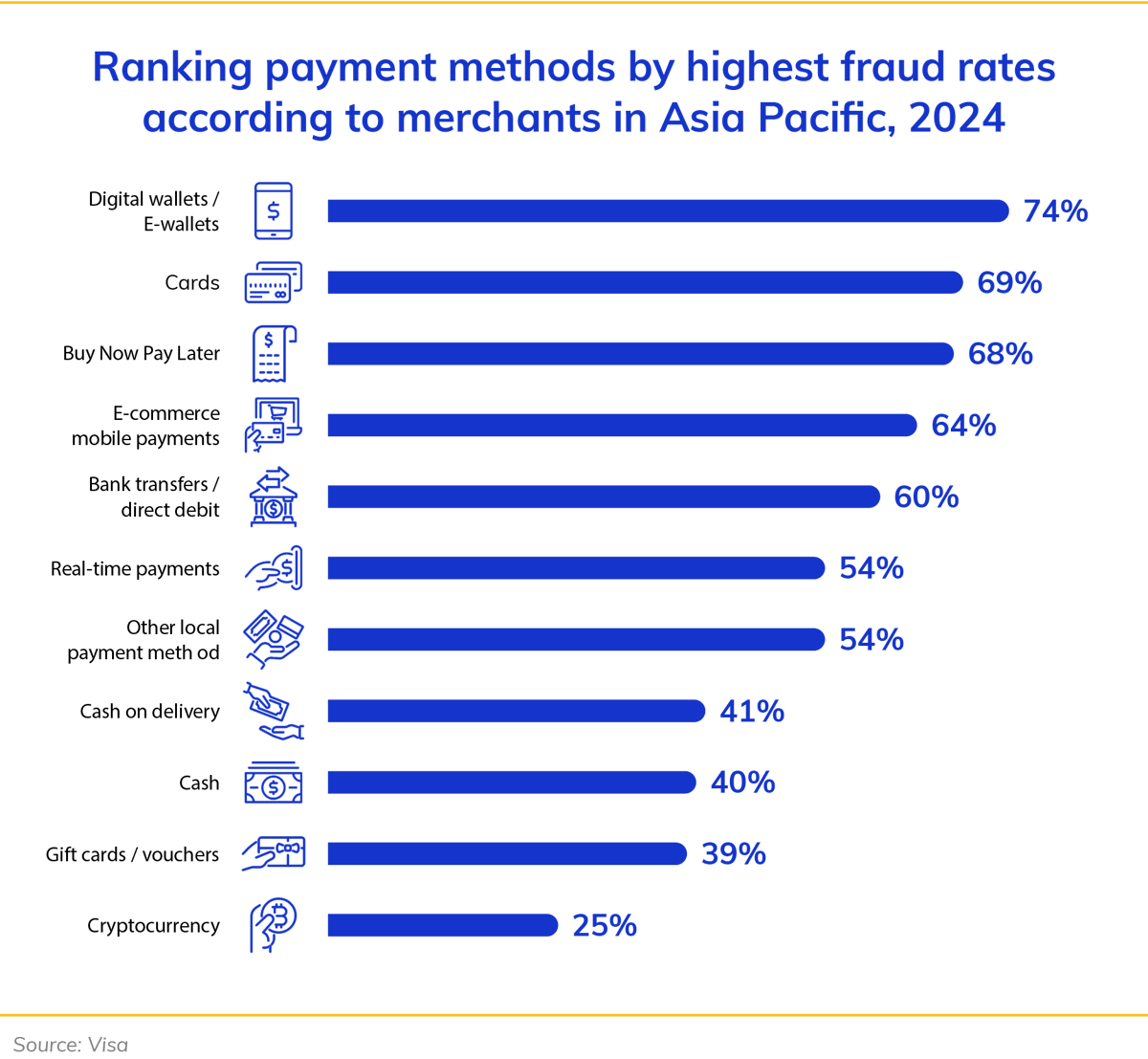

As digital payment acceptance surges across Asia Pacific, so does the risk of fraud – and recent research by Visa suggests that fraudsters are targeting the most popular payment methods.

The most widely accepted payment methods, like digital wallets and cards, experience the highest rates of fraud. Meanwhile, buy-now-pay-later, mobile payments, debit transfers, and real-time payments, which are gaining popularity across Asia Pacific, are similarly seeing rising fraud rates, according to Asia Pacific merchants.

Wiping Out E-Commerce Growth

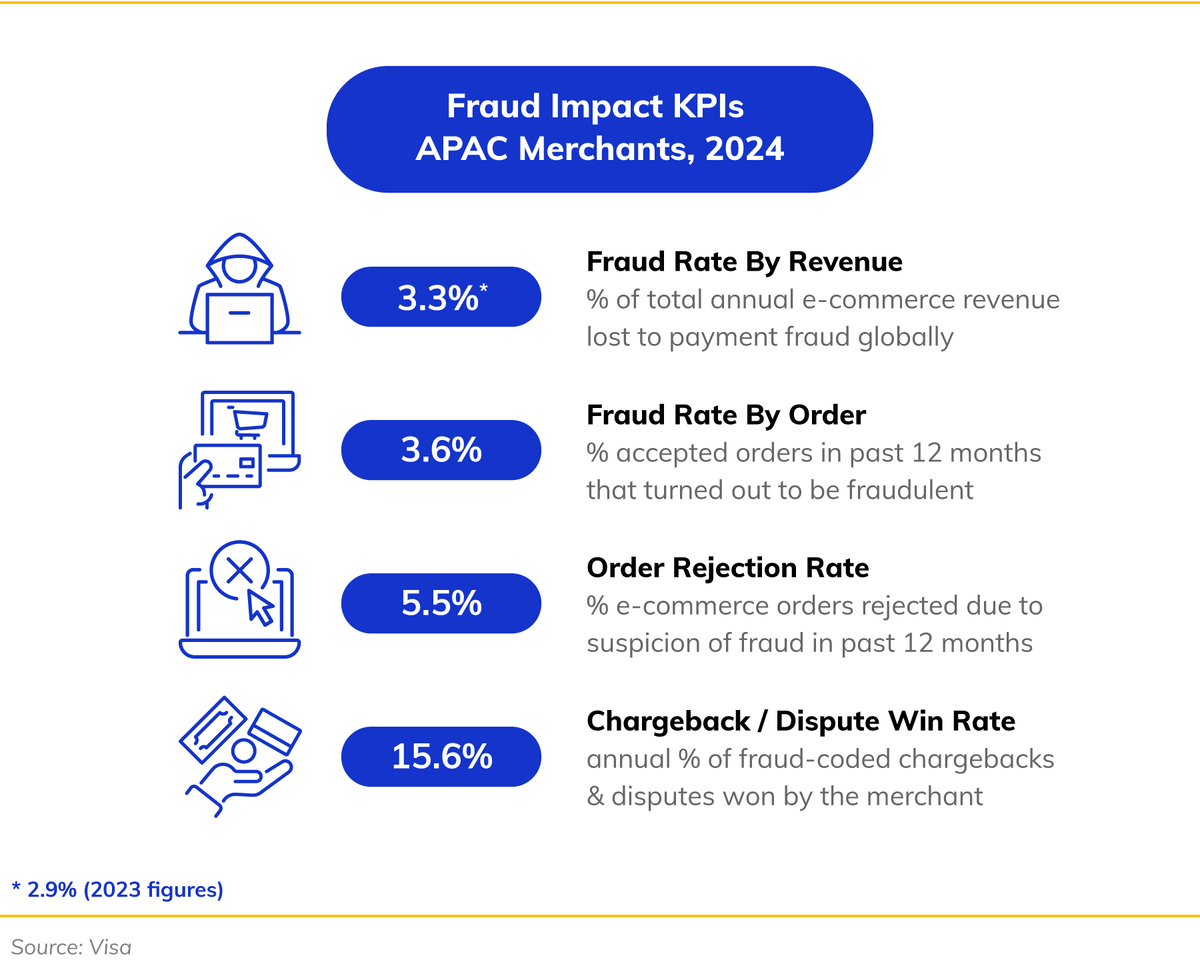

In a region that will account for nearly two-thirds of global E-commerce spending by 2025 (Asian Development Bank), the losses add up: nearly 3.3% of total annual E-commerce revenue is estimated to be lost to payment fraud.

For the 200 million small and medium-sized businesses across Asia Pacific, this margin often means the difference between hiring much-needed staff, investing in new technologies and upgrading existing infrastructure – and effectively wipes out the estimated 3.4% annual growth of E-commerce across the region (Research and Markets). In India, for example, approximately 1 in 3 Indian SMBs has experienced financial losses due to payment fraud (Decentro).

The Growing Toll of Payment Fraud

Furthermore, according to Visa research, $36 of every $1,000 of Asia Pacific merchants’ accepted E-commerce orders turn out to be fraudulent – and an additional $55 are rejected due to fraud suspicions.

Complicating matters, these merchants have a dispute win rate of less than 20%, highlighting the difficulties they face in successfully contesting fraudulent transactions and reclaiming lost revenue.

“A common type of fraud we encounter would be fraudsters using stolen credit card details to make unauthorized purchases. This can happen when card details are stolen through hacking, phishing or skimming. This type of fraud can lead to chargebacks, where we are required to refund the purchase, often after orders have been shipped – a double blow for the business,” notes Love, Bonito’s spokesperson.

Building a Foundation of Secure Payments

But with the help of secure payment technologies, SMBs have an avenue to fight back.

One of the most significant anti-fraud advancements is tokenization, which strengthens every digital transaction and combats third-party fraud by replacing sensitive custom details with a unique digital identifier.

“One way to think about tokens is akin to an armored truck filled with promissory notes, rather than cash – even if you can get into the truck, the notes can’t be used,” explains Previn Pillay, Head of Merchant Sales & Acquiring, Asia Pacific at Visa.

Among Visa’s array of anti-fraud merchant solutions is Visa Token Service (VTS). This foundational platform for global tokenization has issued more than one billion payment tokens across Asia Pacific, slashing payment fraud rates by 58% and creating a $2 billion uplift in merchant revenue. VTS also ensures uninterrupted payments despite changes in card credentials, which underpins a frictionless payment experience.

A First Priority

For regional financial services heavyweight SeaMoney, whose services span payments, financing and banking, customer and merchant security is a first priority.

“Security is crucial to the success of our business, and fraud prevention services like Visa Token Service can help reduce payment fraud rates for our merchants, while simultaneously improving payment success rates for our customers,” said a SeaMoney spokesperson.

Immense opportunity remains. Only around one in two SMBs currently uses some form of tokenization, compared to almost 80% of enterprise merchants (Visa and Cybersource). As digital payments become increasingly ingrained across Asia Pacific, many more SMBs stand to benefit from VTS.

Stamping Out Friendly Fraud

In addition to third-party fraud, Visa helps SMBs combat first-party misuse. Also known as friendly fraud, first-party misuse occurs when a customer disputes an authorized transaction with their bank or credit card company to get a refund, despite having received the goods or services.

This insidious form of fraud accounts for as much as 20% of fraud disputes and is a rapidly growing risk, with almost 60% of merchants reporting a year-on-year rise in incidence rates.

Launched in April 2023, Visa’s Compelling Evidence 3.0 protects SMBs from buyer’s remorse and bad faith by systematically presenting substantial evidence such as proof of delivery, transaction records, and customer communications to help SMBs effectively dispute chargebacks from first-party misuse.

“Robust dispute management and evidence submission are crucial in enhancing first-party fraud prevention and supporting merchant operations across Asia Pacific,” notes Pillay. “Compelling Evidence 3.0 empowers SMBs to prove delivery, document purchase history and submit customer interactions without additional time or paperwork.”

By streamlining dispute handling and not assuming merchant liability, Compelling Evidence 3.0 is expected to save SMBs more than $1 billion globally over the next five years.

The Multiplier Effect of Anti-Fraud Solutions

From VTS to Compelling Evidence 3.0, Visa's investments in technology, which have exceeded $10 billion in the past five years, have paid off. In 2023, Visa protected its global network from $40 billion in fraudulent activity, nearly double the previous year’s total (Bloomberg).

“The growth of Asia Pacific’s digital economy relies on the integrity of its digital payment infrastructure,” says Pillay. “Visa helps SMBs respond to Asia Pacific’s demand for fast and convenient payments, while protecting them by staying ahead of fraud, and maintaining trust and security.”