Why the Wealthy Must Prepare Now for Tax Increases Ahead

Time may be running out for affluent Americans to deal with upcoming changes in tax laws if they haven’t already put a legal and advisory team in place, financial experts say.

Advisors and tax experts widely anticipate that taxes on capital gains tax, estates and income will rise, and are urging their clients to start looking at ways to soften the impact now.

Many estate lawyers have a backlog of work due to both Covid fears triggering high demand to finalize wills and tax concerns prompting more wealth transfers to shelter assets.

“There’s much more demand on attorneys right now, so the sooner clients start having this conversation with their team of advisors and getting in line for the attorney to draft all of these changes, the better,” says Jacqueline Lynch Parks, Senior Wealth Strategist at Truist Wealth.

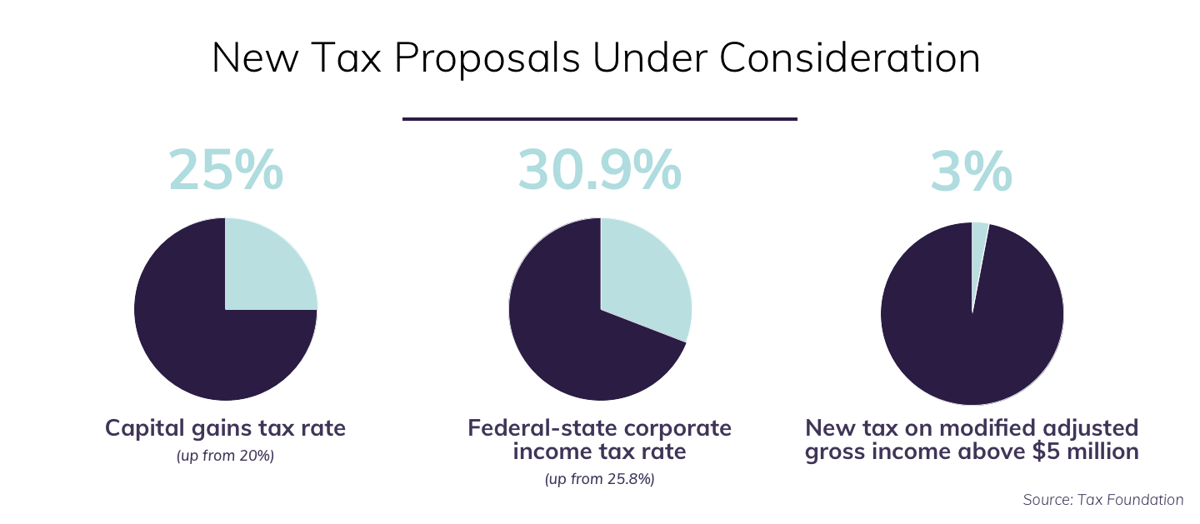

Multiple tax proposals, currently wrapped into various legislative bills, could have a significant impact on tax rates for high-net-worth individuals. While it remains to be seen what will happen, many advisors are telling clients to start preparing for changes now.

Advisors are helping clients review asset allocation, asset location and wealth transfer strategies now, so they don’t feel like they need to scramble to restructure their wealth once new laws are passed.

“If you’re reacting in the moment from one urgent decision to another, that’s a horrible place to be when you’re seeking confidence about the future,” says Paul Stark, Regional Director of Advice and Planning at Truist Wealth.

Instead, he recommends working with a team of advisors to set up a flexible financial plan and framework to evaluate the ever-changing tax landscape, which puts taxpayers in a good position -- even if they don’t have time to react to every change.

“That should be your goal, not the temporary urgency of a tax deadline,” Stark says.

Keep a watchful eye on asset allocation

One of the key strategies to lessen tax burdens is having diverse assets. A flexible financial plan conventionally puts assets in different types of accounts—both taxable and nontaxable—so individuals can draw funds in the most tax-efficient manner. That remains a sound strategy, even with the expected tax changes. What could change, though, is the order of accounts to pull from.

Depending on how tax rules and individual circumstances change, it may be more tax-efficient to draw on assets in a trust that was previously accumulating income, explains Parks. As income tax rules for individuals and trusts are modified by new legislation, it is important that you work with your advisor to determine the most tax-efficient way to support your cash flow needs.

“It’s going to be a case-by-case basis for every single individual taxpayer based on what their balance sheet looks like, and their various sources of income,” says Parks.

Insurance can be an option as a shelter

Insurance policies are becoming popular income-tax shelters, Stark says. Advisors could pull in an insurance specialist to help devise ways to lessen the tax impact, he says.

One strategy could be obtaining a life insurance retirement policy, or LIRP. The purchaser contributes funds to the policy and it grows over time; then the policyholder can withdraw assets from the LIRP without incurring income tax because it’s characterized as a loan. One downside to the strategy is that such vehicles aren’t guaranteed and don’t always perform as expected, so it’s possible to over-borrow.

Wealth transfer strategies may falter

The current estate tax exemption is set at $11.7 million for singles and $23.4 million for married couples. There are several proposals on the table right now to lower the exemptions, and it’s uncertain exactly where they will land; however, the consensus is that they will be significantly lowered and likely next year.

Various trusts have allowed the affluent to maximize giving to the next generation, but changes are likely to come. Some wealth transfer techniques or strategies such as grantor trusts could be made obsolete, says Stark. Affluent individuals may have to gauge how much they’re comfortable parting with, and work with an advisor to build more flexibility into their plan so they’re able to absorb any tax law changes that may or may not occur.

“Whenever you’re considering a wealth transfer strategy be aware that many of these strategies involve parting with assets. It’s important to go through a financial plan and make sure that you analyze your ability to maintain your lifestyle if you execute on some of these strategies,” Stark says..

Taxes are ever-changing

The current anticipated batch of tax changes may be nerve-wracking to some, but it’s helpful to keep in mind that tax laws are ever-changing and that a sound financial plan can weather the changes.

“Taxes are a huge consideration, but they shouldn’t overshadow your proper evaluation of the underlying investment strategy,” says Parks.

- Tax season isn’t until spring, but starting the conversation sooner rather than later is essential. “Inaction now can become an irreversible decision,” says Stark.

- Estate tax exemptions are likely to be lower in the near future, and if you’ve been looking at strategies to use your current exemption but haven’t implemented anything yet, now may be a good time to execute them. “Some people have been sitting on the sidelines for a while because they felt like they had until the end of 2025 to take action,” says Parks—but in this case, sooner is better than later. “We’ve been warning our clients that the sunset of the current exemption could be accelerated. In order to use or to take advantage of that exemption during your lifetime, you have to part with control or beneficial ownership of the wealth,” she says

- Be ready to review your balance sheet, sources of income and spending. That will help your advisory team find the most tax-efficient way to draw on funds. “You would be surprised how many people at every single wealth level don’t really have a good understanding of their balance sheet and their various sources of wealth,” says Parks. “It may take some time to pull the information together, but this is a critical first step to properly evaluate whether implementing additional wealth transfer strategies will be appropriate or beneficial for you.”

- If you hear about new approaches or strategies, ask your tax, legal and financial advisors to weigh in before you consider implementing them. Anytime there are significant tax law changes, many self-proclaimed experts will try and sell new ideas or strategies. “If something sounds too good to be true, it probably is. I would caution clients that if someone’s promoting a strategy, you should get independent advice from your trusted advisors to determine whether it is a good fit for your particular situation,” Parks says.