Blueprint for a Building Boom

$33B

The US economy stands to recoup $33 billion in losses due to flight delays at outdated airports.

Source: Federal Aviation Administration, 2019 study

$87B

Could flow back into the US economy from traffic congestion reduction through properly maintained roads.

Source: Infix

$1.50

Annual private economic activity generated by each public dollar invested in infrastructure.

Source: World Bank

It’s not uncommon for large data centers to comprise 100,000 square feet—a little less than two American football fields—and the largest of the hyperscale centers have square footage in the millions.

Source: Institute of Electrical and Electronics Engineers

Data centers can accommodate tens of thousands of servers.

Each rack in a hyperscale data center can use as much power each day as three to six American homes.

Source: Data Center Dynamics

But servers only account for about a quarter of a data center’s total energy needs. Nearly half of its energy goes toward cooling the computers. To manage temperatures, some centers deploy high-performance roofing insulation, allowing the facility to maintain cooler temps with lower operational costs.

Sources: McKinsey, Holcim

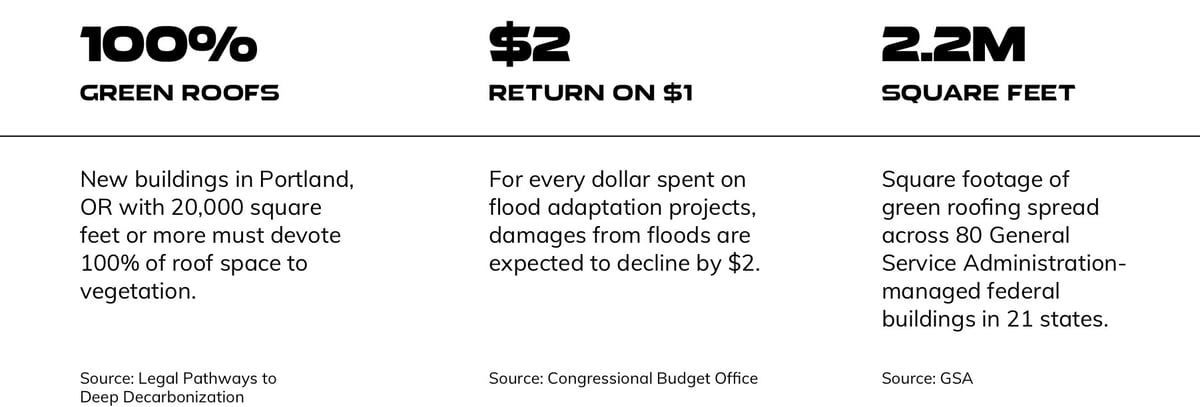

GREEN ROOFING

US demand for green roofs—which are proven to naturally cool interiors and divert rainwater from flood zones, while reducing the size, cost and maintenance of stormwater infrastructure and detention—is projected to reach $207 Million in 2025.

Sources: US Green Roofing Market 2022–2030; EPA: Stormwater Best Practices

REFLECTIVE EXTERIORS

On building exteriors, reflective surfaces are used to manage internal temperatures and mitigate the urban heat island effect. Reflective white roofs installed in New York and Los Angeles have proven effective in lowering surrounding temperatures. University of Maryland researchers have developed a microporous coating that, when applied to a building’s surface, reduces dependence on air conditioning.

Sources: American Society of Mechanical Engineers; Yale School of the Environment

PERMEABLE CONCRETE

According to the London School of Economics, floods can reduce a city’s economic activity by up to 8% the year after the flood. One solution that cities are deploying is permeable concrete on roadways, sidewalks, parking lots and plazas, allowing stormwater to infiltrate the pavement’s surface, where it can help green cities by hydrating tree roots, rather than collecting and impeding mobility.