Funding the Future

Keeping mid-sized companies on the path to achieving growth goals requires treating their treasuries like precision instruments. Learn how companies in three key industries—Industrials, Healthcare, and Digital, Technology and Communications—are turning challenges into opportunities by making working capital work smarter.

From building resilient supply chains in a volatile macro-economic landscape to addressing labor shortages and the ongoing AI and automation imperative, companies of all sizes are facing complex challenges in the year ahead.

These market forces are playing out against a balance-sheet backdrop that keeps business leaders up at night: tightening credit, interest-rate concerns and heightened risk. Alongside those macro themes, AI occupies a macro presence on the horizon, as more and more businesses balance the positive disruption it offers with the cost and complexity of adoption.

Whether the challenges are policy-driven or perennial, meeting them as a mid-sized company trying to scale requires a strategic approach to working capital. And business leaders also need a clear-eyed view of their own financial complexities, according to Tasnim Ghiawadwala, Head of Citi Commercial Bank.

Many growing companies imagine their treasury function to be a straightforward system of managing cash on hand through a flow of payments in and payments out as well as covering overhead expenses, possibly in multiple currencies and difficult jurisdictions.

Explore how the mid-market in these three key industries is expanding working capital to insulate against complexity while funding growth plans that can yield insights for other leaders.

A renewed onshoring focus may reorder supply chains again—but it doesn’t have to wreak cash-flow havoc.

The Challenge

First, the good news. According to Federal Reserve data on the state of US manufacturing, factory capacity utilization—a measure of potential output being used—climbed to a three-month high of 77.6% at the start of 2025. This activity, combined with Institute for Supply Management (ISM) data projecting capex gains of 5.2% in 2025, indicates the industry is proceeding with confidence rather than contracting from risk, as well as moving beyond residual sluggishness from higher interest rates.

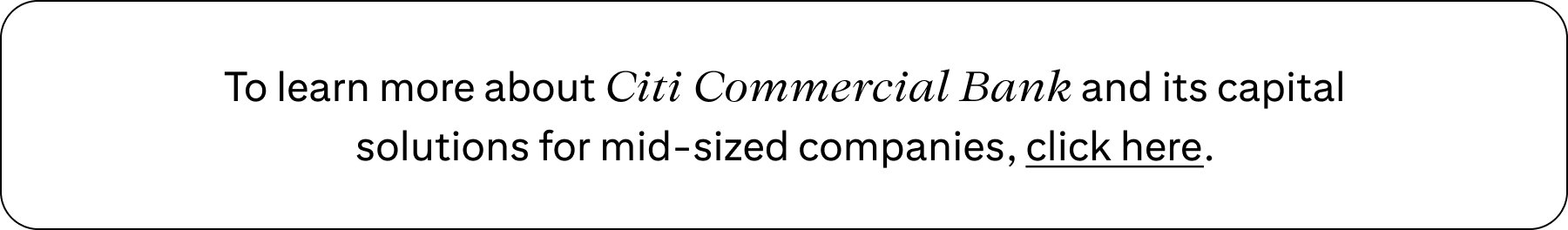

Still, market volatility in response to US implementation of tariffs on foreign imports points to an underlying fragility in the industrial sector’s interdependence. In Citi Commercial Bank’s annual survey of 750 leaders of mid-sized companies – whose insights informed the 2024 Global Industry Insights report – respondents from Industrials topped the list of leaders seeking working capital improvements, pointing to the intertwined costs of labor, logistics, and financing.

Blending capital goods, automotive products, paper and packaging, transportation and logistics, metals and mining, aerospace, construction and chemicals, Industrials are particularly vulnerable to shifts in pricing and procurement. The industry also has specific needs emerging technologies can meet, with automation and robotics often superseding AI as the digital-transformation focus.

The Impact

Conceived in part to bolster domestic production, tariffs can also impact industrials’ working capital in the short term.

Sourcing domestically means increased upfront costs, Geronimo adds. “It’s going to mean inventory requirements. It’s going to put pressure on cash flow.”

For now, as measured by ISM, inventory levels are shrinking—a healthy indicator of production growth. Even so, company size matters.

“When you think of mid-sized versus large companies, the biggest question is whether they have access to capital,” Geronimo says. “What do their supplier relationships look like?”

These size-related considerations can determine resilience in the face of supply chain disruptions.

The Takeaway

Mid-sized industrial companies don’t have to sacrifice scale as they seek supply chain resilience and transformation through technology. The automotive and arms categories are standout category examples of Industrials’ exposure to quickly shifting terrain, per Citi’s Global Industry Insights Report. These shifts—ranging from supplier volatility to AI innovation that could yield new applications seemingly overnight—can mean quickly onboarding new partners and providers.

And it takes a financial support system with the accounts-payable strength to negotiate optimal payment terms to maintain working capital reserves.

For example, onboarding a new domestic supplier in the wake of tariffs can lead to unfavorable terms like lower Days Payable Outstanding (DPO).

In Geronimo’s view, the mid-market should consider financial partners for their ability to fill gaps in buying power.

“That’s so important to working capital because it means the ability to say, ‘We’re no longer paying you on day 30, we’re paying you on day 90,’” he says. “That speaks to buying power—but also to relationships.”

Automation is the prescription for healthcare growth—but it has to be managed strategically and securely.

$13 billion

Projected market size for new Alzheimer’s drugs by 2030—forecast by Bloomberg Intelligence to be the next breakthrough area rivaling the obesity treatment drug-discovery boom.

The Challenge

Everyday consumers are familiar with the rising cost of healthcare. The cost of hospital services has outpaced the inflation rate for more than two decades, according to Bloomberg.

Meanwhile, the Association of American Medical Colleges forecasts a flagging talent pipeline, with the US facing a shortage of up to 86,000 physicians by 2036.

“All across the sector, there are escalating labor costs, tariffs, supply chain disruptions, stricter regulations around patient data and evolving interoperability needs,” says Laura Fogarty, North America Industry Head, Healthcare, Citi Commercial Bank.

In healthcare, as with most industries, vital help could come from AI and automation—but ensuring security and affordability poses challenges for the working capital resources of mid-sized operations. These concerns could be why three in five healthcare organizations surveyed for Citi’s 2024 Global Industry Insights report have not yet adopted any form of AI in their organization.

The Impact

While every company these days likes to say it’s really a technology company, healthcare companies have the highest bar to clear—and the biggest potential rewards—in delivering on that promise, says Fogarty.

From healthcare providers and payors to medical device and pharmaceutical manufacturers, Fogarty has seen her client base within Citi Commercial Bank adopt AI tools to accelerate product delivery, personalize care delivery and improve revenue cycle management.

Savings in health spending from AI adoption could reach $360 billion a year, according to Bloomberg analysis.

Healthcare operations that implement process automation or gain a global view of liquidity are likely to realize a working capital return on investment through efficiencies and reduced overhead, Fogarty says.

The Takeaway

Several of the leaders of mid-sized healthcare organizations surveyed for Citi’s Global Industry Insights Report are ramping up use of automation and outsourcing software, with one company deploying AI citing the development of massive proprietary datasets in their workflows.

These are encouraging signals that the three in five organizations not yet experimenting with AI may add it to their roadmaps. When they do, Fogarty advises a clear strategy for what your company needs from automation measures. With that in place, the next step is taking advantage of Software as a Service (SaaS) AI solutions to tackle the identified business challenge or opportunity. This could lead to enhanced efficiency and improved healthcare outcomes, to name a few.

It’s fine to start small to prove ROI, she says. Even automating billing helps insulate against rising costs and the threat of inflation, with built-in data protections against the industry’s higher risk threshold due to regulation.

Larger healthcare industry players are often better resourced to onboard multiple technology platforms and workflows. Healthcare providers must also navigate interoperability needs, integrating patient data for secure access between platforms and other providers.

Balancing these healthcare industry priorities—automation, security, affordability—is increasingly possible through software outsourcing models designed with patient-data needs in mind, Fogarty says.

“I would argue that you don’t have to be big to benefit,” she says. “But you do have to be strategic to benefit.”

Innovation attracts capital—but without a strong treasury infrastructure, funding can’t foster growth.

$100+ million

Cost to train a typical AI model, even with the move to “small language models” over large language models (LLMs).

Source: Bloomberg

The Challenge

Leaders of Digital, Technology and Communications companies surveyed for Citi’s Global Industry Insights Report showed the highest levels of maturity in their AI utilization. Their 63% rate of AI implementation was more than double the rate of the industries featured in the report.

Meanwhile, AI-centered startups continue to attract investment, even as general startup funding hasn’t fully recovered from interest rate hikes the Federal Reserve initiated in 2022, according to Bloomberg.

The question is, will those healthy funding rounds for AI’s next big things be used with the long game in mind, or merely to get products to market and dominate share?

A review of startup hiring practices can forecast how durable a successful funding round is likely to be, says Mike Berry, North America Industry Head, Digital, Technology & Communications, Citi Commercial Bank.

“Many of these companies are flush with cash because they’ve raised a certain round, but at most, they have a payables person,” he says.

If treasury teams are the last to be staffed, this can create a P&L bottleneck as vendors need to be paid while funding is tied up in the costs of product rollouts or new market penetration.

The Impact

To close gaps in the industry’s working capital oversight, Berry spends a lot of time on whiteboard sessions with the bank’s mid-sized Digital, Technology and Communications clients, mapping funding flows.

“I’ll ask, ‘When do you get paid? How do you get paid? How quickly? What do you do with that cash?’ How we can help them streamline—that is where our bankers are spending a lot of time supporting our clients.”

AI solutions developed in-house can streamline professional functions like finance, as well as accelerate research and development. This may be why nearly half of Digital, Technology and Communications companies surveyed for the Global Industry Insights Report plan to develop bespoke AI instead of contracting with outside vendors, despite proprietary AI requiring more capital expenditure.

Consider the fast-growing fintech category. Fintech company revenues are projected to grow from $245 billion to $1.5 trillion over the next five years, according to BCG.

Operationalizing the accounts payable and receivable functions for growing technology companies in the automated payments space is an especially urgent challenge Berry says. That’s not only because payments are the sector’s bread and butter, but because of its rapid expansion.

The Takeaway

While AI startups can be capital vacuums, smaller, fast-growing fintech operations don't have the financial profile to obtain $100 million-plus credit lines. They move money on behalf of customers, and need a financial support system capable of supporting that payment flow.

Often, that means surveying each company’s client base to understand the give and take on payment terms. Doing business with the behemoths of the tech world is different than business with smaller partners and suppliers, in terms of securing advantageous terms for new capital.

For smaller vendors, a bank like Citi can help land payments terms that help these companies hold on to working dollars for as long as possible.

Berry’s clients are driven by sales and market share, and becoming operational in new countries quickly is an imperative. The Global Industry Insights Report also found that the Digital, Technology and Communications industry is the most likely to consider expanding into new markets in 2025: 74% for Digital, Technology and Communications companies, compared to 60% for all industries combined.

But international offerings require the infrastructure to navigate the differences between being able to accept payments in Portugal versus Switzerland, for example.

“Given that these tech companies may only have one or two people assigned to their treasury functions, working with a bank that has an extensive global network and a deep level of local expertise is mission-critical,” Berry says.

Whether it’s a pre-profit startup on a scale trajectory, or an established mid-sized player, sustainable growth relies on careful calibration of capital, says Citi Commercial Bank’s Tasnim Ghiawadwala.

Funding their future ambitions also requires the right financial support system. Because of Citi’s size and reach—spanning 144 countries in which Citi can issue currencies—mid-sized companies can benefit from access to ideas already pressure-tested by bigger players in the same industries and verticals.

“We can say, ‘The largest companies are doing this, have you thought about that?’ Our mid-sized clients see the value in that,” Ghiawadwala says. “They’re learning fast, adapting fast—both in talent and processes—which vastly improves their capital.”

© 2025 Citigroup, Inc. All rights reserved. Citi, Citi and Arc Design and other marks used herein are service marks of Citigroup, Inc. or its affiliates, used and registered throughout the world. Citi Commercial Bank is a business of Citibank N.A. Any views, unless reflected in Citi’s Research Reports, are those of the individuals and may not necessarily reflect the views of Citi or any of its affiliates. Although the statements contained herein based on outside sources are believed by Citi to be reliable, their accuracy and completeness have not been verified. Any assumptions or information contained herein constitute an opinion only, as of the date of this presentation or on any specified dates and is subject to change without notice. Any forecasts or forward-looking statements may not be attained.