Turning Market Uncertainty Into Fixed Income Opportunity

“I keep hearing the same thing from clients, advisors and policy makers: uncertainty,” says Sara Devereux, Head of Fixed Income at Vanguard. “But here’s the thing: uncertainty creates both risk and opportunity.”

The key is having the right approach to capture that opportunity. While many asset management firms rely on a few star portfolio managers who pursue momentum-driven investment approaches, Vanguard has embraced a strategy that has paid dividends even during volatile times.

After more than two decades in fixed income, Devereux says she’s never seen such a rich opportunity set for bond investors. But capitalizing on those opportunities requires managers with unwavering discipline, as well as the expertise of a team that uses a systematic process that trumps attempts to hit home runs via big bets.

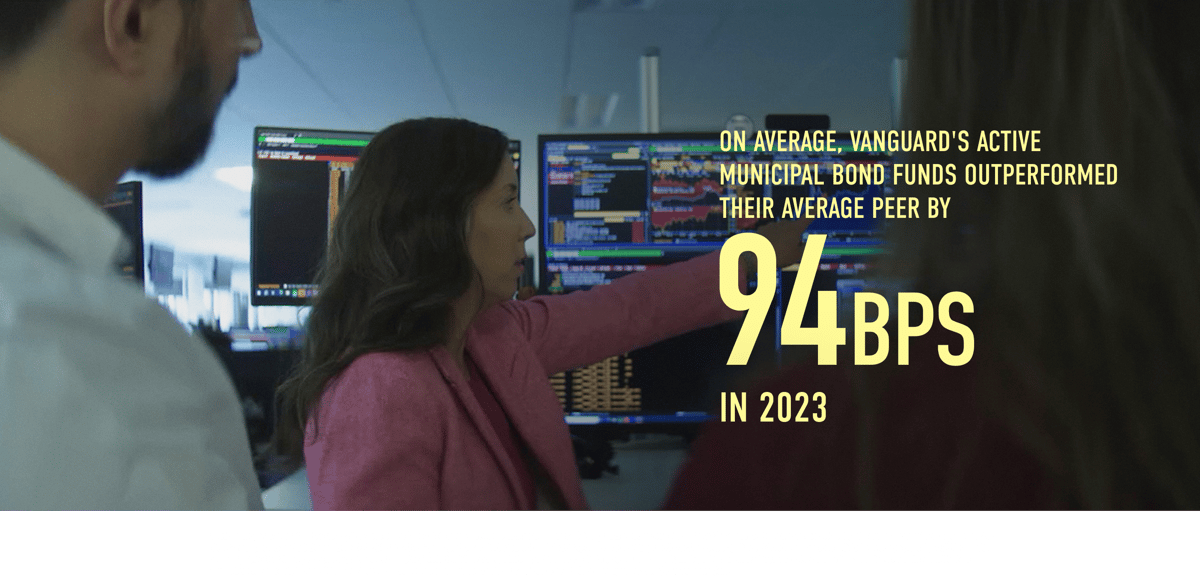

“We focus on repeatable, reliable strategies—what I call ‘hitting singles and doubles,’” says Devereux. Those strategies include grinding through security selection and using technologies such as artificial intelligence and machine learning to augment the team’s expertise.

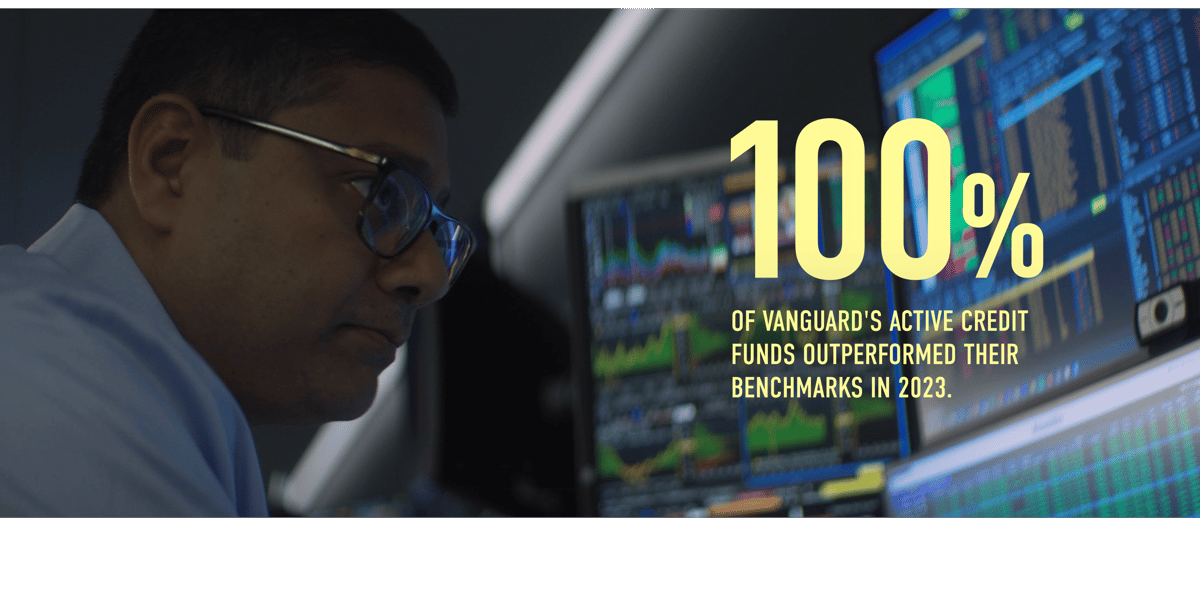

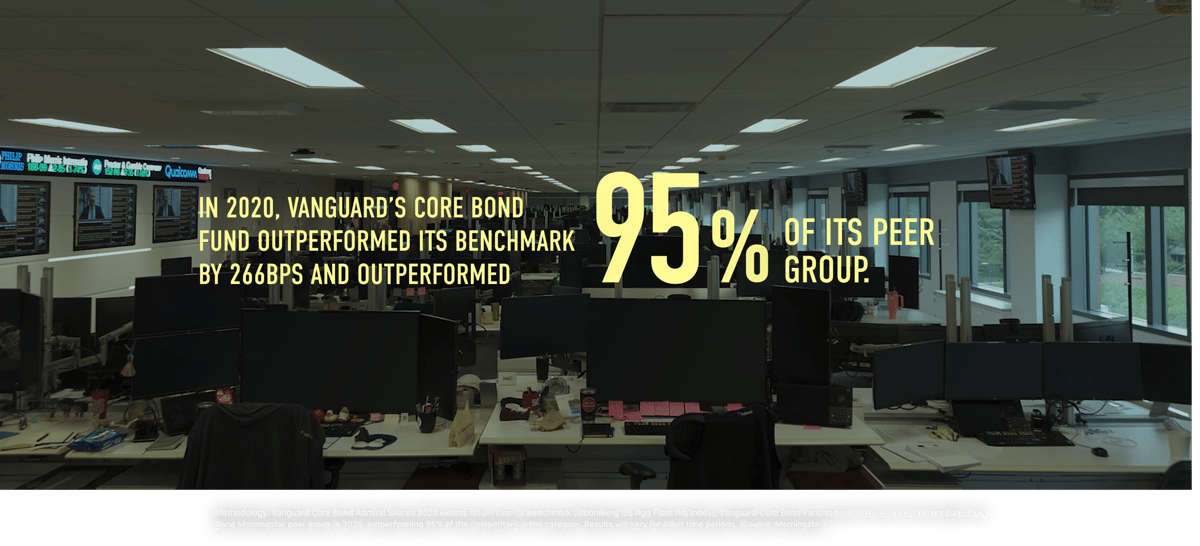

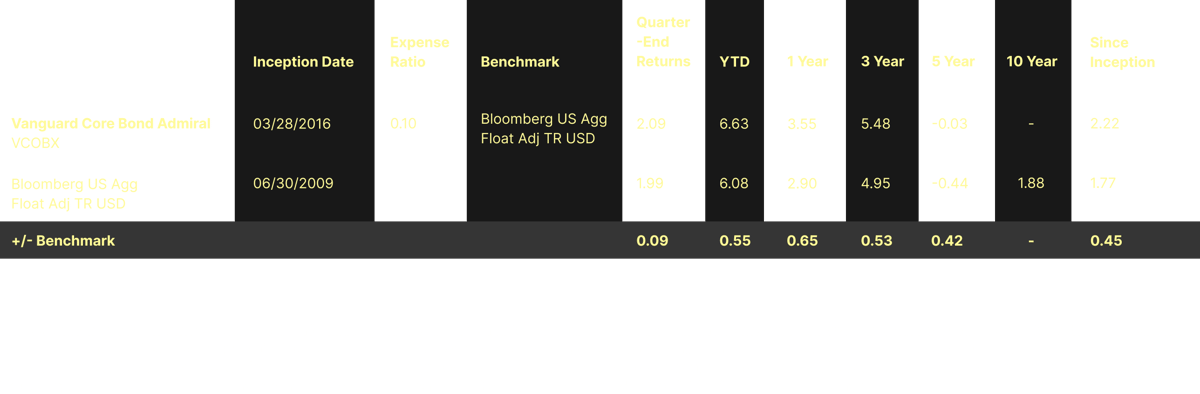

Those singles and doubles compound over time. Vanguard believes that alpha generation isn’t luck, it’s a process, and it comes from precision, not prediction.

This systematic approach allows Vanguard to identify opportunities when others see only risk. In March 2023, the Silicon Valley Bank collapse triggered panic selling, but Vanguard’s team turned to their established research framework.

“For 20 different regional banks, our team already had financial models built,” says Arvind Narayanan, Co-Head of Investment Grade Credit at Vanguard. While competitors were frozen by fear, Vanguard deployed several billion dollars of capital into five fundamentally sound banks identified through Vanguard’s proprietary stress tests.

Vanguard’s Fixed Income team has more than 200 portfolio managers, traders, research analysts, and risk experts.

“Our team includes professionals who’ve navigated multiple credit cycles, interest rate environments and market dislocations,” says Devereux. “That institutional memory is invaluable when markets turn volatile.”

What differentiates this bench is stability and experience. Paul Malloy, Head of Municipal Bonds at Vanguard, leads a 50-person team that, as of 09/30/2025, averages 14 years of industry experience.

That deep bench can enable quick pivots when the markets turn. When the U.S. municipal bond market saw a huge influx of cash in the fall of 2023, Vanguard’s Municipals team worked to find the right opportunities among the 1 million US municipal bonds, which come from more than 50,000 state and local entities, all with their own revenue streams and risk profiles.

Vanguard’s team-based approach, fueled by its deep bench, ensures that no single individual determines portfolio success.

“Every portfolio benefits from the best ideas across our entire Fixed Income team,” Devereux says. The firm’s best insights don’t remain siloed within single funds; they’re methodically deployed across all eligible portfolios, ensuring that investors benefit from collective expertise—rather than being limited by the narrow focus of single-manager approaches in volatile markets.

The collaborative nature of this approach is especially valuable during complex market events such as Covid, when Shaykevich worked with other team leaders to identify when the Federal Reserve was likely to provide major support to the markets.

The firm’s cost discipline reflects its ownership structure. Vanguard is owned by its funds, which are owned by Vanguard’s fund shareholder clients. “We’re not trying to maximize profits for external shareholders,” Devereux explains. “Every basis point we save allows investors to keep more of their returns.”

Vanguard has built what Devereux calls “a performance and cost multiplier,” powered by industry-leading returns and accelerated by the lowest expense ratios in asset management.

Vanguard’s consistent, repeatable strategies, application of time-tested approaches across portfolios and its deep bench of experts work together to create what Devereux calls disciplined opportunism. “We’re not ‘low risk’—we are disciplined and opportunistic risk,” she says. “We take the right risk, at the right time, in the right size.”

“That approach matters, so bonds can do what they’re meant to do: provide stability, income and diversification in your portfolio,” says Devereux.

Watch Now

NOW PLAYING

Navigating Bond Market Complexity With Confidence | Presented by Vanguard

▶ PLAY NOW

NOW PLAYING

When Markets Turn, Vanguard Is Ready | Presented by Vanguard

▶ PLAY NOW

NOW PLAYING

Inside Vanguard's Credit Research Engine | Presented by Vanguard

▶ PLAY NOW

Visit vanguard.com to obtain a Vanguard fund prospectus, or, if available, a summary prospectus, which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

.png)