Technology has transformed trading—and the finance industry is now at a tipping point.

1

Trading

Goes Online

In February 1971, electronic trading is born with the launch of NASDAQ, the world’s first electronic stock market. Created by the National Association of Securities Dealers (NASD), the “AQ” stands for Automated Quotations.

Soon a byword for innovation, NASDAQ quickly becomes the world’s second-largest stock exchange, after the New York Stock Exchange, attracting high-tech and growth stocks. Around this time, AI enters the trading lexicon.

Despite the hype, early attempts to replicate human analysis fail to deliver, and the world quickly plunges into the first “AI winter” as investment in the technology dries up. However, the touch-paper has been lit and the seeds of a tech-led financial future have been sown.

In 1982, NAICO-NET, the world’s first online trading platform, is launched, opening up the world of stock trading to ordinary consumers. It starts as a tool for institutional bankers and traders, connecting trades at a breakneck speed that reduces the difference, or spread, between buy and ask prices. As an early tool attempting to democratize the stock market, NAICO-NET opens international trading to average people alongside institutional investors, almost eradicating the need for brokers. However, it is also prohibitively expensive, so online trading remains the domain of the wealthy. At this point, technology still relies heavily on human intervention, as the platform only suggests trade connections and needs a person at NAICO-NET’s offices to execute trades.

That same year, daily trading volume on the NYSE hits 100 million for the first time, setting the wheels in motion for public interest in stock trading to soar.

According to the NYSE census, by 1990, more than  20% of Americans own stocks.

20% of Americans own stocks.

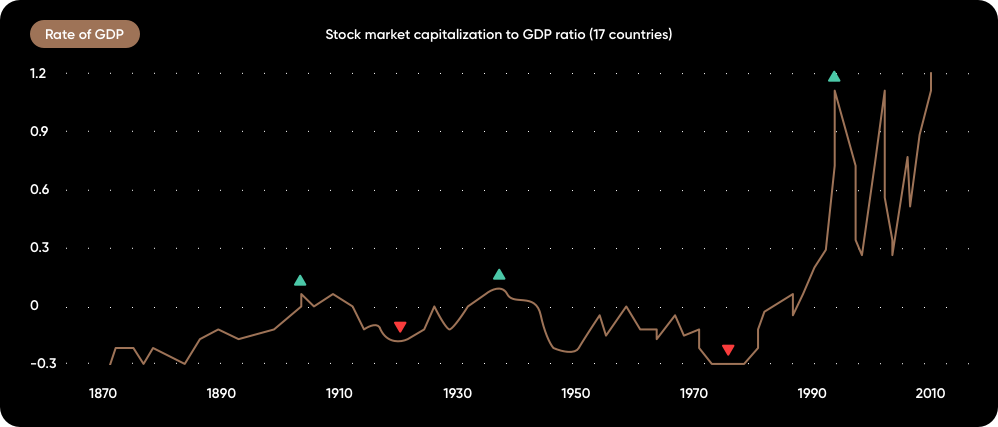

On Oct. 27, 1986, the so-called Big Bang—the day the stock market is deregulated in London—catapults the London Stock Exchange into the modern era. This spells the end of the old system of face-to-face trading, where buyers and sellers used a series of hand gestures across a trading pit—known as “open outcry”—to make trades. Electronic trading hugely speeds up buying and selling and rapidly increases the number of daily trades. The volume of trades passing through the new terminals soars, reaching $7.5 billion in value the week after the Big Bang, compared to $4.5 billion in the week just before.

Source: CEPR

2

Computers

Get Personal

While institutional investors in New York and London are going “electronic”, so are people in offices and homes. The 1975 launch of the Altair 8800, a personal computer kit that users assemble themselves, kick-starts the microcomputing revolution—and the programming language that students Bill Gates and Paul Allen write for the Altair leads them to co-found Microsoft.

In 1981, computers go mass-market when IBM launches the IBM 5150, which uses Microsoft’s MS-DOS operating system. The first PC to be widely adopted across industry, the 5150 spawns many clones and an ecosystem of software.

While laptops and netbooks start to appear in the early 1980s, it’s not until the first decade of the millennium that laptop sales overtake those of desktop computers, spurring changes in working practices as people are enabled to work anywhere.

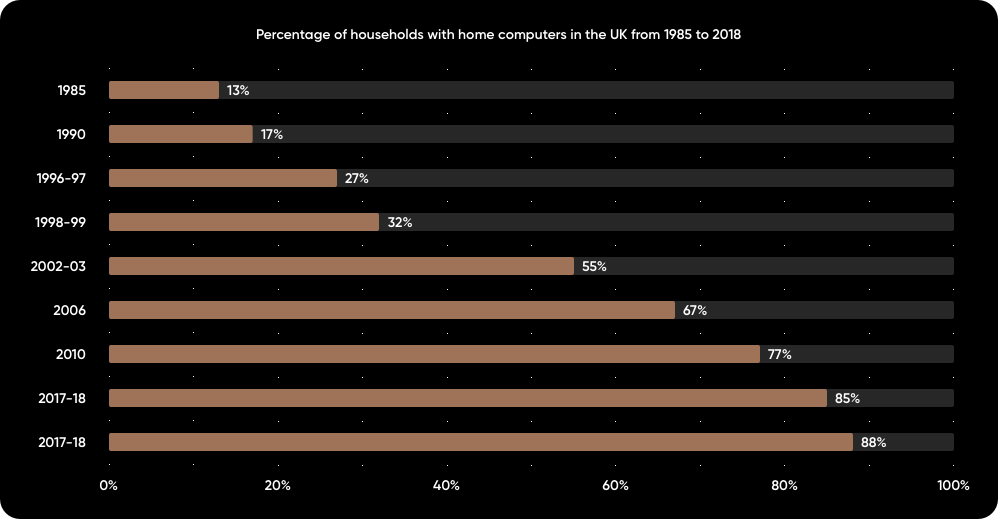

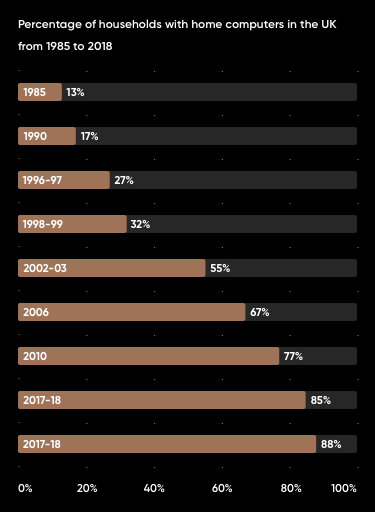

Throughout the 1990s, home computer ownership booms in the UK, with more than  50% of households owning one by 2003.

50% of households owning one by 2003.

The personal computer allows individual investors to perform statistical analyses that only institutional investors could once afford to do, and to keep records, retrieve information and test theories against historical data, all from the comfort of their own homes. However, it will be another decade before the personal computer opens doors for casual investors.

Source: Office for National Statistics (UK)

3

Weaving the

World Wide Web

In 1989, British scientist Tim Berners-Lee invents the World Wide Web while working at CERN, the particle physics laboratory in Geneva.

He affixes a handwritten note to the computer he uses to develop the code for the web, which reads: “This machine is a server. DO NOT POWER IT DOWN!!” The note does its job—and the code survives.

In 1993, CERN launches the World Wide Web software into the public domain and releases an open license, triggering the web’s massive growth.

But another innovation piques the interest of the financial world and radically changes every industry across the globe: the birth of online payments.

In 1994, the first fully online transaction between two cyberspace entrepreneurs takes place, as well as the world’s first online order, at Pizza Hut.

Amid intense interest in internet stocks, the NASDAQ Composite Index, where many tech stocks are listed, rises from 1,000 points in 1995 to more than  5,000 by 2000.

Source: Bloomberg

5,000 by 2000.

Source: Bloomberg

However, what goes up must come down, and the dot-com bubble famously bursts that year as investors realize that the business models of many internet startups are illusory. From the ashes rise Google, Amazon and other tech-stock giants that are now household names.

Greater scrutiny of internet startups follows the crash, and confidence in the sector is restored, opening up a host of new opportunities that capture the imagination of traders and dominate global markets in years to come. Rumblings of the trading potential of AI technology begin again after more than two decades of a long, cold AI winter, and the concept of “Big Data” emerges. AI works best with big data sets, which are facilitated by newly powerful computers, opening the door for its utility in financial markets.

4

A Smarter Mobile Era

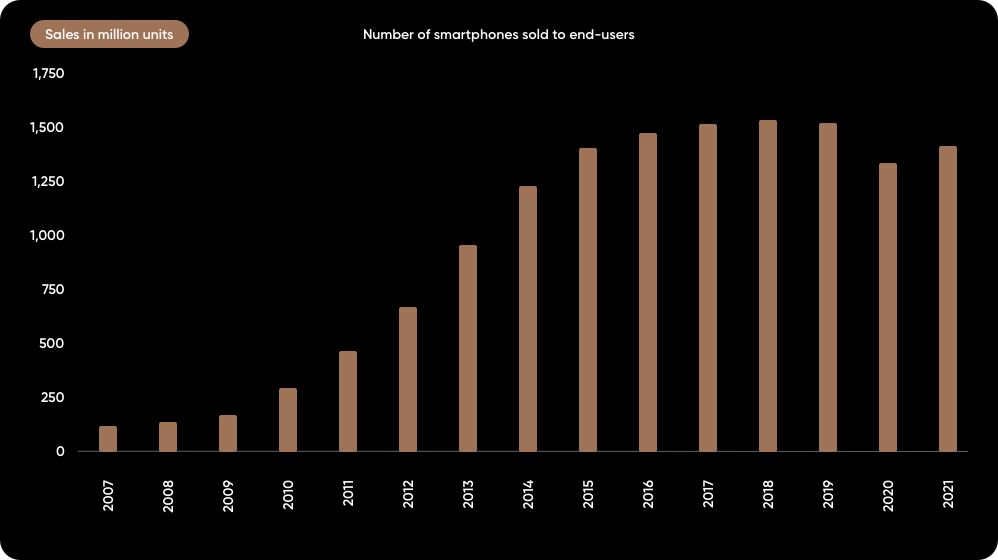

In June 2007, Apple introduces the iPhone, kicking off the smartphone era. Google’s Android mobile operating system launches within a year, and Apple’s iPad tablet is introduced in 2010.

These portable devices revolutionize internet connectivity and allow mobile payments.

Western Union, which had facilitated customer-to-customer money transfers since 1871, launches a smartphone app in 2011, enabling mobile money transfers.

4.8 hours.

The average time people spend on their smartphone each day. That's increased by  30% in the

past two years.

Source: Data.ai

30% in the

past two years.

Source: Data.ai

Over the next five years, a slew of smartphone stock-trading apps is launched, and mobile trading expands rapidly from 2018 onward. Tarik Chebib, Group Chief Revenue Officer at Capital.com, says wider access to smartphones and greater confidence in electronic trading helped mobile become a way of life for many investors.

“The adoption of mobile technology and Wi-Fi everywhere, has fueled the rise of mobile-first trading platforms such as Capital.com. This is why having an app with a good user interface is so important.”

Tarik Chebib

Source: Gartner

5

Market Cracks Reveal

New Opportunities

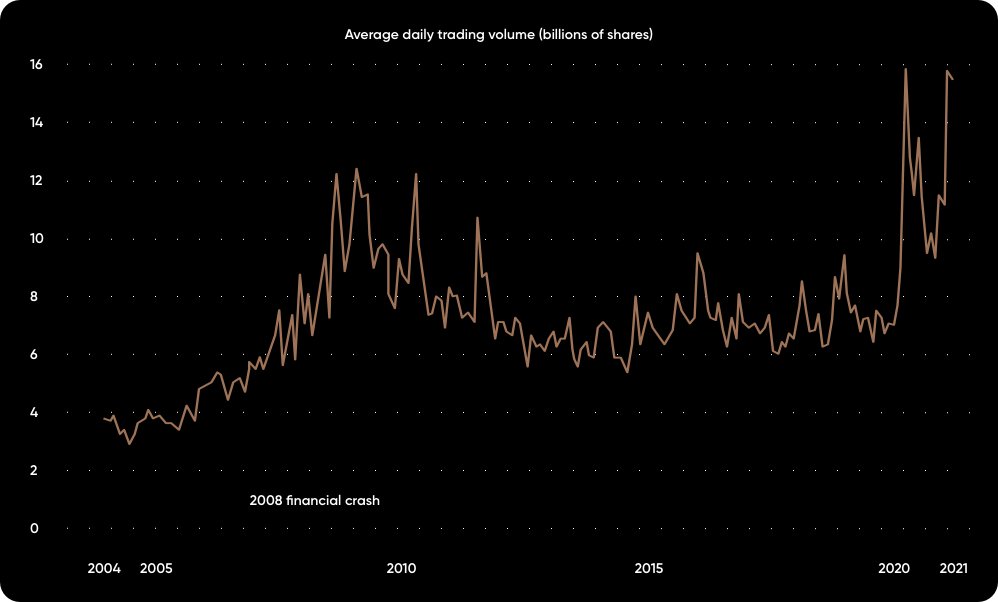

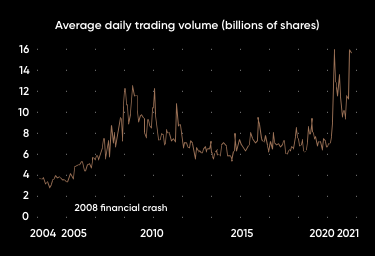

On Sept. 15, 2008, investment bank Lehman Brothers, established in 1847, collapses, ushering in the global financial crisis.

This reshapes the financial landscape and exposes widespread and longstanding malpractice within the financial sector. In the aftermath of the crash, governments pump money into assets to prevent deflation, boosting stock prices.

The crash creates skepticism about established trading practices by banks, institutions and hedge funds—and exchange-traded funds (ETFs), which allow passive investing by tracking sectors and markets, proliferate rapidly after the crash.

The lack of trust in banks leads to regulatory change, opening up the market to new providers and contributing to the rise of fintech upstarts.

With the world still reeling from the effects of the crash, a new financial vision is born. Bitcoin arrives in 2009, designed to do away with banking altogether—and it’s soon followed by other cryptocurrencies using blockchain technology. Accelerated smartphone adoption propels mobile devices to become a primary way for people to access the internet and financial services.

It’s now the age of the entrepreneur, as startups become synonymous with innovation and capture investor and consumer interest amid increased demand for new financial products and services. In 2018 alone, venture capital firms invest a total of $254 billion in 18,000 businesses around the world, an increase of 46% from the year before. New technologies from Silicon Valley and beyond make it easier to create digital banking and investment products using open banking, allowing third-party companies to access financial data. Traditional banks begin to move away from legacy systems, and “banking-as-a-service” emerges as a concept to enhance financial inclusion and improve customer experience.

As a result, the decade following 2008 sees strong growth in retail trading as more individuals are empowered to make informed financial decisions and become investors.

It’s now the age of the entrepreneur, as startups become synonymous with innovation and capture investor and consumer interest amid increased demand for new financial products and services. In 2018 alone, venture capital firms invest a total of $254 billion in 18,000 businesses around the world, an increase of 46% from the year before. New technologies from Silicon Valley and beyond make it easier to create digital banking and investment products using open banking, allowing third-party companies to access financial data. Traditional banks begin to move away from legacy systems, and “banking-as-a-service” emerges as a concept to enhance financial inclusion and improve customer experience.

As a result, the decade following 2008 sees strong growth in retail trading as more individuals are empowered to make informed financial decisions and become investors.

Source: Bloomberg Intelligence

6

The World

Goes Virtual

Starting in 2020, pandemic lockdowns force people to stay at home, changing the way they work, live and play.

Stuck indoors with time on their hands and searching for new online pastimes, many people turn to trading to learn a new skill. The popularity of retail trading apps, which allow users to conveniently trade from anywhere, soars.

In 2021, retail investors account for 23% of US equity trading volume, twice the amount in 2019 and equivalent to hedge funds and mutual funds combined. WallStreetBets, a Reddit group that discusses stocks and options trading, descends on video game retailer GameStop, causing the share price to surge by 1,500% and forcing the financial regulator to step in.

Source: Reddit

By this time, mobile and online stock market trading, using advanced machine-learning technologies like deep learning, deep neural networks and natural language processing, has become a mainstay, breaking down barriers to entry for retail investors and facilitating the decision-making process for institutional investors.

Now that technology has opened up the markets and allowed anyone with a mobile phone to gain access, how will it change and evolve again to help this new generation of self-directed traders? As investors and traders become more empowered, self-directed learning will become important— technology and education will be the next frontier.

Capital.com is harnessing technology to build a best-in-class platform that puts education and learning at the centre of everything it does. Convenience and ease-of-use is key to learning—which is why Capital.com offers traders an educational app they can use on the go: Investmate. It also provides traders with a rich and free toolkit that includes varied learning materials available on its website, app and YouTube trading channels.

But to really make a difference to a trader’s learning, the experience must be personal, which is why Capital.com is combining quality education tools with cutting-edge technology to deliver a trading platform that is truly innovative, intuitive and inspired.

“At Capital.com, we believe unique traders deserve unique experiences, bespoke to their needs. That is why we want to build solutions that help people understand, learn and ultimately master their skills.”

Peter Hetherington, Group CEO, Capital.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 84.19% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.