Across global markets, venture capitalists and investors see investment playing a central role in supporting digital transformation in the years ahead.

However, one technology is front of mind for these investors due to its ability to accelerate digital transformation: artificial intelligence. In our study, investors saw artificial intelligence as four times more important to digital transformation than blockchain and nearly five times more important than automation and cloud computing.

That excitement is apparent in the investments that they’re making. According to PitchBook data compiled for Bloomberg, the value of funding for AI companies climbed 27% globally, to $17.9 billion in the third quarter of 2023 compared to the year before.

Technologies seen as key to accelerating digital transformation

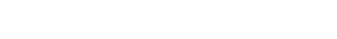

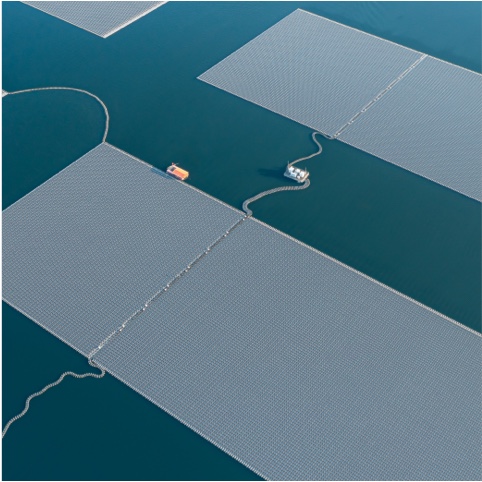

Investment opportunities in climate technology have grown beyond solar panels and batteries to include food and agriculture, the built environment and climate finance.

However, investors and venture capital leaders still see renewables and energy storage as the emerging technologies that are most important to supporting a sustainable future, outpacing sustainable infrastructure, connectivity and EVs in our survey.

Emerging technologies that are most important to achieving a sustainable future

These same two technologies—renewables and energy storage—are also seen as the ones that will attract the most investment in 2030.

That view is consistent with BloombergNEF, which says that for the world to be on track for net zero, about $1.2 trillion needs to be invested in wind and solar every year between 2023 and 2030.

But perhaps what’s most interesting is that technology has not replaced the human factor when these investors are deciding which companies to invest in. Even in this era of data and analytics, our survey reveals that investors and venture capital leaders rely first and foremost on the company management team when making an investment decision.

What tools and/or information do you use to make decisions about investing in emerging technologies?

The potential gains from emerging technologies are massive. According to Bloomberg Intelligence, the generative AI market could reach $1.3 trillion in 2032, and it is a dominant catalyst of positive estimate revisions and multiple expansion for most tech segments, including hardware, software and internet.

Top motivations for investing in

emerging technologies

Our survey reveals that investment in emerging technologies is driven by diverse motivations, including innovation, diversification, greater returns and first-mover advantage.

Overall, climate change lags behind these factors as drivers of investment in emerging technology, but not everywhere. In the US and the UK, investors and venture capital leaders list climate change as a Top 3 motivation for investing in emerging technologies.

One reason for this gap in the investment landscape around climate change could be the fear of the unknown. In our survey, investors and venture capital leaders both agree that a lack of defined standards and quality control are the biggest barriers to investment in emerging technologies

These unknowns may be driving investors toward seeking short-term returns from their emerging technology investments and discouraging them from adopting the long-term vision necessary to finance the energy transition.

That’s where the public sector comes in. Whether through policies or incentives, most respondents see governments playing a primary role in achieving a sustainable future.

Gaps in the current investment landscape that could prevent the achievement of a sustainable future

The amount of investment needed to achieve a net-zero world by 2050 is staggering. BloombergNEF estimates it could cost $196 trillion in investments for the world to reach net-zero carbon emissions by 2050, as many countries have pledged to do, to avoid catastrophic global warming.

In addition, BloombergNEF suggests annual green investments will need to nearly triple to $6.9 trillion by 2030 if we are to have any hope of hitting net zero by 2050. This transition means that consumers, businesses and government will need to swap gas-powered vehicles for EVs, and replace fossil fuel-powered energy with renewables like wind and solar, including new grids to connect them.

Emerging technologies can provide a powerful engine to drive the world toward this sustainable future. Our survey reveals a strong consensus among investors and venture capital leaders that sustainable goals are within reach and that technology will play the leading role in achieving them.

Likelihood that the world will achieve a sustainable future by 2030

- 50% Highly Likely

- 45% Likely

- 95% of respondents

agree

- 95% of respondents

- 3% Neither likely nor unlikely

- 1% Unlikely

- 1% Highly unlikely

Agreement that “Technology will play the lead role in the world achieving a sustainable future”

- 60% Completely agree

- 38% Somewhat agree

- 95% of respondents

agree

- 95% of respondents

- 2% Neither agree nor disagree

If emerging technologies really hold the promise of a sustainable tomorrow, the key question is, how? One reason for optimism is the way emerging technologies intersect with megatrends, the powerful and transformative global forces shaping our future.

Investors must take a holistic view of these megatrends to understand how they interconnect with each other and how they will be impacted by emerging technologies to reveal risks and opportunities.

Emerging Technologies

Megatrends

Connectivity & Digital collaboration tools

Digital Technologies

The widespread use of technologies involving the representation, storage, and processing of information in bits.

Renewable energy and energy storage

Climate Change

The human-induced warming of the atmosphere resulting in environmental degradation.

Health / medical technologies

Inequalities

The differences between the levels of health, wealth and opportunity across groups of people.

Health / medical technologies

Demographic Shift

The overall slowing of population growth resulting in population aging, e.g., declining fertility and increasing life expectancy.

Sustainable infrastructure

Urbanization

The increasing concentration of the world's population in cities.

This connection between emerging technologies and megatrends amplifies the positive impact of these technologies. For example, the climate change megatrend will amplify the development of emerging technologies like renewables and energy storage, while the megatrend of urbanization will create opportunities to implement sustainable infrastructure technologies.

In the investment landscape, everything is connected. The role of investment in accelerating progress is to see both the short-term challenges and long-term potential of emerging technologies and find opportunities to support those technologies that will have the most impact on tomorrow.

The future depends on it.

Mubadala’s Strategy

As a trusted partner and responsible steward, Mubadala actively engages with top-tier investors and industry leaders to invest capital and bolster the growth and innovation of our portfolio companies.

The Bloomberg Media study underscores the vital role of innovation and emerging technologies in achieving sustainability. It also highlights the pivotal role investors play in propelling these technologies forward, enhancing their economic viability, and generating positive societal impacts. Industry innovation, portfolio diversification, profitable economics, and proactive investor engagement are key motivators and drivers of success for responsible investors. The overarching theme is collaboration and partnership, aimed at jointly addressing global challenges, seizing opportunities and accelerating positive and lasting impact.

Accelerating Tomorrow

Bloomberg Media’s Future Technologies Study, sponsored by Mubadala

Download the Study