In the longer term, there is the troubling trend of governments worldwide printing money to address financial crises. The U.S. money supply—known as the M2—began expanding at a faster rate than normal with the 2008 fiscal crisis, then went almost vertical with the onset of the pandemic.

By contrast, the supply of Bitcoin isn’t controlled by politicians or policy makers. There will only ever be 21 million Bitcoins created—a factor that favors the digital currency’s appreciation. The recent spike in the M2 has happened at the same time as a spike in Bitcoin’s value. “That growth has been a reaction to the growth of the global money supply, as nations around the world have engaged in money printing in response to the COVID-19 healthcare crisis,” says Greg Cipolaro, NYDIG’s Global Head of Research.

Bitcoin

Goes Pro

How BTC Fits Into Institutional Portfolios

Section 1

A Very Short History of Bitcoin Mainstreaming

In the 13 years since the first Bitcoin was created, the digital currency has gone from a curiosity on the fringes of the financial system to an asset that has earned a place in many sophisticated portfolios. While doubters still exist, Bitcoin is now widely viewed on Wall Street as a legitimate store of value.

The Eras of Bitcoin

Because Bitcoin is an asset class unlike any other, its attributes are idiosyncratic. It has a fixed supply, serving as an inflation hedge. Even a small allocation of Bitcoin can add a large helping of diversification to a portfolio. It has had the return profile of a tech company without adding balance sheet or management risk. Bitcoin represents the opportunity to invest in an idea, rather than a company bringing an idea to life. For Bitcoin, that idea is ultimately providing the world with a sound monetary system available to all.

Below, we review the eras of Bitcoin’s development, trace the ups and downs of its trading history, and recount the major milestones on its road to the mainstream.

Developers & Hobbyists Early

Adopters Mainstream Retail Investors Institutional

Investors

Adopters Mainstream Retail Investors Institutional

Investors

The people who helped create the Bitcoin open-source monetary system — most of whom were attracted to the technical challenge or interested in the politics of a currency beyond the control of any one country — comprise the genesis of the Bitcoin investor community.

Source: Bloomberg. Daily closing prices for Bitcoin in U.S. dollars.

April 2010

A year after the first Bitcoins were mined, nascent exchanges begin to handle transactions. A single Bitcoin is priced at 3 cents.

February 2011

Bitcoin passes the $1 mark for the first time, in part because a group of Silicon Valley angel investors were inspired enough by the technology to begin purchasing the cryptocurrency.

June 2011

Prices rocket to $30, following publicity over the Dark Web’s Silk Road site, where Bitcoin was accepted as currency. But those prices drop back to the single digits by August after profit-taking. It’s the first of the digital currency’s many peaks and troughs, and the most stomach-churning, with a drop in value of over 90%.

April 2013

Prices hit $100, then pass $200 just eight days later. At the time, the rise is believed to be caused by a proposal by the government of Cyprus to tax every bank account, which leads individuals in EU countries facing economic challenges to move some of their money into Bitcoin. Later, attention shifts to the April announcement by Tyler and Cameron Winklevoss—who famously sued Mark Zuckerberg, alleging he stole the idea for Facebook—that they have purchased $11 million in Bitcoin.

November 2013

Prices again double in about a week, going past $1,000. Chinese investors, trying to evade capital controls, are thought to be behind the rise. Research conducted years later suggests that the spike was caused by a single shadowy trader who bought 600,000 Bitcoins. In any case, the run-up in value attracts venture capital money to companies creating the Bitcoin ecosystem; in 2014, they raise $315 million in funding—three times as much as in 2013.

April 2014

In a move that reflects growing interest in the digital currency on Wall Street, the Bloomberg terminal begins offering Bitcoin pricing. The announcement comes with a caveat: “Bitcoin may be the biggest technology innovation since the internet or a fad whose crash will be as precipitous as its meteoric rise.”

December 2017

Having finally revisited the $1,000 mark in January, Bitcoin goes on a year-long tear, rising to a high of over $19,000. Bitcoin futures start trading on the CBOE and CME late in the year, further democratizing the digital currency. Retail investors are believed to be behind the boom, along with exploding media coverage of Bitcoin.

March 2020

The year’s closing low of $4,900 comes in mid-March, as the pandemic gets underway. But with governments and central banks printing money in historic amounts, Bitcoin as an inflation hedge gains acceptance. Bitcoin blows past its 2017 all-time high of $19,041, reaching a record $28,996 by December 31.

April 2021

As institutional investors pile into Bitcoin in a major way, its ascent barely takes a breath. New all-time highs are set nearly every day on a march to $63,410. The rise is helped along by a series of major corporations taking a position—most notably Tesla, which in February buys $1.5 billion in Bitcoin and announces it will accept it as payment.

September 2021

After Bitcoin declines by almost half from its April high and then begins another rally, Bloomberg Intelligence predicts it is headed to $100,000. “Portfolios of some combination of gold and bonds appear increasingly naked without some Bitcoin,” it says.

Source: Bloomberg. Daily closing prices for Bitcoin in U.S. dollars.

How Bitcoin

Went Mainstream

Went Mainstream

What has drawn institutional investors to Bitcoin, rather than other cryptocurrencies and digital assets? NYDIG has identified a set of unique characteristics that collectively create very strong network effects. They include:

1

Bitcoin’s limited supply—there will only ever be 21 million Bitcoins created—is colliding with increased demand to push prices higher.

2

Adoption of Bitcoin is at an all-time high, with the number of addresses that hold Bitcoin—the best proxy there is for the number of investors—at 25.6 million. (Because some of those addresses are for exchanges, the total number of investors is almost certainly in the hundreds of millions.)

3

Engagement with the cryptocurrency is also rising, with the number of unique daily active Bitcoin addresses approaching 900,000.

4

Investors are holding Bitcoin for longer periods, with 63% of the total supply having been held for at least one year.

5

As the first digital currency, Bitcoin has established a lead that will be difficult for any competitor to overcome. The first-mover advantages that play out in technology companies also are evident in digital currencies.

As Bitcoin adoption has grown, so has its price. A NYDIG analysis found that Bitcoin’s market cap has tracked the square of the number of network addresses 93.8% of the time. Using that insight, they calculated the model price for Bitcoin on a logarithmic scale and compared it to the actual price. The resulting lines follow a similar path.

Bitcoin's Model Price vs Actual Price

Source: Glassnode, NYDIG

Section 2

Why Institutions Are Investing in Bitcoin

Institutional investors aren’t monolithic, and each is motivated by their own goals and objectives. But across the different types of institutional investors, there has clearly been an accelerating interest in Bitcoin.

Each investor type has found that Bitcoin provides a solution for the unique challenges they face. For some, Bitcoin is an inflation hedge, and for others, Bitcoin’s superior risk-adjusted returns are the allure. Consequently, banks and wealth managers have been building Bitcoin products to meet client demands.

Here are some of the headline-grabbing Bitcoin moves made by major companies, financial institutions, and countries in recent years:

Month

January 2014

Price of a Bitcoin

$833

TigerDirect and Overstock.com become the first large retailers to accept Bitcoin as payment.

Stepping back from the headlines to look at the trend, as of the end of September 2021, there were 2,171 unique addresses that each held over 1,000 Bitcoins—about $45 million worth at September 30 prices. That is up 32% since the start of 2018, but still represents just the “very, very earliest stages of institutional adoption,” according to Greg Cipolaro, NYDIG’s Global Head of Research.

Number of Addresses with Large Balances

Source: Glassnode, NYDIG

Motivations for investing in Bitcoin vary among institutional investors, even within each category, according to NYDIG’s Cipolaro. But in general terms, here are the motivations that tend to predominate in each category:

Institutional Investor Category Primary Motivation for Investing in Bitcoin

Corporate Treasurers Hedging corporate capital against inflation risk

Commercial Banks Providing products like savings accounts and credit cards denominated in Bitcoin rather

than dollars

Mutual Funds & ETFs Meeting investor demand for an easier way to invest in Bitcoin

Insurance Companies Meeting long-dated obligations

Hedge Funds Realizing high risk-adjusted returns

Pension Funds Increasing total returns

Endowments & Philanthropies Increasing returns and diversifying portfolios

Traders Providing trading opportunities at a time when volatility of more traditional

categories is suppressed

Section 3

Factors Institutions Consider

While an investment’s appreciation and volatility are important, they are only two of a mosaic of factors considered by institutional investors with a range of objectives. Some of Bitcoin’s characteristics are positive for one investor and may be a hindrance for another. Here’s how each of those factors favor or disfavor investments in Bitcoin.

Back

Next

1

Appreciation

2

Volatility

3

Risk-Adjusted Returns

4

Inflation

5

Demand

6

Time Horizon

7

Liquidity

8

Tax Treatment

9

Regulation Risk

10

Custody

11

Environmental Impact

12

Social Impact

13

Transaction Fees

14

Governance Impact

15

Ordinary Currency Use

Section 4

Bitcoin v. Other Assets

Given the multitude of factors discussed above that institutional investors consider when building their portfolios, it is no surprise that there is no single definition of Bitcoin’s proper place in these portfolios.

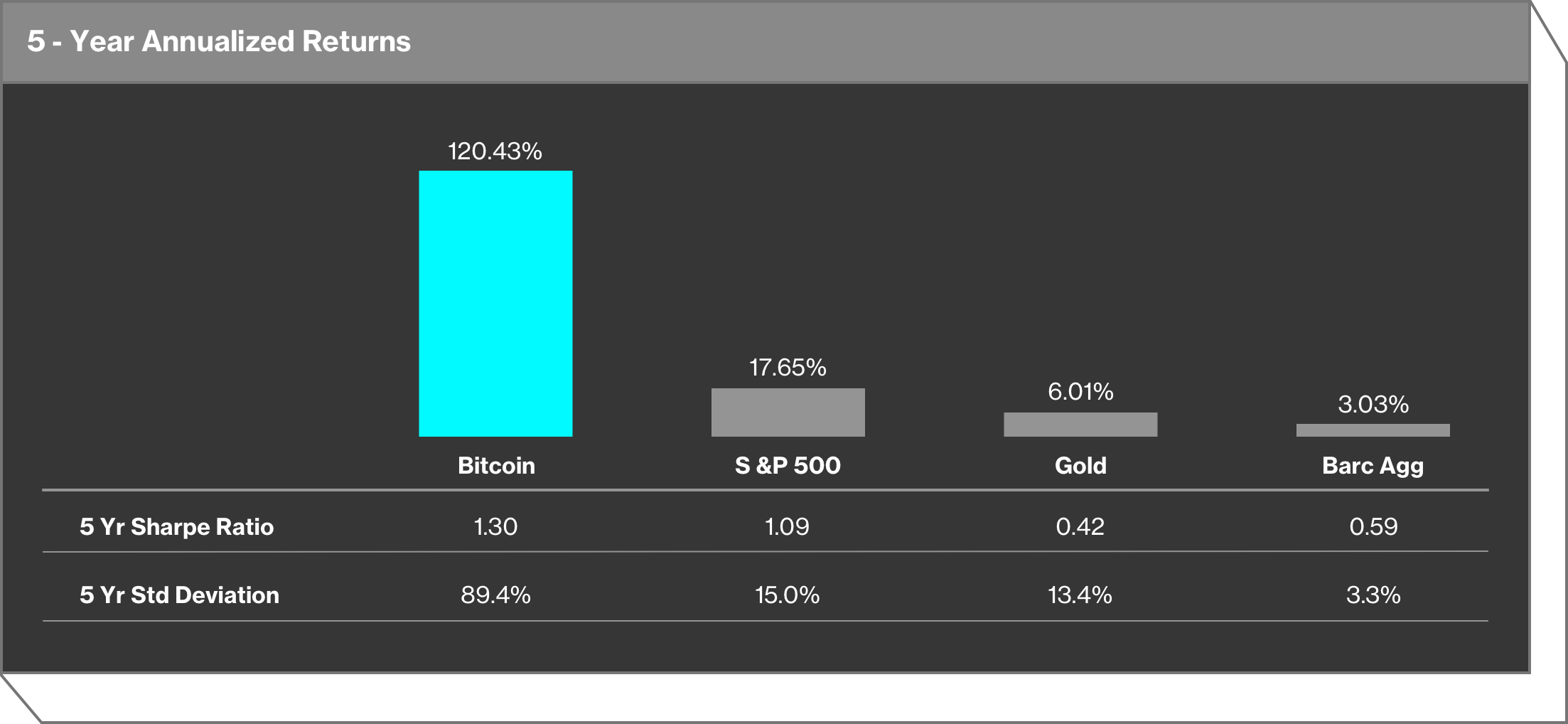

Annualized total return provides a starting point to analyze the role of Bitcoin in an institutional portfolio. Notably, Bitcoin’s return has outpaced by a wide margin that of all other major types of investments, on an annualized basis, over the past one, three and five years.

1 Year 3 Years 5 Years

302.83% Bitcoin

88.50% Bitcoin

141.63% Bitcoin

42.90% Commodities

19.06% Large Cap US Stocks

18.66% Large Cap US Stocks

40.95% Emerging Markets

18.01% All US Stocks

18.05% All US Stocks

35.54% Real Estate

13.23% Gold

10.88% Intl. Stocks

33.64% All US Stocks

12.38% Emerging Markets

10.83% Emerging Markets

31.61% Large Cap US Stocks

10.58% Art

7.95% Art

25.94% Intl. Stocks

10.33% Intl. Stocks

6.41% Hedge Funds

18.37% Hedge Funds

8.86% Real Estate

5.68% Gold

15.16% Art

7.27% Hedge Funds

5.10% Real Estate

0.52% Intl. Bonds

5.43% US Bonds

3.71% Commodities

-0.08% US Bonds

4.56% Intl. Bonds

3.11% US Bonds

-1.23% Fiat Currencies

3.94% Commodities

2.47% Intl. Bonds

-8.79% Gold

-1.01% Fiat Currencies

-0.78% Fiat Currencies

Source: Bloomberg analysis of market data. Annualized returns calculated on monthly periods ending August 31, 2021, except for Art, which ends December 31, 2020.

Proxies for each type of investment:

All US Stocks

The Bloomberg US 3000 Total Return Index is a float market-cap-weighted benchmark of the 3,000 most highly capitalized US companies.

Art

The Masterworks.io Post-War and Contemporary Art Index is price weighted and uses repeat-sale pairs, which track objects that have been sold at least twice at public auction. By examining price fluctuations of the same object, the index controls for qualitative factors and allows the calculation of returns. Returns are weighted on purchase price.

Bitcoin

Bloomberg chart of the price of 1 Bitcoin in U.S. dollars.

Emerging Markets

The Bloomberg Emerging Markets Large, Mid & Small Cap Total Return Index is a float market-cap-weighted equity benchmark that covers 99% of the market cap of the measured market.

Commodities

The Bloomberg Commodity ex-Precious Metals Total Return Index excludes futures contracts from the precious metals sector.

Fiat Currencies

The Bloomberg Dollar Spot Index tracks the performance of a basket of 10 leading global currencies versus the U.S. dollar. The weight of each currency in the basket is determined annually based on its share of international trade and FX liquidity.

Gold

The Bloomberg Composite Gold Index is comprised of 76% Bloomberg Gold Tracker Total Return Index and 24% iShares Gold Trust. The Composite Gold Index is composed of liquid exchange-traded gold futures, and the Gold Trust is made up primarily of gold held by a custodian on behalf of the trust.

Hedge Funds

The Bloomberg All Hedge Index represents the average performance of hedge funds.

International Bonds

The Bloomberg Global Aggregate Index is a flagship measure of global investment-grade debt from 24 local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed-and emerging-market issuers.

International Stocks

The Bloomberg World ex North America Large, Mid & Small Cap Total Return Index is a float market-cap-weighted equity benchmark that covers 99% of the market cap of the measured market.

Large Cap US Stocks

The Bloomberg US Large Cap Total Return Index is a float market-cap-weighted benchmark of the 500 most highly capitalized U.S. companies.

Real Estate

The Bloomberg US Real Estate Large, Mid & Small Cap Price Return Index is a float market-cap-weighted equity benchmark that covers 99% of the market cap of the measured market.

US Bonds

The Bloomberg US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate pass-throughs), ABS and CMBS (agency and non-agency).

In addition to total return, leading factors institutional investors typically consider include:

Time Horizon

It’s next to impossible to predict Bitcoin’s trading range in the near term, but unlike a fiat currency or even a stock, we know how much Bitcoin will ever be created, and that additions to its supply are declining over time. Also, its trading history over a period of years has demonstrated market-beating returns.

Inflation

In the inflationary cycle that economies appear to be entering, Bitcoin’s limited supply can serve as a hedge.

Liquidity

Bitcoin’s market cap, which stood at approximately $800 billion in mid-September, is larger than that of all but a handful of U.S. companies, making it easy to trade. And unlike a company stock, it’s traded 24/7/365 without interruption.

How Much Should One Invest in Bitcoin?

The amount of Bitcoin that an institutional investor should buy will depend on all those factors above, and others. Running scenarios using a portfolio model can provide a guide to how much additional return even a small amount of Bitcoin might produce.

Taking the classic 60% stocks/40% bonds portfolio as an example, what would adding 1% increments of Bitcoin, and reducing allocations of stocks and bonds by 0.5% each to make way, do over the past five years to the portfolio’s risk-adjusted returns, as measured by the Sharpe Ratio?

60/40 Portfolio Sharpe Ratios

Source: Bloomberg analysis of market data. Model portfolio composed of 60% Bloomberg US Large Cap Total Return Index and 40% Bloomberg US Aggregate Bond Index. Performance from Jan. 1, 2017 through Sept. 15, 2021.

For this portfolio, the risk-adjusted returns begin to level out at an allocation of about 15% Bitcoin. But one need not reach that level to see significant increases in returns. In fact, the biggest boost to returns is at the lowest levels of Bitcoin allocation: Going from 0% to 1% Bitcoin increases risk-adjusted returns by 9%, and going from 1% to 2% boosts it by almost another 8%.

Section 5

Coin of the Realm?

The notion that Bitcoin can move beyond merely functioning as a store of value for investors to become a currency that ordinary citizens use in daily transactions has always been at the core of its promise. If it were to do so, that would also greatly reinforce the value proposition of Bitcoin as an investment.

The idea of Bitcoin as a daily carry has always been a tough sell to observers in Western nations, where fiat currencies are relatively stable and highly valued, compared to most other nation’s currencies. Why would someone take the trouble to buy a cup of coffee with Bitcoin, when the dollar, pound or euro in your pocket today does that perfectly well? That skepticism is reinforced by the volatility of Bitcoin relative to those Western fiat currencies. In the time it takes to buy a cup of coffee, the Bitcoin in your pocket could rise or fall significantly.

But for people in nations where currencies are subject to hyperinflation, and are valued lower than Western currencies, Bitcoin’s volatility can appear tame in comparison to the downward trajectory of the fiat currency. In those places, Bitcoin is already being seen as a means to help people maintain their businesses, feed their families and preserve wealth in turbulent times.

Saifdean Ammous is one of these people. An author and professor who taught economics for 10 years at the Lebanese American University north of Beirut, Ammous saw firsthand how currency devaluation can affect people and economies. It made him a Bitcoin true believer. “Bitcoin has absolutely saved my life, no exaggeration,” he says.

Ammous arrived in Lebanon in 1998 to undertake undergraduate studies. It was just eight years after the end of the Lebanese civil war. The Lebanese pound was recovering from a post-civil-war plunge that had cut its value; it took 2,527 pounds to buy a single U.S. dollar in 1992.

At the time Ammous became an economics professor at the Lebanese American University in 2009, Bitcoin was in its infancy. He recalls taking a dim view of the cryptocurrency at first. In 2013, the Silk Road platform—on which illegal drugs were bought and sold with Bitcoin—was shut down by various government agencies. But rather than depress the price of Bitcoin, it rose in value -- proving to Ammous that it was already more than just a currency for the underworld.

In 2017, as Bitcoin grew in value, Ammous believed it had become a functional alternative to central banks, and he used it as such. Before the three-decade economic bubble began to unravel, he moved his funds from Lebanese pounds to Bitcoin. In 2018, he published The Bitcoin Standard, which outlined the case for the Bitcoin network as a decentralized technological alternative to central banks.

Ammous left his job in Lebanon in 2019, as the country became embroiled in protests over economic turmoil and government corruption. Bitcoin allowed him to move his retirement account out of the country when Lebanon enacted capital controls. “Had I not been into Bitcoin, I would have had my savings entirely in the Lebanese banking system. I would have been wiped out,” he says.

By 2021, the Lebanese currency had lost more than 95% of its value compared to the U.S. dollar. But Bitcoin holders were protected from the crash. The few students and friends who listened to Ammous still send emails thanking him for introducing them to Bitcoin, and talk about the difference it has made in their lives. Ammous now teaches courses on Bitcoin and economics on his online learning platform.

Ammous’ experience isn’t unique. Bitcoin is increasingly becoming a financial lifeboat for people in nations on the fringes of the world economy. Here are some of the places it’s seeing the most extensive adoption:

1

Vietnam

Despite the government declaring Bitcoin illegal, Vietnam tops the 2021 Chainalysis Global Crypto Adoption Index. While some shops in Ho Chi Minh City accept Bitcoin, it is primarily used as an investment vehicle to protect against devaluation of the fiat currency. Value of 1 Vietnamese Dong in dollars: $0.000044

2

Nigeria

Sub-Saharan Africa’s Bitcoin trading volume is rivaled only by North America’s, and Nigeria is a hotbed. Political unrest and rampant inflation are driving adoption. Value of 1 Nigerian Naira in dollars: $0.0024

3

Afghanistan

The chaos, oppression and economic upheaval in the wake of the recent U.S. pullout have created strong Bitcoin demand. Some believe that Bitcoin will play a vital role in countering cash shortages and asset seizures by the Taliban. Value of 1 Afghan Aghani in dollars: $0.011

4

El Salvador

In 2021, El Salvador became the first nation to officially adopt Bitcoin as legal tender and require businesses to accept Bitcoin as payment. Despite some technical glitches and protests, the government said that as of Sept. 21, it had equipped 25% of its citizens with digital wallets. The U.S. dollar had been used as the country’s sole currency since 2001.

5

Ukraine

With a burgeoning tech sector and popular efforts to stamp out government corruption, Ukraine has been receptive to cryptocurrencies. Digital currency is now accepted at hundreds of businesses across the nation, helping lift Ukraine to the No. 4 position on the Global Crypto Adoption Index. The nation officially legalized Bitcoin in September 2021. Value of 1 Ukraine Hryvnia in dollars: $0.038

Addressing Roadblocks to Further Adoption

Bitcoin was built to favor security over speed. Consequently, it can sometimes take as much as an hour to process a payment, which has hindered day-to-day use of the cryptocurrency. Entrepreneurs have built what’s known as a “second layer” of applications that can sit on top of the Bitcoin blockchain to speed up transactions.

The Lightning Network, one of the leading such applications, is a payments system that allows transactions to occur off the blockchain much more quickly and for lower fees. El Salvador is using it to speed daily transactions and remittances. Setting up the channel with a retailer can take up to an hour on Lightning. But once’s that’s done, here’s how a cup of coffee gets purchased on the Lightning Network versus the traditional Bitcoin blockchain:

Faster Transactions

Lightning: Customer opens a payment channel with a coffee shop that allows instant transactions to buy a cappuccino. They can keep this channel open indefinitely.

Bitcoin blockchain: Customer and shop owner have to wait for their small transaction to move onto the Bitcoin blockchain.

Lower Costs

Lightning: Customer and shop avoid high fees by keeping transactions off the blockchain until the channel is closed. Once that happens, all of the small transactions are consolidated into one transaction to save time and money.

Bitcoin blockchain: With the average transaction fee at around $3, it’ll cost you about the same as a cup of coffee to make your payment for your coffee, and that cost can go up as more transactions are made on the blockchain.

Bigger Scale

Lightning: The application allows the kinds of transaction levels that credit cards have, making a payments system practical and scalable.

Bitcoin blockchain: The blockchain only has room for a limited number of transactions to be validated, so it can’t scale up to handle day-to-day transactions.

For all of its promise, the Lightning Network still has some problems to tackle—among them the possibility that payment channels could be vulnerable to scams. When a payment channel is opened, a nefarious party could attempt to close it, steal the funds and disappear offline. And regulators, whether they understand the network or not, may step in to create laws that could affect privacy, or lead to slower transactions and higher fees.

But the development of Lightning and other second-layer applications will make Bitcoin as a real coin of the realm a technical possibility. And if that were to happen in more countries around the world, it would have an enormous effect on the value of the cryptocurrency—both for daily users and for institutional investors.

Message from New York Digital Investment Group: This content has been prepared solely for informational purposes, and does not represent investment advice or provide an opinion regarding the fairness of any transaction nor does it constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment. strategy. Bitcoin investments have historically been highly volatile, and are for investors with a high risk tolerance. Investors in bitcoin could lose the entire value of their investment.