Taking the Journey To Net Zero

presented by

The time to act is now. How can we reach net zero emissions by 2050? Keeping the world habitable for future generations requires a transition to more sustainable energy sources. There are many possible pathways to reduce emissions and help limit global warming to 1.5°C. None of them will be easy. The decisions we make now could have far-reaching consequences. How can we reach net zero? Explore three different paths to net zero by 2050 based on modelling of public figures and proprietary data and insights from Bloomberg New Energy Finance (BNEF) and UBS insights and research.

Choose Your Path

BNEF’s green scenario prioritizes clean energy, where renewable energy makes up 85% of primary energy production in 2050, complemented by green hydrogen produced from water, using electrolyzers powered by wind and solar.

scenario

The transition to green

renewables

as primary

energy

43% point

43% pointincrease on 2021

Fuel mix: the power of

wind and solar

Today, fossil fuels provide 83% of our primary energy, but in this scenario, wind and solar power will lead the way. With falling production costs, improving efficiencies and policies that encourage the development of wind and solar farms, these clean energy sources are predicted to grow from providing 15% of global energy demand in 2030 to 70% by 2050.

This means adding as much as 505 GW of wind and 455 GW of solar capacity, along with 25 GWh of battery storage every year to 2030. That equates to more than five times the amount of wind power capacity added in 2020, three times the amount of solar and 26 times the amount of battery storage.

At the same time, more than 100 GW of coal-fired capacity needs to retire on average each year, so that by 2030 coal-fired power is about 70% below 2019 levels.

The good news is that it is now cheaper to build new renewables from scratch than operate existing coal and gas plants in a growing number of countries, including China, India and much of Europe, while wind or solar power are the cheapest form of new-build electricity generation in almost all major markets, covering two-thirds of world population, some 77% of global GDP, and 91% of all electricity generation.

The year when fossil-fuel power generation is overtaken by zero-carbon sources.

Source: BNEF New Energy Outlook, 2021GW

amount of renewable energy needed every year for the next three decades.

amount of renewable energy needed every year for the next three decades.

Outlook, 2021

Emerging technologies

Alongside wind and solar, developing technologies including new hydrogen-fired, combined-cycle and open-cycle turbines will emerge toward the end of the decade, eventually accounting for 5.5 TW of capacity in 2050. This is roughly the same size as all the coal, gas, nuclear and hydro power stations running in the world today put together.

Hydrogen must scale rapidly, although its role in abatement is limited in this decade. New demand for hydrogen in 2050 is 1,318 million tons in the Green Scenario, where it increases to around 22% of total final energy consumption, compared with less than 0.002% today. 1.9 TW of electrolyzers will need to be deployed by 2030 to kickstart the hydrogen sector.

Sector Focus

Transportation

- Electrification of vehicles accounts for 42% of total emissions reductions. Hydrogen accounts for 19%.

- Hydrogen-powered flight begins to emerge from 2030, reaching 55% penetration in 2050, while the share of sustainable aviation fuel (SAF) grows to 39%.

Buildings and infrastructure

- 186 million households install heat pump systems by 2030, increasing to 1.4 billion by 2050.

- Hydrogen grows and makes up 12% of final energy use in buildings in 2050.

Industry and manufacturing

- Hydrogen-based heat replaces around 43% of fossil fuel use in industry by 2050.

- The shift to hydrogen for primary steel production accounts for up to 92% of emissions reductions and 77% of final energy demand in 2050.

Investment opportunities

To realize the ambition of a net-zero future will require huge capital inflows. Annual investment in energy infrastructure will need to more than double, from around $1.7 trillion per year today, to somewhere between $3.1 trillion and $5.8 trillion per year on average over the next three decades.

New investment in wind and solar capacity has been flat at around $300 billion per year for several years. According to BNEF, this needs to rise to between $763 billion to $1.8 trillion per year between 2021 and 2030 to get on track for net zero.

Green scenario investment breakdown

UBS Insights

Green Scenario

UBS Insights

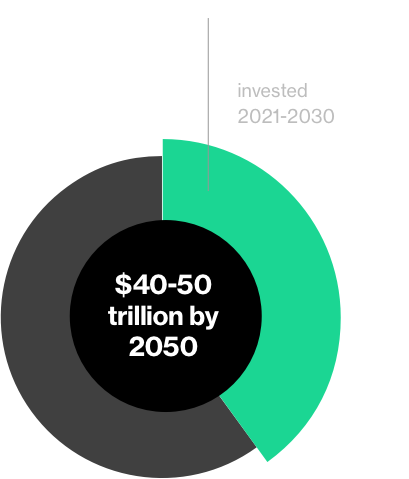

Based on IRENA calculations1, we expect about $40–50 trillion of global energy transition investments in the years 2021–30 alone, representing 40% of the total over the next three decades, funded by lending, debt, and equity (public and private). We believe this offers attractive investment opportunities for investors.

Companies that provide technological solutions to climate change challenges can expect to benefit, whereas those that are too slow to adapt could see rising costs and a loss of competitiveness.

Source: UBS Chief Investment Office GWM, Leading the way to net-zero — Global Greentech investment opportunities, 20 Oct. 2021

Investment in the

Global Energy Transition

Using China as a test case, we estimate the cost of producing green hydrogen is set to drop 75% by the end of this decade and another 50% by 2050. The versatility and range of applications of hydrogen means it could be an important part of the world’s decarbonization efforts.

Source: UBS, Q-Series, Green hydrogen: production to pump - how to navigate an emerging multi-US$trn value chain? 5 Aug. 2021

Reducing carbon emissions at a time when global energy demand is rising means that increased energy efficiency will be essential. Clean electricity will play a key role across all sectors—from transport and buildings to industry—and is essential to producing low-emission fuels such as green hydrogen. To achieve this, total electricity generation is expected to increase over 2.5 times between today and 20502.

Decarbonizing the production of electricity is therefore the largest opportunity for reducing CO2 emissions. While wind and solar energy have already become cost competitive with fuel-based or nuclear power electricity generation in many countries, expected further cost declines should soon make them the cheapest way to produce electricity.

Source: UBS Chief Investment Office GWM, Leading the way to net-zero — Global Greentech investment opportunities, 20 Oct. 2021

The investment opportunities in greentech

We see the biggest short-to-medium-term investment opportunities in five areas:

- Clean energy

- Energy efficiency, digitalization

- Electrification, batteries

- Bioenergy

- Green financing

Over the longer term, we expect new investment opportunities in technologies like:

- Hydrogen

- Carbon capture, utilization, and storage

Time to mass adoption

Enabling technologies

- Clean energy

- Energy efficiency, digitalization

- Electrification, batteries

- Bioenergy

- Hydrogen

- Carbon capture, utilization, and storage (CCUS)

- Other (e.g. green financing)

Most (and least) favored markets for the energy transition

| Most Favored | Least Favored | |

|---|---|---|

| Clean Energy Generation |

Renewable equipment manufacturers (wind, turbines, solar panels, hydro) | O&G equipment, fossil-fuel generation |

|

Infrastructure (Grid, Storage, Hydrogen) |

HV / MV equipment makers, battery storage, electrolyzers, other hydrogen equipment | |

| Transport | Rolling stock + rail equipment makers, marine decarbonization solutions, battery makers | Airlines, traditional truck OEMs, ICE suppliers |

| Buildings | Energy efficiency solutions in HVAC, LV products | Traditional construction equipment manufacturers |

| Industry | Automation solutions, electric mining equipment, electric power tools, efficiency equipment | Combustion engine-based equipment makers / suppliers |

Clean Energy

Generation

Renewable equipment manufacturers (wind, turbines, solar panels, hydro)

O&G equipment, fossil-fuel generation

Infrastructure

(Grid, Storage, Hydrogen)

HV / MV equipment makers, battery storage, electrolyzers, other hydrogen equipment

Transport

Rolling stock + rail equipment makers, marine decarbonization solutions, battery makers

Airlines, traditional truck OEMs, ICE suppliers

Buildings

Energy efficiency solutions in HVAC, LV products

Traditional construction equipment manufacturers

Industry

Automation solutions, electric mining equipment, electric power tools, efficiency equipment

Combustion engine-based equipment makers / suppliers

Based on The New Energy Outlook (NEO), BloombergNEF’s annual long-term scenario analysis on the future of the energy economy. In practice, we will probably see a mix of these solutions as each country pursues climate strategies that best suit them, considering their existing domestic economy, international trade and geopolitics. Country-specific climate pathways will be one focus of subsequent iterations of the New Energy Outlook.

Important Information About Sustainable Investing Strategies: Sustainable Investing strategies aim to consider and incorporate environmental, social and governance (ESG) factors into investment process and portfolio construction. Strategies across geographies and styles approach ESG analysis and incorporate the findings in a variety of ways. Incorporating ESG factors or Sustainable Investing considerations may inhibit UBS’s ability to participate in or to advise on certain investment opportunities that otherwise would be consistent with the Client’s investment objectives. The returns on a portfolio consisting primarily of sustainable investments may be lower or higher than portfolios where ESG factors, exclusions, or other sustainability issues are not considered by UBS, and the investment instruments available to such portfolios may differ. Companies, product issuers and/or manufacturers may not necessarily meet high performance standards on all aspects of ESG or Sustainable Investing issues.These materials have not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. They are published solely for informational purposes and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments or to participate in any particular trading strategy. The recipient should not construe the contents of these materials as legal, tax, accounting, regulatory, or other specialist or technical advice or services or investment advice or a personal recommendation. No representation or warranty, either express or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein except with respect to information concerning UBS, nor is it intended to be a complete statement or summary of the securities markets or developments referred to in these materials or a guarantee that the services described herein comply with all applicable laws, rules and regulations. They should not be regarded by recipients as a substitute for the exercise of their own judgment. Any opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by other business areas or groups of UBS as a result of using different assumptions and criteria. UBS is under no obligation to update or keep current the information contained herein, and past performance is not necessarily indicative of future results. Neither UBS nor any of its directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of these materials or reliance upon the information contained herein. Additional information may be made available upon request. Not all products or services described herein are available in all jurisdictions and clients wishing to effect transactions should contact their local sales representative for further information and availability.

© UBS 2022. All rights reserved.

Bloomberg and UBS AG are not affiliated.

Coal and gas maintain a 10% and 9% share of final energy consumption in 2050, thanks to carbon capture and storage technology. Oil drops to 10% in this scenario from 42% today.

scenario

The transition to gray

fossil fuels

as primary

energy

43% point

43% pointdecrease on 2021

Fuel mix: carbon capture

offers outlet for coal

The energy supply crisis at the end of 2021 coupled with the determination of major economies, including China and India, to continue with large-scale infrastructure development, showed how difficult ending the dependence on fossil fuels will be. In the gray scenario, CCS means a revival for coal. By 2050, there is 1.7 TW of coal-fired power using CCS, which is almost as much as today’s global coal capacity combined. Oil, however, is in significant, long-term decline.

But unabated coal generation, which isn’t mitigated with CO2 reduction technology, will suffer. Thanks to the rapid decarbonization required to meet carbon emission targets, it will fall as much as 72%. But renewables will help fill the gap, led by solar PV with 7.3 TW and onshore wind with 5.6 TW deployed by 2050.

of today’s coal installed capacity will be offline by 2050.

Source: BNEF New Energy Outlook, 2021GW

average addition of renewable energy needed every year to reach net zero.

average addition of renewable energy needed every year to reach net zero.

Outlook, 2021

Emerging technologies

The IPCC’s Sixth Assessment report was ‘code red’ for humanity. The UN panel of experts made it clear that to keep the 1.5°C climate pledge, reducing emissions is not enough; we must also remove billions of tons of CO2 that is already in the atmosphere. Carbon capture with permanent storage (CCS) or utilization of the captured CO2 (CCU) are both useful tools for reducing emissions.

In the gray scenario, CCS would be applied across a variety of processes that emit CO2, including power generation, as well as aluminum, steel and cement production. Widespread use of CCS captures over 174 gigatons of CO2 to 2050 and accounts for 18% of total emissions reductions. Although CCS does not play a meaningful abatement role in the 2020s, 936 million tons of carbon capture and storage is in place by 2030, getting it to scale is a critical task for this decade.

Bioenergy (energy made from biomass or biofuel) plays a larger role, particularly in aviation and shipping, accounting for 6% of emissions reduction in the end-use economy. Blue hydrogen helps reduce emissions in industry and transport by 4%.

Sector Focus

Transportation

- By 2050, sustainable aviation fuel fulfills 95% of jet-fuel demand.

- Biofuels supply 46% of shipping fuel in 2050, compared with 4% in 2030. On-board CCS allows oil to continue to supply 17% of final energy.

Buildings and infrastructure

- Efficient heat pumps, direct electric heaters and clean-cooking systems provide almost 75% of building emissions reductions.

- Improved building efficiency and heat pump systems reduces energy consumption by 9% in 2050.

Industry and manufacturing

- Hydrogen-based heat replaces around 43% of fossil fuel use in industry by 2050.

- CCS accounts for 46% of all industrial emissions abatement by 2050, including: 58% aluminum, 59% steel , 84% cement.

Investment opportunities

The investment for the gray scenario is lower than for green or red. This is mainly as the investment needed for fossil-fuel and CCS infrastructure is relatively lower than for hydrogen and nuclear required in the other scenarios. But reaching net zero in gray scenario still represents a $94-$99 trillion investment opportunity, including $19.4 trillion of cumulative investment in fossil fuels.

Gray scenario investment breakdown

UBS Insights

Gray Scenario

UBS Insights

The surge in coal and natural gas prices highlights the complexity of the world’s energy transition. While demand for renewables is on the rise, fossil fuels still provide most of our energy needs today. Energy prices are likely to stay volatile given insufficient investment in new oil and gas supplies, and the transition away from them is taking considerable time.

We expect coal and gas prices to peak at the turn of the year and ease in 2022, but risks remain skewed upwards as winter in the Northern Hemisphere approaches. A colder-than-normal winter, a risk we’re monitoring, could see prices shoot up again, which could weigh on the outlook for global growth.

Companies have been pursuing processes such as carbon capture, utilization, and storage (CCUS) to help decarbonize their manufacturing. Several regions, including the US and Europe, have already launched supportive regulation or the funding of projects aimed at capturing carbon emissions and storing them underground.

Given the need to significantly reduce greenhouse gases in the atmosphere over the next several decades to achieve net-zero, CCUS technologies will have a significant role to play, at least in some major markets. The US and China could be attractive markets for CCUS technology if the cost to build and operate facilities can be reduced. Even the new hydrogen economy stands to benefit, and the so-called blue hydrogen (based on fossil fuels combined with CCUS) could be an attractive way to pursue decarbonization in select regions.

Source: Leading the way to net-zero — Global Greentech investment opportunities, 20 Oct. 2021, Chief Investment Office GWM, UBS

Hard-to-abate sectors

Heavy industry (cement, steel, chemicals) is responsible for material emissions but essential to our society. The good news is that substantial abatements are not only possible, but value accretive. We believe this is one of the most misunderstood opportunities in today’s markets, both from an investor and climate point of view.

Recent steps by leading cement and steel companies suggest that heavy industry may no longer be ‘hard-to-abate.’ Success by early adopters could put pressure on peers to act. We expect the net zero race to accelerate and become the key performance differentiator in emission-intense sectors. We believe that our decarbonization framework is an important step in encouraging the transition in industries that are too important to discard.

The CCS opportunity

CCS provides an opportunity for some high emissions sectors to be transformed into a much cleaner form. Many of these technologies are available today, but investment is crucial for them to be implemented. Cement and steel manufacturing are just two examples of sectors where CCS will play a meaningful role. Additionally, shifting from fossil-fuel derived power to hydroelectric, solar or wind power will change the emission profile completely. At UBS, we want to get involved and drive positive change.

Source: UBS Asset Management, The value of a green transition: A model for including decarbonization in company valuation, 2021

Based on The New Energy Outlook (NEO), BloombergNEF’s annual long-term scenario analysis on the future of the energy economy. In practice, we will probably see a mix of these solutions as each country pursues climate strategies that best suit them, considering their existing domestic economy, international trade and geopolitics. Country-specific climate pathways will be one focus of subsequent iterations of the New Energy Outlook.

Important Information About Sustainable Investing Strategies: Sustainable Investing strategies aim to consider and incorporate environmental, social and governance (ESG) factors into investment process and portfolio construction. Strategies across geographies and styles approach ESG analysis and incorporate the findings in a variety of ways. Incorporating ESG factors or Sustainable Investing considerations may inhibit UBS’s ability to participate in or to advise on certain investment opportunities that otherwise would be consistent with the Client’s investment objectives. The returns on a portfolio consisting primarily of sustainable investments may be lower or higher than portfolios where ESG factors, exclusions, or other sustainability issues are not considered by UBS, and the investment instruments available to such portfolios may differ. Companies, product issuers and/or manufacturers may not necessarily meet high performance standards on all aspects of ESG or Sustainable Investing issues.These materials have not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. They are published solely for informational purposes and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments or to participate in any particular trading strategy. The recipient should not construe the contents of these materials as legal, tax, accounting, regulatory, or other specialist or technical advice or services or investment advice or a personal recommendation. No representation or warranty, either express or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein except with respect to information concerning UBS, nor is it intended to be a complete statement or summary of the securities markets or developments referred to in these materials or a guarantee that the services described herein comply with all applicable laws, rules and regulations. They should not be regarded by recipients as a substitute for the exercise of their own judgment. Any opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by other business areas or groups of UBS as a result of using different assumptions and criteria. UBS is under no obligation to update or keep current the information contained herein, and past performance is not necessarily indicative of future results. Neither UBS nor any of its directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of these materials or reliance upon the information contained herein. Additional information may be made available upon request. Not all products or services described herein are available in all jurisdictions and clients wishing to effect transactions should contact their local sales representative for further information and availability.

© UBS 2022. All rights reserved.

Bloomberg and UBS AG are not affiliated.

This pathway follows a similar trajectory to the Green Scenario, except that it deploys smaller, more modular, nuclear plants to complement wind, solar and battery technology in the power sector, and manufacture so-called red hydrogen with dedicated nuclear power plants.

Clean electricity accounts for 61% of total abatement to 2050. Of this, wind power makes up 41%, solar 20%, nuclear 26% and other zero-emissions power, including hydro, some 13%.

scenario

There is 7,080GW of nuclear capacity by 2050. This is about 19-times the nuclear power capacity installed globally today. Just under half of that is used to generate electricity in the end-use economy. The rest is made up of dedicated nuclear plants that power electrolyzers producing so-called ‘red hydrogen’.

The transition to red

nuclear

as primary

energy

43% point

43% pointincrease on 2021

The Red Scenario shows demand for coal, oil and gas for combustion drops to zero by 2050, replaced by renewables, electricity and hydrogen.

Coal demand (million metric tons, 6,000kcal/kg)

Source: BNEF New Energy Outlook, 2021TWh

1.5 times more electricity than is produced worldwide today.

1.5 times more electricity than is produced worldwide today.

Energy Outlook, 2021

Emerging technologies

As electrolyzer technology improves, BNEF assumes that the electricity required to produce one ton of hydrogen falls from 53 MWh today to 45 MWh in 2050. That means hydrogen manufacturing in our Red Scenario requires 59,264 TWh of electricity generation. The hydrogen in the Red Scenario translates to 1.5 times more electricity than is produced worldwide today.

Overall electricity use, including power used to make hydrogen, increases 3.7 times from 2019 levels in the Red Scenario to 96,417 TWh in 2050.

Sector Focus

Transportation

- In shipping, biofuels and ammonia derived from zero-carbon hydrogen each make up 18%-35% of emissions reductions.

- Ammonia derived from hydrogen becomes the dominant solution in shipping for new vessels post-2030, and hydrogen-fueled planes emerge for short- to medium-haul flights between 500 kilometers and 4,500 kilometers.

- By 2050, sustainable aviation fuel fulfills 39% of jet-fuel demand.

Buildings and infrastructure

- Efficient heat pumps, direct electric heaters and clean-cooking systems provide almost 75% of building emissions reductions.

- Around 186 million households install heat pump systems by 2030, increasing to 1.4 billion by 2050.

- Hydrogen grows and makes up 12% of final energy use in buildings by 2050.

- One route to decarbonize building energy is to switch from direct combustion of fossil fuels to electricity. Electricity consumption in buildings is already relatively high, with appliances, air conditioners and electric heating systems accounting for just under a quarter of final energy in residential buildings today, and more than 50% of energy in commercial buildings.

Industry and manufacturing

- Hydrogen-based heat replaces around 43% of fossil fuel use in industry to 2050.

- The shift to hydrogen for primary steel production accounts for up to 92% of emissions reductions and 77% of final energy demand in 2050.

Challenges for Nuclear

Following the reactor accident in Fukushima in 2011, nuclear energy has fallen out of favor in many markets. In Switzerland, for example, where it accounts for 36% of all electricity generation—making it second only to hydroelectric power—the electorate voted not to build any new reactors in May 2017.

Added to nuclear’s lack of support among parts of the population are challenges around profitability and a reluctance among some companies to invest. However, from a climate perspective the great advantage of nuclear technology is that no CO2 emissions are released during electricity production.

In fact, Switzerland’s electricity generation provides an insight into the benefits of this nuclear-led scenario today. It notably releases few emissions; a staggering 95% of electricity is generated CO2-free, according to the UBS Sustainable Energy for Switzerland report in Sept. 2019.

- 0.2% Wind energy

- 0.4% Wood-burning furnaces

- 0.5% Biogas

- 2.9% Photovoltaics

- 4.5% Conventional thermal power and district heating plants

- 36.1% Nuclear power stations

- 55.4% Hydroelectric

Clean energy from nuclear fusion?

We live in interesting times, and when it comes to energy transition one possibility is that we learn to capture clean energy from nuclear fusion. Last year (March 2021) Dennis Whyte, Professor of Nuclear Science and Engineering at MIT, said the university’s NET SPARC project expects to achieve net energy gain from fusion by 2025 and that commercial applications for the technology “could follow in the 2030s”.

It led analysts at UBS to report commercially viable fusion energy “could change our otherwise pessimistic outlook on global carbon emissions” and could also become a competing technology for renewable energy, which in turn may affect investor willingness to pay for wind and solar earnings “over very long time frames”.

Unlike nuclear fission, which involves splitting an atom, nuclear fusion aims to fuse atoms together through immense pressure and heat, the same process the sun uses to generate energy. Replicating the process on Earth has always required more energy to perform the fusion reaction than the energy produced, however, if this balance can be inverted and replicated at lower temperatures, known as ‘cold fusion’, the process could potentially produce limitless amounts of clean energy.

Such a development would be good news for firms focused on developing power sources that run on low-energy nuclear reactions.

We expect generation from renewables and nuclear power to displace most fossil fuel use, and the share of fossil fuels is likely to decline from 80% in 2020 to just over 20% in 2050. Source: Energy transition and the capital goods sector: A US $75-90tn tailwind for the sector? 30 Sept. 2021, UBS

UBS Insights

Red Scenario

UBS Insights

Our daily lives are highly dependent on an uninterrupted supply of energy. Demand for energy has grown strongly over the years, and yet our thirst for it increases day by day. Crude oil, coal and natural gas are still the main energy sources. Energy is the fuel for economic growth, as it powers transportation, heats our homes and charges our electronics.

Source: Introduction to energy, Understanding commodities, 21 Oct. 2021, UBS

Global momentum to tackle the climate crisis has been building in the last decade. Progress has been made on many fronts, including huge strides in renewable energy generation, which is increasingly cost competitive with fossil fuel alternatives.

Advances both in electric vehicle technology and in energy efficiency, coupled with societal pressure on governments and politicians to embrace a more environmentally friendly agenda, are helping to shift the Earth’s course toward a net-zero future. Nevertheless, much more remains to be done, and speed will be of the essence.

Still ways to go before fossil fuels become extinct

Fossil fuels will likely remain an important layer of the world’s energy base for some time. But their overall market share will increasingly give way to renewable fuels, as fossil fuel resources grow scarcer as time passes. But demand is still going to rise over the next decade, in our view.

We expect demand for oil to increase this decade and then plateau and begin a gradual decline at some stage during the next decade. Demand for natural gas, as the cleanest fossil fuel, is likely to grow faster than for oil and peak at a later point. Demand for coal, as the dirtiest fuel, is likely peaking and should steadily decline in the years ahead. Carbon capture technologies could alter the equation for fossil fuels and push out those timelines— especially for oil—although the cost of the technology is currently too high for widespread use.

The green revolution, like the industrial and technological revolutions, will be fueled by capital markets and banks.

Source: Ralph Hamers, Group Chief Executive Officer at UBSHere are three ideas that could help investors play a larger role in financing the innovation that will be key to a smoother energy transition.

We are seeing rapid progress in listed company disclosures and bond markets where investor engagement is influencing corporate actions. But higher standards in the public market risk some polluters going private, seeking less transparency. A whole-economy transition needs private markets to shift too.

The role of the private sector could be magnified through development banks. Development banks provided $66 billion of green-related finance last year and this could be doubled or tripled to turbocharge clean-energy technology investment. Innovation in the mechanisms to bring private capital to the table as a multiplier for public or development bank dollars could yield material results.

The green revolution, like the industrial and technological revolutions, will be fueled by capital markets and banks. No government or public body can meet this challenge alone. Without a keen focus on funding innovation, the whole-economy transition won't go fast enough or far enough to save the planet. To avoid that tragedy, we must act now. Source: If the green revolution is to succeed, investors must play a leading role, The Times, Oct. 28, 2021, Ralph Hamers, Group CEO, UBS

Based on The New Energy Outlook (NEO), BloombergNEF’s annual long-term scenario analysis on the future of the energy economy. In practice, we will probably see a mix of these solutions as each country pursues climate strategies that best suit them, considering their existing domestic economy, international trade and geopolitics. Country-specific climate pathways will be one focus of subsequent iterations of the New Energy Outlook.

Important Information About Sustainable Investing Strategies: Sustainable Investing strategies aim to consider and incorporate environmental, social and governance (ESG) factors into investment process and portfolio construction. Strategies across geographies and styles approach ESG analysis and incorporate the findings in a variety of ways. Incorporating ESG factors or Sustainable Investing considerations may inhibit UBS’s ability to participate in or to advise on certain investment opportunities that otherwise would be consistent with the Client’s investment objectives. The returns on a portfolio consisting primarily of sustainable investments may be lower or higher than portfolios where ESG factors, exclusions, or other sustainability issues are not considered by UBS, and the investment instruments available to such portfolios may differ. Companies, product issuers and/or manufacturers may not necessarily meet high performance standards on all aspects of ESG or Sustainable Investing issues.These materials have not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. They are published solely for informational purposes and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments or to participate in any particular trading strategy. The recipient should not construe the contents of these materials as legal, tax, accounting, regulatory, or other specialist or technical advice or services or investment advice or a personal recommendation. No representation or warranty, either express or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein except with respect to information concerning UBS, nor is it intended to be a complete statement or summary of the securities markets or developments referred to in these materials or a guarantee that the services described herein comply with all applicable laws, rules and regulations. They should not be regarded by recipients as a substitute for the exercise of their own judgment. Any opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by other business areas or groups of UBS as a result of using different assumptions and criteria. UBS is under no obligation to update or keep current the information contained herein, and past performance is not necessarily indicative of future results. Neither UBS nor any of its directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of these materials or reliance upon the information contained herein. Additional information may be made available upon request. Not all products or services described herein are available in all jurisdictions and clients wishing to effect transactions should contact their local sales representative for further information and availability.

© UBS 2022. All rights reserved.

Bloomberg and UBS AG are not affiliated.