The Greater Bay Area: Opening Doors for Wealth Management

For wealth managers in Hong Kong, the Greater Bay Area (GBA) represents what some have described as the greatest wealth-management opportunity in a generation.

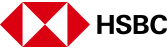

Residents of the nine Pearl River Delta cities in Guangdong province are estimated to have combined annual savings of $567 billion, while those in Hong Kong and Macau hold about $119 billion.[1] And Guangdong GBA has an estimated 290,000 households with more than RMB10 million of investible assets.[2]

“This will reinforce Hong Kong’s status as a leading international financial hub serving global and mainland clients.”

— Ms Maggie Ng, Head of Wealth and Personal Banking, Hong Kong, HSBC

Combined, these assets are worth almost RMB3 trillion – making the GBA the richest megalopolis in the world, and opening access to this pool of capital would potentially more than double the addressable domestic private wealth market of Hong Kong-based managers over the next decade.

Opening Doors

The Chinese government eased open the doors to this market in September with the launch of the GBA Cross-boundary Wealth Management Connect (WMC) scheme. The scheme allows the cross-border investment in financial products sold by banks between nine mainland Guangdong cities, Hong Kong and Macau via a closed-loop fund flow.

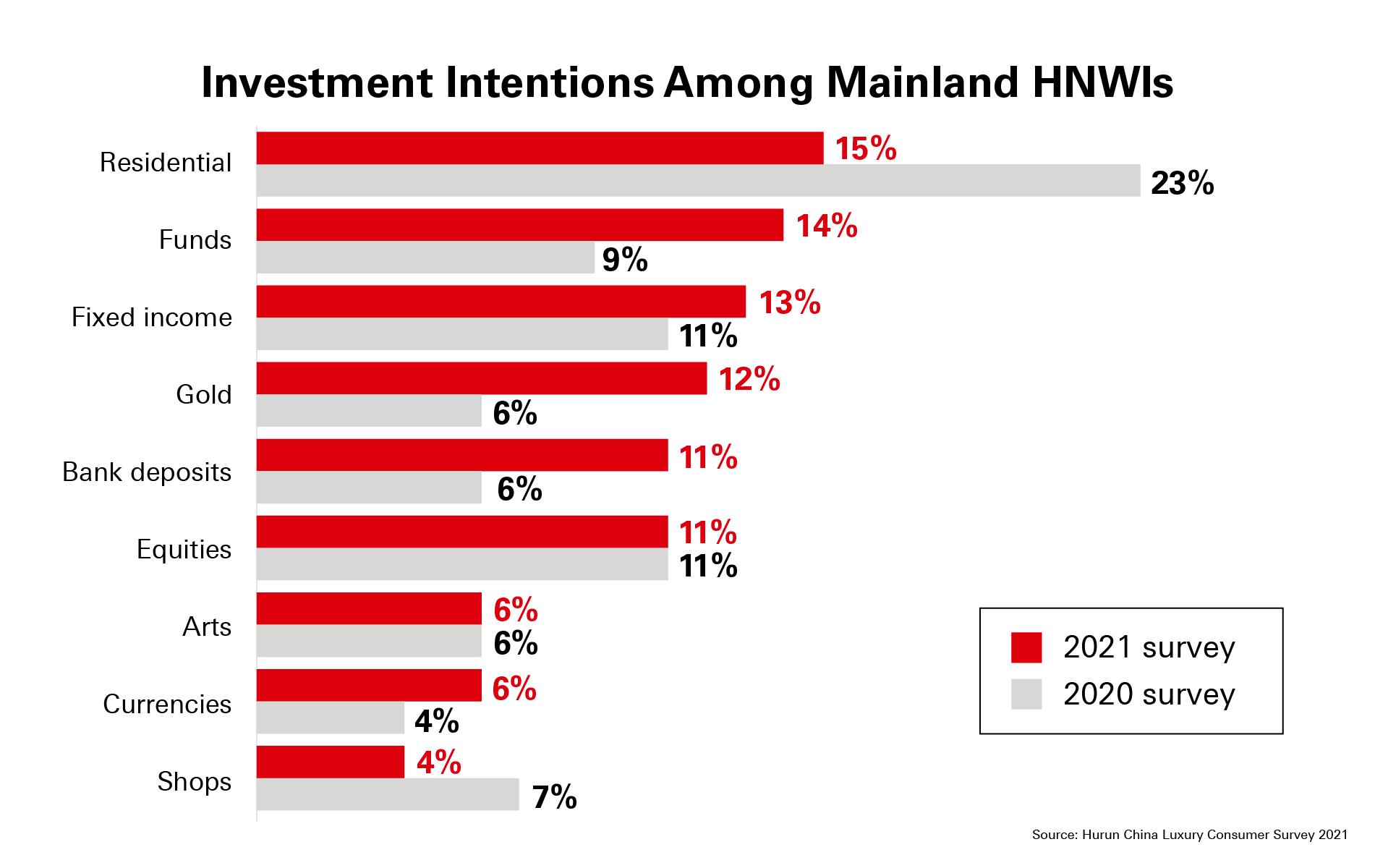

For managers, the WMC promises to fuel the growth of assets under management in Hong Kong, which has long been a preferred regional hub for wealth-management and financial services because of its proximity to mainland China, low tax rate, cultural similarities and access to global markets. Further, it bolsters the status of Hong Kong at a time when the city is energetically promoting itself as a hub for family offices.

“The Wealth Management Connect means there will be a lot of investment opportunities coming into Hong Kong,” says Maggie Ng, Head of Wealth and Personal Banking, Hong Kong, HSBC. “This will reinforce Hong Kong’s status as a leading international financial hub serving global and mainland clients. The Wealth Management Connect will also increase talent mobility between Hong Kong and the rest of Greater Bay Area as the region becomes more integrated.”

For Hong Kong investors, the scheme offers the opportunity to further diversify portfolios and expand their RMB holdings. For investors on the mainland, the WMC offers the chance to expand their offshore investments while boosting their asset diversification opportunities and exerting greater control over the liquidity of their RMB holdings.

For banks with an established presence in the GBA, and a long track record of wealth-management product distribution, the WMC represents an enormous opportunity to expand in mainland China. On average, 41% of AUM is currently sourced from mainland China, according to a report from KPMG. This figure is expected to increase to 51% in five years, emphasising the growing significance of mainland China to Hong Kong’s wealth-management industry.[3]Diversifying Mainland Portfolios

As China’s financial markets become more open and sophisticated, a greater proportion of household wealth will likely be invested abroad. Studies[4] by the China Banking Association show that the appetite for overseas investment among high-net-worth investors (HNWI) on the mainland is growing, primarily for the purposes of risk diversification. A survey by HSBC shows that 80% of mainland investors in the GBA plan to invest via the WMC[5] and around 70% will increase their asset allocation in Hong Kong.

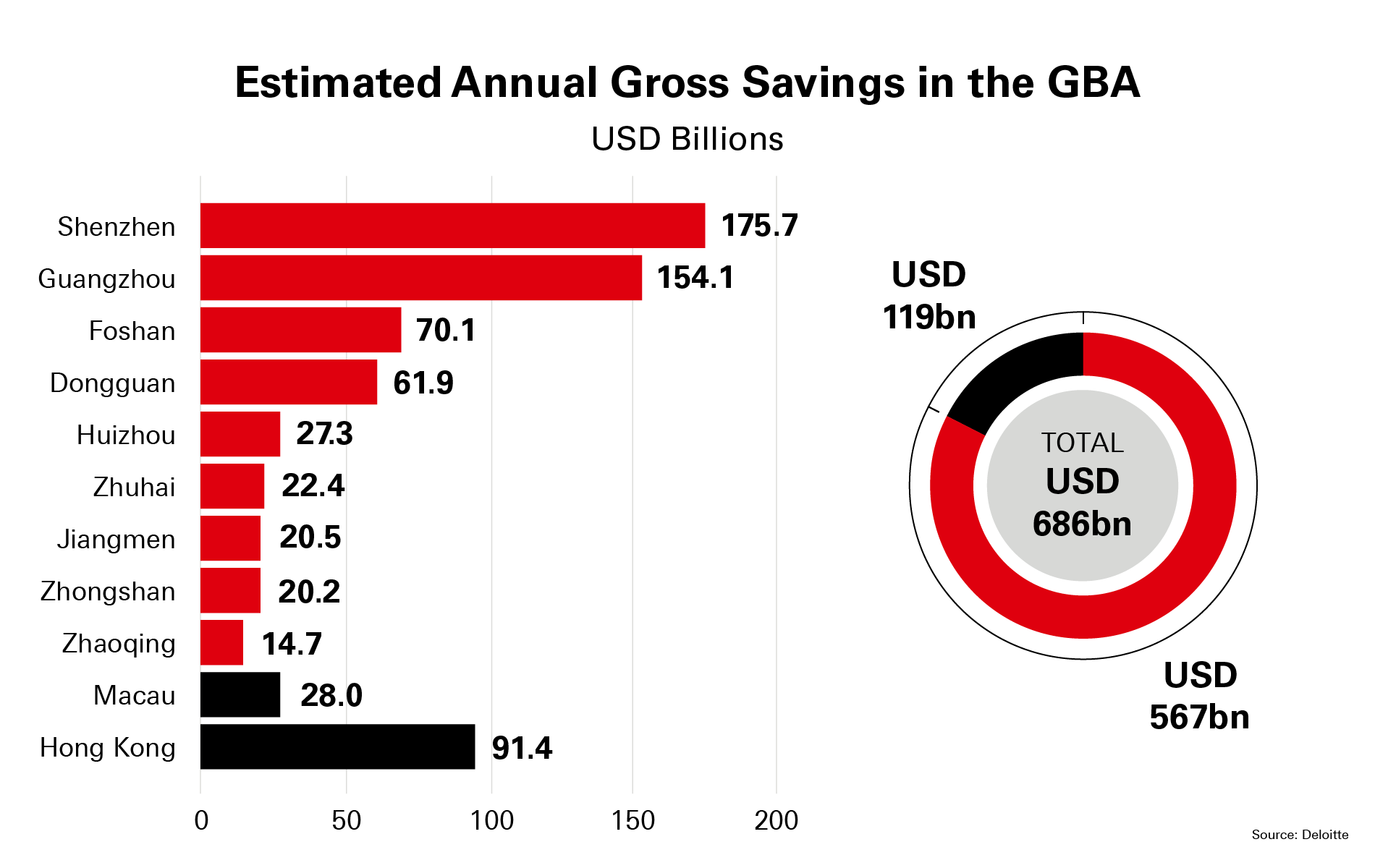

Chinese households have significant share of their wealth invested in real estate. Property accounts for roughly 40% of household assets[6] but investment appetites are changing.

“From our studies, we know that only around 20% of high-net-worth families have international investments,” Ng says. “Portfolio diversification is very important. The Wealth Management Connect will enable mainland Chinese consumer in particular to achieve greater diversification in their investments.”

A 2020 survey showed that the proportion of HNWI who plan to increase their property investments dropped dramatically from 2019, and recent crises in the property market may drive that percentage even lower. At the same time, investors are becoming more interested in funds, fixed income and other assets. This bodes well for the future of the WMC.

Another study from Oliver Wyman and the World Economic Forum backs that up, showing that approximately two-thirds of investors in the GBA prefer foreign investment products over local products, given similar risks and returns.[7] And nearly 60% of southbound investors are interested in investing in overseas mutual fund products.[8]

“The current scheme starts with a list of low- to medium-risk products,” says Trista Sun, EVP Designate and Head of Wealth and Personal Banking, HSBC China. “That's where investors are going to enjoy diversification through this platform. Very interestingly, the first two weeks of market data show that mainland Chinese customers are more interested in large deposits whereas Hong Kongers are focused on fixed income.”

"Not only are we a bank, we also have very strong asset management companies in both Hong Kong and mainland China, and we have very strong insurance companies across the border."

— Trista Sun, EVP Designate and Head of Wealth and Personal Banking, HSBC China

The Impact of Economic Integration

Greater economic integration and cross-border collaboration in the GBA will reinforce Hong Kong’s role as a leading financial hub and the world’s largest clearing center for RMB.

As China’s economic influence expands, and access to its wealth markets increases, demand for RMB will continue to grow. Hong Kong has the world’s biggest reserves of RMB outside the mainland, processes almost three-quarters of the world’s RMB payments, and has the world’s highest turnover of RMB foreign-exchange and derivatives trading.[9]

In October, HSBC – the largest international bank in the GBA and Hong Kong’s leading wealth manager – became one of the first banks to launch services under the WMC pilot scheme, enabling GBA residents to make digital, round-the-clock cross-boundary investments in more than 100 wealth-management products.

Eligible mainland GBA customers using the Southbound services will have access to multi-asset, bond, and money market funds in various currencies managed by leading global and regional fund managers, bonds issued by international companies and governments, as well as deposits in 11 currencies. Eligible Hong Kong customers using the Northbound channel can choose among a number of multi-asset funds, bond funds and money-market funds offered by leading asset managers.

The bank has set up about 60 GBA Wealth Management Connect Centres in existing GBA retail outlets, where dedicated staff will help customers with account opening and enquiries related to the scheme.

“HSBC has a dominant position in Hong Kong, and we are the only international bank with a presence in the 20 major cities across the Guangdong economic area,” Sun says. “Not only are we a bank, we also have very strong asset management companies in both Hong Kong and mainland China, and we have very strong insurance companies across the border. Taken together, our banking, insurance and asset management capabilities uniquely position us to serve evolving consumer needs.”

If you are a Hong Kong resident and would like to learn more, click here.

If you are a resident in the 9 mainland GBA cities and are interest to know more, click here.

If you are interested to learn more about wealth opportunity in Asia, please click here.