A Wealth of Knowledge: How Will Asia Manage its Rising Prosperity?

The accumulation of wealth is an almost universal human goal. Freedom from financial stress, the ability to live a comfortable life, own a home and accrue personal possessions, educate children and give them opportunities for a bright future; these are desires common among societies around the world.

Too often, however, there is one vital ingredient missing from the pursuit of that goal: wealth education. Building wealth without a clear plan for managing your money is like buying a car without learning to drive. In both cases, accidents are much more likely.

This problem is global, but tends to be more acute when prosperity rises rapidly from a relatively low base, and people who suddenly become affluent lack the know-how to preserve and sustainably grow their wealth.[1]

"The most promising tech solutions help our customers bank when, where and how they choose."

— Kevin Martin, Global COO and Head of Digital Transformation, Wealth & Personal Banking, HSBC

This emerging prosperous class lives in an investment environment that’s increasingly complex, fast-paced, and driven by technology.

“Technology has made wealth management faster, easier and more convenient,” said

Kevin Martin, Global COO and Head of Digital Transformation, Wealth & Personal Banking, HSBC. “For instance, the digital investment account opening journey that HSBC has launched in Singapore and Hong Kong takes less than five minutes to complete, with the account being activated the following day.”

Although it’s becoming quicker and easier to buy and sell a wide range of assets round-the-clock, financial knowledge is not accelerating at the same pace.[4] A significant proportion of this emerging prosperous class will need expert assistance to achieve financial security and build wealth.

As Wave One of the 2020 Bloomberg Wealth Study noted, “faced with increasing complexity, affluent consumers are seeking guidance.”

First Steps

The challenges posed to investors by a complex and fragmented investment universe have been made plain during the pandemic.

While the record number of new retail investors opening trading accounts during the crisis bodes well for the goal of broader financial inclusion, a lack of experience and financial literacy meant that the surge in retail participation was accompanied by high volatility and losses.[5]

In a single March 2020 week in Australia alone, for example, retail losses from trading online Contracts for Difference amounted to A$234 million.[6] In Southeast Asia, one in three people experienced online fraud in 2020.[7]

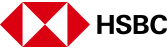

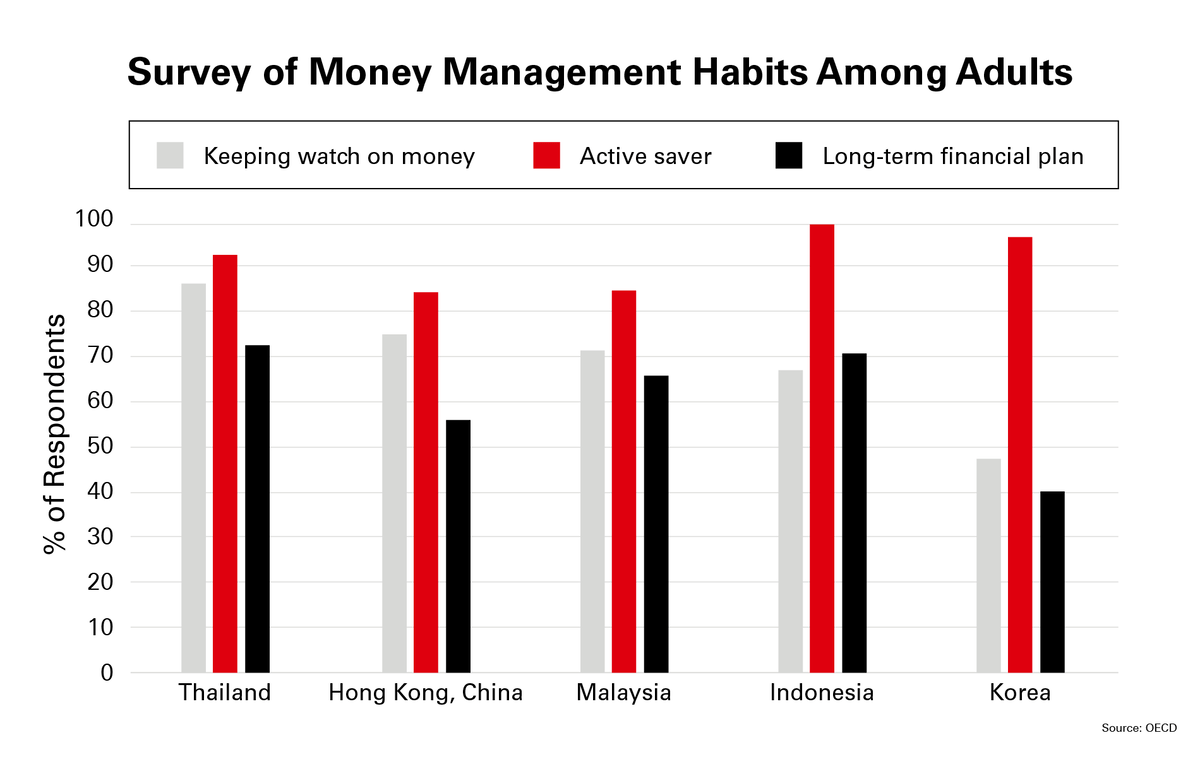

The solution to these problems lies in education. An international survey of financial literacy by the Organisation for Economic Cooperation & Development (OECD) concluded that adults who are better informed about money management are “less likely to face hardship in the event of a downturn, more likely to be able to bounce back quickly when things start to improve,” and less prone to fraud.[10]

But when it comes to the fundamentals of investing and saving, even the affluent often don’t know where to start. Wave One of the 2020 Bloomberg Wealth Study, for instance, showed that over a third of investors in the U.S. consider themselves beginners. And, on average, women are less confident about investing than men.

This is where expert advice is critical. While there is no shortage of financial information available – and it is easier than ever to make a start in investments and financial planning – choosing a reliable source can be the most difficult part.

In the post-pandemic world, people’s ability to sandbag their financial foundations will be more critical than ever, and financial institutions are becoming more aware of the need to provide customers with tools to improve their financial knowledge and manage their wealth.

Tech Tools: Bridging the Information Gap

While training seminars, how-to guides and exchange tours have long made financial knowledge accessible, they only reach a limited number of people. Technology is plugging those gaps. Digital delivery of financial knowledge and wealth management tools can reach wider audiences, offers almost infinite scalability, cost efficiency, and enables providers to use data to analyze and modify their offerings for different audiences and markets.

Despite limitations—the sheer volume of information online can lead to unstructured or misguided learning if new investors follow the wrong path—institutions are using digital education in increasingly creative ways.

"The most promising tech solutions help our customers bank when, where and how they choose."

— Kevin Martin, Global COO and Head of Digital Transformation, Wealth & Personal Banking, HSBC

In Hong Kong, for example, HSBC launched its investment recommendation tool, which gives customers a view of what people with similar portfolios are currently investing in, supported by insights and educational content to help guide investment decisions. And in Mainland China it launched Wealth Assistant—an AI chatbot that helps guide customers across their wealth journey, offering insights along the way.

Just as experienced investors move their capital into safer assets in times of uncertainty, many customers are demonstrating a similar “flight to quality” when it comes to choosing trusted sources for their financial knowledge and decision-making.

HSBC attracted strong new money for its Asia private banking business last year, while wealth balances in Asia continue their steady ascent.

“The most promising tech solutions help our customers bank when, where and how they choose,” Martin said. “This means a digitised and consistent experience across all our channels, underpinned by technology. It isn’t just about launching new tech solutions though – we must also help our customers take advantage of them. In select branches in Hong Kong, we run very popular digital pilots, open to anyone who wants to learn how to use mobile tools for banking and wealth management.”

If you are interested to learn more, please find details on services in your location: Hong Kong, Singapore, China, Malaysia, India, Taiwan and other locations.