Secure, Seamless, Personalized: Powering the Future of Payments in Australia and New Zealand

he payments landscape in Australia and New Zealand has been evolving rapidly, driving a decline in the use of cash and cheques with digital transactions increasingly replacing more traditional payment methods. Technology and shifting demands are driving the development of new offerings, with more innovations to come.

In recent years, the payments landscape in Australia and New Zealand has been characterized by technological disruption, shifting expectations from retailers and their customers and improved offerings from fintechs and other digital players.

As e-commerce expands globally, many retailers need service providers that offer seamless cross-border payments solutions, as well as tech-enabled analytics that provide visibility of the end-to-end payments process.

With increasing demand for personalization, flexibility, and convenience, concerns about fraud and data loss in the digital space are also on the rise. Today, there is a fundamental expectation for advanced security measures to protect every transaction.

Balancing Innovation and Risk

Meeting the evolving needs of modern retailers and businesses requires the ability to innovate securely and responsibly. In Australia and New Zealand, where consumer expectations are sophisticated and digital adoption is high, delivering seamless experiences and robust safeguards are non-negotiable.

“Our clients want to make sure that their payments are seamless, safe and secure,” says Bianca Bates, Head of Payments for J.P. Morgan in Australia and New Zealand. “That’s why we’re so focused on security and reliability.”

J.P. Morgan Payments runs a thriving e-commerce business and excels as a leading e-commerce merchant acquirer, with an annual processing volume exceeding $2.6 trillion in commerce payments.[1] An US$18 billion firmwide investment in technology underpins its success, balancing innovation with security.

One example of J.P. Morgan's commitment to innovation is its biometric payments offering in the US, which it plans to integrate across its global platform. In the near future, customers will pay using their face or palm, transforming the checkout experience.

Artificial Intelligence (AI) is also a major focus. Some AI-driven solutions bring internal efficiencies, allowing clients to move money faster, for instance, while others detect fraud, improve client servicing or generate insights from data that can be used to improve operations and offerings.

However, Bates adds, rolling out such solutions requires a crucial balance between innovation, security and reliability. Some new solutions are helping to navigate this balance, such as offerings from Kinexys by J.P. Morgan. Kinexys is the firm’s industry-leading blockchain business unit, which enables seamless, 24/7 money movement globally, with transactions totaling more than US$1.5 trillion since inception.[2][3]

Kinexys’ advanced distributed ledger technology enables atomic settlement with the added advantage of programmability. This capability allows Kinexys to globally validate accounts in real-time, reducing the risk of erroneous and fraudulent transactions.

Commonwealth Bank of Australia (CBA), for example, will soon be the first Australian bank to help validate bank account details used in international payments to Australia, by enabling its NameCheck technology on Kinexys Liink, offered through Kinexys by J.P. Morgan.

The Rise of Borderless, Seamless Retail

As the only global bank in the Australia and New Zealand market with a comprehensive suite of transaction banking services, including acquiring, J.P. Morgan offers a one-stop shop in this ever-evolving economy.

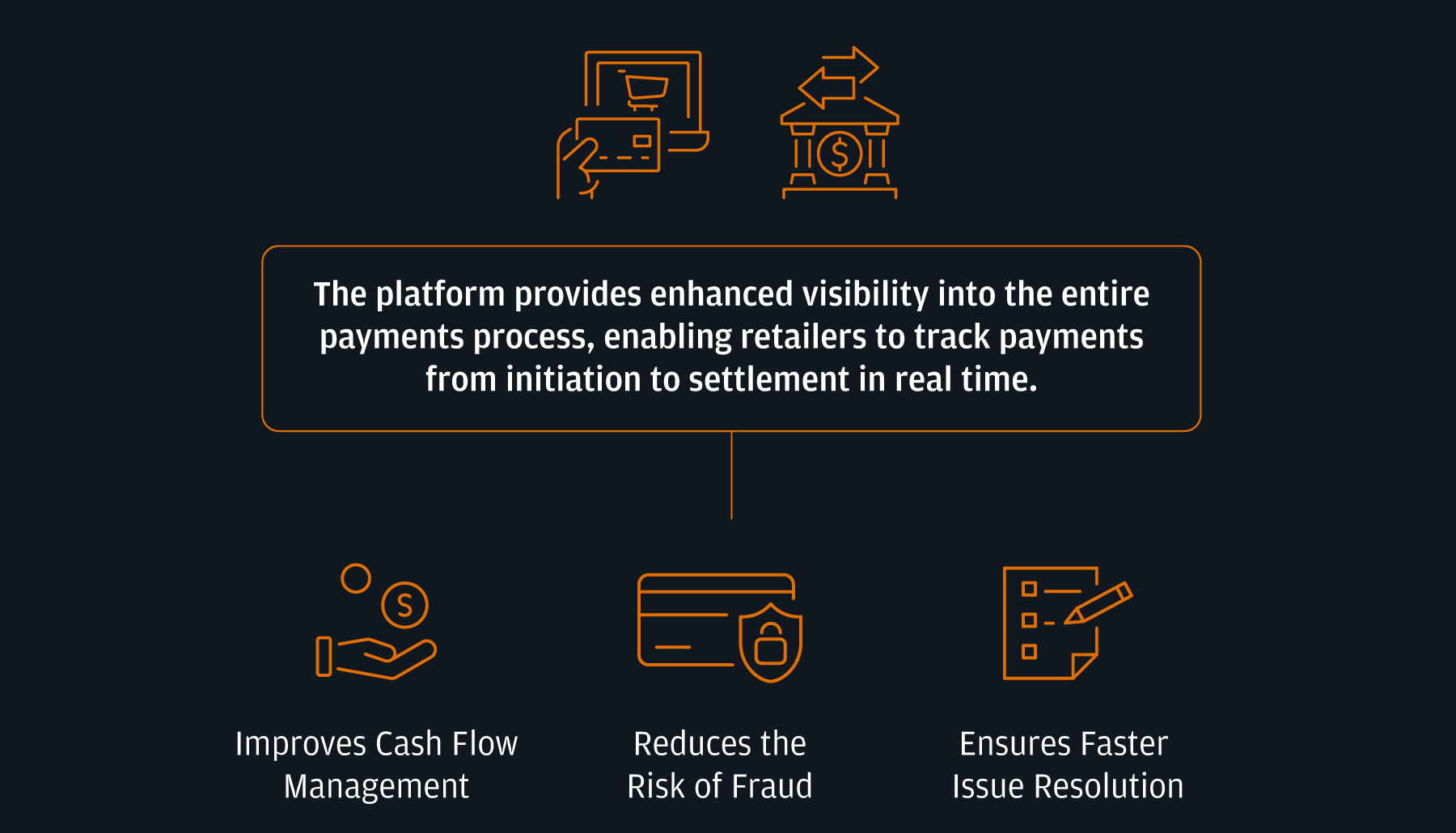

In recent years, retailers have increasingly focused on creating personalized shopping experiences for their customers, a shift that necessitates robust data and analytics capabilities. To address this, J.P. Morgan Payments launched the Commerce Platform in Australia last year, an e-commerce acquiring solution that provides global clients with a seamless and consistent experience for acquiring and reporting through a single API.

J.P. Morgan is also set to launch an advanced merchant insights capability in Australia and New Zealand, providing clients with unparalleled access to data and analytics to enhance decision-making and elevate the customer experience.

“This will ultimately help our clients realize operational efficiencies, bring more flexibility and convenience to customers’ shopping journeys, and stay ahead of the competition,” Bates adds.

Chubb Insurance is leveraging the platform to streamline transactions, reduce friction, and enhance its customer experience in Australia and New Zealand, as well as in several key markets across Asia.

A More Competitive, Rewarding Retail Future

The upshot, Bates says, is that it has never been easier for retailers to be at the forefront of giving customers what they want: a secure, personalized experience.

Retailers in Australia and New Zealand, she adds, can benefit from the breadth and depth of J.P. Morgan Payments‘ global platform, and its comprehensive offering in the Australian market, including local and global cash, liquidity, trade and acquiring solutions.

“We have a full-service local offering, and the added advantage of global connectivity and our global platforms—whether we’re talking about our e-commerce platform, for instance, or our liquidity or FX solutions, which can efficiently move money around the world,” Bates says.

In Australia’s mature retail market, where expectations are high and switching brands is easy, it will be increasingly important for retailers to anticipate change. And while retailers’ use of data provides a vital edge, the right payments partner will be crucial.

Sources: