How PayPal Is Supporting Black-Owned Businesses to Help Close the Racial Wealth Gap

In 2015, when PayPal separated from eBay Inc. to become an independent company, the digital payments platform made a commitment to democratize financial services, and began focusing on developing products and services to increase access for communities underserved by the traditional financial system.

To improve the financial health of its customers across the full economic spectrum, PayPal has built a strategy grounded in its mission and its four core values—inclusion, innovation, collaboration and wellness—that are integrated into the fabric of the business.

“Our mission and our values are reinforcing,” says Franz Paasche, Senior Vice President and Chief Corporate Affairs Officer at PayPal. “At the heart is a real commitment to inclusion. And if you think about how we have worked to do our part to address racial equity, to address the racial wealth gap, to address social justice—that aligns directly to our values as a company.”

Helping Black-owned businesses during the pandemic

PayPal’s efforts were accelerated by the global pandemic and the social unrest following the deaths of George Floyd and Breonna Taylor, which highlighted glaring racial disparities and structural biases that exist across society, from healthcare to housing.

“We went to the U.S. government and said, ‘Let us help facilitate the distribution of Paycheck Protection Program loans to make sure that small businesses in communities most impacted by the pandemic get the funds needed to survive,’” says Paasche. “As a company working to build a more inclusive economy, we knew that we were well positioned to take decisive action to help close the racial wealth gap through this work and ultimately became one of the first non-bank institutions approved to distribute PPP loans.”

PayPal has distributed more than $2 billion of PPP loans, according to the company, and the average size of a loan from PayPal to its customers was $28,000. PPP loans provided through PayPal were over-indexed in the majority of the top 30 counties that have the highest density of Black business activity, contrary to overall PPP lending. As a result of the company’s role in the program, PayPal saw firsthand the devastating effect that the pandemic was having on Black-owned businesses.

“As we studied the impact on our customers, we started seeing really difficult-to-accept data showing that Black-owned small businesses were closing at twice the rate and were being disproportionately affected by the pandemic,” Paasche says. “And we could see the impact that was occurring in the most vulnerable communities in this country—and around the world. We understand the clear economic underpinning to racial injustice, and we know the Black community continues to face an enormous number of economic hurdles.

“This is the result of many interlocking and interconnected issues, including limited access to capital and equity financing, employee discrimination, educational disparities—the list goes on,” Paasche continues. “So we started listening and working across sectors to leverage our core capabilities, resources and reach to do more for Black-owned businesses and communities that were struggling to survive.”

Creating impact through partnership

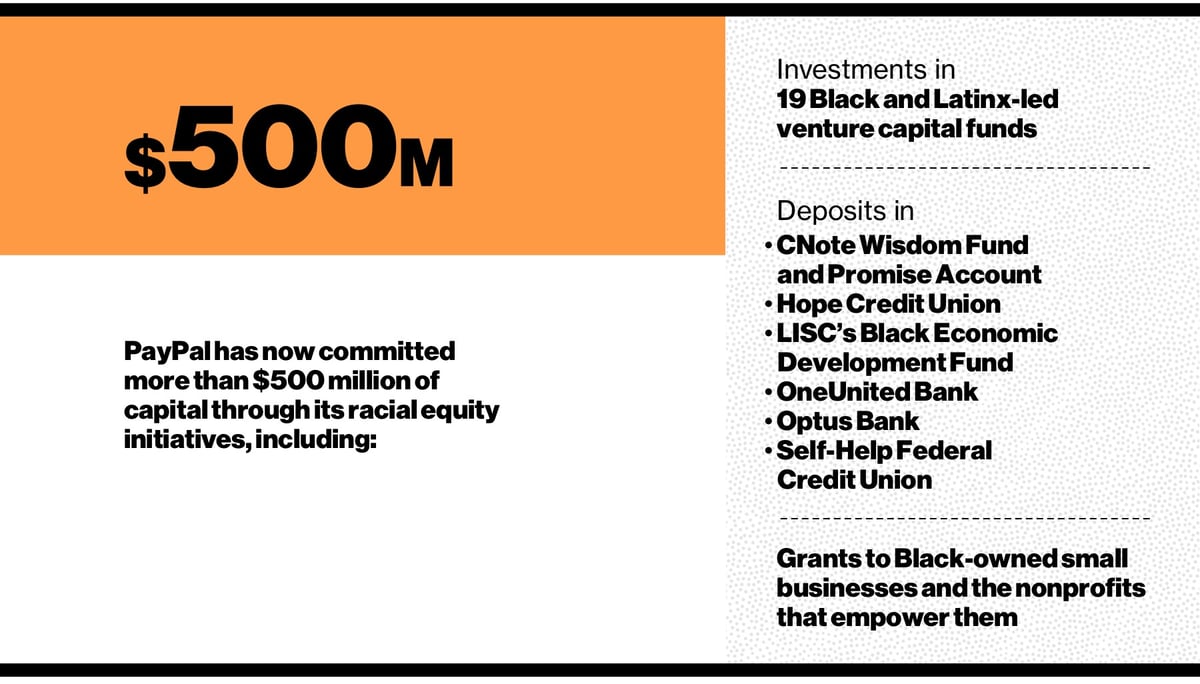

In June 2020, as the country grappled with the civil unrest that followed the death of George Floyd, Breonna Taylor and others, PayPal CEO Dan Schulman said that the company wouldn’t simply condemn racism, but would also take steps in the fight for racial equality, including a $535 million commitment to help Black- and minority-owned businesses and communities.

“We know how to help small businesses,” says Paasche. “We leveraged our expertise to put in place a multi-pronged initiative to help Black-owned small businesses, as well as Black-owned or led financial institutions. This initiative was designed to take immediate, medium and long-term action to help stabilize what we saw as growing inequity.”

With Black-owned businesses closing at alarming rates, PayPal’s first step was to figure out a way to provide capital that could help these businesses keep their doors open. PayPal was deliberate in partnering on this effort with an organization that has deep ties to underserved communities and was best positioned to understand their needs. The Association for Enterprise Opportunity (AEO), a Washington, D.C.-based organization that, for the past 30 years, has assisted underserved entrepreneurs in starting, stabilizing and expanding their businesses.

Through our Empowerment Grant efforts in partnership with AEO, we distributed $15 million in grants to nearly 1,400 Black-owned small businesses across the U.S.

“What was amazing to us was that the effect was so instant. The money came at a time when these businesses needed it most,” Paasche says. “As of our last assessment, the survival rate of the businesses that we supported through our grants is close to 90%. These businesses are still open because we were able to connect at a critical juncture when they just needed capital to survive. And we’ve also committed to sticking with them, offering free business development programming, coaching, and network building opportunities to help ensure they have what they need to stabilize and reopen their businesses.”

This programming was developed in partnership with other companies, including Adobe, Deloitte, Facebook, GoDaddy, Guidehouse, Mastercard and Qualtrics, and provides businesses with the tools to not only sustain, but grow their operations.

PayPal has a long history of partnering with both corporate and nonprofit organizations to expand the impact of its initiatives and advance the company’s vision for inclusive economic recovery and growth.

“Our approach to partnerships is deeply embedded in many of the social impact initiatives we’ve driven,” says Paasche. “When PayPal became an independent company, [CEO] Dan Schulman and I focused on how we were going to stand up our social innovation efforts. And we decided this couldn’t be something separate from the company’s core work and tied up in a foundation. We had to do it through the company, through our employees, through partnerships with nonprofits, and through products and services.”

Ultimately, for Paasche and the PayPal team, purpose and profit are intertwined.

“Purpose and profit are inextricably linked and need to be core to a company’s integrated strategy—how the company grows and expands, and how we think about products, how we think about customer service, how we think about our internal programs. Our employees and customers are inspired by this, and they rally—they’re willing to push hard for initiatives aligned to our values because it’s clear that we’re doing something different.”