Investing at Market Peaks

By Audrey Goh

No one likes to invest at the peak of equity markets. With prices near all-time highs, and numerous risks on the horizon, it is not surprising investors are worried about a significant market pullback negatively impacting their portfolio returns.

Instead of fretting over potential risk scenarios (See “What could go wrong?”), one exercise I like to do when faced with a seemingly hard-to-solve problem is to turn it upside down. Thinking about a problem in a different light often helps me to uncover hidden beliefs about the question I am trying to answer. As Charlie Munger says: “Invert, always invert.”

For concerned investors, a more relevant question to ask, in my view, is: What happens if one were to only invest at market peaks? (Hint: the answer may surprise you.)

Let me introduce you to Dan. He has only invested at equity market peaks, right before a significant market correction.

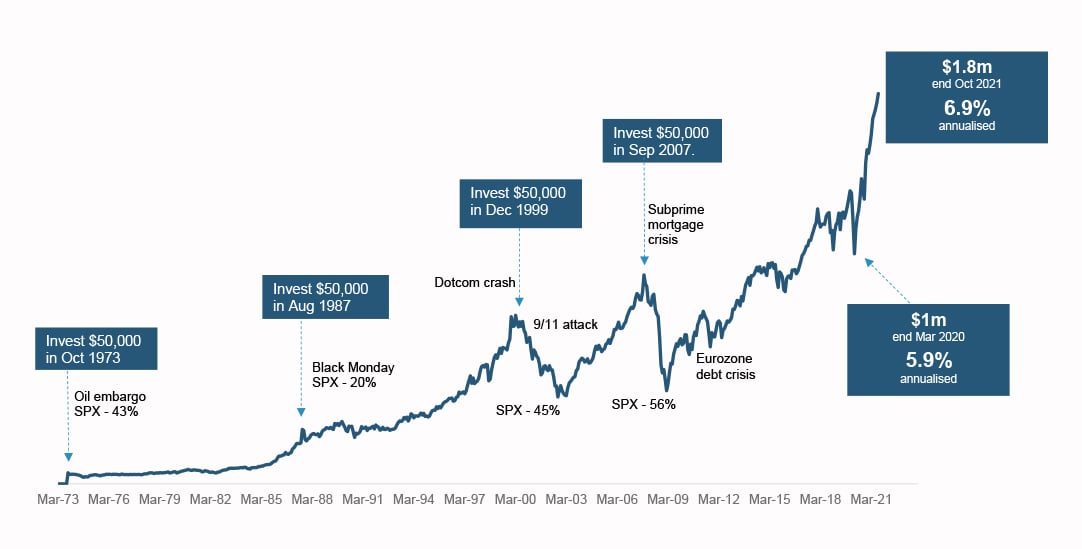

- In March 1973, he invested $50,000 in global equities, right before the oil embargo, which saw equities fall over 40% over the next 18 months.

- In 1987, he invested $50,000 again, right before the infamous Black Monday, only to see markets fall 20%.

- In December 1999, he decided to plough another $50,000 into equities after seeing many of his friends make quick and easy money in the stock markets. Of course, December 1999 marked the peak of the Dot-com bubble, which saw stocks fall by over 45% over the next few years.

- In September 2007, he decided to take one last plunge into equities just before the real estate bubble burst in the U.S., triggering what we now know as the Great Financial Crisis. This crisis saw global equities drop almost 60% over the next two years.

- Knowing how unlucky he had been in timing markets, he stayed invested throughout, fearing he’d also sell at the worst possible time.

- Reviewing his portfolio in March 2020 (when the stock market hit another low during the Covid pandemic), he was pleasantly surprised to see it was valued at over $1 million, compared with his initial $200,000 investment. This equalled an annualised return of almost 6%, which is not too shabby.

- Had he held on until the end of October 2021, he would have made $1.8 million — an annualised return of close to 7%.

For Investors, Time in the Market is More Important than Timing the Market.

S&P500 Index Performance Over the Past Half-Century

Most investors, however, can probably do much better than this, with some disciplined, regular investments and regular rebalancing of portfolios. Even a simple dollar-cost-averaging into the market through the business cycle on a regular basis would deliver better results than this extreme buy-at-the-peak-and-hold strategy. Ideally, everyone wants to buy at market bottoms and sell at the peak. However, it is nearly impossible to get it right on a consistent basis and do to it with enough capital to achieve your long-term goals and financial objectives. (Also see “Principles for successful investing.”)

While the above is an extreme hypothetical illustration, there are three key takeaways for investors:

- There are always uncertainties in financial markets. Instead of focusing on the uncertain, we should focus on what is relatively more certain and base our decisions around that. Numerous studies show that the discipline to invest regularly throughout the cycle and staying in the market over the long term will improve the odds of one’s success, certainly above and beyond a buy (at the peak)-and-hold strategy.

- While it is always painful to see markets going down right after you invest, with sufficient time in the market, the outcome is not be as bad as one may fear. Losses are part and parcel of investing. What may be less obvious is the loss of opportunity, which may feel somewhat less painful, but no less real. The earlier one starts to invest, the longer the runway for returns to compound. Make time your best friend.

- Famed investor Benjamin Graham put it succinctly: “In the short-run, the stock is a voting machine, but in the long-run, the market is a weighing machine.” Would you prefer to subject your wealth to the whims of market swings, or create a disciplined game plan to capture what equity markets ultimately will deliver over the long term?

Audrey Goh is Senior Cross-asset Strategist at Standard Chartered Wealth Management’s CIO office.