Why Investors Should Be Sharply Focused on the U.S. Dollar

By Manpreet Gill

For many investors, the U.S. Dollar can prove to be the dark horse that makes or breaks an investment strategy. Equity and bond investors (rightfully) obsess over macro and micro factors specifically linked to their asset class. However, history shows that different U.S. Dollar environments can lead to very different outcomes for major asset classes such as equities, bonds and gold.

This year, we expect the U.S. Dollar to eventually peak and start to turn lower. A USD top could offer significant support for equities and other risky asset classes.

Dollar Weakness: Good for Stocks and Risky Bonds

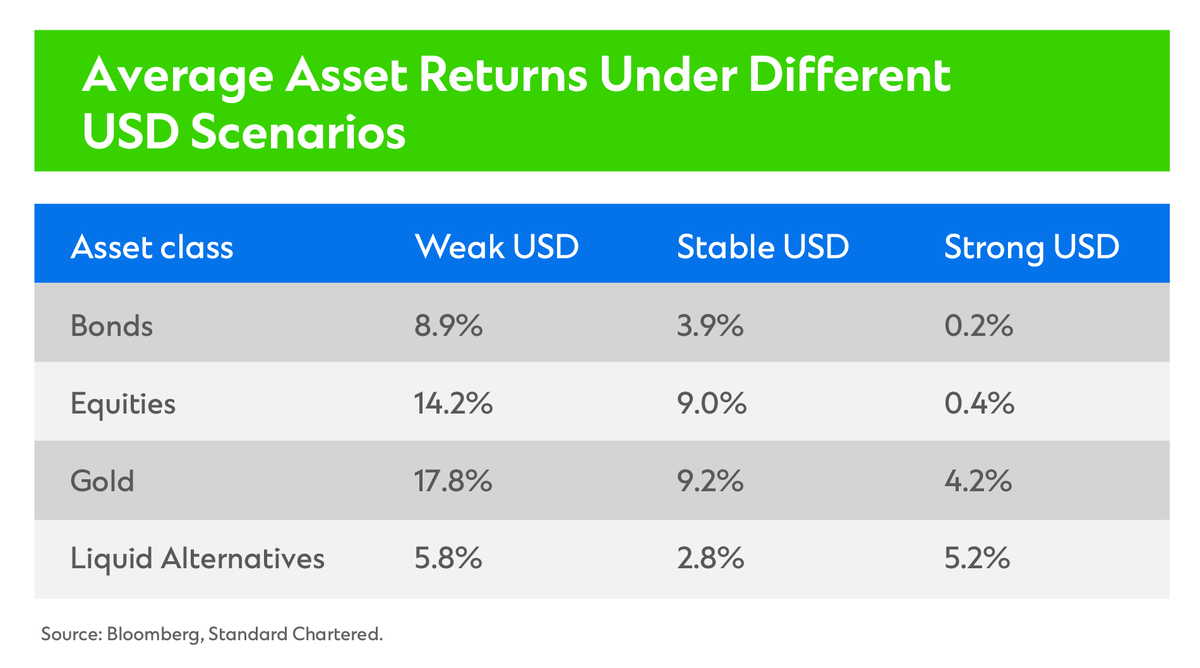

A look-back over the past two decades shows that different USD regimes tend to lead to very distinct types of asset class performances:

- Periods of USD weakness have historically coincided with strong returns across most asset classes. Risky asset classes such as equities delivered very strong annualised returns (about 14%) over such periods, though gold was also a strong performer (about 18% annualised returns). Most asset classes, including more defensive ones such as high-quality bonds, did well.

- Historical periods when the U.S. Dollar was rangebound offered somewhat more tempered returns. However, in relative terms, equities and gold were still amongst the top performers, similar to the USD weakness scenario.

- Periods of U.S. Dollar strength, though, proved to be far more challenging. During such periods, liquid alternative strategies and gold ended up being the top-performing asset classes in relative terms. Equities, on the other hand, were largely flat.

The influence of the USD on asset class returns could be somewhat surprising. However, we believe two factors might explain the relationships:

- The nature of the USD regime can tell us much about the macro environment. For example, historically, periods of USD weakness have often coincided with strong global risk appetite. Dramatic USD gains, on the other hand, often occur during a flight to safety as investors seek perceived safe haven currencies.

- The direct currency translation effects of USD moves can be significant. For example, euro-area equities outperformed in common currency terms during periods of USD weakness, but EUR strength contributed a significant portion of this outperformance.

What Is Our View on the USD Today?

In 2022, we expect the USD to follow a ‘reverse-V’, strengthening initially in Q1, before peaking and moving gradually lower.

Relative bond yield differentials (between the U.S. and major economies such as the euro area and Japan) are one key explanation. In recent months, the USD has strengthened as the rise in U.S. short-term bond yields outpaced those of other major currencies amid rising Fed policy tightening expectations. We believe this may have further to go, given the USD’s tendency to overshoot on shorter time horizons on strong momentum.

Beyond a 1-3 month horizon, though, we expect the USD to peak. This is likely to occur as the market prices in a Fed interest rate hiking cycle and begins to focus on the possibility of other major central banks such as the ECB to follow suite and as near-term USD momentum fades. This means that, on a 6-12 month horizon, it is likely that we end up in either a range-bound or weaker USD environment. As our table above shows, both environments are positive for risky assets such as equities. Hence our preference for riskier assets this year.

Manpreet Gill is Head of FICC Strategy at Standard Chartered’s Wealth Management CIO office